What are the best oil stocks to buy?

Aug 26, 2021 · Among the major integrated oil companies, including Chevron, ExxonMobil, BP, and Royal Dutch Shell, Chevron has the lowest debt-to-equity ratio at just 0.21 and carries $7.5 billion in cash. Oil ...

Is now the time to buy oil stocks?

Feb 23, 2022 · With runaway inflation and rising oil prices, now is the best time to buy this leading energy giant. Inflation is running rampant, rising 7.5% in …

When to sell oil stocks?

Dec 06, 2021 · Best Value for Money Oil Stocks. 1. Murphy Oil Corp. (MUR) Murphy Oil Corporation is a major oil and gas exploration corporation that also has assets in the production of both crude oil and natural gas. Murphy also has refineries and retail operations in some parts of the United States.

How do I invest in oil stocks?

Mar 01, 2022 · SHEL stock has gains of nearly 16% year-to-date and 26% in the last year. Revenue growth of 43% in 2021 was impressive. More impressive was the surge in net income from a …

How do you buy stock in oil?

You can invest in oil-related stocks, oil mutual funds and oil futures. To buy or sell oil investments, you'll need to have a brokerage account.

Are oil stocks a good buy now?

Are Oil Stocks Good Investments? Yes, oil stocks are good investments for long-term investors and possibly deserve a place in a diversified portfolio. Oil shares typically offer the potential for both capital appreciation and passive income in the form of dividends.Mar 8, 2022

What is the best oil stock to buy now?

What are the top oil stocks to invest in?Oil stockTicker SymbolDescriptionEnbridge(NYSE: ENB)A Canadian energy infrastructure giant.ExxonMobil(NYSE: XOM)A large-scale, integrated oil supermajor.Phillips 66(NYSE: PSX)A leading refining company with midstream, chemical, and distribution operations.2 more rows

Is oil a good investment in 2021?

Though oil-price growth shouldn't be nearly as dramatic as in 2021. "Crude and oil product prices should benefit from oil demand moving above 2019 levels," say UBS analysts. "We expect Brent to rise into a $80-$90 range in 2022."Jan 6, 2022

Will oil stocks go up 2022?

Occidental Petroleum stock has risen 78% so far in 2022 — exceeding the 61% rise in oil prices so far this year. After all, in the fourth quarter of 2021 its revenue soared over 90% while net income popped 238%.Mar 8, 2022

Is it safe to buy oil stocks?

Investing in the oil and gas industry carries a number of significant risks. Three of those risks are commodity price volatility risk, cutting of dividend payments for those companies that pay them, and the possibility of an oil spill or another accident during the production of oil or natural gas.

How can I invest in rising oil prices?

Investors can also gain exposure to oil by purchasing related equities directly, or through energy-sector ETFs and mutual funds. While energy stocks come with their own risks, ETFs and mutual funds offer diversification within the sector.Mar 3, 2022

What stocks benefit from low oil prices?

Consumer Discretionary: This sector includes companies in retail, travel, entertainment and restaurants. These businesses benefit indirectly from lower oil prices, as consumers looks for places to spend the money that they save on fuel.

What is the price of oil stock today?

WTI Crude105.6+1.34Brent Crude110.3+1.52Natural Gas7.292+0.295Heating Oil3.889+0.171Gasoline •10 hours3.341+0.0503 more rows

Can you buy oil futures?

Buy Oil Futures Directly. Your first option is to buy and sell oil futures directly through a commodities exchange. Some of the most popular are the New York Mercantile Exchange (NYMEX) and the Chicago Mercantile Exchange (CME or CME Group). You can also purchase through a broker like TradeStation.

Is Exxon stock a buy?

Exxon Mobil currently has a Zacks Rank of #1 (Strong Buy). Our research shows that stocks rated Zacks Rank #1 (Strong Buy) and #2 (Buy) and Style Scores of A or B outperform the market over the following one-month period.Mar 9, 2022

Is investing in oil and gas a good idea?

In the oil and gas industry, this means that drilling costs—from equipment to labor—are up to 100% tax deductible. Oil and gas investments are an excellent write-off against income or gains in other areas. This makes oil a very good investment for many!

What is the largest E&P company in the world?

ConocoPhillips ( NYSE:COP) is one of the largest E&P-focused companies in the world, with operations in more than a dozen countries. It also produces oil using a variety of sources and methods, including horizontal drilling and hydraulic fracturing of shale in the U.S., oil sands mining in Canada, and deepwater drilling, as well as other conventional production techniques elsewhere around the world.

What is Phillips 66?

Phillips 66 ( NYSE:PSX) is one of the leading oil refining companies, with operations in the U.S. and Europe. It also has investments in midstream operations -- including sizable stakes in two master limited partnerships, Phillips 66 Partners ( NYSE:PSX P) and DCP Midstream ( NYSE:DCP) -- and in petrochemicals via its CPChem joint venture with Chevron ( NYSE:CVX). Finally, its marketing and specialties business distributes refined products and manufactures specialty products such as lubricants.

What is the role of OPEC in the world?

The world’s 13 largest oil-exporting nations are part of OPEC (Organization of the Petroleum Exporting Countries), an organization that works to coordinate members’ oil policies. OPEC's actions can significantly affect the price of oil.

Why are oil companies important?

Oil companies are crucial to the global economy as it is currently structured because they provide fossil fuels for transportation and power, as well as the core ingredients of petrochemicals, which are used to make plastic and rubber. However, the oil industry is highly competitive and volatile. That volatility was on full display in 2020 as crude ...

What is oil company?

An oil company is an entity engaged in at least one of the following three activities: Upstream exploration and production (E&P) of oil and natural gas, as well as oilfield services. Midstream transportation, processing, and storage of oil and related liquids, including refined petroleum products and natural gas liquids (NGLs) ...

Why is it important to be aware of the oil sector?

Because of that, it's best to focus on companies built to weather the sector's inevitable downturns. That means focusing on those with relative immunity to price fluctuations, such as E&Ps with ultra-low production costs and integrated oil giants.

Why can't oil companies increase their supply?

Since the lead time is long to develop new oil and gas assets , oil companies cannot quickly increase their supplies in response to favorable market conditions. Given the volatility in oil prices, an oil company must have three crucial characteristics to survive the industry's inevitable downturns.

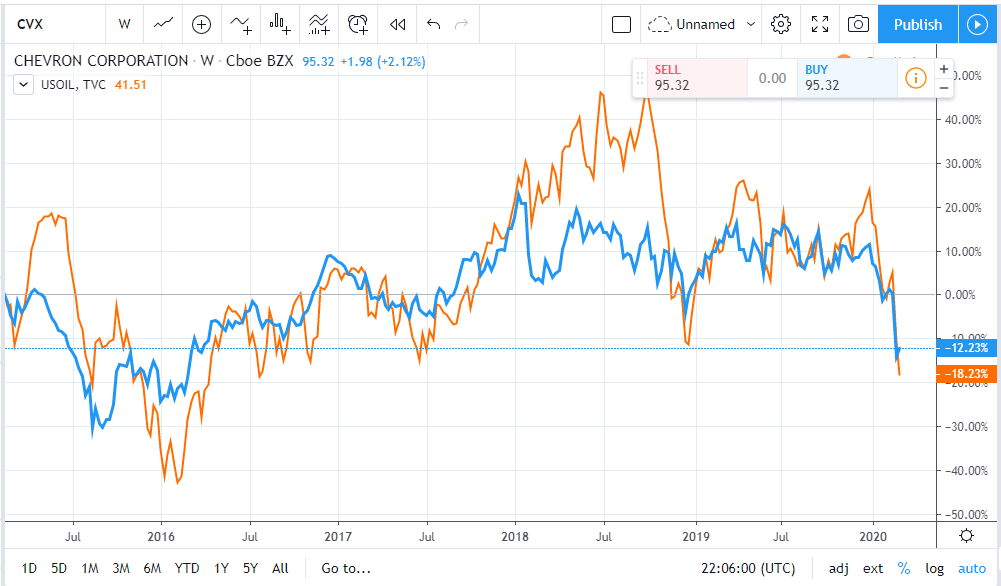

Chevron's fundamentals make it a top oil stock in the evolving energy industry

Justin loves covering stocks across all industries, but his heart is in high-growth technology. He's been a student of the market for more than a decade. Stocks are his second love to his wife and kids, which is how he spends his free time.

Key Points

Renewable energy sources are gaining steam, but oil and gas will not go away anytime soon.

1. Energy is evolving, but oil still has its place

Oil companies have long powered our world, but that is steadily changing. Climate change has pushed society to seek out cleaner methods for generating energy. Renewables like wind and solar have been around for years; adoption has been slow because of the higher costs of renewable energy.

2. Gaining strength with oil recovery

Chevron is what is called an "integrated" oil and gas company, which means it participates in all three phases of production:

3. A large dividend with plenty of support

The pandemic was a unique event, but world events impact oil prices from time to time. Because its business is sensitive to oil prices, management must operate the company to protect investors from these tough times.

Why Chevron's a buy today

Chevron's stock has yet to recover to pre-pandemic levels, but the business itself is showing strong momentum. The company generated a free cash flow of $11.2 billion from its operating activities through the first six months of 2021, enough to cover the dividend and start a buyback program.

NYSE: XOM

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

ExxonMobil is an oil and gas giant that's only begun to wake from its slumber

Oil is enjoying its best year since prices topped out at more than $100 per barrel a decade ago. Oil and gas behemoth ExxonMobil ( XOM -1.11% ) has rallied with it, hitting pre-COVID share prices.

1. The most substantial cash flow in years

ExxonMobil's an integrated oil stock, which means it participates in multiple aspects of the oil and gas industry, including the exploration and extraction of fossil fuels (upstream) and the refining and distribution of fossil fuel products (downstream).

2. The dividend is still awesome

The up-and-down nature of the oil industry makes it hard for many oil and gas companies to pay a dividend over the long term reliably. But ExxonMobil is a $300 billion oil company and has the massive size and resources to be flexible when needed.

3. Production prospects look strong

ExxonMobil is emphasizing efficiency after a near decade-long bear market in oil prices. Of course, it also helps to get a little luck. Its Guyana exploration has been a smashing success over the past few years.

Ready for new highs?

ExxonMobil's become more careful with how it spends money and with recovering oil prices, free cash flow is its highest in a decade.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

NYSE: XOM

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

With runaway inflation and rising oil prices, now is the best time to buy this leading energy giant

Inflation is running rampant, rising 7.5% in January, the highest it's been in 40 years, and gasoline prices are at a seven-year high. The average price paid at the pump for regular gas is $3.42 a gallon.

Priming the pump of growth

Business is booming for Exxon, the largest U.S. oil company, and the company recently reported fourth-quarter earnings showing that it generated $8.9 billion in profits, the most it's made since 2015.

Better than ever

Exxon says production of oil and gas is up by 2% from the year-ago period on a recovery in demand. Profits also improved in its refining segment, reaching the low end of a range they have been in over the past decade despite slack demand in jet fuel.

Everything points to growth

Global oil production is expected to rise considerably over the next few years; gas prices are soaring, with at least one industry expert predicting $5-a-gallon gas in our future, maybe even as high as $7 a gallon.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What is etoro trading?

eToro is the world’s leading social trading and investing platform and is perfect for those who are looking to add oil stocks to their portfolio. Their platform is very user-friendly and with 0% commission to pay they are a great choice.

Where is Cabot Oil and Gas located?

Cabot Oil & Gas Corporation is a company that you may or may not know, but it does develop and explore oil and gas properties throughout North America, and places such as the Rocky Mountains, Western United States, and Texas. With expiration of oil set to boom in some type of economic expansion, it is likely that Cabot will continue to attract a lot of inflows. With a market cap of just $7.7 billion, and a 12 month trailing return of 5.2%, it has performed quite well amongst its peers.

Why is it important to use a broker?

The broker you use will be important. However, there are just a handful of things that you will need to pay attention to in order to be successful. For example, the broker needs to be regulated, and of course the broker needs to offer the instruments and markets you wish to trade. There are a lot of extras that you could take advantage of as well, so by looking around you can get extra value for your business if you are paying attention.

Is Murphy Oil a major oil company?

Murphy Oil Corporation is a major oil and gas exploration corporation that also has assets in the production of both crude oil and natural gas. Murphy also has refineries and retail operations in some parts of the United States. As the oil prices over the last couple of years have plunged, Murphy has reported a large net loss of 324 million dollars, during the Q2 part of 2020. If the economy starts to recover, Murphy will certainly be one of the major beneficiaries due to demand for energy. The market cap of $1.2 billion and a 12 month trailing P/E ratio of 5.3 makes this a strong value play.

The Most Substantial Cash Flow in Years

- ExxonMobil's an integrated oil stock, which means it participates in multiple aspects of the oil and gas industry, including the exploration and extraction of fossil fuels (upstream) and the refining and distribution of fossil fuel products (downstream). You can reasonably simplify the company's business by looking at its financials over time and how several factors have affected them. The …

The Dividend Is Still Awesome

- The up-and-down nature of the oil industry makes it hard for many oil and gas companies to pay a dividend over the long term reliably. But ExxonMobil is a $300 billion oil company and has the massive size and resources to be flexible when needed. It's a Dividend Aristocrat that has paid and raised its dividend annually for the past 38 years, spanning multiple market cycles. Oil stock…

Production Prospects Look Strong

- ExxonMobil is emphasizing efficiency after a near decade-long bear marketin oil prices. Of course, it also helps to get a little luck. Its Guyana exploration has been a smashing success over the past few years. It has repeatedly found high-yielding areas to drill, and production in the Guyana region could grow to more than a million barrels of oil per day over the next five years. The crucial part i…

Ready For New Highs?

- ExxonMobil's become more careful with how it spends money and with recovering oil prices, free cash flow is its highest in a decade. Shares could still have near-term upside if oil continues rallying, but what I like is that the challenges of the past decade have pushed the company to become more careful with its capital instead of spending like a drunken sailor. As a long-term in…