Full Answer

Is Brookfield Renewable Partners the perfect stock?

There's little question that Brookfield Renewable Partners is a well-balanced partnership operating in a good market niche. However, investors have clearly recognized its strengths here. After a huge price advance in 2019, Brookfield no longer looks like much of a bargain, despite its over 4% yield.

Will Brookfield Renewable Partners (BEP) outperform or underperform the S&P 500?

MarketBeat's community ratings are surveys of what our community members think about Brookfield Renewable Partners and other stocks. Vote “Outperform” if you believe BEP.UN will outperform the S&P 500 over the long term. Vote “Underperform” if you believe BEP.UN will underperform the S&P 500 over the long term.

What are Wall Street analysts'target prices for Brookfield Renewable Partners?

11 Wall Street analysts have issued 1-year target prices for Brookfield Renewable Partners' stock. Their forecasts range from C$42.00 to C$55.00. On average, they anticipate Brookfield Renewable Partners' share price to reach C$46.73 in the next twelve months.

Does Brookfield Renewable have long-term power contracts?

However, Brookfield Renewable isn't just about building new power assets. It generally signs long-term contracts for the production it builds, with agreements that contain annual escalators. Right now the average contract term for the power portfolio is around 14 years.

See more

Is Brookfield Renewable stock a good buy?

Is Brookfield Renewable Energy a buy or a sell? In the last year, 21 stock analysts published opinions about BEP. UN-T. 19 analysts recommended to BUY the stock.

Is Brookfield Renewable partners publicly traded?

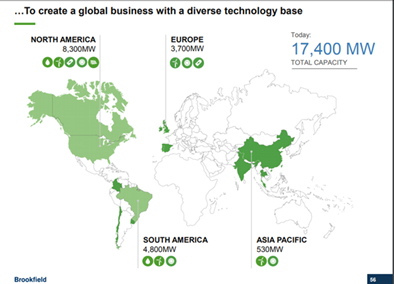

Brookfield Renewable operates one of the world's largest publicly traded, pure-play renewable power platforms. Our portfolio consists of hydroelectric, wind, solar and storage facilities in North America, South America, Europe and Asia.

Is Brookfield Renewable a buy or sell?

Brookfield Renewable Partners has received a consensus rating of Buy. The company's average rating score is 2.88, and is based on 14 buy ratings, 2 hold ratings, and no sell ratings.

Is Brookfield Renewable an ETF?

Brookfield Renewable Acquires Premier Renewable Developer Urban Grid, Adding Approximately 20,000 Megawatts of Solar and Energy Storage Projects in the U.S....BEP Description — Brookfield Renewable Partners LP.Company Name:Brookfield Renewable Partners LPTotal Market Value Held by ETFs:$20,249,1595 more rows

What happened to Brookfield Renewable partners?

Shares of Brookfield Renewable Corporation (BEPC 0.23%) plunged 36.8% in 2021, according to data provided by S&P Global Market Intelligence. Meanwhile, the economically equivalent publicly traded partnership, Brookfield Renewable Partners (BEP -1.15%), slumped 17%.

Who owns Brookfield Renewable partners?

Brookfield Asset ManagementBrookfield Renewable Partners / Parent organizationBrookfield Asset Management Inc. is a Canadian multinational company that is one of the world's largest alternative investment management companies, with US$688 billion of assets under management in 2021. Wikipedia

What is the best renewable energy stock?

11 Best Renewable Energy Stocks to Buy Right NowCanadian Solar Inc. (NASDAQ:CSIQ) ... SunPower Corporation (NASDAQ:SPWR) Number of Hedge Fund Holders: 20. ... Brookfield Renewable Partners L.P. (NYSE:BEP) Number of Hedge Fund Holders: 21. ... Plug Power Inc. ... Sunnova Energy International Inc. ... Bloom Energy Corporation (NYSE:BE)

Is Brookfield Renewable undervalued?

Brookfield Renewable shows a prevailing Real Value of $43.0 per share. The current price of the firm is $36.13. At this time, the firm appears to be undervalued....USD 36.13 0.67 1.89%LowEstimated ValueHigh34.2936.0337.77

Is Brookfield Renewable a good company?

Is Brookfield Renewable a good company to work for? Brookfield Renewable has an overall rating of 3.5 out of 5, based on over 306 reviews left anonymously by employees. 69% of employees would recommend working at Brookfield Renewable to a friend and 61% have a positive outlook for the business.

Should I buy BEP or BEPC stock?

BEPC is trading at a premium to BEP right now as it seems to be the vehicle investors are more willing to invest in. For pure income investors BEP is the obvious choice thanks to its higher yield and equal growth in distribution whereas from a total return perspective investors should opt for BEPC.

What is the difference between Brookfield and renewable partners?

The only difference is that BEP is a publicly traded partnership sitting in Bermuda whereas BEPC is a Canadian corporation listed on NYSE and TSX as a means to "provide investors with greater flexibility in how they access BEP's globally diversified portfolio of high-quality renewable power assets".

How big is Brookfield Renewable?

We are one of the world's largest investors in renewable power, with approximately 21,000 megawatts of generating capacity.

Is Brookfield Renewable Partners a buy right now?

16 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Brookfield Renewable Partners in the last year. There a...

Are investors shorting Brookfield Renewable Partners?

Brookfield Renewable Partners saw a increase in short interest during the month of April. As of April 30th, there was short interest totaling 1,690...

When is Brookfield Renewable Partners' next earnings date?

Brookfield Renewable Partners is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings for...

How were Brookfield Renewable Partners' earnings last quarter?

Brookfield Renewable Partners L.P. (NYSE:BEP) released its quarterly earnings results on Monday, May, 9th. The utilities provider reported ($0.16)...

How often does Brookfield Renewable Partners pay dividends? What is the dividend yield for Brookfield Renewable Partners?

Brookfield Renewable Partners announced a quarterly dividend on Friday, May 6th. Stockholders of record on Tuesday, May 31st will be given a divide...

Is Brookfield Renewable Partners a good dividend stock?

Brookfield Renewable Partners pays an annual dividend of $1.28 per share and currently has a dividend yield of 3.48%. View Brookfield Renewable Pa...

When did Brookfield Renewable Partners' stock split? How did Brookfield Renewable Partners' stock split work?

Shares of Brookfield Renewable Partners split on Monday, December 14th 2020. The 3-2 split was announced on Wednesday, November 4th 2020. The newly...

What price target have analysts set for BEP?

16 Wall Street analysts have issued 1 year target prices for Brookfield Renewable Partners' stock. Their forecasts range from $38.00 to $49.00. On...

Who are Brookfield Renewable Partners' key executives?

Brookfield Renewable Partners' management team includes the following people: Mr. Connor David Teskey , CEO & Managing Partner (Age 34, Pay $1.4...

What is Brookfield Renewable Energy stock symbol?

Brookfield Renewable Energy is a Canadian stock, trading under the symbol BEP.UN-T on the Toronto Stock Exchange (undefined). It is usually referre...

Is Brookfield Renewable Energy a buy or a sell?

In the last year, 26 stock analysts published opinions about BEP.UN-T. 24 analysts recommended to BUY the stock. 1 analyst recommended to SELL the...

Is Brookfield Renewable Energy a good investment or a top pick?

Brookfield Renewable Energy was recommended as a Top Pick by null on null. Read the latest stock experts ratings for Brookfield Renewable Energy.

Why is Brookfield Renewable Energy stock dropping?

Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should b...

Is Brookfield Renewable Energy worth watching?

26 stock analysts on Stockchase covered Brookfield Renewable Energy In the last year. It is a trending stock that is worth watching.

What is Brookfield Renewable Energy stock price?

On 2022-05-27, Brookfield Renewable Energy (BEP.UN-T) stock closed at a price of $46.7.

NYSE: BEPC

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

This renewable power giant has a lot going for it, but there's one thing you need to understand before you buy in

Clean energy is increasingly the energy of choice for the world, as governments across the globe look to reduce the use of carbon fuels. That positions Brookfield Renewable ( BEPC -0.49% ) very well for the future, given that its primary focus is owning and operating clean energy assets.

Lots to like here

From a big-picture perspective, Brookfield Renewable is positioned incredibly well to participate in a major long-term global shift taking place in the energy sector. That's the story that most investors hear.

Some warts to consider

Although there are plenty of reasons to like Brookfield Renewable, no company is perfect. So you need to take a close look at some important negatives before you buy here.

A great stock, but maybe not a great buy

All in, Brookfield Renewable, whether you buy the MLP or the corporate version of the shares, is a very well-run company that's in an incredible position to keep growing its business.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

When is Brookfield Renewable Partners earnings call?

How can I listen to Brookfield Renewable Partners' earnings call? Brookfield Renewable Partners will be holding an earnings conference call on Thursday, August 5th at 11:00 AM Eastern . Interested parties can register for or listen to the call using this link or dial in at 404-537-3406 with passcode "7282435".

When will Brookfield split?

The 3-2 split was announced on Wednesday, November 4th 2020. The newly issued shares were payable to shareholders after the market closes on Friday, December 11th 2020. An investor that had 100 shares of Brookfield Renewable Partners stock prior to the split would have 150 shares after the split.

What is Brookfield Renewable Energy stock symbol?

Brookfield Renewable Energy is a Canadian stock, trading under the symbol BEP.UN-T on the Toronto Stock Exchange (BEP.UN-CT). It is usually referred to as TSX:BEP.UN or BEP.UN-T

Is Brookfield Renewable Energy a buy or a sell?

In the last year, 21 stock analysts published opinions about BEP.UN-T. 18 analysts recommended to BUY the stock. 1 analyst recommended to SELL the stock. The latest stock analyst recommendation is . Read the latest stock experts' ratings for Brookfield Renewable Energy.

Is Brookfield Renewable Energy a good investment or a top pick?

Brookfield Renewable Energy was recommended as a Top Pick by on . Read the latest stock experts ratings for Brookfield Renewable Energy.

Why is Brookfield Renewable Energy stock dropping?

Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should buy, sell or hold the stock.

Is Brookfield Renewable Energy worth watching?

21 stock analysts on Stockchase covered Brookfield Renewable Energy In the last year. It is a trending stock that is worth watching.

What is Brookfield Renewable Partners?

For much of its life, it used its own money and privately managed cash for others for this investing. More recently, however, it has started to use controlled master limited partnerships (MLPs), allowing individual investors to invest alongside it. Brookfield Renewable Partners is one of those MLPs. This relationship allows the partnership to punch above its $9 billion market cap, since it can partner with its nearly $60 billion market cap parent when inking acquisitions or making investments.

Is Brookfield Renewable Partners a good investment?

But a great company isn't always a great investment, particularly if you pay too much for it. That tidbit of investment wisdom comes from famed value investor Benjamin Graham -- the man who helped train Warren Buffett.

What happens to Brookfield stock if it cools off?

Meanwhile, if the renewable energy market cools off or Brookfield grows at the lower end of its target range, it could affect the premium investors are willing to pay for the stock. If that happens, it might not generate market-beating total returns.

How much cash flow will Brookfield have in 2025?

Brookfield estimates that it can grow its cash flow per share at an 11% to 16% annual rate through at least 2025, powered by the following factors: Embedded inflation escalators in existing contracts should add 1% to 2% to its bottom line each year.

How many gigawatts does Brookfield have?

Brookfield has a massive pipeline of development projects to help power its growth. At the end of 2020, it had 23 gigawatts (GW) of projects in various stages of development, which is more than its current 19.4 GW operating portfolio.

Does Brookfield have a premium valuation?

Meanwhile, Brookfield could take advantage of its premium valuation by using its stock as currency to make value-accretive acquisitions, enabling it to grow earnings even faster. However, highly valued stocks can quickly lose their luster during a stock market sell-off.

The renewable-energy stock has gone on an incredible run but is still below its 2020 high

Born and raised in the Deep South of Georgia, Jason now calls Southern California home. A Fool since 2006, he began contributing to Fool.com in 2012. Trying to invest better? Like learning about companies with great (or really bad) stories? Jason can usually be found there, cutting through the noise and trying to get to the heart of the story.

A great history points toward a great future

Since going public over a decade ago, Brookfield Renewable has delivered incredible returns:

The trends that underpin the opportunity

Brookfield Renewable's existing portfolio makes it one of the biggest independent renewable-energy producers in the world, and its near-term pipeline has it lined up for a lot more growth in the next few years. But those growth prospects won't end after those 13,000 MW of projects are completed.

Brookfield is worth buying now and holding for years to come

It's worth mentioning that Brookfield Renewable has crushed it over the past year, as its share price is up 42%. The dividend yield is above 4% but well below the average over the past decade. That's reason for some to worry that Brookfield Renewable is overvalued, but I'm not convinced that's the case.

New York Stock Exchange

The company owns and operates a portfolio of renewable power generating facilities including 193 hydroelectric generating stations 11 wind facilities and two natural gas-fired plants in USA Canada and Brazil.

News & Analysis: Brookfield Renewable Partners L.P

The Fool has written over 300 articles on Brookfield Renewable Partners L.P..

Key Data Points

Primary metrics and data points about Brookfield Renewable Partners L.P..

Environmental, Social, and Governance Rating

"A" score indicates excellent relative ESG performance and a high degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

Business Summary

The company owns and operates a portfolio of renewable power generating facilities including 193 hydroelectric generating stations 11 wind facilities and two natural gas-fired plants in USA Canada and Brazil.

About Brookfield Renewable Partners

Brookfield Renewable Partners L.P. owns a portfolio of renewable power generating facilities in the North America, Colombia, Brazil, Europe, and internationally. The company operates through Hydroelectric; Wind; and Solar, Storage, and others segments.

Brookfield Renewable Partners (TSE:BEP.UN) Frequently Asked Questions

14 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Brookfield Renewable Partners in the last twelve months. There are currently 4 hold ratings and 10 buy ratings for the stock.