Most brokers let you trade on the OTC markets. Recon Africa stock is also listed on the Frankfurt and Toronto stock exchanges. You can check with your broker and see if they allow trading in international stocks. Also, you could open a broking account with any of the brokers that allow trading in international stocks.

Full Answer

Is reconnaissance Energy Africa (recaf) stock a good buy?

Find the latest Reconnaissance Energy Africa Ltd. (RECAF) stock quote, history, news and other vital information to help you with your stock trading and investing.

What is the recaf stock price prediction for 14 days?

RECAF | Complete Reconnaissance Energy Africa Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

What do you think about recaf?

At Walletinvestor.com we predict future values with technical analysis for wide selection of stocks like Reconnaissance Energy Africa Ltd (RECAF). If you are looking for stocks with good return, Reconnaissance Energy Africa Ltd can be a profitable investment option. Reconnaissance Energy Africa Ltd quote is equal to 4.834 USD at 2022-04-17. Based on our forecasts, a long …

Are recafshares good for investing?

Apr 20, 2022 · Reconnaissance Energy Africa Ltd OTC Updated Apr 20, 2022 7:59 PM. RECAF 4.84 0.03 (0.62%). 6,666

How do I buy Recon Africa stock?

To buy shares in Reconnaissance Energy (Africa) you'll need a share-dealing account with an online or offline stock broker. Once you have opened your account and transferred funds into it, you'll be able to search and select shares to buy and sell.Apr 14, 2022

Is Recaf an OTC stock?

Stock Quote (U.S.: OTC) | MarketWatch....Performance.5 Day2.34%YTD0.14%1 Year-4.07%2 more rows

Is Recaf a good stock?

The Score for RECAF is 73, which is 46% above its historic median score of 50, and infers lower risk than normal. RECAF is currently trading in the 70-80% percentile range relative to its historical Stock Score levels.

Is Recon Africa a good stock to buy?

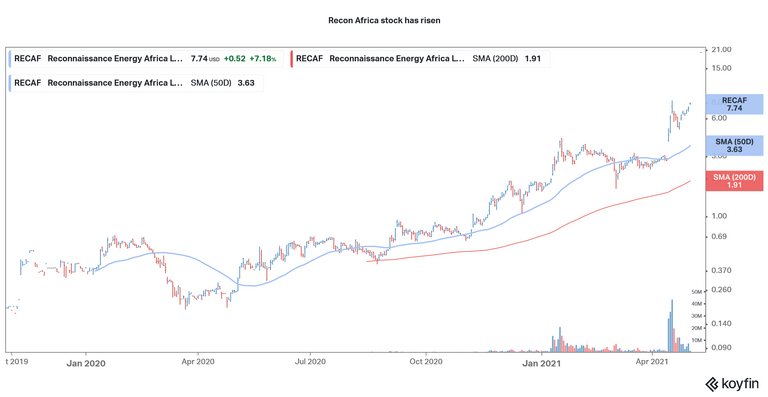

The Reconnaissance Energy Africa Ltd stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average.

How many outstanding shares does Recaf have?

199.26MOwnershipTypeCommon Stock Held% of Shares OutstandingCorporations (Private)518,5000.26%Individuals / Insiders1.97M0.99%Public and Other196.63M98.68%Total199.26M100.00%1 more row

What is meant by Reco price?

Reco - This broker has upgraded this stock from it's previous report. (eg. - Sell->Hold) Target - Broker has maintained previous recommendation but increased share price target.

What is happening with Recon Africa?

Seismic Operations ReconAfrica's has completed approximately 30% of its 450 km seismic field acquisition which has produced good initial data quality. The program is on schedule for completion by the end of October 2021.

Reconnaissance Energy Africa Ltd ( RECAF ) Stock Market info

Recommendations: Buy or sell Reconnaissance Energy Africa stock? Wall Street Stock Market & Finance report, prediction for the future: You'll find the Reconnaissance Energy Africa share forecasts, stock quote and buy / sell signals below.

Also on walletinvestor.com

Term Box: Best Reconnaissance Energy Africa Ltd forecast, RECAF stock price prediction, RECAF forecast, Reconnaissance Energy Africa Ltd finance tips, RECAF prediction, Reconnaissance Energy Africa Ltd analyst report, RECAF stock price predictions 2022, Reconnaissance Energy Africa Ltd stock forecast, RECAF forecast tomorrow, Reconnaissance Energy Africa Ltd technical analysis, RECAF stock future price, Reconnaissance Energy Africa Ltd projections, Reconnaissance Energy Africa Ltd market prognosis, RECAF expected stock price..

Reconnaissance Energy Africa Ltd Stock Forecast

Is Reconnaissance Energy Africa Ltd Stock Undervalued? The current Reconnaissance Energy Africa Ltd [ RECAF] share price is $4.77. The Score for RECAF is 50, which is 0% below its historic median score of 50, and infers higher risk than normal.

Reconnaissance Energy Africa Ltd Stock Price History

Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and RECAF is experiencing selling pressure, which indicates risk of future bearish movement.

Stock Predictions

Is Reconnaissance Energy Africa Ltd stock public? Yes, Reconnaissance Energy Africa Ltd is a publicly traded company.

Component Grades

We have 9 different ratings for every stock to help you appreciate its future potential. You can unlock it all now.

Reconnaissance Energy Africa Ltd. (RECAF) Company Bio

Reconnaissance Energy Africa Ltd. operates as an exploration company. The extracts oil and gas. Reconnaissance Energy Africa serves customers in the United Kingdom and Africa.

Company Profile

Reconnaissance Energy Africa Ltd., a junior oil and gas company, engages in the identification, exploration, and development of oil and/or gas assets in Namibia and Botswana. It holds a 90% interest in a petroleum exploration license that covers an…

Analyst Opinions

The Equity Summary Score is an accuracy-weighted sentiment derived from the ratings of independent research providers on Fidelity.com. It uses the past relative accuracy of the providers in determining the emphasis placed on any individual opinion. Learn More....

Research Reports

This generated report* compiles independent, third-party information highlighting key fundamental and technical data, analyst opinions, stock price movement, earnings data, and industry comparisons. Available only to Fidelity customers.

Is Reconnaissance Energy Africa on fire?

Reconnaissance Energy Africa, also known as Recon Africa, has been on a fire and the stock has gained 2,830 percent over the last year. However, the stock is down 13 percent from its 52-week highs and is in a correction zone.

Is Recon Africa making money?

Recon Africa isn't making any current revenues. It's largely a play on the Namibian oil find, which the company calls Kavango Basin. The project is controversial due to the environmental harm that it's expected to cause. Several funds and individual investors have been shying away from fossil fuel stocks due to the environmental harm that they cause.

Is Recon Africa a penny stock?

None of the Wall Street analysts seem to be covering Recon Africa stock. The company was a penny stock before it caught the markets’ attention and not many analysts cover penny names given the inherent risk in such stocks.