- Calculate a Stock's Monthly Returns. The return for any given month equals the last trading price for the last business day of the month, divided by the last trading price ...

- Determine Average Monthly Return. To calculate the average monthly return, add up all returns and divide them by the number of months.

- Find the Standard Deviation. Add up the squares of the deviations you have calculated previously. ...

How to calculate AGI from W-2?

- Steps To Calculate Your AGI – Adjusted Gross Income Using W-2 Form

- Gross Income You can find your gross income in box 1 of your W-2 form (total wages, compensations, and tips).

- Adding additional incomes Once you have your gross income, add income from other sources to it. These can include taxable interest, dividends, capital gains, royalties, alimony received, etc. ...

- Subtract Allowable ...

How to calculate stock returns manually?

Total Stock Return Calculator (Click Here or Scroll Down) The formula for the total stock return is the appreciation in the price plus any dividends paid, divided by the original price of the stock. The income sources from a stock is dividends and its increase in value. The first portion of the numerator of the total stock return formula looks ...

What is the annual return rate for stocks?

The average stock market return is about 10% per year for nearly the last century. The S&P 500 is often considered the benchmark measure for annual stock market returns. Though 10% is the average stock market return, returns in any year are far from average. Here’s what new investors starting today should know about stock market returns.

How do you calculate the total value of a stock?

4 ways to calculate the relative value of a stock

- Price-to-earnings ratio (P/E) What it is. Offers a snapshot of what you’ll pay for a company’s future earnings. ...

- Price/earnings-to-growth ratio (PEG) What it is. Considers a company’s earnings growth. ...

- Price-to-book ratio (P/B) What it is. A snapshot of the value of a company’s assets. ...

- Free cash flow (FCF)

How do you calculate monthly return on stocks?

The calculation of monthly returns on investment Once you have those figures, the calculation is simple. Take the ending balance, and either add back net withdrawals or subtract out net deposits during the period. Then divide the result by the starting balance at the beginning of the month.

How do you calculate average return on stock?

Here's how to calculate the average stock market return:Divide the ending value of the investment by the beginning value of the assessment. ... Divide the number of units by the number of years in the time period. ... Multiply the result of Step 1 by the result of Step 2. ... Subtract 1 to get the annualized rate of return.

What is the average monthly return on the stock market?

The average return of the stock market over the long term is about 10%, as measured by the S&P 500 index. This long-term historical average is a more reasonable expectation for stock market returns, compared to the 14.5% annualized 10-year performance on the S&P 500 over the past decade, through March 31, 2022.

How do you calculate average monthly rate?

Once you have all the numbers for each month, add all the numbers together for each month, and then divide them by the total amount of months.

What does average monthly return mean?

The average return is the simple mathematical average of a series of returns generated over a specified period of time. An average return is calculated the same way that a simple average is calculated for any set of numbers.

How do you calculate the average return on a stock in Excel?

Average Rate of Return = Average Annual Profit / Initial InvestmentAverage Rate of Return = $1,600,000 / $4,500,000.Average Rate of Return = 35.56%

How much money do I need to invest to make $1000 a month?

Assuming a deduction rate of 5%, savings of $240,000 would be required to pull out $1,000 per month: $240,000 savings x 5% = $12,000 per year or $1,000 per month.

How much money do day traders with $10000 Accounts make per day on average?

Day traders get a wide variety of results that largely depend on the amount of capital they can risk, and their skill at managing that money. If you have a trading account of $10,000, a good day might bring in a five percent gain, or $500.

How do I calculate average monthly value in Excel?

How to calculate monthly averages=AVERAGEIFS(numeric data range,date range,">=" & first day of month,date range,"<=" & EOMONTH(first day of month,More items...•

What is a monthly average?

By analogy with annual averages and moving averages generally this term ought to refer to the average values of a time series occurring within a month, the resulting figure being representative of that particular month.

How do you calculate a 3 month average?

1. sum of three months' turnover%, then divided by 3. 2. sum of three months' numerators, then divided by sum of three months' denominator.

How many periods of 60 monthly returns?

What goes into 60 monthly return calculations is 1,259 daily periods for each stock plus a few nasty corporate actions we can't ignore.

How many items are needed for daily returns?

The calculation of daily returns requires four items from the daily stream of data: prices, dividends, splits and spin-offs. I will review the tabs below, with 1,259 daily prices, but let me say a few words about each one first.

How rare are special dividends?

Special dividends are rare, occurring for less than 1 percent of companies annually. Spin-offs are more frequent than you might imagine. In the sample of 100 stocks over the past 10 years, between 2 and 3 percent of companies enacted a spinoff each year.

What is a stock split?

The next topic is a stock split. A split is nothing more than the change of the price of a stock through an accounting procedure. It's like cutting a pie into 8 slices instead of 4. If you add it all up, you still have 1 pie, regardless of whether each piece is one quarter or one eighth of the pie.

How many rows are there in the daily price table?

The table shows Ticker, Name, Frequency, which is daily, the start and end dates plus a count of the number of daily prices which is 1,259 rows. Let's look at daily prices using the Microsoft tab.

What is the percentage of 0.056175 in Excel?

The number 0.056175 in cell C7 refers to the return on Microsoft for April 2003, so just over 5.6 percent. In an earlier tutorial ( System Setup ) we went over how to download this data and import it to Excel. Understanding how it was put together is important and that is the point here.

What are the four stocks that are in decimal format?

The end result sits on the Returns tab. Here we have monthly returns, in decimal format, for each of four US stocks: Microsoft, eBay, Abbott Labs and Merck.

Why are monthly returns so small?

Note that most of the time, monthly returns will be relatively small. That's because most people are used to seeing annual returns rather than monthly ones. If you want to know the corresponding annual return, then there are two things you can do.

Why is it important to look at monthly returns?

Nevertheless, looking at monthly returns on investment can give you important information about whether you're doing better or worse than the overall market, and if you're systematically underperforming, you can take steps to adopt better investing strategies.

How to calculate percentage gain or loss?

Once you have those figures, the calculation is simple. Take the ending balance, and either add back net withdrawals or subtract out net deposits during the period . Then divide the result by the starting balance at the beginning of the month. Subtract 1 and multiply by 100, and you'll have the percentage gain or loss that corresponds to your monthly return.

Is monthly return easy to calculate?

Monthly returns are easy to calculate, and they can provide some interesting data to consider. Just don't let a month's performance distract you from the long-term nature of successful investing.

Is it important to put too much importance on a single monthly return?

However, it's important not to put too much importance on any single monthly return. Concluding the success or failure of a strategy based on just one month can lead you to make erroneous decisions. If you note consistent underperformance for multiple months, then it can make sense to take a closer look.

Why should dividends be entered as positive numbers?

The dividends should be entered in as positive numbers, because they represent a cash inflow to you. Finally, I'll enter the share price as of the most recent trading day. On November 9, 2015, Microsoft shares traded for $54.10 per share.

Is IRR annual or monthly?

As one final reminder, remember that IRRs are annual. Thus, if you hold an investment for only a few days or weeks, the return will likely seem very high. A 10% gain in a month, for example, works out to an IRR of 207%, which tells you that a 10% return in a month will more than triple your investment in one year's time if you continue to earn that return.

Calculating a Stock's Total Return

The team at Fervent Learning's Investment Fundamentals offers an in-depth explanation of how to calculate stock returns. They explain that the basic formula is as follows: Return = (Ending Value - Initial Value)/Initial Value.

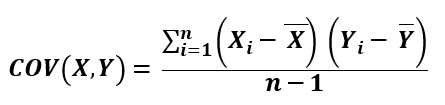

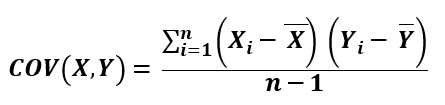

Calculating Average Monthly Return

There are several ways to calculate average monthly return, again depending on what data you're working with. If you've derived a stock's return from its adjusted closing price as above, then there are two ways to obtain an annual rate of return, from which you can calculate a monthly average.

Additional Formulas for Obtaining Monthly Average

However, the more accurate formula is to add 1 to the rate per period and raise that sum to the power of the number of periods, all before subtracting 1 again. For daily rates, this would be ( (1 + Daily Rate) ^ 250 -1) x 100 percent . To get the monthly average, again divide by 12 .

Additional Tips for Calculating Monthly Average

You can do all of these calculations in Excel or similar programs. Here is the most straightforward method: create a column for dates and a corresponding column for adjusted closing price on that date.

Why is it important to look at monthly returns on investment?

Nevertheless, looking at monthly returns on investment can give you important information about whether you're doing better or worse than the overall market, and if you're systematically underperforming, you can take steps to adopt better investing strategies.

Why is monthly return important?

Monthly returns can be useful to investors in assessing short-term performance and determining the characteristics of the portfolio that you've put together. For instance, if you have a stock portfolio, you can compare your monthly return to that of the Dow Jones Industrials or another stock market benchmark that matches up to your particular ...

Is it important to have a strategy based on one month?

If your returns are dramatically different, it can be evidence of whether you have a strategy that works well or poorly. However, it's important not to put too much importance on any single monthly return. Concluding the success or failure of a strategy based on just one month can lead you to make erroneous decisions.

What is average return?

Average return is defined as the mathematical average of a series of returns generated over a period of time. In regards to the calculator, average return for the first calculation is the rate in which the beginning balance concludes as the ending balance, based on deposits and withdrawals that are made in-between over time. The time value of money is accounted for, which is a theory that states that a dollar today is worth more than a dollar tomorrow. For the second calculation, average return is the total return of the entire period (for all returns involved) divided by the number of periods. The time value of money is also accounted for here.

What is cumulative return?

Cumulative return refers to the aggregate amount an investment gains or loses irrespective of time, and can be presented as either a numerical sum total or as a percentage rate. It is generally contrasted with annual return, which is the return (or loss) of an investment in a single year only.

What is the ARR in accounting?

The average rate of return (ARR), also known as accounting rate of return, is the average amount (usually annualized) of cash flow generated over the life of an investment. ARR does not account for the time value of money. As a result, it is best to use ARR in conjunction with other metrics when considering large financial decisions.

How to calculate average return on stock portfolio?

Calculating the average return on your stock portfolio first requires calculating the return for each period. Then you can add each period's return together and divide that value by how many periods there are to get the average return.

How to calculate average return?

Add each period's return and then divide by the number of periods to calculate the average return. Continuing with the example, suppose your portfolio experienced returns of 25 percent, -10 percent, 30 percent and -20 percent for the next four years.

How to calculate yearly return of 5 percent?

Then subtract the two years of losses -- a total of 30 percent -- to get a total gain of 25 percent. Divide 25 percent by 5 years to calculate the average yearly return of 5 percent.

How to calculate the first year's return?

Subtract the portfolio's beginning value from the ending value of each year and then divide by the beginning value. Doing so calculates each year's return. Continuing with the example, subtract $4,500 from $4,950 to get $450. Divide $450 by $4,500 to calculate the first year's return of 0.10, or 10 percent.

How to calculate ending price of stock?

Multiply the number of shares of each stock by the ending price for each year and then add each stock's total. The ending price in one year is the same as the beginning value in the next year.

What does the average return on a portfolio of stocks show?

The average return on a portfolio of stocks should show you how well your investments have worked over a period of time. This not only shows you how you performed, but it also helps to predict future returns.

How to segment a portfolio?

You need the number of shares of each stock and the beginning and ending prices for each year. Multiply the number of shares of each stock by its price at the beginning of each year and then add each stock's total for the year.

Annualized Return vs. Average Return

Computing Return from Value Growth

- The average growth rate is used to assess an increase or decrease in the value of an investment over a period of time. The growth rate is computed using the growth rate formula: For example, assume that an investor invested $100,000 in an investment product, and the stock prices fluctuated from $100 to $250. Using the above formula to calculate the average return gives the …

Average Return vs. Geometric Average

- The geometric average proves to be ideal when analyzing average historical returns. What sets the geometric meanapart is that it assumes the actual value invested. Computation only pays attention to the return values and applies a comparison concept when analyzing the performance of more than a single investment over multiple time periods. The geometric average return take…

Limitations of Average Return

- Despite its preferences as an easy and effective measure for internal returns, the average return has several pitfalls. It does not account for different projects that might require different capital outlays. In the same vein, it ignores future costs that may affect profit; rather, it only focuses on projected cash flows resulting from a capital injection. Also, average return does not consider th…

More Resources

- Thank you for reading CFI’s guide on Average Return. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below: 1. Annualized Total Return 2. Return on Investment (ROI) 3. Average Annual Growth Rate 4. Annualized Rate of Return

Outline

Step 1 - Our Sample Data Set

Step 2 - Which Return Calculation Is Appropriate?

Step 3 - The Daily Process

Step 4 - Pricing Sources

The Math

- Let's take a quick look at The Math section. First is a formula for daily return with no dividends or corporate actions. In this simple calculation you take today's stock price and divide it by yesterday's stock price, then subtract 1. We saw that in the previous tutorial. 1. Daily return without dividends = (Price (Today) / Price (Yesterday)) - 1 ...

Exercises

Summary

Step 5 - Next: Return Distributions