Cost of Equity Example in Excel (CAPM Approach)

- Find the RFR (risk-free rate) of the market

- Compute or locate the beta of each company

- Calculate the ERP (Equity Risk Premium) ERP = E (Rm) – Rf Where: E (R m) = Expected market return R f = Risk-free rate of return

- Use the CAPM formula to calculate the cost of equity.

How do you calculate cost of Common Equity?

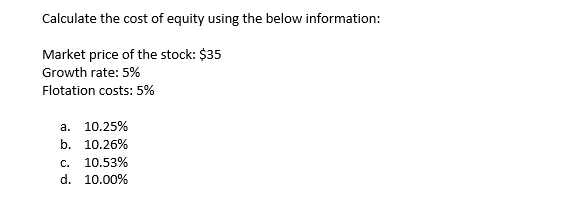

Cost of Equity Formula. The following Cost of Equity Formula shows how to calculate cost of equity. Cost of Equity = Dividends Per Share/Market Value Stock + Dividend Growth Rate. How to Calculate Cost of Equity. To apply the cost of equity formula, we need dividends per share, market value of the stock and growth rate.

How do you calculate the weighted average cost of capital?

WACC Calculation – Basic Example

- Step # 1 – Calculating Market Value of Equity / Market Capitalization. ...

- Step # 2 – Finding Market Value of Debt. Let’s say we have a company for which we know the total debt. ...

- Step # 3 Calculate Cost of Equity. Beta of the stock is 1.5

- Step # 4 – Calculate the Cost of Debt. Risk free rate = 4%. ...

- Step # 5 – WACC Calculation. ...

How do you calculate stock equity?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE ... factors to determine the right price to buy a stock. It is important to consider other factors ...

How do I calculate the cost of equity using Excel?

- Cost of Equity Formula= (3.20/20) + 1.31%

- Cost of Equity Formula= 17.31%

- Hence, the cost of equity for the XYZ company will be 17.31%.

Does CAPM calculate cost of equity?

CAPM is a formula used to calculate the cost of equity—the rate of return a company pays to equity investors. For companies that pay dividends, the dividend capitalization model can be used to calculate the cost of equity.

What is the formula for common stock?

Common Stock=Total Equity+Treasury Stocks-Additional paid in capital-Preferred stocks-Retained earnings. when we were given the total Equity and Retained earnings, then by deducting retained earnings from the total Equity will provide us with the value of the common stock.

What are 3 methods used to calculate the cost of equity capital?

Three methods are used to estimate the cost of equity. These are the capital asset pricing model, the dividend discount model, and the bond yield plus risk premium method.

How do you calculate cost of common equity in Excel?

After gathering the necessary information, enter the risk-free rate, beta and market rate of return into three adjacent cells in Excel, for example, A1 through A3. In cell A4, enter the formula = A1+A2(A3-A1) to render the cost of equity using the CAPM method.

What is cost of common stock?

The term cost of common stock refers to a calculation that allows the investor-analyst to understand how expensive it is for a company to issue common stock. The cost of common stock is also one of three metrics used to calculate a company's cost of capital.

What is common stock in equity?

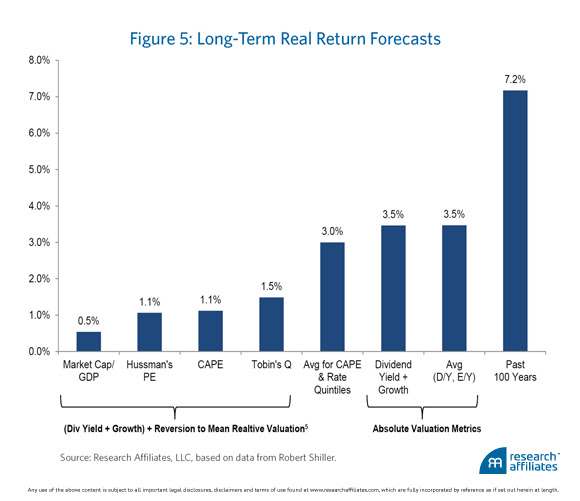

Common stock is a security that represents ownership in a corporation. Holders of common stock elect the board of directors and vote on corporate policies. This form of equity ownership typically yields higher rates of return long term.

How do you calculate cost of equity on a balance sheet?

Cost of equity, Re = (next year's dividends per share/current market value of stock) + growth rate of dividends. Note that this equation does not take preferred stock into account. If next year's dividends are not provided, you can either guess or use current dividends.

Why is cost of equity share capital calculated?

Cost of equity share capital is that part of cost of capital which is payable to equity shareholder. Every shareholder gets shares for getting return on it. So, for company point of view, it will be cost and company must earn more than cost of equity capital in order to leave unaffected the market value of its shares.

Is cost of equity same as cost of capital?

A company's cost of capital refers to the cost that it must pay in order to raise new capital funds, while its cost of equity measures the returns demanded by investors who are part of the company's ownership structure.

How do you calculate cost of equity in WACC?

WACC is calculated by multiplying the cost of each capital source (debt and equity) by its relevant weight by market value, and then adding the products together to determine the total. The cost of equity can be found using the capital asset pricing model (CAPM).

What is WACC discount rate?

WACC is typically used as a discount rate for unlevered free cash flow#N#Unlevered Free Cash Flow Unlevered Free Cash Flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense.#N#(FCFF). Since WACC accounts for the cost of equity and cost of debt, the value can be used to discount the FCFF, which is the entire free cash flow available to the firm. It is important to discount it at the rate it costs to finance (WACC).

What is the difference between WACC and WACC?

The cost of equity applies only to equity investments, whereas the Weighted Average Cost of Capital (WACC)#N#WACC WACC is a firm’s Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. #N#accounts for both equity and debt investments.

What is the purpose of WACC?

accounts for both equity and debt investments. Cost of equity can be used to determine the relative cost of an investment if the firm doesn’t possess debt (i.e., the firm only raises money through issuing stock). The WACC is used instead for a firm with debt.

What is CAPM investment?

CAPM takes into account the riskiness of an investment relative to the market. The model is less exact due to the estimates made in the calculation (because it uses historical information).

Why do firms use cost of equity?

A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities. Companies typically use a combination of equity and debt financing, with equity capital being more expensive.

How to find the share price of a company?

The share price of a company can be found by searching the ticker or company name on the exchange that the stock is being traded on, or by simply using a credible search engine.

How to find beta?

Beta can be found online or calculated by using regression: dividing the covariance of the asset and market’s returns by the variance of the market.

What is dividend growth model?

The dividend growth model requires that a company pays dividends, and it is based on upcoming dividends. The logic behind the equation is that the company’s obligation to pay dividends is the cost of paying its shareholders and, therefore, the Ke, i.e., cost of equity. This is a limited model in its interpretation of costs.

What is market risk premium?

Market Risk Premium The market risk premium is the supplementary return on the portfolio because of the additional risk involved in the portfolio; essentially, the market risk premium is the premium return investors should have to make sure to invest in stock instead of risk-free securities. read more.

What is special dividend?

Special Dividend The term "Special Dividend" refers to an amount distributed to shareholders in the name of a dividend that is in addition to the regular dividend. Companies do this in the event of an unexpected inflow of cash or assets. read more. for the time being.

What is cost of equity?

A firm uses a cost of equity (Ke) to assess the relative attractiveness of its opportunities in the form of investments, including both external projects and internal acquisition. Companies will typically use a combination of debt and equity financing, with equity capital is proving to be more expensive.

How does capital market work?

As the capital market allows them to invest in different companies in form of equity or debt, so they will be seeking a good opportunity to maximize their return. The company can raise new common stocks by issuing new common stock to the market or reinvesting the return from the prior year (retained earning).

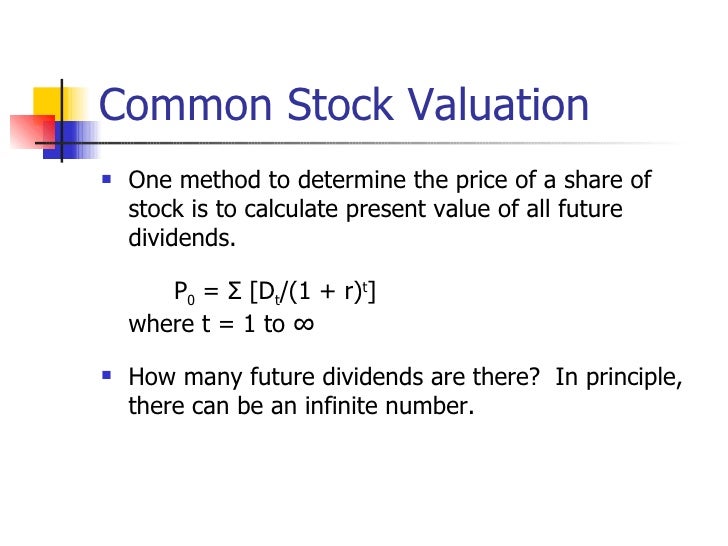

What is dividend discount model?

Dividend Discount Model uses the common stock dividend as the basis to evaluate the rate of return. The price of common stock can be determined by the present value of all future dividends.

What is capital asset pricing model?

The capital asset pricing model is the relationship between the expected return and risk attached. The expected return equal to the return of a risk-free asset plus the risk premium.

Does a change in common stock affect the return of investors?

Any change in common stock will have an impact on the return of investors. It has no cost incurred when we decide to invest in one company, but the opportunity which the investors are able to invest and make a higher return in other companies.

Why is common stock important?

The common stock is very important for an equity investor as it gives them voting rights which is one of the most prominent characteristics of common stock. The common stockholders are entitled to vote on various corporate subjects which may include acquisition of another company, who should constitute the board and other similar big decisions. Usually, each common stockholder gets one vote for every share. Another striking feature of common stock is that these stocks usually outperform another form of securities, like bonds and preferred stocks, in the long run. However, common stock comes with a strong downside, that in case a company goes into bankruptcy, then the common stockholders get nothing until the creditors are fully paid off. In other words, when the company has to sell off its assets, then the cash generated from the sale will first go to the lenders, creditors, and other stakeholders, then the common stockholders are paid if anything is left. As such, common stock is another appropriate example of the trade-off between risk and returns, such that these stocks offer a higher return as they are riskier than another form of securities.

What is the formula for common stock?

However, in some of the cases where there is no preferred stock, additional paid-in capital, and treasury stock, then the formula for common stock becomes simply total equity minus retained earnings. It is the case with most of the smaller companies that have only one class of stock.

How to calculate common stock?

The formula for common stock can be derived by using the following steps: Step 1: Firstly , determine the value of the total equity of the company which can be either in the form of owner’s equity or stockholder’s equity. Step 2: Next, determine the number of outstanding preferred stocks and the value of each preferred stock.

What is common stock?

The term “common stock” refers to the type of security for ownership of a corporation such that the holder of such securities has voting rights that can be exercised for various corporate events. Examples of such events include a selection of the board of directors or other major corporate decision.

Why are common stocks listed in the equity section?

Common stocks are listed in the equity section because stocks are considered as an asset. From the total number of stocks, we can calculate the number of outstanding stocks. Outstanding stocks are stocks that are issued to the public and owned by stockholders, investors, and company members. If we deduct the number of treasury stocks ...

What is equity in a company?

Equity is the claim of shareholders claims on the company assets. By purchasing stocks of the company, they have the right to claim ownership in the company. Their ownership percentage is determined by the ratio of shares owned to the total number of outstanding shares.

What is Treasury stock?

Treasury stocks are stocks that have been repurchased by the company that issued the stocks in the first place. These shares have no voting rights or dividend payments. Neither does this stock receive any assets after the company liquidates. To summarize the formula, Outstanding stocks = Issued stocks – Treasury stocks.

What is a claim on a company's assets?

The claims on a company’s assets are comprised of liability and equity. Liability includes the claims on the company’s assets by external firms or individuals. Mortgage and loans are examples of liabilities of a company.

What happens when a company goes public?

When a company goes public from private, it offers an opportunity for investors to claim partial ownership in the company by buying its stocks. This initial offering is known as IPO and this is when the company becomes a publicly owned company.

Is equity a common stock?

Keep in mind that equity is not just comprised of common stocks. It also includes retained earnings, treasury stock, and preferred stocks. When you add up the liabilities and stockholder equity, their sum will always be equal to the total value of the company’s assets.

What is common equity?

The equity being offered to common shareholders by a company is known as common equity. It is very easy to evaluate common equity. Common equity can be calculated by deducting proffered equity from total equity of shareholder calculated by financial statements issued by the company. Common equity is an important ingredient ...

Why is common equity important?

Common equity is an important ingredient of preparing investment road map for investors looking to invest in a company. Using common equity one can estimate ratios and projected returns on common equity. This is how potential investors can understand how lucrative it will it be invest in a particular company as a common shareholder.

How to come down to common equity?

You can come down to Common Equity by multiplying outstanding common stock by the face value of stock to get the desired figure. In case of a company having 10,000 shares with a face value of $5/per share, its common equity will be $50,000.

What is preferred stock?

Preferred Stocks– When a person invests in the Preferred stocks, he or she is preferred over common stock investors in terms of getting dividends from the company. The downside of the preferred stock is that preferred stockholders do not have a right to vote.

What is dividend in accounting?

What is dividends -Dividend is a reward, money, stocks which are distributed among the shareholders of that company. Dividends are decided by the board of directors and need the approval of shareholders. Common stocks are represented in the stockholder equity section on a balance sheet.

Why do people invest in common stocks?

Investors invest in common stocks to generate income at a high rate.The advantage associated with the common stocks that holders acquire a voting right. Single stock provides one vote. Dividends are also offered to them when left. In case of bankruptcy, all preferred stockholders, bondholders, creditors get their dividends before the common stockholders. If the company does not have any dividend left after paying off all other holders, the common stockholder will get nothing. In such situations, it becomes risky to invest in common stocks. Here you will get finance assignment help from our assignment finance experts.

What happens if a company goes bankrupt?

In case of bankruptcy, all preferred stockholders, bondholders, creditors get their dividends before the common stockholders. If the company does not have any dividend left after paying off all other holders, the common stockholder will get nothing. In such situations, it becomes risky to invest in common stocks.

Why do corporations sell their shares?

A corporation sells its shares in order to make money from the individuals so that it can invest this money in the further progress of the corporation. In replacement, the company provides voting rights to the stockholders and the dividends when it is issued. In simple words, stockholders are the partial owner of the company and get dividends ...

What are the two types of stocks?

Types of Stocks– There are two types of stocks. Common Stocks. Preferred Stocks. 1. Common Stocks – An investor can purchase both types of stocks when available as both have their own privileges. But common stocks are the share that most people invest in. One share allows one vote to the buyer.

What is total equity?

Total Equity: Total Equity is the total net worth or capital of the company. When the liabilities are deducted from the assets, it gives the total equity of the company.

What is CAPM in accounting?

For accountants and analysts, CAPM is a tried-and-true methodology for estimating the cost of shareholder equity. The model quantifies the relationship between systematic risk and expected return for assets and is applicable to a multitude of accounting and financial contexts.

What does it mean when a stock has a beta of one?

A beta value of "one" indicates that the stock moves in tandem with the market. If the Nasdaq gains 5 percent, so does the individual security. A higher beta indicates a more volatile stock, and a lower beta reflects greater stability.

What is risk free rate?

The risk-free rate is generally defined as the (more or less guaranteed) rate of return on short-term U.S. Treasury bills, because the value of this type of security is extremely stable, and the return is backed by the U.S. government.

Who is Andrew Bloomenthal?

Andrew Bloomenthal has 20+ years of editorial experience as a financial journalist and as a financial services marketing writer . In capital budgeting, corporate accountants and financial analysts often use the capital asset pricing model (CAPM) to estimate the cost of shareholder equity.

What Is The Cost of Common Stock Equity?

How to Calculate The Cost of Common Stock Equity?

- In order to calculate the cost of common stock equity, there are two common models or techniques that we can use. These are the constant-growth valuation model or the Gordon Model and capital asset pricing model (CAPM).

Constant-Growth vs CAPM Techniques

- Even though both models can be used to calculate the cost of common stock equity; however, there are a number of differences. The CAPM model directly considers the firm’s risk; nondiversifiable risk which is represented by beta, in order to calculate the required rate of return of common stock equity. Unlike the CAPM model, the constant-growth valuation model does no…