Where can I trade premarket?

Mar 06, 2019 · How to Buy Stocks Pre-Market Prepare to Place an Order. Open an online trading account if you do not have one. Be sure the brokerage firm you select... Find Your Desired Stock. Decide which stock you want to buy pre-market. Go to your trading account order entry page and... Enter Your Order. Find ...

How to buy stock in the pre market with Etrade?

Apr 07, 2022 · A premarket trader might attempt to buy or sell early before the retail market can react to the news. Other events that might trigger premarket interest could include a court ruling in a lawsuit or a change in regulations. If an influential analyst downgrades or upgrades a stock, that also can encourage premarket traders.

When to buy and when to sell stocks [guide]?

Only limit orders are accepted in pre-market trading. Prices from other traders are quoted as bid and ask: Bid is the highest price at which you can sell; ask is the lowest price at which you can buy. For example, if XYZ is quoted pre-market as $27.35 bid and $27.52 ask, the lowest price at which you can buy is $27.52.

How to trade during premarket?

Premarket Trading Tips For Beginners - Warrior Trading. COOKIE CONSENT. We use cookies to personalize content and ads, to provide social media features and to analyze our traffic. We also share information about your use of our site with our social media, advertising and analytics partners. Review Our Cookie Policy Here.

Can I buy stock before the market opens?

How do you buy pre-market trading?

- You can only place limit orders.

- Orders are only good for that session, they do not carry over to the regular market session.

- Premarket sessions are typically much less liquid.

- Premarket orders are matched electronically through ECNs.

Who can buy during premarket?

How do I trade in pre open sessions?

Can I buy stock after-hours?

Can I trade at 4am on TD Ameritrade?

Where can I trade stocks at 4am?

- The Nasdaq and other major stock exchanges have steadily augmented their trading hours to provide investors with more time to buy and sell securities.

- Nasdaq's pre-market operations let investors start trading at 4 a.m. Eastern time.

Does Fidelity allow premarket trading?

What time does premarket trading start?

Some electronic exchanges accommodate trading as early as 4 a.m. EST. However, most premarket trading in the U.S. takes place from 8 a.m. to 9:30 a.m. EST. Premarket trading is a fairly new development. In 1991, the NYSE responded to around-the-clock global trading by allowing trading after regular market hours.

Who can take advantage of premarket trading?

If you’re wondering who can take advantage of premarket trading, it’s really just about anyone. While institutional and high-net-worth individual investors most commonly trade before the market opens, technically anyone can do it.

Why do investors monitor premarket trading?

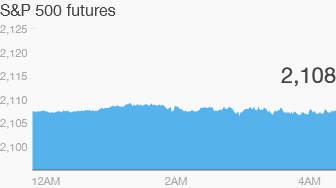

Some investors monitor premarket trading to see where the market and individual securities are headed when regular trading starts . Changes in prices and trading volumes can foreshadow the rest of the day’s market events.

Why is competition so intense in the premarket hours?

Competition is more intense in the premarket hours because relatively few individual investors trade then. That can put individual investors at a significant disadvantage with professional traders, who have access to more information.

What is pre market trading?

This is called premarket trading, and it allows investors to buy and sell stocks before official market hours. A major benefit of this type of trading is it lets investors react to off-hour news and events. However, a limited number of buyers and volatile prices can make premarket trading a bit risky for novice investors.

What would trigger premarket interest?

Other events that might trigger premarket interest could include a court ruling in a lawsuit or a change in regulations.

What happens if the earnings announcement is different from expectations?

If the earnings news is considerably different from expectations, this could cause the stock to rise or fall the next trading day. A premarket trader might attempt to buy or sell early before the retail market can react to the news.

What is premarket trading?

Premarket trading is a goldmine for some traders and a minefield for others. In this post, we’ll help you better understand premarket trading, how to do it, and the risks…. Let’s get to it!

What time does premarket trading start?

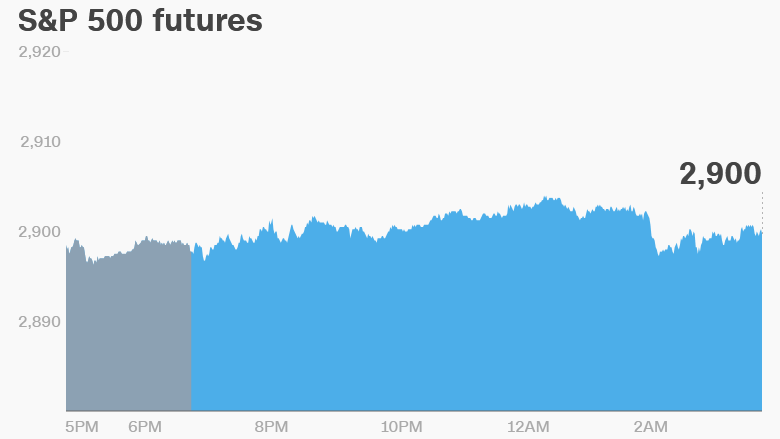

Premarket trading is the stock exchange trading activity that occurs before the market officially opens for its regular session at 9:30 a.m. Eastern. Traders can use premarket activity to look for niche trading opportunities.

Why is premarket session so difficult?

The premarket session is much trickier to trade than the regular session. That’s mainly due to the lack of liquidity and trading volume in the premarket. There just aren’t many traders at their screens ready to buy and sell.

Why does the stock price move up?

When a company releases earnings, it can cause the stock price to make a sharp move up or down. These sudden price moves are often larger when it happens in the premarket session … that’s due to the lower liquidity we just talked about.

How long does it take to trade on the NYSE?

Both the Nasdaq and NYSE allow 5 hours and 30 minutes of premarket trading before the official session starts.

How to trade well?

Trading well involves managing your risk intelligently. And to manage your risk, you need the ability to exit your position if things go south. To do that quickly, you need liquidity. And there’s not always much of it in premarket sessions.

Why is bid ask spread so expensive?

The lack of liquidity and volume means that the bid-ask spreads are wider. That can make it very expensive if you need to hit a bid or offer to exit a trade suddenly.

Watch Before You Act

Most online brokers provide access to pre-market trading. Talk to your broker or explore your trading platform, and watch the action to familiarize yourself with the procedure before trading.

Trading Procedure

Only limit orders are accepted in pre-market trading. Prices from other traders are quoted as bid and ask: Bid is the highest price at which you can sell; ask is the lowest price at which you can buy. For example, if XYZ is quoted pre-market as $27.35 bid and $27.52 ask, the lowest price at which you can buy is $27.52.

Enter Your Order

Decide how many shares you want to buy and how much you are willing to pay. The current ask is a good indication, although prices may be moving fast; watch the reported trades to determine the trend. Enter your order -- the number of shares you want to buy and the limit price.

Order Execution and Adjusting the Price

If 300 shares of XYZ are available at $27.52, your order will be executed right away and reported back to you through your broker. If there are fewer than 300 shares available at that price, your order might be partially executed -- that is, you will get some shares, but not all.

Beware of Risks

Because of limited volume and participation, pre-market trading is often subject to wide price swings. Experienced traders take advantage of novices’ emotional trading by setting ask prices high and bid prices low. Be sure there's a good reason why you can’t wait half an hour to buy your stock in the regular market when it opens.

More Articles

Based in San Diego, Slav Fedorov started writing for online publications in 2007, specializing in stock trading. He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker. Now working as a professional trader, Fedorov is also the founder of a stock-picking company.

What time does premarket trading start?

Premarket trading occurs during the time period before the stock market opens, which usually happens between 8:00 a.m. and 9:30 a.m EST. Many stock traders focus on how shares of a company perform after the opening bell and completely disregard the premarket trading session. The major U.S. stock market exchanges open for normal trading ...

How many shares can you buy in a premarket order?

The orders have limitations as well: 25,000 is the maximum number of shares per order. Brokers only honor premarket orders for the precise session in which investors placed them.

Why do traders like premarket trading?

A lot of traders like trading the premarket because of the volatility, so take your time and learn the ropes before diving in!

What does limited trading activity mean?

Limited trading activity also means that investors may find greater price fluctuations than they would have seen during regular hours of trading.

What time does the stock market open?

The major U.S. stock market exchanges open for normal trading from 9:30 a.m. ET to 4:00 p.m. ET, Monday through Friday unless it is a holiday. Thousands of stock traders are drawn to the exchanges immediately following the opening bell . The stock market is crowded during regular hours of trading which is why some investors have embraced ...

What does less volume mean in stock market?

Less trading volume might also mean bigger spreads between the ask and bid prices. Therefore, investors could find it more grueling to get as favorable share prices as they could have during normal trading sessions.

Can you execute a premarket order?

Premarket orders are not executed as easily as those executed during regular hours. Brokerage firms only accept limit orders (those directing the firms to sell or buy shares at a given price) in premarket. Your broker will not execute your order if the shares are not trading within the designated limit.

How many shares can you put on a pre market order?

There are limitations on the orders, too, with 25,000 shares the usual maximum per order. Pre-market orders are only honored for the particular session in which they are placed. While pre-market orders aren’t carried over into the regular session, there is no guarantee they are placed during the pre-market session if the trading activity is significantly low.

Who can place pre market orders?

In the past, only institutional investors such as banks, mutual funds, insurance companies, hedge funds and the like could place pre-market orders. While pre-market orders are now available to all brokerage clients, they are best used by experienced private investors.

What time do post market orders start?

Whether buying or selling after-hours, these orders are placed after the market’s close, usually starting as early as 4:05 p.m. EST and continuing until 8 p.m. 00:00.

When placing a pre market order on your broker platform, is it important that you clearly delineate the order as

When placing a pre-market order on your broker’s platform, it’s critical that you clearly delineate the order as such. Otherwise, the brokerage considers it a regular order, executed once standard hours begin. Before you trade, check out pre-market trade prices as they go through so you can see the trend. Once you determine your buy or sell price, you can place your order.

How to avoid trading outside limits?

If you want to avoid trading outside the limits so that your order isn’t placed, check the bid price if you want to purchase the shares and the asking price if you want to sell them. Your trade will go through immediately, either buying or selling, if you place your order at the current bid or ask prices.

What time does Wall Street trade?

On normal business days, regular trading hours are between 9:30 a.m. and 4 p.m.

Where do pre market orders take place?

All pre-market orders take place via electronic markets , not the exchanges available once the trading day commences.

How to sort pre market securities?

Sort pre-market securities by volume and find out where your competition is risking their capital. Then look at open positions, as well as the flavors of the day, such as stocks reporting earnings or commodities reacting to geopolitical events.

Why do stocks print big moves in the pre-market?

Securities print big moves in the pre-market because algorithms push them to extreme prices, trying to attract weak-handed capital. Use those rips and dips to get positioned in the opposite direction or take fortuitous exits on open positions.

Why is pre market preparation important?

It is an urgent task because financial markets are highly competitive and require constant realignment of strategies to short-term conditions. This is especially true in our modern environment wherein securities trade through a 24-hour cycle.

Do securities offer opportunities?

A majority of securities will offer no opportunities during that market day. It is your job to find needles in haystacks by following the short-term money flow .

What does it mean when you trade when the stock market opens?

So if you trade when these announcements are made, that means you're better able to react to the news. Once the market opens, share prices will have already changed, causing the stock price to better reflect fair value. And if you've already hit that point, it may have become too late to make a trade.

What time does the stock market open in 2021?

Updated May 4, 2021. Novice stock traders know the stock market has regular trading hours. Unless it's a holiday, the market is open for business between 9:30 a.m. and 4 p.m. Monday to Friday. 1 2 Billions of shares of stock are traded in the American markets alone, making them very liquid and efficient. 3 .

Why is it so hard to know when to buy or sell after hours?

Finally, because after-hours sessions are largely made up of professional traders and the volume is low, higher price volatility may be present. This may make it more difficult to know when to buy or sell.

How many shares can you put on one order on NASDAQ?

Only limit orders are accepted with a maximum of 25,000 shares on one order. Most listed and NASDAQ securities are available. Orders are only good for the particular session in which they are placed and are not good for carryover into the next trading session.

Why don't companies make announcements?

They don't like to make announcements during regular trading sessions because it could cause a large knee-jerk reaction that misrepresents the true value of their stock. If a company announced its last-quarter earnings ...

When are economic indicators released?

Economic Indicators. Many economic indicators are released at 8:30 a.m. — an hour before trading begins in New York. Market reaction to these indicators can cause big movements in price, and therefore, set the tone for the trading day.

Can you trade during pre market and after hours?

If you decide to trade during pre-market and after-hours sessions, you may be limited in what you can do . If we take a look at Charles Schwab's extended-hour overview, there are key differences between standard trading and after-hours trading. 7 During the regular trading day, traders can expect: Trading on exchanges.

How much does pre market trading cost?

Others have a special fee schedule, or have a surcharge, like E*TRADE, which charges an additional $0.005 per share for extended-hours trades. Your broker's particular pre-market policy should be available on their website, or by calling their customer service number.

Why do we need pre market trading?

The main benefit of having access to pre-market trading is the ability to immediately react to news items, such as earnings reports. In general, by the time the normal trading session begins, stocks will have made their reactionary moves and it will be too late to place a trade to ride the earnings reaction.

What time do you trade stocks?

For example, Scottrade has a relatively long pre-market trading session that runs from 6 a.m. ET to 9:28 a.m. ET, while TD Ameritrade limits pre -market trading to a 75-minute window between 8 a.m. ET and 9:15 a.m. ET. A few brokerages don't offer pre-market trading at all. The NASDAQ allows pre-market trading as early as 4 a.m. ET, so there are many possible time windows brokerages can offer.

What is the trading session before the market opens?

The trading session that takes place before the market opens is known as the pre-market session, and many U.S. brokerages allow customers to trade in the pre-market hours -- although the hours, costs, and procedures can vary.

Why is it harder to buy and sell shares?

Lower liquidity: There are generally fewer buyers and sellers participating in the extended-hours trading sessions, and therefore it may be tougher to buy and sell shares for a competitive price.

Can bid/ask spreads be higher in pre market?

Wider spreads: Bid/ask spreads can be much higher in the pre-market session.