In summary, here are the five steps every stock trader needs to undertake to successfully conduct fundamental analysis on your favorite stock:

- Study the financial ratios of your favorite company

- Understand the company’s business model

- Study the financials of the company like balance sheet, cash flow statements, etc.

- Understand stock’s industry risks

Full Answer

What is the easy way to check stock fundamentals?

Oct 02, 2019 · In summary, here are the five steps every stock trader needs to undertake to successfully conduct fundamental analysis on your favorite stock: Study the financial ratios of your favorite company Understand the company’s business model Study the financials of the company like balance sheet, cash flow ...

How to analyze stocks for beginners?

Apr 29, 2021 · 5 Tips on How to Conduct Fundamental Analysis. Find Reputable Sources. Make sure you can trust your data sources. Most companies make their financial statements public. You can also get a ... Read the News. Perform Background …

What is the best way to analyze stocks?

Mar 04, 2022 · Hiccup is a slang term for a short-term disruption within a longer-term plan, goal or trend. A hiccup can be used to describe the business actions of a particular company, a stock price downturn ...

How to perform fundamental analysis of stocks?

Analyzing stock fundamentals Take fundamental analysis to a new level. Whether you're just starting out or are more advanced, learn ways to determine the intrinsic value of a security by examining related economic, financial, and other qualitative and quantitative factors.

How do you analyze the fundamentals of a stock?

- Understand the company. It is very important that you understand the company in which you intend to invest. ...

- Study the financial reports of the company. ...

- Check the debt. ...

- Find the company's competitors. ...

- Analyse the future prospects. ...

- Review all the aspects time to time.

How do you know if a stock is fundamentally strong?

Which are fundamentally good stocks?

- Reliance Industries. As of December 2021, the market capitalisation of Reliance industries stands at Rs. ...

- Tata Consultancy Services. ...

- HDFC Bank. ...

- Infosys. ...

- Hindustan Unilever. ...

- Bajaj Finance. ...

- Asian Paints. ...

- Titan Company.

How do you analyze stock before investing?

- Reviewing Financial Statements: Share market analysis is first and foremost a numbers game. ...

- Industry Analysis: ...

- Researching Stocks: ...

- Price Targets: ...

- Conclusion.

What Is Fundamental Analysis and What Are Its Objectives?

Fundamental analysis is the process of assessing a stock’s fair market value using macro and micro approaches.

Why Fundamental Analysis Is Important

Fundamental analysis tells you a company’s story. It goes beyond speculation to reveal a stock’s nuts and bolts.

What Is Fundamental Analysis Used For?

Fundamental analysis helps determine a stock’s value. Analysts who use it believe a stock’s price should reflect the company’s ability to earn profits.

What Are the Types of Fundamental Analysis?

There are two main types of fundamental analysis. Let’s break it down.

Fundamental Analysis Indicators

There’s a range of fundamental analysis indicators. Below are some of the most common.

5 Tips on How to Conduct Fundamental Analysis

OK, enough theory, right? Let’s break fundamental analysis down into 5 tips…

Is It Possible to Perform a Fundamental Analysis of Cryptocurrency?

It would be difficult. Fundamental analysis relies on things like earnings and business plans, the competitive advantage of a company, and its corporate structure.

Fundamental vs. Technical Analysis

There are two essential methods to analyze a stock. Long-term investors use fundamental analysis of a company’s financial statements, such as earnings, sales, dividends, and future cash flow valuations. Stock Traders use the technical analysis of stock charts, prices, patterns, and supply and demand using volume indicators.

How to Analyze a Stock Using Fundamental Analysis

The fundamental analysis of stocks is an analysis of the foundation of a company’s financial operations. Typically fundamental analysis helps you answer the following questions:

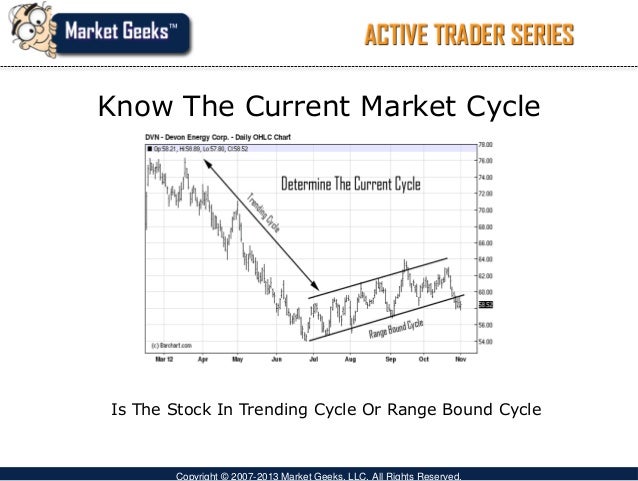

How to Analyze a Stock Using Technical Analysis

For the short-term stock trader, technical analysis is the key to success. Technical analysts evaluate the supply and demand dynamics in the trading of stock on the exchange to predict future price moves. The three main factors are the stock price, the number of buyers and sellers, and the volume of stocks being traded.

Summary

As you can see, there are many ways to analyze a stock. How you analyze a stock very much depends on whether you are a short-term trader or a long-term investor. As a trader, you will use the technical analysis of stock charts to analyze future stock price movements.

How to analyze stocks – Fundamental stock analysis

Fundamental analysis of stocks is to analyze the historical financial numbers of a company to assess the quality and the price of a stock. The numbers are taken from the income statement, balance sheet, and cash flow statement.

Cancel reply

You are commenting using your WordPress.com account. ( Log Out / Change )

What Is Fundamental Analysis?

As one of the techniques used in equity or stock valuation, fundamental analysis is a method that measures the intrinsic value, or true value, of a stock by looking at financial and economic factors.

Understanding Fundamental Analysis

For stocks, fundamental analysis utilizes metrics such as earnings, revenue, future growth, profit margins, return on equity, and other data to help determine the underlying value of a company as well as the company’s potential for future growth.

Intrinsic Value

When conducting fundamental analysis, investors are trying to come up with a model that helps determine the projected value of a company. The calculation is based on the data available to the public.

Quantitative Fundamentals

Quantitative fundamentals, an integral component of fundamental analysis, involve hard numbers. These are the quantifiable or measurable factors and characteristics of a business.

Qualitative Fundamentals

As we have just learned the ins and outs of quantitative analysis, another important part of the equation is qualitative analysis. Qualitative fundamentals are usually less tangible and are difficult to measure.

How To Value A Stock Using Fundamental Analysis: Final Thoughts

Fundamental analysis is the root of most stock valuation techniques. By using a fundamental equation with real economic and financial data, investors can have a more systematic valuation approach.

Fundamental vs. Technical

When it comes to stock analysis, there are two main schools: Fundamental analysis and technical analysis.

Business Basics

Before you begin to analyze public companies for their investment potential, you'll need to understand some business basics, particularly those relating to the

What Is Performance?

When you hear about a company's fundamental performance, its stock price doesn't really enter into the equation. In the context of fundamental analysis, performance refers to the efficiency with which a company moves toward its goals.

Analyze Like a Pro

One of the big ideas behind fundamental analysis is that you're buying the stock to get the financial benefits of owning a prosperous company (see equity), not for the quick and dirty capital gains sought by daytraders.

Fundamental Analysis of Stocks

By definition, fundamental analysis is a form of stock analysis that relies on key business metrics, such as earnings, revenue, and cash flow. The aim is to calculate the “fair value” of a company and its shares. To determine this, investment professionals examine numerous stock indicators as part of the analysis.

Fundamental Analysis vs Technical Analysis

The philosophy behind fundamental price analysis is that only long-term healthy companies can also offer price increases and high dividends. Although companies may be overvalued in the short term, in the long term, the share price cannot deviate from the “true” value of the company. It tries to determine this “true value.”

Fundamental Analysis Tools

Fundamental analysts never rely on just one or a few metrics. You will analyze management and corporate strategy, innovative strength, and competitive position in different markets. A comprehensive analysis of the financial statements provides information about the company’s profitability and financial health.

How to do Fundamental Analysis of Stocks

Fundamental analysis is based on existing data and information generated by the company and its environment. Not only actual and historical data are considered. The analysis also takes into account forecasts. This is because future expectations largely determine the value of a share. The following analysis fields play a role:

Examples of Fundamental Analysis

The P/E ratio is one of the most widely used metrics in stock trading.

Fundamental Analysis of Stocks Books

Two of the best books on fundamental analysis of stocks are; Fundamental Analysis For Dummies by Matt Krantz and Warren Buffett’s Accounting Book: Reading Financial Statements for Value Investing.

Lastly

Which key figures are best used to evaluate shares also depends on the stock market phase. In principle, there are two valuation approaches. If the stock market behaved rationally, then everything would be quite simple; You would buy the undervalued stocks and sell those that are overvalued.

Price-to-Earnings Growth (PEG) Ratio

Because the P/E ratio isn't enough in and of itself, many investors use the price to earnings growth (PEG) ratio. Instead of merely looking at the price and earnings, the PEG ratio incorporates the historical growth rate of the company's earnings. This ratio also tells you how company A's stock stacks up against company B's stock.

Dividend Yield

It's always nice to have a back-up when a stock's growth falters. This is why dividend-paying stocks are attractive to many investors—even when prices drop, you get a paycheck. The dividend yield shows how much of a payday you're getting for your money. By dividing the stock's annual dividend by the stock's price, you get a percentage.

The Bottom Line

The P/E ratio, P/B ratio, PEG ratio, and dividend yields are too narrowly focused to stand alone as a single measure of a stock. By combining these methods of valuation, you can get a better view of a stock's worth. Any one of these can be influenced by creative accounting—as can more complex ratios like cash flow.