How to buy shares in Airbus Group

- Choose a platform. If you're a beginner, our share-dealing table below can help you choose.

- Open your account. You'll need your ID, bank details and national insurance number.

- Confirm your payment details. ...

- Search the platform for stock code: EADSY in this case.

- Research Airbus Group shares. ...

- Buy your Airbus Group shares. ...

- Compare share trading platforms. Use our comparison table to help you find a platform that fits you.

- Open your brokerage account. Complete an application with your details.

- Confirm your payment details. Fund your account.

- Research the stock. ...

- Purchase now or later. ...

- Check in on your investment.

Is the Airbus share price a good buy?

In the meantime, the Airbus share can be considered as a growth stock since it has shown a good stock market performance with a 345% increase in value in ten years. It may therefore be worth buying and holding this stock as part of a long-term investment strategy.

What is the Stock Exchange symbol for Airbus?

Since 10 July 2000, Airbus shares have been listed on: In July 2000 EADS (stock exchange symbol EAD ) was created by merging Aerospatiale Matra of France, DASA of Germany (DaimlerChrysler Aerospace AG excluding MTU Triebwerke) and CASA of Spain (Construcciones Aeronauticas SA).

How volatile is Airbus's stock compared to the market?

Over the last 12 months, Airbus's shares have ranged in value from as little as $27.13 up to $35. A popular way to gauge a stock's volatility is its "beta". Beta is a measure of a share's volatility in relation to the market. The market (PINK average) beta is 1, while Airbus's is 1.9223.

Why invest in Airbus?

A secure business model: Airbus' business model offers a range of solutions in the aviation and aerospace segments that are both safe and environmentally friendly, and a strong commitment to companies and utilities.

Can you buy shares in Airbus?

You can buy or sell Airbus SE shares through a Stocks and Shares ISA, Lifetime ISA, SIPP or Fund and Share Account.

Is Airbus publicly traded?

Since 10 July 2000, Airbus shares have been listed on: the Paris Stock Exchange. the Frankfurt Stock Exchange. and the Spanish stock exchanges in Madrid, Bilbao, Barcelona and Valencia.

Is Airbus a buy or sell?

Airbus has received a consensus rating of Buy. The company's average rating score is 2.78, and is based on 7 buy ratings, 2 hold ratings, and no sell ratings.

Who owns Airbus shares?

AirbusLagardère production plant in Toulouse, FranceTotal equity€9.49 billion (2021)OwnerAs of November 2020: SOGEPA (France): 11.0% GZBV (Germany): 10.9% Capital Group Companies (10.1%) SEPI (Spain): 4.1% The Vanguard Group (2.19%) PRIMECAP Management Company (2.1%) Invesco (1.1%) Others: 58.51%21 more rows

Is Airbus a good stock to buy?

Is Airbus a buy or a sell? In the last year, 2 stock analysts published opinions about EADSY-OTC. 2 analysts recommended to BUY the stock. 0 analysts recommended to SELL the stock.

Which is better Airbus or Boeing?

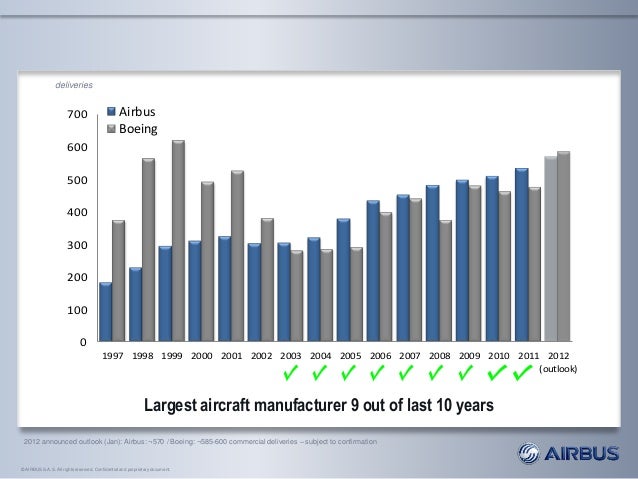

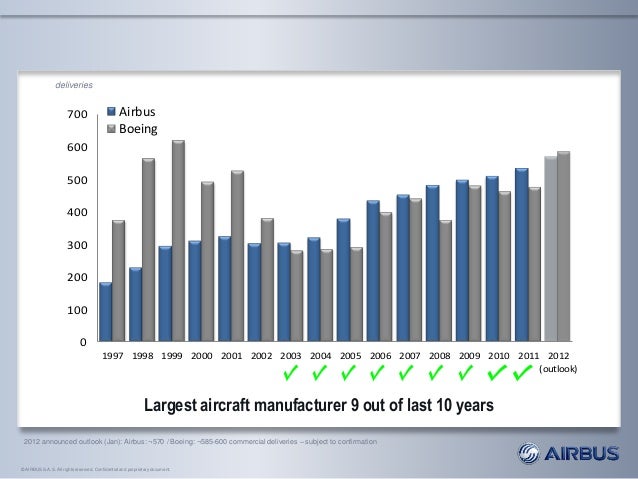

While Airbus is the overall winner in this category, Boeing was behind far more widebody flights with 1,103,294 flights compared to 645,220 with Airbus aircraft. The gap between narrowbody operations was slightly more significant at: Airbus 8,744,941 - 7,804,654 Boeing.

How can I buy Airbus stock in Canada?

To buy Airbus on the stock market:Find an online broker offering stock investments.Open your trading account by filling out a simple form.Deposit funds into your account.Search for the stock.Place a buy order to add Airbus to your stock portfolio.

Is Airbus bigger or Boeing?

Airbus is the smaller company in terms of employee numbers, falling short of Boeing by approximately 26,000. However, we can see that, for 2019, it was far more successful than Boeing in terms of profit and gross orders.

Is Airbus safer than Boeing?

What about Boeing and Airbus' safety record? According to Airfleets.net, Airbus has suffered 86 total crashes or accidents between its models – fewer than just the 147 suffered by Boeing's 737 alone.

Do pilots prefer Airbus or Boeing?

Absolutely. Airbus and Boeing have different control systems, and most pilots strongly prefer one over the other. (The Explainer isn't aware of a poll, and so has no way of knowing which manufacturer pilots favor overall.) Modern Airbus planes employ a “fly-by-wire” system.

What kind of business is AIRBUS GROUP?

Airbus SE, formerly Airbus Group SE, is a Dutch aerospace and defense company with three business segments: Airbus, Airbus Helicopters, and Airbus...

How can I buy stock in AIRBUS GROUP?

Decide how much you are happy to invest in AIRBUS GROUP stock. Never invest money you cannot afford to lose. Decide if you would like to trade with...

Can I Buy AIRBUS GROUP shares straight from them?

You cannot buy AIRBUS GROUP shares direct with AIRBUS GROUP. Shares from AIRBUS GROUP must be purchased through a stock brokerage firm. You can buy...

How much does it cost to buy an AIRBUS GROUP Stock?

Shares of AIRBUS GROUP trade for around €106.74. AIRBUS GROUP stock has had a 52 week low of €90.24, and a 52 high of €121.10.AIRBUS GROUP stock pr...

What is the minimum required investment for AIRBUS GROUP?

The minimum investment to buy AIRBUS GROUP would depend on the current price of AIRBUS GROUP stock and the costs associated with the stock or CFD b...

What kind of stock is AIRBUS GROUP?

AIRBUS GROUP stock have the stock ticker AIR and are known as ordinary shares on the (EPA) stock exchange.You can buy AIRBUS GROUP Stock with a sto...

How to buy Airbus stock?

The safest and easiest way to buy OTC:EADSY stocks is by using a regulated broker like eToro or DEGiro. You can open an account with the platform,...

Where to buy Airbus stock?

You will first want to find a licensed broker that supports OTC:EADSY stock. One of our favourite brokers, eToro for example, allows you to make in...

Is OTC:EADSY stock a good investment?

As with any other asset, there is an element of risk associated with buying OTC:EADSY stocks. Therefore, you will want to study the market and make...

Is Airbus stock safe to invest in?

All stocks are volatile, or affected by market circumstances. The case with OTC:EADSY is no different, with its price fluctuating dramatically with...

How do you trade Airbus stocks?

You can trade stocks by first opening an account with a regulated platform and making a deposit in US dollars, EUROs or other currency. Next, searc...

How to sell Airbus stock?

To sell your OTC:EADSY stocks investment, you can sign in to your broker account and cash out directly from within your portfolio. If you have stor...

What is the best Airbus stock trading platform?

eToro, is a top-rated platform for beginners, albeit, it charges significantly lower fees. For example, there are no fees to deposit with a debit/c...

What is the stock price of Airbus?

Are you curious about how the stock price of Airbus is developing ? In the graph below you can see immediately at which price you can buy CFD shares in Airbus:

How can you actively invest in Aribus?

The stock price of Airbus can fluctuate sharply. You saw this, for example, during the corona pandemic: when all the aircraft were grounded and there was little perspective, the share price fell sharply. The price rose sharply later when positive news about the vaccines came out. By actively trading, you can respond well to all the movements in the Airbus stock.

What is the Airbus Group?

The company Airbus Group was known as European Aeronautic Defence and Space Company (EADS) until 2014. This company is a European aerospace and defence consortium. The company was formed in 2000 with the merger of the French Aerospatiale-Matra, the German DASA and the Spanish Construcciones Aeronautics CASA).

How many aircraft will Airbus deliver in 2020?

However, with the sale of 560 aircraft, Airbus did meet its internal target. With this number of aircraft delivered, Airbus remained far ahead of US competitor Boeing. This company announced in November 2020 that it had only delivered 118 new aircraft.

Where is Airbus located?

The Airbus Group has a total of 170 locations worldwide. Several branches can be found in Belgium, Germany, France, Spain, the United Kingdom and the Netherlands. The branches in the Netherlands are located in Amsterdam and Leiden. In Leiden, the head office of the Airbus Group is located. The head office is located in the Netherlands because the Netherlands is a neutral location.

Which company has the largest aircraft division?

The Airbus division is the company’s largest. This division contributes two-thirds of the turnover. This division supplies passenger aircraft to airlines.

Who is Airbus' biggest competitor?

Airbus’ biggest competitor is Boeing: these two titans are actually always competing for market share in civil aviation. Airbus manages to compete well in this market. In the military branch, it does not always do so well: the A400, for example, was a failure in 2016. Nevertheless, future results on normal aviation may compensate for these disappointing results.

How to buy Airbus stocks?

Below is a quick guide on how to buy OTC:EADSY stocks safe, fast and around the world in less than five minutes.

How do I buy shares of Airbus?

Shares of EADSY can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

What stocks does Reportlab like better than Airbus?

Wall Street analysts have given Airbus a “Hold” rating, but there may be better short-term opportunities in the market. Some of Reportlab’s past winning trading ideas have resulted in 5-15% weekly gains. Reportlab just released five new trading ideas, but Airbus wasn’t one of them. Reportlab thinks five stocks may be even better buys in the how to buy stocks guide.

When is Airbus’ next earnings date?

Airbus is scheduled to release its next quarterly earnings announcement on Thursday, February 11th 2021.

Are investors shorting Airbus?

Airbus saw a decline in short interest during the month of January. As of January 15th, there was short interest totaling 138,200 shares, a decline of 26.8% from the December 31st total of 188,700 shares. Based on an average daily trading volume, of 525,200 shares, the short-interest ratio is currently 0.3 days.

Who are some of Airbus’ key competitors?

Some companies that are related to Airbus include L’Oréal (LRLCY), China Construction Bank (CICHY), Agricultural Bank of China (ACGBY), Bank of China (BACHY), Industria de Diseño Textil (IDEXY), Iberdrola (IBDRY), Schneider Electric S.E. (SBGSY), Recruit (RCRRF), L’Air Liquide (AIQUY), Shin-Etsu Chemical (SHE CY), KDDI (KDDIY), Atlas Copco (ATLKY), Deutsche Post (DPSGY), Daikin Industries,Ltd. (DKILY) and Vinci (VCISY).

How much money does Airbus make?

Airbus has a market capitalization of $88.51 billion and generates $78.94 billion in revenue each year. The aerospace company earns $-1,525,440,000.00 in net income (profit) each year or $1.28 on an earnings per share basis.

How to buy Airbus SE stocks?

Below is a quick guide on how to buy EPA:AIR stocks safe, fast and around the world in less than five minutes.

What is Airbus SE (AIR.PA)’s stock price today?

One share of AIR stock can currently be purchased for approximately €93.42.

What stocks does Reportlab like better than Airbus SE (AIR.PA)?

Wall Street analysts have given Airbus SE (AIR.PA) a “Buy” rating, but there may be better short-term opportunities in the market. Some of Reportlab’s past winning trading ideas have resulted in 5-15% weekly gains. Reportlab just released five new trading ideas, but Airbus SE (AIR.PA) wasn’t one of them. Reportlab thinks five stocks may be even better buys in the how to buy stocks guide.

Who are some of Airbus SE (AIR.PA)’s key competitors?

Some companies that are related to Airbus SE (AIR.PA) include (XNNH) (XNNH), Airbus (EADSF), Astro Aerospace (ASDN), Austal (AUTLF), Austal Limited (ASB.AX) (ASB), BAE Systems (BAESF), Bantek (DRUS), Bombardier (BDRBF), Cobham (CBHMF), Dassault Aviation (DUAVF), Draganfly (DFLYF), Electro Optic Systems Holdings Limited (EOS.AX) (EOS), Firan Technology Group (FTGFF), FLYHT Aerospace Solutions (FLYLF) and HEICOCorp . (HEI/A).

What price target have analysts set for AIR?

13 brokers have issued 12-month price objectives for Airbus SE (AIR.PA)’s stock. Their forecasts range from €63.00 to €137.00. On average, they expect Airbus SE (AIR.PA)’s stock price to reach €97.58 in the next twelve months. This suggests a possible upside of 4.5% from the stock’s current price.

How does Airbus SE price work?

Airbus SE ’s share price is determined by its bid-ask spread, which is the difference between the price that buyers are willing to pay and the price that sellers are willing to accept. Airbus SE ’s price can fluctuate throughout the course of each trading day—when you buy Airbus SE through Stash, we execute the market order during our next available trading window (we have two a day). At Stash, we don’t recommend trying to predict the market when buying investments. We believe it can be a better strategy to buy quality investments you believe in, then hang onto them.

Where is Airbus SE based?

Airbus SE, formerly Airbus Group SE, is a company based in the Netherlands that is active in the aerospace and defense industry. The Company operates through three segments: Airbus, Airbus Helicopters and Airbus Defence and Space.

How much does Stash cost?

Stash offers three subscription plans: Stash Beginner, Stash Growth, and Stash+. Our Beginner plan starts at just $1 per month.

How often is the stock market updated?

This is the performance of the investments since the start of the year, updated approximately every 20 minutes during market hours (usually business days between 9:30 a.m. and 4:00 p.m. ET).

What to consider when buying stocks?

Consider P/E ratio, profit and loss, and news when buying stocks.

How often is the last publicly stated price of a stock updated?

The last publicly stated price for one share of an investment, updated every approximately 20 minutes during market hours (usually business days between 9:30 a.m. and 4:00 p.m. ET).

Who is the CEO of Airbus?

Airbus CEO Guillaume Faury said the deal was a "very positive signal that we [are starting] to be on the front foot again."

What is Airbus Group?

Airbus Group NV manufactures airplanes and military equipment. The company operates through four segments which consist of The Airbus, The Eurocopter, The Astrium and The Cassidian division. It develop, manufacture, market and sell commercial jet aircrafts, military transport aircrafts and special mission aircrafts, civil and military helicopters, satellites, orbital infrastructures and launchers as well as space-related services missiles systems, military combat and training aircrafts. Airbus Group NV, formerly known as European Aeronautic Defence and Space Company EADS NV, is headquartered in Mendelweg, NETHERLANDS.

What is an X industry?

The X Industry (aka Expanded Industry) is a subset of the M (Medium Sized) Industry, which is a subset of the larger Sector category, which is used to classify all of the stocks in the Zacks Universe. The Zacks database contains over 10,000 stocks.

What are the different grades for stocks?

Within each Score, stocks are graded into five groups: A, B, C, D and F. As you might remember from your school days, an A, is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F.

Is a B better than a C?

An A is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F. Value Score A. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B.

When did Airbus start buying back shares?

Airbus started implementing a share buyback programme on 28 February 2018 for the sole purpose of covering its long-term incentive plan in shares. The repurchased shares will be redistributed to the beneficiaries of long-term incentive plans according to the relevant plan rules. The share buyback programme was completed on 10 April 2018.

How many shares are there in Airbus?

Airbus shares are exclusively ordinary shares with a par value of € 1. The authorised share capital consists of 3,000,000,000 shares.

When will Airbus repurchase 10% of its capital?

The share buyback is undertaken pursuant to the general authority conferred on the Airbus SE Board of Directors by the 13th resolution to repurchase up to 10% of Airbus SE’s issued share capital by the Annual General Meeting of shareholders of Airbus SE on 10 April 2019.

When did Airbus change its name?

In January 2014, EADS was renamed Airbus Group. As a result, its listing name (Airbus Group) and stock exchange symbol (AIR) were changed. However, its ISIN and Euronext codes remained unchanged. Airbus Group changed its stock market listing name to Airbus in January 2017. Its stock exchange symbol, ISIN and Euronext codes remain unchanged. On 12 April 2017 Airbus Group was renamed Airbus after approval of the respective resolution at the Annual General Meeting of Shareholders.

When did EADS become a company?

In July 2000 EADS (stock exchange symbol EAD ) was created by merging Aerospatiale Matra of France, DASA of Germany (DaimlerChrysler Aerospace AG excluding MTU Triebwerke) and CASA of Spain (Construcciones Aeronauticas SA). Aerospatiale Matra was already listed on the Paris Stock Exchange prior to the merger. Its shares were then swapped on a one-to-one basis and new shares were issued.

Does Airbus have a share buyback program?

Airbus implements from time to time share buyback programmes . In the framework of such programmes, Airbus fulfils trade reporting obligations to the stock exchange authorities in accordance with Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (“EU Market Abuse Regulation”).

How much did Airbus stock drop in 2020?

Its last market close was $32.7, which is 7.52% down on its pre-crash value of $35.36 and 155.47% up on the lowest point reached during the March 2020 crash when the shares fell as low as $12.8.

What is the EBITDA of Airbus?

Airbus's EBITDA (earnings before interest, taxes, depreciation and amortisation) is a whopping $4.1 billion (£3 billion). The EBITDA is a measure of a Airbus's overall financial performance and is widely used to measure a its profitability.

When did Airbus split?

Airbus's shares were split on a 4:1 basis on 16 October 2013. So if you had owned 1 share the day before before the split, the next day you'd have owned 4 shares. This wouldn't directly have changed the overall worth of your Airbus shares – just the quantity.

Have Airbus's shares ever split?

Airbus's shares were split on a 4:1 basis on 16 October 2013. So if you had owned 1 share the day before before the split, the next day you'd have owned 4 shares. This wouldn't directly have changed the overall worth of your Airbus shares – just the quantity. However, indirectly, the new 75% lower share price could have impacted the market appetite for Airbus shares which in turn could have impacted Airbus's share price.