There are three important formulas for book value:

- Book value of an asset = total cost - accumulated depreciation

- Book value of a company = assets - total liabilities

- Book value per share (BVPS) = (shareholders' equity - preferred stock) / average shares outstanding

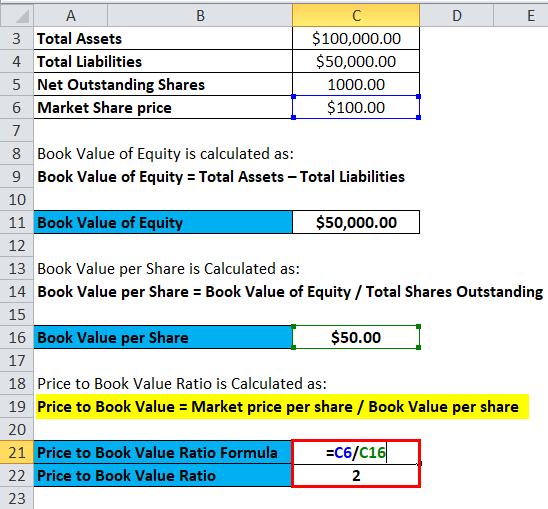

- Book value = Total Assets - Total Liabilities.

- BVPS = Book Value / Number of Shares Outstanding.

- P/B = Market Price per Share / Book Value per Share.

How do you calculate the book value of a stock?

Here's the formula for how to calculate Book Value per Share: This formula takes the total book value, subtracts the preferred shareholder equity, and then divides by the total outstanding shares of common stock. This gives an exact book value price per share of common stock.

What is book value per share of common stock?

Book value per share of common stock is the amount of net assets that each share of common stock represents. Since the number of shares owned by a stockholder determines his or her portion of equity in a corporation, some stockholders have keen interest in knowing the book value of the shares they own.

What is book value of equity (formula)?

Book Value of Equity (Formula, Example) | How to Calculate? Book value of equity represents the fund that belongs to the equity shareholders and is available for the distribution to the shareholders and it is calculated as the net amount remaining after the deduction of all the liabilities of the company from its total assets.

What is book value?

Book value refers to a company's net assets, calculated as the value of its assets net of (subtracting) its liabilities. It can also be calculated as the total shareholder equity of a company.

How do you calculate book value of a stock?

The formula for calculating book value per share is the total common stockholders' equity less the preferred stock, divided by the number of common shares of the company.

What is the book value formula?

What is the book value formula? There are three important formulas for book value: Book value of an asset = total cost - accumulated depreciation. Book value of a company = assets - total liabilities. Book value per share (BVPS) = (shareholders' equity - preferred stock) / average shares outstanding.

How is book value of purchase calculated?

The formula for calculating NBV is as follows:Net Book Value = Original Asset Cost – Accumulated Depreciation.Accumulated Depreciation = $15,000 x 4 years = $60,000.Net Book Value = $200,000 – $60,000 = $140,000.

How do you calculate the Incentric value of a stock?

Estimate all of a company's future cash flows. Calculate the present value of each of these future cash flows. Sum up the present values to obtain the intrinsic value of the stock.

How do I calculate book value in Excel?

First, enter the value of a common stock, retained earnings, and additional paid-in capital into cells A1 through A3. Then, in cell A4, enter the formula "=A1 + A2 + A3". This yields the value of common equity. Then, enter the formula for the BVPS.

What is book value of a share?

Book value per share (BVPS) is the ratio of equity available to common shareholders divided by the number of outstanding shares. This figure represents the minimum value of a company's equity and measures the book value of a firm on a per-share basis.

What is book value with example?

The book values of assets are routinely compared to market values as part of various financial analyses. For example, if you bought a machine for $50,000 and its associated depreciation was $10,000 per year, then at the end of the second year, the machine would have a book value of $30,000.

What is book value?

Book value is the worth of a company based on its financial books. Market value is the worth of a company based on the perceived worth by the market. If the market value of an organisation is higher than its book value, it implies that the stock market is assigning more significance to its stocks.

How Warren Buffett calculates intrinsic value?

Buffett follows the Benjamin Graham school of value investing. Value investors look for securities with prices that are unjustifiably low based on their intrinsic worth. There isn't a universally accepted way to determine intrinsic worth, but it's most often estimated by analyzing a company's fundamentals.

Is intrinsic value and book value same?

Book value and intrinsic value are two ways to measure the value of a company. There are a number of differences between them, but essentially book value is a measure of the present, while intrinsic value takes into account estimates into the future.

What is extrinsic value of stock?

Extrinsic value is the difference between the market price of an option, also knowns as its premium, and its intrinsic price, which is the difference between an option's strike price and the underlying asset's price. Extrinsic value rises with increase in volatility in the market.

What Is Book Value? How to Find Or Calculate Book Value?

The way to identify an undervalued stock is to empirically determine an intrinsic value of the stock that serves as a benchmark against which the s...

Why Use Book Value as A valuation method?

Book Value of a firm, in an ideal world, represents the value of the business the shareholders will be left with if all the assets are sold for cas...

Book Value of Stock Is Not Always What It Seems

It is important to realize that the book value that is reported on the balance sheet is an accounting number and as such it may or may not be the s...

Inventory Can Be Simple Or Complicated

Inventory, if it turns fast enough, is typically not a problem. However, depending on the accounting method the company uses to value inventory, it...

How to Determine If A Stock Is Undervalued Using Book Value

A very simplistic way of using book value to determine if the stock is undervalued is to look at the market to book value ratio. This is also calle...

How to Find Book Value Per Share That Is Usable If Market Values Are Uncertain

As you can imagine, proper analysis of the balance sheet requires quite a bit of work. One way to avoid this is to find stocks where this level of...

What is book value in finance?

In personal finance, the book value of an investment is the price paid for a security or debt investment. When a company sells stock, the selling price minus the book value is the capital gain or loss from the investment.

Where does the book value come from?

The term book value derives from the accounting practice of recording asset value at the original historical cost in the books. While the book value of an asset may stay the same over time by accounting measurements, the book value of a company collectively can grow from the accumulation of earnings generated through asset use.

Why use P/B ratio?

Price-to-book (P/B) ratio as a valuation multiple is useful for value comparison between similar companies within the same industry when they follow a uniform accounting method for asset valuation. The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries whereby some companies may record their assets at historical costs and others mark their assets to market.

Why is it important to compare book value to market value?

Since a company's book value represents the shareholding worth, comparing book value with the market value of the shares can serve as an effective valuation technique when trying to decide whether shares are fairly priced. As the accounting value of a firm, book value has two main uses:

What is book value in accounting?

An asset's book value is equivalent to its carrying value on the balance sheet. Book value is often lower than a company's or asset's market value. Book value per share (BVPS) and the price-to-book (P/B) ratio are utilize book value in fundamental analysis. 1:21.

Can book value be a proxy?

There are limitations to how accurately book value can be a proxy to the shares' market worth when mark to market valuation is not applied to assets that may experience increases or decreases of their market values.

What is book value?

The book value is used as an indicator of the value of a company’s stock, and it can be used to predict the possible market price of a share at a given time in the future.

How to increase book value per share?

How to Increase the Book Value Per Share. A company can use the following two methods to increase its book value per share: 1. Repurchase common stocks. One of the main ways of increasing the book value per share is to buy back common stocks from shareholders.

What is stockholders equity?

Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus. , and the preferred stock should be excluded from the value of equity.

What are the limitations of book value per share?

One of the limitations of book value per share as a valuation method is that it is based on the book value, and it excludes other material factors that can affect the price of a company’s share. For example, intangible factors affect the value of a company’s shares and are left out when calculating the BVPS.

How does a company increase its book value?

A company can also increase the book value per share by using the generated profits to buy more assets or reduce liabilities. For example, if ABC Limited generates $1 million in earnings during the year and uses $300,000 to purchase more assets for the company, it will increase the common equity, and hence, raise the BVPS. Similarly, if the company uses $200,000 of the generated revenues to pay up debts and reduce liabilities, it will also increase the equity available to common stockholders.

What is preferred stock?

Preferred Shares Preferred shares (preferred stock, preference shares) are the class of stock ownership in a corporation that has a priority claim on the company’s assets over common stock shares. The shares are more senior than common stock but are more junior relative to debt, such as bonds. .

What is market value per share?

The market value per share represents the current price of a company’s shares, and it is the price that investors are willing to pay for common stocks. The market value is forward-looking and considers a company’s earning ability in future periods.

How to identify an undervalued stock?

The way to identify an undervalued stock is to empirically determine an intrinsic value of the stock that serves as a benchmark against which the stock price can be compared. If this intrinsic value is higher than the stock price in the market today, than the stock can be considered undervalued and vice versa.

What is intangible in accounting?

A company, if it has been operating for a while, has other assets that are intangible. Some of these intangibles are reported on the balance sheet. For example, Goodwill, or as it is sometimes called, Cost in Excess, is the amount this company has overpaid in the past for acquisitions.

Is inventory a problem?

Value of the Inventory on the Book Can be Simple or Complicated. Inventory, if it turns fast enough, is typically not a problem. However, depending on the accounting method the company uses to value inventory, its value may be off quite a bit from its true market value.

Is real estate marked to the market?

Real estate or property presents another challenge. They are typically not marked to the market and are carried at their historical valuations on the balance sheet. Consider a company that owns 100s of thousands of acres of real estate in Florida, at an average booked cost of $2000/acre. This company is now developing retirement resorts and communities on this real estate. Clearly the value of the real estate is enhanced by the use that it is being put to but if you just go by the book value on the balance sheet, you will miss this important point.

Does depreciating assets make the book value of an asset close to the market value?

But this is not always true .

What is the book value of a business?

They are listed in order of liquidity (how quickly they can be turned into cash). The book value shown on the balance sheet is the book value for all assets in that specific category.

What are the factors that determine the book value of a company?

Additional factors like shareholder equity and debt may also have to be accounted for when assessing the book value of an entire company. Book value is calculated on property assets that can be depreciated. Depreciable assets have lasting value, and they include items such as furniture, equipment, buildings, and other personal property .

Why is book value important for tax purposes?

The book value of assets is important for tax purposes because it quantifies the depreciation of those assets. Depreciation is an expense, which is shown in the business profit and loss statement.

What does it mean when an asset has no value on the balance sheet?

That doesn't mean the asset must be scrapped or that the asset doesn' t have value to the company. It just means that the asset has no value on the balance sheet—it has already maximized the potential tax benefits to the business.

What is the limitation of the book value of assets?

The major limitation of the formula for the book value of assets is that it only applies to business accountants. The formula doesn't help individuals who aren't involved in running a business.

Why do businesses use book value?

Businesses use the book value of an asset to offset some of their profits, therefore reducing their taxes. The book value of an asset isn't helpful for individuals—while the formula still works, the tax benefits don't extend beyond business assets.

Can book value be applied to all assets?

However, when applying the concept more broadly, the effect of depreciation may not apply to all assets. Additional factors like shareholder equity and debt may also have to be accounted for when assessing the book value of an entire company.

What is book value of equity?

The term “Book Value of Equity” refers to a firm’s or company’s common equity, which is the amount available that can be distributed among the shareholders, and it is equal to the amount of assets shareholders own outright after all the liabilities have been paid off. Generally, the owner’s equity of a company is influenced by ...

What are the components of book value of equity?

The book value of equity can be broken down into four major components, which are the owner’s contribution, Treasury shares, Retained earnings, and Other comprehensive income. Now, let us have a look at each of the components separately:

Why is book value of equity important?

Book value of equity is an important concept because it helps in the interpretation of the financial health of a company or firm as it is the fair value of the residual assets after all the liabilities are paid off.

What is dividend portion?

It is the portion of the company profit not paid off to the shareholders of the company in the form of dividends#N#Dividends Dividend is that portion of profit which is distributed to the shareholders of the company as the reward for their investment in the company and its distribution amount is decided by the board of the company and thereafter approved by the shareholders of the company. read more#N#. It is accumulated over a while if the company performs well and forms part of the shareholder’s equity.

What is dividends in business?

Dividends Dividend is that portion of profit which is distributed to the shareholders of the company as the reward for their investment in the company and its distribution amount is decided by the board of the company ...

What is the owner's equity?

Generally, the owner’s equity of a company is influenced by the industry in which it operates and how well it can manage its assets and liabilities. In fact, as a thumb rule, companies that are likely to perform well and generate higher profits are the ones that have a book value, which is lower than their market value.

How to tell if a stock is undervalued?

It helps in determining whether a stock is undervalued or over-valued by comparing it with the market price. It indicates the financial health of a company, i.e., a positive value is an indication of a healthy company. In contrast, a negative or declining value is a signal of weak financial health.

How to determine if a company has issued common stock as well as preferred stock?

If company has issued common as well as preferred stock: If a company has issued common as well as preferred stock, the amount of preferred stock and any dividends in arrears thereon are deducted from the total stockholders equity, the resulting figure is divided by the number of shares of common stock outstanding for the period.

What is book value per share?

What is book value? Book value per share of common stock is the amount of net assets that each share of common stock represents. Some stockholders have keen interest in knowing the book value of the shares they own. This article is focused on its calculation.

What is the difference between net assets and equity?

We know that: Net assets = Assets – Liabilities. Equity = Assets – Liabilities. Net assets = Equity. So an alternative and equally acceptable approach is to replace the numerator of the formula by the stockholders’ equity.

Is book value for common stock only?

Mostly, the book value is calculated for common stock only. The presence of preferred stock in the total stockholders equity, however, has a significant impact on the calculation. The formulas and examples for calculating book value per share with and without preferred stock are given below:

What is book value per share?

The book value per share is a company's book value for every common share outstanding. The book value is the difference between total assets and liabilities. Bank stocks tend to trade at prices below their book value per share as the prices take into consideration the increased risks from a bank's trading activities.

What is the P/B ratio of a stock?

The P/B ratio can be above or below one, depending on whether a stock is trading at a price more than or less than equity book value per share. An above-one P/B ratio means the stock is being valued at a premium in the market to equity book value, whereas a below-one P/B ratio means the stock is being valued at a discount to equity book value. For instance, Capital One Financial ( COF) and Citigroup ( C) had P/B ratios of 0.92 and 0.91, respectively, as of Q3 2018. 1 2

What are the risks of trading derivatives?

Valuation Risks. While trading mostly derivatives can generate some of the biggest profits for banks, it also exposes them to potentially catastrophic risks. A bank's investments in trading account assets can reach hundreds of billions of dollars, taking a large chunk out of its total assets.

Do banks have a price to book ratio?

Banks and other financial companies may have attractive price-to-book ratios, putting them on the radar for some value investors. However, upon closer inspection, one should pay attention to the enormous amount of derivatives exposure that these banks carry.