If you are considering building a portfolio with ETFs, here are some simple guidelines:

- Step 1: Determine the Right Allocation Look at your objective for this portfolio (e.g., retirement or saving for a...

- Step 2: Implement Your Strategy The beauty of ETFs is that you can select an ETF for each sector or index in which you...

- Step 3: Monitor and Assess

- Multiple asset classes, by buying a combination of cash, bonds, and stocks.

- Multiple holdings, by buying many bonds and stocks (which you can do through a single ETF) instead of just one or a few.

How do I diversify my portfolio with ETFs?

Using exchange-traded funds, or ETFs, is an easy, low-cost method of diversifying with just a few tickers. Here are 10 ETFs you can buy to construct a diversified portfolio. The core of any U.S. investor's portfolio should be a sizable allocation to the domestic stock market.

What are ETFs and should you invest in them?

An ETF can guard against volatility (up to a certain point) if certain stocks within the ETF fall. This removal of company-specific risk is the biggest draw for most ETF investors. Another benefit of ETFs is the exposure they can give a portfolio to alternative asset classes, such as commodities, currencies, and real estate.

Should you build a low-cost ETF portfolio?

Roboadvisors, which are increasingly popular, often build all-ETF portfolios for their users. Over time, there will be ups and downs in the markets and in individual stocks, but a low-cost ETF portfolio should ease volatility and help you achieve your investment goals.

How many Vanguard ETFs should you have in your portfolio?

Our five Vanguard ETF portfolio needs a great base, and that base comes from a hefty dose of U.S. equities. The United States is still the number one game in town when it comes to the world’s market and every portfolio needs to have plenty of exposure to top stocks like Exxon (NYSE: XOM) or Johnson & Johnson (NYSE: JNJ ).

How do you build a diversified portfolio with ETFs?

1:323:31How to Build a Portfolio with ETFs - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd diversified portfolio. You could diversify your bond allocation with multiple ETFs thatMoreAnd diversified portfolio. You could diversify your bond allocation with multiple ETFs that specialize in certain maturity lengths and bond types corporate high-yield corporate Treasuries and Moonies.

What is a good diversified ETF portfolio?

10 ETFs to buy for a diversified portfolio:iShares Core S&P Total U.S. Stock Market ETF (ITOT)iShares Core MSCI Total International Stock Market ETF (IXUS)Vanguard Total World Stock ETF (VT)iShares U.S. Treasury Bond ETF (GOVT)Vanguard Total World Bond Market ETF (BNDW)SPDR Gold MiniShares (GLDM)More items...•

Are ETFs a good way to diversify?

As a general rule, ETFs provide excellent diversification at a low ongoing expense ratio (OER) since many are passive funds that track a certain benchmark index. Because of this, they typically offer transparency—it's easy to see what stocks, bonds, or other investments the ETF holds each day.

How many ETFs do you need to diversify?

Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification.

Can ETFs make you rich?

This disciplined approach can make you into a millionaire, even if you earn an average salary. You don't need to be an expert stock picker or own a ton of investments to build a seven-figure nest egg. An exchange-traded fund (ETF) can make you an investor in hundreds of companies with a single purchase.

How much of my portfolio should be ETFs?

According to Vanguard, international ETFs should make up no more than 30% of your bond investments and 40% of your stock investments. Sector ETFs: If you'd prefer to narrow your exchange-traded fund investing strategy, sector ETFs let you focus on individual sectors or industries.

Should you hold ETFs long-term?

ETFs can be great building blocks for long-term investors. They can provide broad exposure to market sectors, geographies, and industries and help investors quickly diversify their portfolios and reducing their overall risk profile. The best long-term ETFs provide this exposure for a relatively low expense ratio.

Is S&P 500 enough diversification?

Is Investing in the S&P 500 Less Risky Than Buying a Single Stock? Generally, yes. The S&P 500 is considered well-diversified by sector, which means it includes stocks in all major areas, including technology and consumer discretionary—meaning declines in some sectors may be offset by gains in other sectors.

What can go wrong with ETFs?

It's important that investors understand the risks of using (or misusing) ETFs; let's walk through the top 10.Market risk. The single biggest risk in ETFs is market risk. ... "Judge a book by its cover" risk. ... Exotic-exposure risk. ... Tax risk. ... Counterparty risk. ... Shutdown risk. ... Hot new thing risk. ... Crowded trade risk.More items...

How do I choose an ETF portfolio?

Look at the ETF's underlying index (benchmark) to determine the exposure you're getting. Evaluate tracking differences to see how well the ETF delivers its intended exposure. And look for higher volumes and tighter spreads as an indication of liquidity and ease of access.

How long can you hold an ETF stock?

Holding period: If you hold ETF shares for one year or less, then gain is short-term capital gain. If you hold ETF shares for more than one year, then gain is long-term capital gain.

Is it better to invest in ETFs or individual stocks?

Both stocks and ETFs provide investors with dividends, and each is traded during the day on stock exchanges. Individual stocks are much riskier but can yield higher returns. ETFs are relatively low risk and provide stable, if less profitable, returns.

How do ETFs help diversification?

ETFs provide a simple way to achieve diversification by offering access to a vast range of markets and asset classes. It’s important to note that it is perfectly normal for the Australian share market to fall about one in every five years. One of the biggest impacts on your overall portfolio return is your asset allocation.

What is the best performing sector in 2020?

The technology sector was one of the best performing sectors in 2020. There are only a handful of technology stocks available on the Australian Securities Exchange, meaning investors need to consider looking globally to access this theme.

Is defensive asset more volatile than growth?

Defensive assets tend to be less volatile than growth assets that deliver reliable, stable income. Consider your risk appetite before choosing which asset classes to include in your portfolio when aligning your portfolio with your investment goals.

Is fixed income considered a defensive asset?

On the other hand, fixed income and cash are considered income or defensive assets.

Is self directed investing too focused on the Australian market?

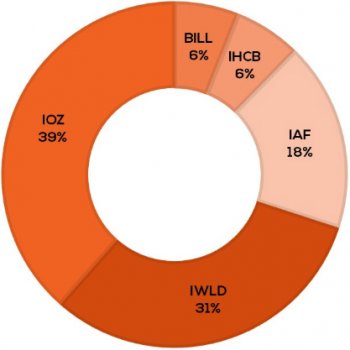

ASX research has concerningly shown that self-directed investor portfolios tend to be too focused on just the Australian share market. Considering the Australian market represents less than 3% of the world’s investable assets, local investors are missing out on diversification opportunities globally.

How to create an all ETF portfolio?

Creating an All-ETF Portfolio. If your plan is to have a portfolio made up solely of ETFs, make sure multiple asset classes are included to create diversification. As an example, you could start by focusing on three areas: Sector ETFs, which concentrate on specific fields, such as financials or healthcare.

How to choose an ETF?

When determining which ETFs are best suited for your portfolio, there are a number of factors to consider. First, you should look at the composition of the ETF. The name alone is not enough information to base a decision on. For instance, several ETFs are made up of water-related stocks.

What are ETFs made of?

For instance, several ETFs are made up of water-related stocks. However, when the top holdings of each are analyzed, it is clear they take different approaches to the niche sector. While one ETF may be composed of water utilities, another may have infrastructure stocks as the top holdings.

How are ETFs different from mutual funds?

First, ETFs can be freely traded like stocks, while mutual fund transactions don't occur until the market closes. Second, expense ratios tend to be lower than those of mutual funds because many ETFs are passively managed vehicles tied to an underlying index or market sector. Mutual funds, on the other hand, are more often actively managed. Because actively managed funds don't commonly beat the performance of indexes, ETFs arguably make a better alternative to actively-managed, higher-cost mutual funds.

Why are ETFs used?

Because ETFs often represent an index of an asset class or sub-class, they can be used to build efficient, passive indexed portfolios. ETFs are also relatively inexpensive, offer higher liquidity and transparency than some mutual funds, and trade throughout the day like a stock.

Why are ETFs better than mutual funds?

Because actively managed funds don't commonly beat the performance of indexes, ETFs arguably make a better alternative to actively-managed, higher-cost mutual funds. The top reason for choosing an ETF over stock is instant diversification.

What are commodities ETFs?

Be sure to look at the makeup of each ETF, as far as individual stocks and sector allocation. Commodity ETFs are an important part of an investor's portfolio. Everything from gold to cotton to corn can be tracked with ETFs or their cousins, exchange-traded notes (ETNs).

Why do Vanguard ETFs work?

Vanguard ETFs make that process easy. There’s a reason why money continues to flow into exchange-traded funds (ETFs) and other indexed products. Passive and indexed portfolios take the guesswork out of market-timing decisions because index funds own all the stocks within a certain market segment.

Why are international stocks considered hometown bias?

Because the U.S. is still top dog, many investors exhibit what’s called “hometown bias.”. That is, they favor the market perhaps more than they should. But international stocks have a place in your portfolio. After all, you’re just as likely to drive a Japanese car or own a Korean appliance.

What is diversification in investment?

Diversification is a battle cry for many financial planners, fund managers, and individual investors alike. It is a management strategy that blends different investments in a single portfolio. The idea behind diversification is that a variety of investments will yield a higher return.

How to make money from stocks?

Equities can be wonderful, but don't put all of your money in one stock or one sector. Consider creating your own virtual mutual fund by investing in a handful of companies you know, trust and even use in your day-to-day life . But stocks aren't just the only thing to consider.

What are the drawbacks of index funds?

One potential drawback of index funds is their passively managed nature. While hands-off investing is generally inexpensive, it can be suboptimal in inefficient markets. Active management can be very beneficial in fixed income markets, especially during challenging economic periods. 3. Keep Building Your Portfolio.

Is investing fun?

Investing can and should be fun. It can be educational, informative, and rewarding. By taking a disciplined approach and using diversification, buy-and-hold and dollar-cost averaging strategies, you may find investing rewarding even in the worst of times.

Is diversification a new concept?

Diversification is not a new concept. With the luxury of hindsight, we can sit back and critique the gyrations and reactions of the markets as they began to stumble during the dotcom crash and again during the Great Recession.

How to build a bulletproof, diversified growth stock portfolio for long-term investing!

Today I am starting a new video series on how to build a growth stock portfolio from scratch. This series is focused on investing for beginners, but investors of all backgrounds will enjoy this content. The stock market can be challenging to navigate, but this diversified portfolio enables successful long-term growth investing.

NASDAQ: QQQ

There will be future videos explaining what stocks I'm buying now, how dollar-cost averaging (DCA) works, and more. Please watch the below video for more information and don't forget to subscribe and click the bell to receive notifications, so you don't miss any future videos in the series.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Benefits of An ETF Portfolio

Choosing The Right ETFs

- When determining which ETFs are best suited for your portfolio, there are a number of factors to consider. First, you should look at the composition of the ETF. The name alone is not enough information to base a decision on. For instance, several ETFs are made up of water-related stocks. However, when the top holdingsof each are analyzed, it is clear they take different appro…

Creating An All-Etf Portfolio

- If your plan is to have a portfolio made up solely of ETFs, make sure multiple asset classes are included to create diversification. As an example, you could start by focusing on three areas: 1. Sector ETFs, which concentrate on specific fields, such as financials or healthcare. Choose ETFs from different sectors that are largely uncorrelated. For ...

The Bottom Line

- Over time, there will be ups and downs in the markets and in individual stocks, but a low-cost ETF portfolio should ease volatility and help you achieve your investment goals.