How to buy stocks in Tanger Factory Outlet Centers

- Compare stock trading platforms. Use our comparison table to help you find a platform that fits you.

- Open your brokerage account. Complete an application with your details.

- Confirm your payment details. Fund your account.

- Research the stock. Find the stock by name or ticker symbol – SKT – and research it before deciding...

- Pick a Brokerage. As a retail investor, you'll need to open an account with a broker before you can invest in SKT or any other stocks. ...

- Decide How Many Shares You Want. ...

- Choose Your Order Type. ...

- Execute Your Trade.

Is Tanger Factory Outlet centers the perfect dividend stock?

Mar 31, 2022 · How can I buy stock in Tanger Factory Outlet Centers Inc? How can you safely invest in Tanger Factory Outlet Centers Inc? Decide if you would like to trade with a stock broker of trade via CFD trading. Open a stock brokerage or CFD trading account with a broker like XTB or AvaTrade. Verify your ...

Why does Tangerine have so many clearance stores?

Feb 05, 2021 · How to buy stocks in Tanger Factory Outlet Centers Compare stock trading platforms. Use our comparison table to help you find a platform that fits you. Open your brokerage account. Complete an application with your details. Confirm your payment details. Fund your account. Research the stock. Find ...

Is Tanger Outlet a safe mall?

Apr 18, 2022 · Comparatively, Tanger Factory Outlet Centers has a beta of 1.86, indicating that its stock price is 86% more volatile than the S&P 500. Dividends EastGroup Properties pays …

Is Tangerine a safe place to shop?

Jan 15, 2021 · It didn't take long for Tanger Factory Outlet Centers ( SKT 1.69% ) to go from a busted dividend stock to a profitable candidate for income investors. The operator of 38 upscale outlet shopping...

Is Tanger publicly traded?

Tanger's operating properties are located in 20 states and in Canada, totaling approximately 13.6 million square feet, leased to over 2,700 stores operated by more than 600 different brand name companies. The Company has more than 41 years of experience in the outlet industry and is a publicly-traded REIT.

Is Tanger a good stock to buy?

Is Tanger Factory Outlet Centers Inc stock A Buy? Tanger Factory Outlet Centers Inc holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

Is SKT stock a buy?

According to the issued ratings of 2 analysts in the last year, the consensus rating for Tanger Factory Outlet Centers stock is Hold based on the current 1 sell rating and 1 buy rating for SKT.

Does Tanger stock pay a dividend?

with 99% accuracy. Sign up for Tanger Factory Outlet Centers, Inc. and we'll email you the dividend information when they declare....SummaryPrevious dividendNext dividendTypeQuarterlyQuarterlyPer share18.25cSign Up RequiredDeclaration date13 Jan 2022 (Thu)11 Apr 2022 (Mon)3 more rows

Is Tanger Factory Outlet a buy?

Tanger Factory Outlet Centers has received a consensus rating of Hold. The company's average rating score is 1.67, and is based on 1 buy rating, no hold ratings, and 2 sell ratings.

Should I sell SKT stock?

Out of 3 analysts, 1 (33.33%) are recommending SKT as a Strong Buy, 0 (0%) are recommending SKT as a Buy, 1 (33.33%) are recommending SKT as a Hold, 0 (0%) are recommending SKT as a Sell, and 1 (33.33%) are recommending SKT as a Strong Sell. What is SKT's earnings growth forecast for 2022-2023?

How old is Steven Tanger?

67Mr. Tanger, 67, is the president and chief executive of Tanger Outlet Centers, in Greensboro, which his father founded in 1981.May 15, 2016

What is the ex dividend date for SKT?

SKT Dividend HistoryEx/EFF DATETYPEPAYMENT DATE04/29/2020CASH05/15/202001/30/2020CASH02/14/202010/30/2019CASH11/15/201907/30/2019CASH08/15/201930 more rows

What is a Tanger Factory Outlet Center?

Tanger Factory Outlet Centers is a real estate investment trust (REIT) that invests in shopping centers and outlet stores. Tanger Factory Outlet Centers is structured in the same way that most other REITs operate — Tanger rents out space to commercial tenants and returns a portion of its income back to shareholders in the form of dividends.

What is short squeeze?

A short squeeze occurs when the price of a security jumps sharply after many investors “short” the stock by betting on its failure. When investors who have shorted see that the price of the security moves upward, they are forced to buy in to prevent further losses. This further increases the price of the stock by adding upward momentum.

How to calculate Tanger's P/E ratio?

Tanger Factory Outlet Centers's "price/earnings-to-growth ratio" can be calculated by dividing its P /E ratio by its growth – to give 3.6521. A low ratio can be interpreted as meaning the stocks offer better value, while a higher ratio can be interpreted as meaning the stocks offer worse value.

Who is Charlie Barton?

Charlie Barton is a publisher at Finder. He specialises in banking and investments products, including banking apps, current accounts, share-dealing platforms and stocks and shares ISAs. Charlie has a first-class degree from the London School of Economics, and in his spare time enjoys long walks on the beach.

Payouts are back at the discount mall operator, but let's size up all of the risks before mistaking this as a safe dividend play

Since 1995, Rick has been writing for The Motley Fool, where he's a consumer and tech stocks specialist. Yes, that's a long time with more than 20,000 bylines over those 24 years. He's been an analyst for Motley Fool Rule Breakers and a portfolio lead analyst for Motley Fool Supernova since each newsletter service's inception.

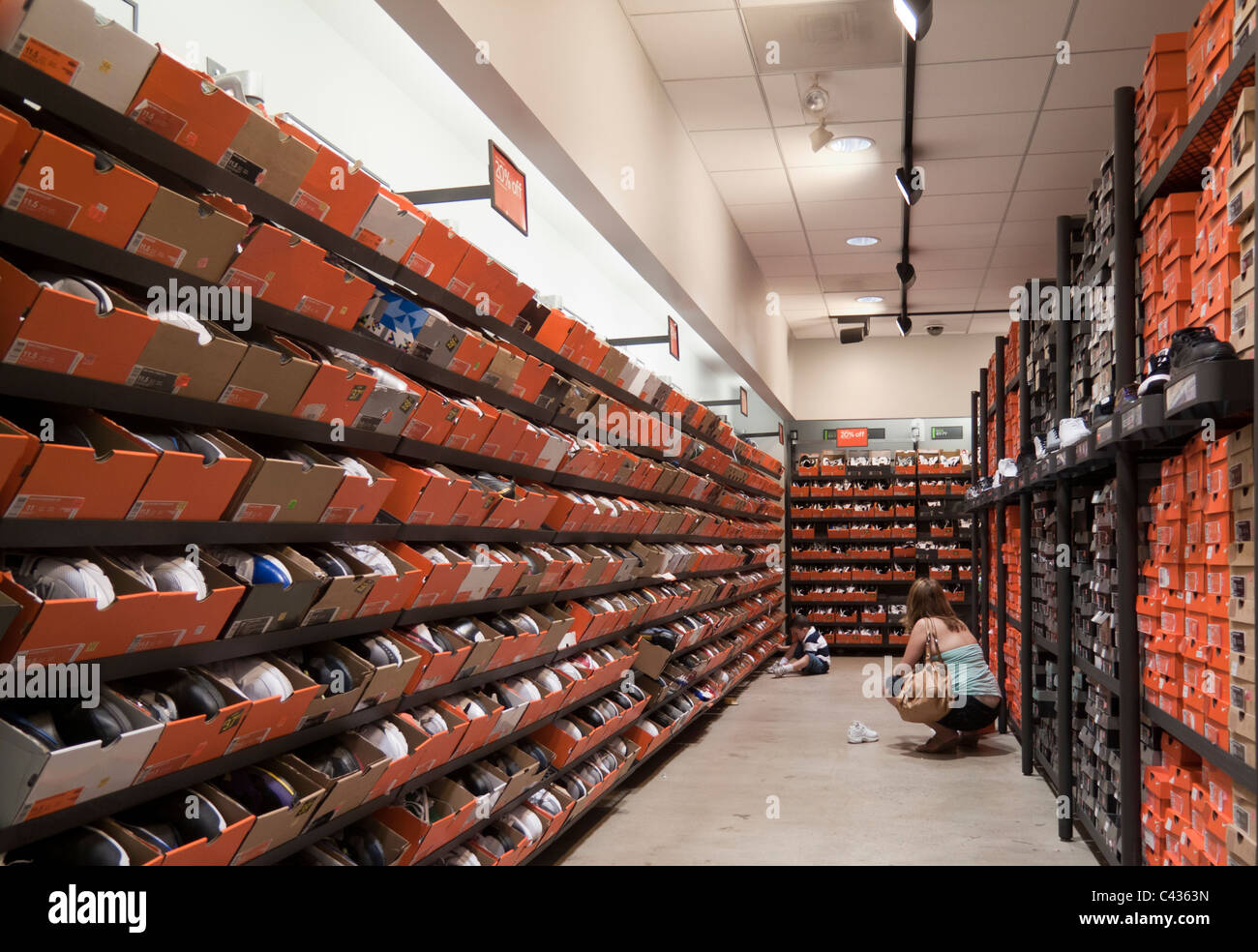

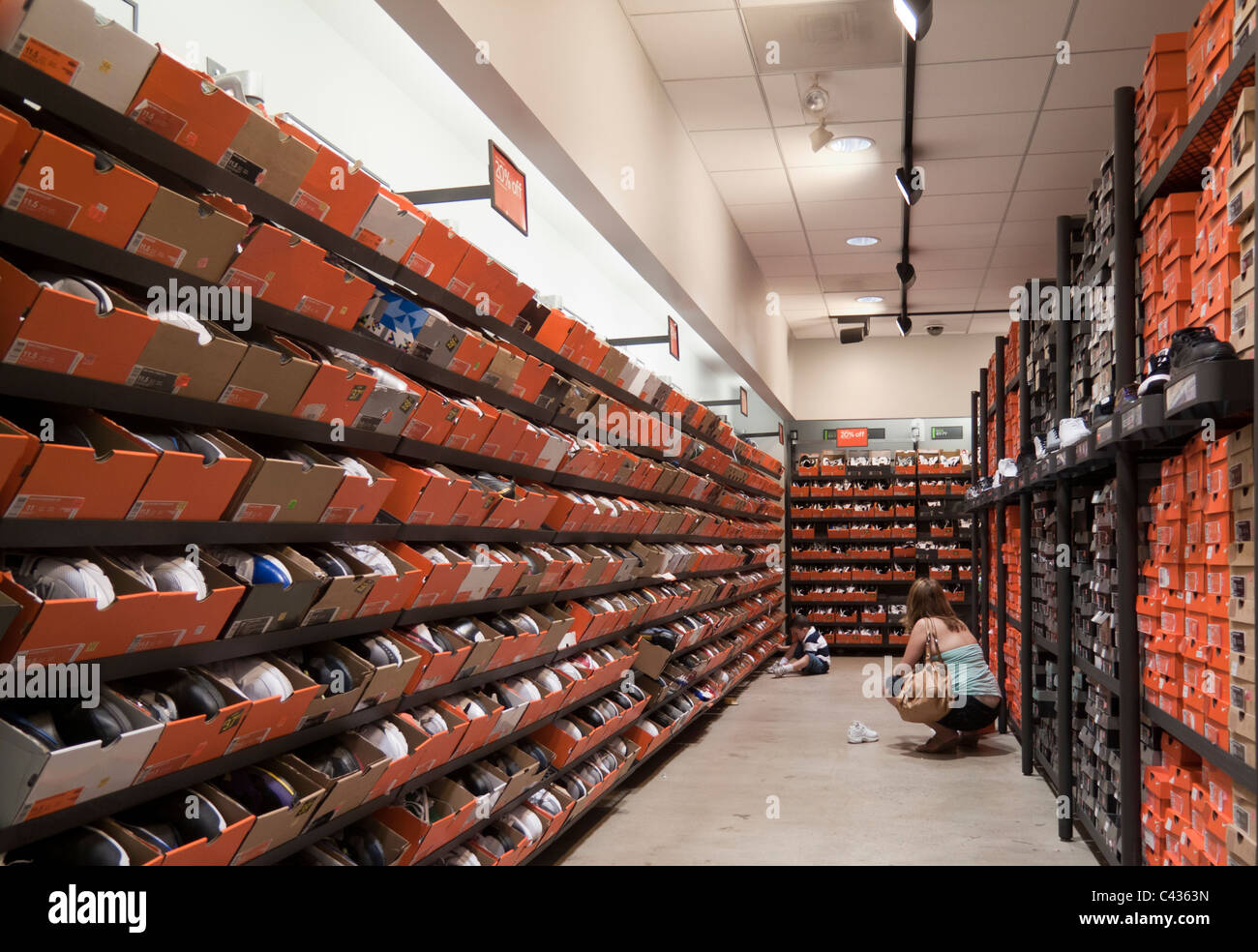

Closing in on closeouts

There are plenty of risks here. Everybody loves a bargain, but Tanger is collecting rent from retailers that have a presence in its outlet centers because they're not perfect. Brand-name retailers open up clearance stores because they're not selling everything they're making at full price.

The retail landlord is working through the COVID-19 crisis as best it can. Will it survive and, perhaps, even thrive?

Reuben Gregg Brewer believes dividends are a window into a company's soul. He tries to invest in good souls.

The bad news

The United States has an overabundance of retail, one of the key facts behind the so-called "retail apocalypse." There are other issues involved, including companies that over-leveraged and fell behind changing customer trends, but too much physical retail is a prime factor. So, even before COVID-19, stores were struggling to compete.

The good news

Tanger, however, isn't your typical mall-owning real estate investment trust. As its full name implies, it owns factory outlet centers. This is among the least developed of the retail property types, with Tanger estimating that factory outlet centers account for only 1% of the U.S. retail property market.

What comes next?

There are no crystal balls on Wall Street, so there's no way to tell what happens from here. The next few quarters' worth of earnings reports are likely to be terrible reading, but that doesn't mean that Tanger has been dealt a knockout punch. It has quickly protected itself while doing all it can to help its tenants.