How to Buy Korean Stocks

- Researching Korean Companies. Gather information on the stocks available for purchase on the Korean Exchange or Korean...

- Initiating Your Purchase. Decide how many shares you wish to purchase, and check the latest share price. You can find...

- Submit Your Order. Submit your order with your broker. The broker should confirm your trade and detail...

How do I buy South Korean stocks?

South Korean stocks may be bought on the Korean Exchange, established in the 1950s. Some large Korean companies also offer their stock on the New York Stock Exchange through American depository shares. Korean stocks can also be purchased indirectly through exchange-traded funds focused on South Korea or the Asia-Pacific region.

What is the South Korea stock market called?

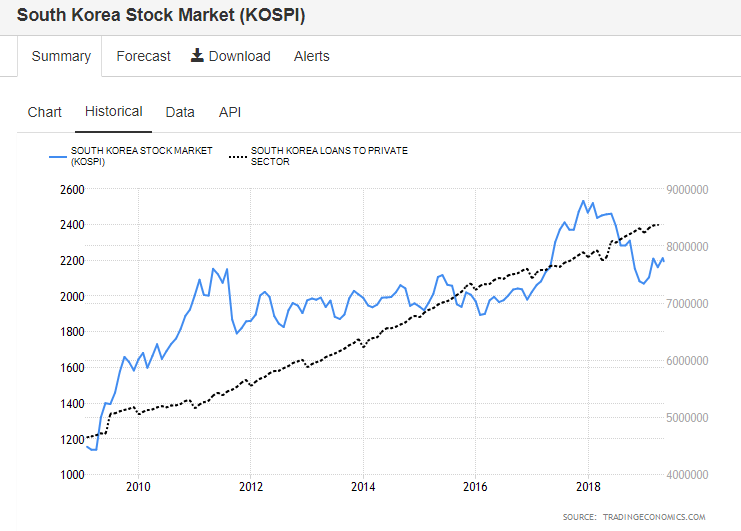

South Korea Stock Market (KOSPI) The Korea Stock Exchange Composite KOSPI is a major stock market index which tracks the performance of all common shares listed on the Korean Stock Exchange. It is a capitalization-weighted index. The KOSPI Index has a base value of 100 as of January 4, 1980.

How do I buy shares in the stock market?

For shares traded in the United States, gather information from the appropriate exchange's website, such as the New York Stock Exchange if the stock is traded there. Decide how many shares you wish to purchase, and check the latest share price.

What indices can I invest in in South Korea?

On the South Korean stock market you'll find 3 indices which are tracked by ETFs. Alternatively, you can invest in indices on the Asia-Pacific region and Emerging Markets. Ja… For an investment in the South Korean stock market, there are 3 indices available which are tracked by 6 ETFs. On the FTSE Korea 30/18 Capped index there is 1 ETF .

How to research Korean companies?

Do you have to confirm your trade with a broker?

Can foreigners invest in Korean stocks?

Foreign investors are allowed to invest in the Korean equity securities market without any restrictions. The only exceptions are a small number of companies of national importance and some industries (such as aviation, communication and broadcasting) where limits ranging from zero to 49.99% apply.

How do I open a stock account in Korea?

The following documents are needed to open an account:Investor Registration Card (issued by Financial Supervisory Service)Copy of Standing Proxy Agreement*Possibly fees will be associated with standing proxy agreement.Copy of Business Registration of Standing Proxy (Institutional investor)More items...

Why are Korean stocks so cheap?

The problem is so long-standing that there is a term for it — the Korea discount. Observers attribute this to several Korea-specific factors: (1) geopolitical risks associated with North Korea, (2) the diversification of conglomerates into unrelated markets and (3) poor shareholder rights.

Can you buy Korean stocks in Australia?

PhillipCapital opens the doors to investors looking to buy Korean stocks in Australia as well as offers unique access to trade some of the world's most exotic markets and fastest growing economies.

What is the South Korean stock market called?

Korea Stock ExchangeKorea Stock Exchange (KRX)

Why should I invest in South Korea?

Strong international financial position (currency reserves and low external debt) Growth of investment in Asia. Brand savvy consumers willing to spend on quality products. High level of disposable household income.

Is South Korea a good investment?

South Korea offers a chance to invest in a stable economy with a high income and a track record of growth. Risks of investing in South Korea include a heavy reliance on imports and a tense relationship with its neighbor, North Korea.

What is the average house price in South Korea?

The average price of apartments amounted to around 1.18 billion South Korean won, while the price of detached and row houses was about 941 and 334 million South Korean won, respectively....CharacteristicPrice in million South Korean won--3 more rows•Apr 22, 2022

Why are Korean stocks falling?

** South Korean shares logged the biggest daily drop in 11 months on Tuesday after concerns over geopolitical tension in Ukraine and U.S. monetary policy tightening fuelled wild volatility on Wall Street. The Korean won weakened, while the benchmark bond yield rose.

How do I buy international stocks in Australia?

There are three main ways to buy international shares:Investing in shares directly using an online broker.Through an index fund or exchange traded fund.Through a managed fund.

How do I buy stocks internationally?

Here's how:Buy individual stocks directly on international exchanges. To do this, however, your brokerage account must give you access to these exchanges—and not all brokerages do. ... Access international stocks via American Depository Receipts (ADRs). ... Invest internationally through ETFs and/or mutual funds.

How do I buy a KRX?

In order to trade at KRX Stock Markets, every investor has to first open a trading account through licensed securities company that has obtained KRX Membership (hereinafter "Members"). Investors can only place (or submit) their trading orders through the Members which act as agents in the market.

1795 Dandridge Ln, Barnhart, MO 63012 | Trulia

1795 Dandridge Ln, Barnhart, MO 63012 is a 1,396 sqft, 2 bath home. See the estimate, review home details, and search for homes nearby.

Contact Us | E*TRADE

Customer Inquiries. If you have any questions about an E*TRADE account, please contact the Customer Service department: Go to Customer Service contact page

Investing in the Korean Market - Haps Magazine

SEOUL, South Korea — Korea has gone from an impoverished war-torn nation to a global market leader in just over a generation and experts predict that the country will sustain substantial growth in the future.. Korean Stock Market. The Korea Exchange (KRX) is responsible for operating the Korean stock market. The KRX has 3 market divisions: KOSPI, KOSDAQ and derivatives.

Contact Us | Customer Service Center | E*TRADE

Want to contact us? Give us a call at (800) 387-2331. You can also contact an E*TRADE customer service representative in person or online via live chat.

How do I invest in South Korean stocks?

The easiest way to invest in the whole South Korean stock market is to invest in a broad market index. This can be done at low cost by using ETFs.

Indices on Asia-Pacific

Besides South Korea ETFs, you may consider ETFs on the Asia-Pacific region. In total, you can invest in 6 Asia-Pacific indices, which are tracked by 15 ETFs. The total expense ratio (TER) of ETFs on Asia-Pacific is between 0.12% p.a. and 0.74% p.a..

Indices on Emerging Markets

Besides South Korea ETFs you may consider emerging markets ETFs. In total, you can invest in 1 emerging markets index, which is tracked by 14 ETFs. The total expense ratio (TER) of ETFs on emerging markets is between 0.14% p.a. and 0.65% p.a..

How to invest in Korea as a foreigner?

To get this, you need to fill out a Foreign Investment Registration Application (FIRA) and also send in supporting identifying documents (usually a copy of your passport) to the FSS. The application itself can be found here. All documents that are sent in electronically (such as your passport copy) should also be notarized.

What is a standing proxy in Korea?

Foreign investors should appoint a local agent (also known as a standing proxy) in Korea to conduct trading processes on their behalf. The local agent can be the Korea Securities Depository (KSD), a foreign exchange bank, a dealer/broker, or a collective investment business entity. The Guide to Investing in Korea linked above also mentions that a “foreign custodian” can act as the local agent; it is thus unclear whether the local custodian bank mentioned in Step 1 can act as the local agent as well (please leave a comment on this post if you happen to know!).

What are the risks of investing in South Korea?

Risks of investing in South Korea include: Geopolitical risk . South Korea is situated in one of the most militarized regions in the world, with a very unstable neighbor in North Korea. Reliance on exports. South Korea's economy relies heavily on exports, which can be detrimental when the global economy is contracting.

Is South Korea a developed country?

South Korea's economy ranks 12th in the world by nominal gross domestic product (GDP), and 33rd by purchasing power parity (PPP). 3 But perhaps most importantly for investors, the economy is viewed as both a stable high-income developed country and a member of the Next Eleven countries, signaling strong growth potential over the coming years.

Is South Korea a good country to invest in?

South Korea has a very attractive economy for international investors , given its rare combination of stability and rapid growth rates. However, there are also many risks that investors should consider before committing capital to the region, including geopolitical risks with its neighbor to the north and export-related risks that could hit during a downturn.

How much tax do you pay when you sell stock in Korea?

You get taxed 0.3% every time you sell your stock. By comparison, most Korean brokers charge 0.015% commission. Tax alone is 20 times higher than that of commission (spread) for individual retail traders. That means for you to just break-even, the price will need to increase by at least several levels.

What are ants in Korea?

In South Korea, retail traders are colloquially named ‘ants’. Primarily, two problems mentioned below puts the ‘ants’ at near insurmountable disadvantage. Retail traders taxed every time they sell stocks (even if you sell at a loss), which makes it near impossible to profit from day trading.

Is South Korea a comfortable place to work?

South Korea's work environment is far from being comfortable for foreigners, even those who speak Korean. Discrimination, long work-hours, strict hierarchy, complex decision making process, unclear responsibilities, regular drinking time with your colleagues, social pressure...

Is Big Hit Entertainment listed on Kospi?

Big Hit Entertainment is anticipated to be listed on South Korea’s main bourse, Kospi, in October, there are two ways that potential retail investors can acquire the entertainment management agency’s stocks - putting in preorder deposits for a pub. Continue Reading.

Is South Korea easier than China?

Many can. Fortunately, South Korea doesn’t have rigid rules on capital controls, so that makes the process easier than China. I would avoid the local stock exchange, which is harder to gain access to anyway, and focus on buying international indexes from Korea, rather than buying indexes in Korea. Once you find a broker, then you can follow model ...

Can a US citizen trade in Korea?

A US citizen has no capital controls, and may do business in any country, with certain well-known exceptions (North Korea, for instance). You will probably need a lick broker to access the South Korean stock exchange, and to facilitate foreign exchange transactions. You will need to trade in Korean won as you are buying ordinaries.

How To Invest In Korean Stocks?

Investing in Korean stocks might sound hard, but in reality, it’s not. There are four steps to invest in Korean stocks:

The Pros and Cons of Investing in Korea

Here below are some pros and cons of investing in Korean stocks or companies.

Can You Day Trade in Korea?

Yes, the stock market was opened to day trading for foreigners and it can now be carried out on Korean Stock Exchange.

Conclusion

All in all, can foreigners buy stocks in Korea can be a great investment for anyone looking for good returns and can also provide you with the knowledge that can help you become more familiar with the Korean market.

Brokers that trade in the KRX

You can choose to purchase Korean stocks direct from the Korean Stock Exchange (KRX).

Buy Korean GDRs listed on the LSE

If you find purchasing Korean stocks on the KRX to be too expensive, you can consider purchasing a Global Depositary Receipt (GDR).

Buy Korean ETFs listed on the NYSE

If you do not want to pick a specific Korean stock to invest in, why not buy the Korean market as a whole instead?

Conclusion

The ways that you can invest in Korean stocks is rather limited for a Singaporean investor. This is because:

Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

How to research Korean companies?

Researching Korean Companies. Gather information on the stocks available for purchase on the Korean Exchange or Korean stocks available for purchase on U.S. exchanges. As could be expected, most of the traded companies on Korean exchanges are headquartered in South Korea. After gathering your research, determine which stock you would like to trade.

Do you have to confirm your trade with a broker?

The broker should confirm your trade and detail the number of shares you bought and the price per share. Always keep in mind that investing in stocks is risky. You may lose money if the value of your stock declines, so do not invest more than you can afford to lose.

South Korea's Booming Economy

South Korean Pros and Cons

- South Korea combines stability and rapid growth rates, which is rare. This appeals to international investors. But there are also many risks that investors should think about before putting their money in the region. These include geopolitical riskswith its neighbor, North Korea. Investors should also be aware of the risk that the country's exports could suffer during a downturn. Benef…

Investing in South Korean ETFs

- The easiest way to invest in South Korea is with exchange-traded funds (ETFs). ETFs provide instant diversification in a single security. These funds are traded on the U.S. stock exchange.7 The iShares MSCI South Korea Index Fund (EWY) is the most popular South Korean ETF. It has a $30.6 billion net asset value and 1,242 holdings, as of September 1...

Investing in South Korean ADRs

- American Depository Receipts (ADRs) represent another way to invest in South Korean companies. You can hold these without going outside of the United States.9These ADRs let investors buy foreign companies on the U.S. stock exchange. They are not, though, as liquid as many other U.S. stocks. Because of this, they should be traded with some caution. Popular Sout…