Here is a step-by-step instruction on how to buy individual stocks:

- Open a stock trading account

- Screen and research the stock you want to buy

- Decide how much to invest in a single stock

- Choose what order type to use

- Active management of your stock trades

Can You get Rich on a single stock?

Yes, you can get rich from stocks if you start early, think long-term, begin with a sizeable capital, and regularly add to your investment. And the good thing is, you don’t need to know much about individual stocks before you can start investing. There is more to investing in stocks than buying a couple of shares.

How to get rich from single stock trading?

Single Stock Trading Strategy

- Step #1: Identify the Opening Drive – Directional Bias. The single stock trading strategy focal point is to capture that momentum move or the extension of the initial price move.

- Step #2: Wait for the Stock Price Stalling Out - Consolidate. ...

- Step #3: Buy if we break above the top of Consolidation. ...

What are the best stocks to invest in?

When Is the Best Time to Invest In a Roth IRA?

- The Sooner the Better. The amount of tax you pay on Roth contributions depends on how much you earn, so it’s wise to invest in one when you are making ...

- Convert When Income Dips. There is an annual limit to how much you can contribute to a Roth IRA—in 2022 it’s $6,000 ($7,000 if you’re age 50 or older).

- When Federal Income Tax Rates Are Favorable. ...

What is the best place to buy shares?

Top 10 Best Shares to Buy Right Now

- British American Tobacco (JSE) – Best Long-term Investment. Dividend yield: 7.64% YTD return: -5.11% Although British American Tobacco has its primary listing on the London Stock Exchange, the cigarette ...

- Naspers (JSE) – Best South African Stock for Positive Returns. ...

- Netflix (NASDAQ) – Global Studio with a Growing Audience. ...

Can I buy just one share of stock?

Many people would say the smallest number of shares an investor can purchase is one, but the real answer is not quite as straightforward. Today, it is increasingly common for investors to purchase fractional shares, where as little as $1 can be applied to a stock buy order.

How do I buy my first share of stock?

To buy stocks, you'll typically need the assistance of a stockbroker, since you cannot simply call up a stock exchange and ask to buy stocks directly. When you use a stockbroker, whether a human being or an online platform, you can choose the investment that you wish to buy or sell and how the trade should be handled.

How much does it cost to buy a single stock?

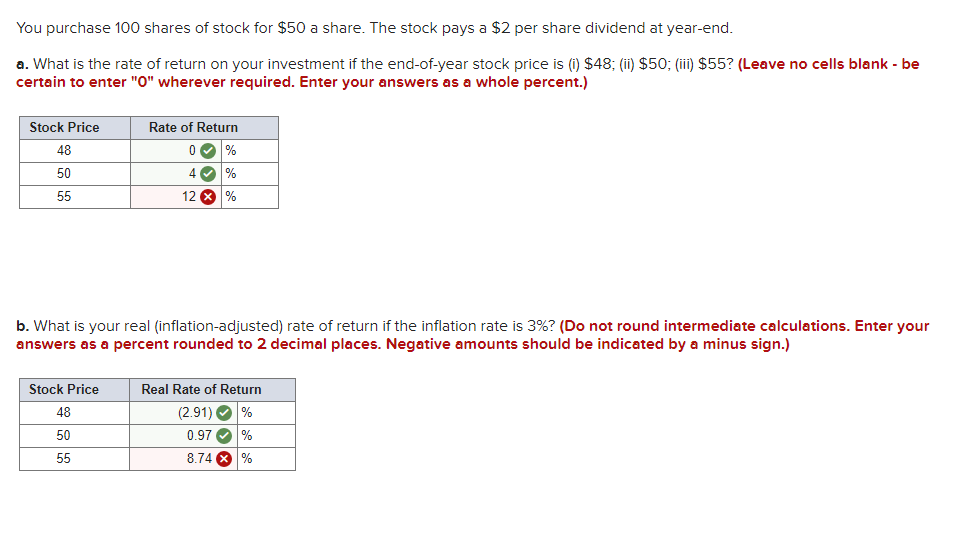

If the investor uses an online broker, the price will be $2,000. If a full-service broker is used, there will be a fee of 2% of the total trade value, with a minimum commission of $50. The total price of the shares alone is $20 * 100, or $2,000.

How much stock should a beginner buy?

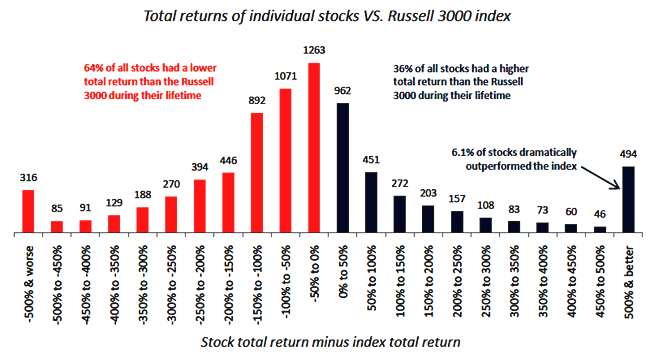

If you can keep your costs down, some experts recommend buying a portfolio of 12 to 18 stocks to properly diversify out the risk of owning individual stocks. Your diversification should be based on total share value, not share count.

How do beginners invest?

6 investments for beginners401(k) or employer retirement plan.A robo-advisor.Target-date mutual fund.Index funds.Exchange-traded funds (ETFs)Investment apps.

Should I buy 1 Google share?

Should you buy Google stock? Google parent Alphabet's stock split will not affect the value of the stock an investor holds. But if you wanted to buy even a single share of Google but found it too expensive, that will be much easier to afford after the stock splits.

What is the smallest amount of stock I can buy?

While there is no minimum order limit on the purchase of a publicly-traded company's stock, it's advisable to buy blocks of stock with a minimum value of $500 to $1,000. This is because no matter what online or offline service an investor uses to purchase stock, there are brokerage fees and commissions on the trade.

What happens if you invest 100 a month?

Investing just $100 a month over a period of years can be a lucrative strategy to grow your wealth over time. Doing so allows for the benefit of compounding returns, where gains build off of previous gains.

How to buy stocks without a broker?

Another way to buy stocks without a broker is through a dividend reinvestment plan, which allows investors to automatically reinvest dividends back into the stock, rather than taking the dividends as income. Like direct stock plans, though, you’ll have to seek out the companies that offer these programs.

Who said "Buy into a company because you want to own it, not because you want the stock to go

Warren Buffett famously said, “Buy into a company because you want to own it, not because you want the stock to go up.”. He’s done pretty well for himself by following that rule. Once you’ve identified these companies, it’s time to do a little research.

What is a limit order in stock trading?

A limit order gives you more control over the price at which your trade is executed. If XYZ stock is trading at $100 a share and you think a $95 per-share price is more in line with how you value the company, your limit order tells your broker to hold tight and execute your order only when the ask price drops to that level. On the selling side, a limit order tells your broker to part with the shares once the bid rises to the level you set.

What is a stop level in stock?

Once a stock reaches a certain price, the “stop price” or “stop level,” a market order is executed and the entire order is filled at the prevailing price.

Do you own shares or stock?

For the most part, yes. Owning “stock” and owning “shares” both mean you have ownership — or equity — in a company. Typically, you’ll see “shares” used to refer to the size of an ownership stake in a specific company, while “stock” often means equity as a whole.

Is there a single best stock?

There is no single "best stock," which is why many financial advisors advocate for investing in low-cost index funds. However, if you’d like to add a few individual stocks to your portfolio, beginners may want to consider blue-chip stocks in the S&P 500.

Before You Buy

Before you buy a share of stock, you will need to open a brokerage account. Full service, discount, and online brokerage firms handle such requests. An individual can enter the order online if that option is available, or phone the order in to a broker.

Considerations

The commission of a single share of stock can be expensive in relation to the price of the stock. Also, there are shipping and transfer fees. Many brokerage firms charge as much as $100 to transfer a single share of stock.

Benefits

Buying a share of stock is a good way to get a young person interested in the stock market and investing. Framed, it also makes a great gift. It is a relatively easy process, but it is important to consider fees. Also, if the stock pays a dividend, be prepared for quarterly checks for just a few cents.

Step 1

Decide whether you want the single share of stock to be a physical gift, or a way to build wealth for the long term. If you want to purchase a share of stock as a gift for a child or grandchild, companies like OneShare (see Resources) can provide you with a framed stock certificate in the recipient's name.

Step 2

Open an account at ShareBuilder, OneShare or the service of your choice. To open an account at ShareBuilder, just click on the "Get Started" button. ShareBuilder has no minimum investment requirements, and trades are as low as $4 each.

Step 3

Log on to your brokerage account if you want to buy a single share of stock to hold in your account. Go to the trading menu and enter the ticker symbol of the stock you want to buy. You can find the ticker symbol in the stock tables of your local newspaper, or you can look it up on financial websites like Yahoo! Finance and CNN Money.

Step 4

Review the details of your trade and make sure you have enough cash in your account to complete the purchase. Double-check the cost of the commission, since a high commission could add considerably to the cost of that one share of stock.

Step 5

Print a copy of the trade confirmation and keep it with your tax records. You will need this documentation to compute your capital gain when you sell the stock down the line.

What is the best way to buy stocks?

An online brokerage account is the most convenient place to buy stocks, but it’s far from your only option. If you see yourself as a hands-on investor who likes researching companies and learning about markets, an online brokerage account is a great place to get started buying stocks.

What is value stock?

Value stocks are shares of stock that are priced at a discount and stand to see price gains as the market comes to recognize their true value. With value investing, you’re looking for “shares on sale,” with low price-to-earnings and price-to-book ratios.

What is a stock screener?

Stock screeners help you narrow down your list of potential stocks to buy and offer an endless range of filters to screen out all the companies that do not meet your parameters. Nearly all online brokerage accounts offer stock screeners, and there are more than a few free versions available online.

How much is Alphabet stock worth in 2020?

Take Google parent, Alphabet, Inc.: As of late September 2020, Alphabet is priced at nearly $1,500 a share.

What is a full service broker?

Full-service brokers provide well-heeled clients with a broad variety of financial services, from retirement planning and tax preparation to estate planning. They also can help you buy stocks. The trouble is full-service brokers charge steep commissions compared to online brokers.

Is a brokerage account taxable?

If you’re investing for a day sooner than retirement—or you’ve already maxed out your retirement accounts—look to a taxable brokerage account. While they don’t offer the tax advantages of IRAs, they also don’t have any limitations on how much money you can deposit or when you can withdraw funds.

How to buy stock in a stock market?

Step 1: Open a stock trading account. Step 2: Screen and research the stock you want to buy. Step 3: Decide how much to invest in a single stock. Step 4: Choose what order type to use. Step 5: Active management of your stock trades.

Do two stocks move the same?

In this regard, no two stocks will move the same. Obviously, this means that you need to trade each stock individually and apply different tools to gauge the stock price movement. Maybe you found yourself in a position where most of your trades and subsequent profits come from one single stock.