How to Buy Stocks Pre-Market

- Prepare to Place an Order. Trading opportunities don’t end just because the stock market closes. ...

- Find Your Desired Stock. Open an online trading account if you do not have one. ...

- Enter Your Order. Decide which stock you want to buy pre-market. ...

- Following Up With Your Order. Find the order box on your order entry page. ...

Where can I trade premarket?

Trading Opportunities for the Premarket Session

- Company Earnings Announcements. When a company releases earnings, it can cause the stock price to make a sharp move up or down. ...

- Overnight Market Action. The global financial markets generally move in waves. ...

- Early Morning News Catalysts. News catalysts include just about any news story that could affect a stock’s price. ...

How to buy stock in the pre market with Etrade?

Your guide to placing your first stock order

- Learn the basics. Make sure you understand some key ideas before placing your first trade. ...

- Research before you trade. Doing your research can help you identify investments that are right for you and fit your goals. ...

- Choose your platform. ...

- Enter your order. ...

When to buy and when to sell stocks [guide]?

We go where the value is. For the second month in a row that takes us to a former selection in this leading global producer of photomasks used in semiconductors and displays, which has seen its stock fall 16% after climbing to its highest level in over a ...

How to trade during premarket?

- Change from the standard session closing price

- Last Trade and Tick

- Bid and Ask Size

What is premarket trading?

Premarket trading is a goldmine for some traders and a minefield for others. In this post, we’ll help you better understand premarket trading, how to do it, and the risks…. Let’s get to it!

What time does premarket trading start?

Premarket trading is the stock exchange trading activity that occurs before the market officially opens for its regular session at 9:30 a.m. Eastern. Traders can use premarket activity to look for niche trading opportunities.

What is a premarket movers?

Premarket movers are the stocks that put in large moves in the premarket session. This may be due to news stories, earnings announcements, large order flow, or social media buzz. Here’s what’s key for skilled traders: these large premarket moves tend to be driven by emotion.

Why do stock exchanges halt trading?

Exchanges often place a halt on the trading of a stock when a company has some regulatory issues. It can also be if a news announcement is expected or there are discrepancies in the orders. A halt is temporary.

Can you place limit orders on a premarket?

In regard to order types, you can only place limit orders. Market orders aren’t allowed premarket. That’s due to the exchange not wanting big traders to smack the price around too much. The orders you place are also only valid for that current premarket session.

Is premarket trading risky?

Overall, you should know that premarket trading is riskier than regular session trading. It’s all too easy to get trapped in a position with no way out. Premarket vs. After-Hours. Apart from the premarket and regular trading sessions, there’s also an after-hours session.

Watch Before You Act

Most online brokers provide access to pre-market trading. Talk to your broker or explore your trading platform, and watch the action to familiarize yourself with the procedure before trading.

Trading Procedure

Only limit orders are accepted in pre-market trading. Prices from other traders are quoted as bid and ask: Bid is the highest price at which you can sell; ask is the lowest price at which you can buy. For example, if XYZ is quoted pre-market as $27.35 bid and $27.52 ask, the lowest price at which you can buy is $27.52.

Enter Your Order

Decide how many shares you want to buy and how much you are willing to pay. The current ask is a good indication, although prices may be moving fast; watch the reported trades to determine the trend. Enter your order -- the number of shares you want to buy and the limit price.

Order Execution and Adjusting the Price

If 300 shares of XYZ are available at $27.52, your order will be executed right away and reported back to you through your broker. If there are fewer than 300 shares available at that price, your order might be partially executed -- that is, you will get some shares, but not all.

Beware of Risks

Because of limited volume and participation, pre-market trading is often subject to wide price swings. Experienced traders take advantage of novices’ emotional trading by setting ask prices high and bid prices low. Be sure there's a good reason why you can’t wait half an hour to buy your stock in the regular market when it opens.

More Articles

Based in San Diego, Slav Fedorov started writing for online publications in 2007, specializing in stock trading. He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker. Now working as a professional trader, Fedorov is also the founder of a stock-picking company.

What does it mean when you trade when the stock market opens?

So if you trade when these announcements are made, that means you're better able to react to the news. Once the market opens, share prices will have already changed, causing the stock price to better reflect fair value. And if you've already hit that point, it may have become too late to make a trade.

What time does the stock market open in 2021?

Updated May 4, 2021. Novice stock traders know the stock market has regular trading hours. Unless it's a holiday, the market is open for business between 9:30 a.m. and 4 p.m. Monday to Friday. 1 2 Billions of shares of stock are traded in the American markets alone, making them very liquid and efficient. 3 .

Why is it so hard to know when to buy or sell after hours?

Finally, because after-hours sessions are largely made up of professional traders and the volume is low, higher price volatility may be present. This may make it more difficult to know when to buy or sell.

How many shares can you put on one order on NASDAQ?

Only limit orders are accepted with a maximum of 25,000 shares on one order. Most listed and NASDAQ securities are available. Orders are only good for the particular session in which they are placed and are not good for carryover into the next trading session.

Why don't companies make announcements?

They don't like to make announcements during regular trading sessions because it could cause a large knee-jerk reaction that misrepresents the true value of their stock. If a company announced its last-quarter earnings ...

When are economic indicators released?

Economic Indicators. Many economic indicators are released at 8:30 a.m. — an hour before trading begins in New York. Market reaction to these indicators can cause big movements in price, and therefore, set the tone for the trading day.

Can you trade during pre market and after hours?

If you decide to trade during pre-market and after-hours sessions, you may be limited in what you can do . If we take a look at Charles Schwab's extended-hour overview, there are key differences between standard trading and after-hours trading. 7 During the regular trading day, traders can expect: Trading on exchanges.

How to sort pre market securities?

Sort pre-market securities by volume and find out where your competition is risking their capital. Then look at open positions, as well as the flavors of the day, such as stocks reporting earnings or commodities reacting to geopolitical events.

Why is pre market preparation important?

It is an urgent task because financial markets are highly competitive and require constant realignment of strategies to short-term conditions. This is especially true in our modern environment wherein securities trade through a 24-hour cycle.

What time does pre market trading take place?

The pre-market trading session takes place each trading day between 8 a.m. and 9:30 a.m. EST. Buying pre-market relies on using a broker permitting such trading, but most of the top brokers do. Charles Schwab, for example, allows the placing of pre-market orders between 8:05 a.m. of the prior trading day and 9:25 a.m. of the trading day. The brokerage executes these pre-market orders between 7 a.m. and 9:25 a.m. EST.

Who can place pre market orders?

In the past, only institutional investors such as banks, mutual funds, insurance companies, hedge funds and the like could place pre-market orders. While pre-market orders are now available to all brokerage clients, they are best used by experienced private investors.

What time do post market orders start?

Whether buying or selling after-hours, these orders are placed after the market’s close, usually starting as early as 4:05 p.m. EST and continuing until 8 p.m. 00:00.

When placing a pre market order on your broker platform, is it important that you clearly delineate the order as

When placing a pre-market order on your broker’s platform, it’s critical that you clearly delineate the order as such. Otherwise, the brokerage considers it a regular order, executed once standard hours begin. Before you trade, check out pre-market trade prices as they go through so you can see the trend. Once you determine your buy or sell price, you can place your order.

How to avoid trading outside limits?

If you want to avoid trading outside the limits so that your order isn’t placed, check the bid price if you want to purchase the shares and the asking price if you want to sell them. Your trade will go through immediately, either buying or selling, if you place your order at the current bid or ask prices.

Can you adjust your price if the shares are moving in a different direction?

You can adjust your price if the shares are moving in a different direction so that your order is executed. There is usually greater price fluctuation in the pre-market, as well as greater volatility and wider spreads between the bid and ask prices, or the supply and demand.

Can you place a pre market order during regular trading hours?

Pre-market orders aren’t placed as easily as orders placed during regular hours. Only limit orders are accepted pre-market, with orders directing the broker to buy or sell shares at a specified price. Keep in mind that if the shares are trading outside of your designated limit, the broker will not execute the order.

What time does the stock market open in New York?

Normal stock market hours on the New York Stock Exchange are from 9:30 a.m. to 4 p.m. EST during the week – but outside of normal trading hours, premarket and after-hours trading take over and investors enter into new territory. Trading stocks can be different during intraday hours versus after hours.

Why is it so hard to capitalize on after market hours?

Thomas Shohfi, assistant professor at Rensselaer Polytechnic Institute in Troy, New York, says "it's difficult to capitalize on this because they (retail investors), generally, cannot move as quickly as institutions that can process information and transact accordingly at a much faster speed.". Professional traders in after-market hours have access ...

Why do institutional investors take on the risks associated with extended hours trading?

Securities and Exchange Commission, these institutional investors can take on the risks associated with extended-hours trading like price volatility and lack of liquidity because they have sophisticated trading strategies that require them to make 24-hour adjustments to their portfolios that hedge risks.

Why are earnings important?

Earnings are an important component for long-term investors to consider. Leading up to these announcements, investors who have been following a company for a while may be able to predict earnings results and make market decisions based on their anticipations.

Why are futures called derivatives?

Contracts for futures derive their value from the performance of the underlying index, which is why they are called derivatives. Investors can trade index futures to predict whether the price of equities on an index will rise or fall. [. See: How to Pick Stocks: 7 Things All Beginner Investors Should Know.

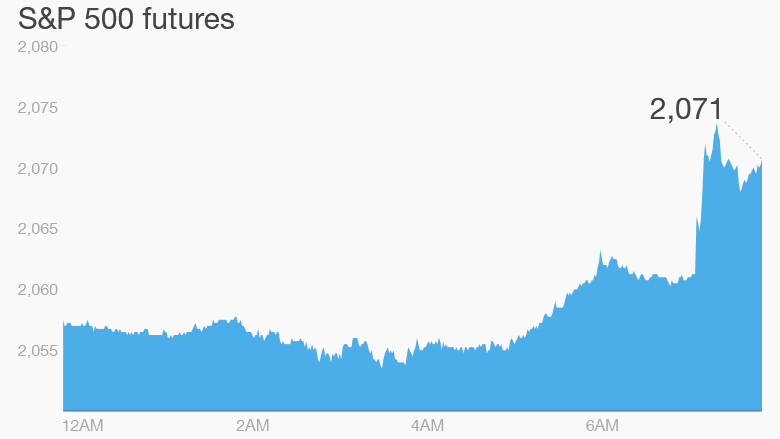

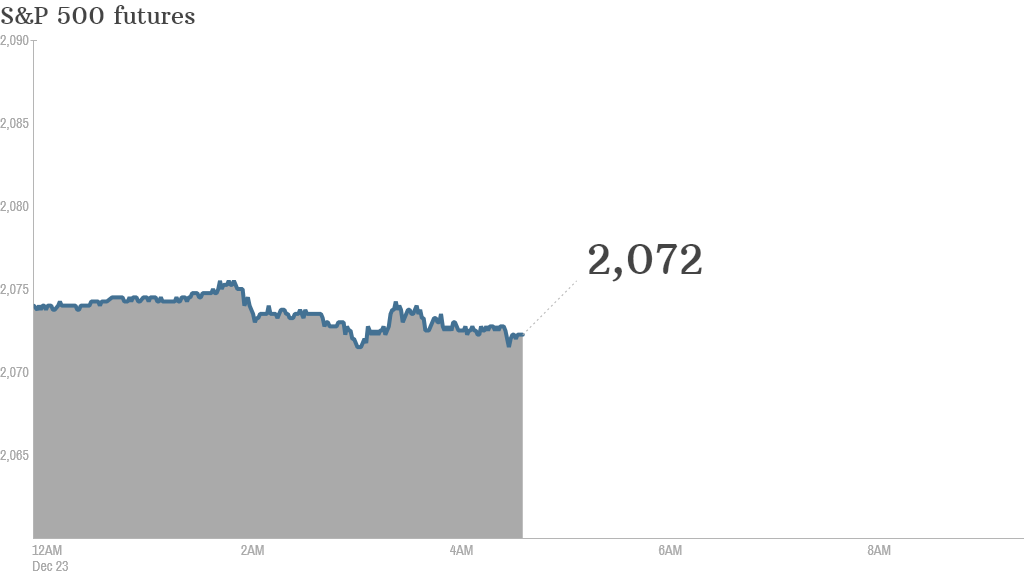

How long do futures trade?

Futures trade 24 hours a day and are a part of a forward-looking global market. International market movements can be seen in the increase or decrease in index futures as stocks are bought and sold globally.

What is index futures?

Index Futures. The futures market allows market participants, namely manufacturers and producers of commodities, to buy commodities like wheat, corn, coffee or precious metals during a particular time in the future and at a specific price. This allows businesses to manage risk and market volatility.

What is a premarket movers?

Premarket movers – stocks trading well above or below their previous day’s closing price or with a lot of volume before the market opens – provide a number of exciting opportunities for day traders. Typically, premarket movers are jumping in response to news or financial releases, so these stocks are likely to see a lot ...

How to tell if a stock is up 10%?

You can identify stocks that are trading in the premarket with decent volume by looking at a moving average of their premarket volume.

Is every stock trading up or down in the premarket?

Not every stock that’s trading up or down in the premarket hours is poised for a trade. There are a handful of things to look for when identifying premarket movers that are worth your attention at market open. First, volume is key. Premarket trading often happens on low volume because there simply aren’t that many traders active before ...