Accounting for Stock Purchase Warrants

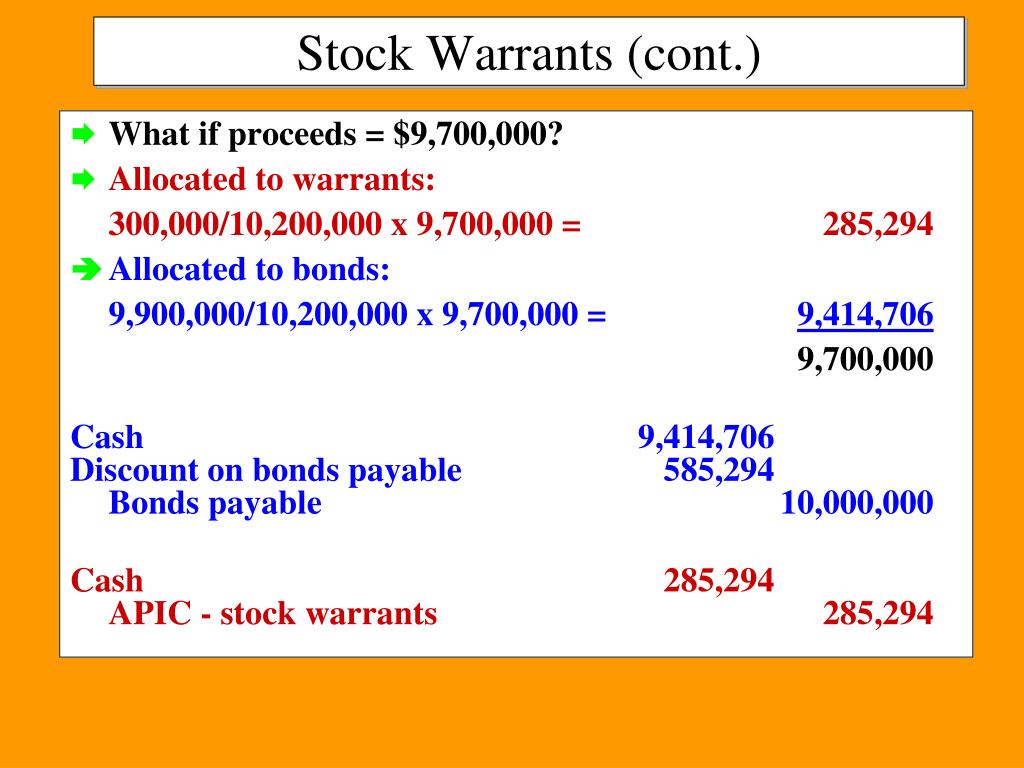

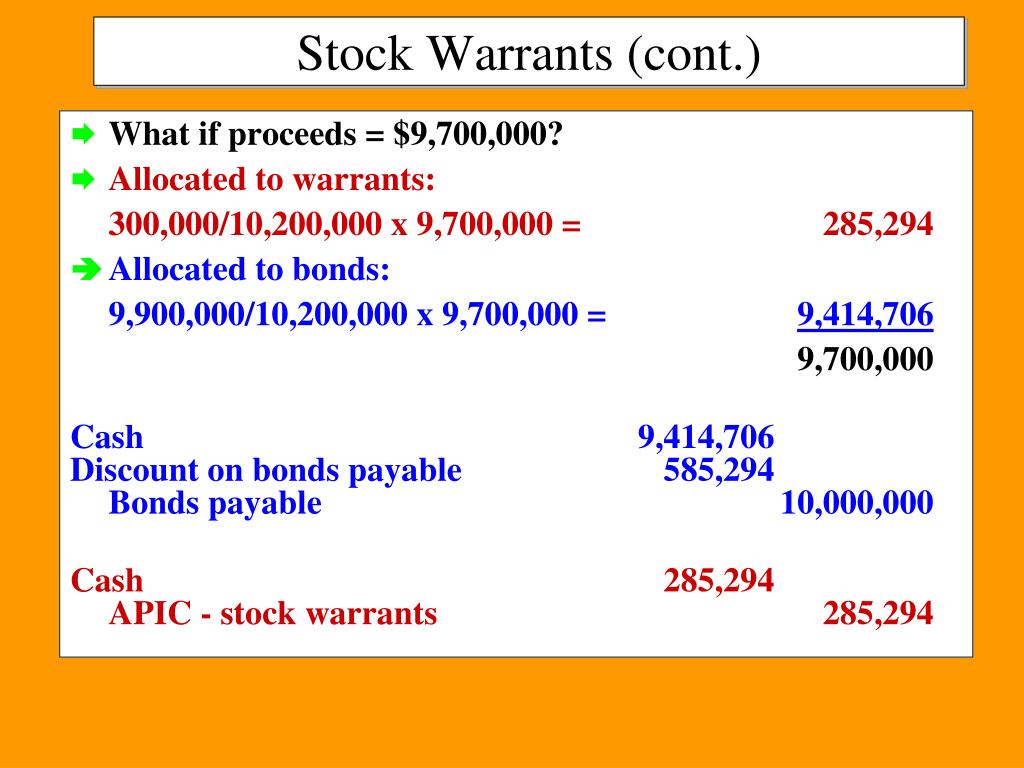

- Market Values. To account separately for stock purchase warrants, a market value must be established for both the stock purchase warrant and the debt security with which it is issued.

- Issuance Entry. The market value of the stock purchase warrant and the security are summed up and a percent of the total is calculated for each.

- Warrant Exercise Entry. When the stock purchase warrant is exercised, the holder purchases shares of stock at the price specified on the warrant.

- Financial Reporting. When the debt security and stock purchase warrant are sold to an investor, only balance sheet accounts are affected.

How to calculate the value of stock warrants?

Reviews

- 4.5 / 5 (15 votes) 67% 27% - - 7% Rate this Downloadable Best Practice Write a review

- Balakrishna Gopinath (last updated: 28/06/2021 05:48)

- Arif Arafat Zahari (last updated: 15/09/2020 10:05)

- Samantha (wenhua) Lee (last updated: 07/09/2020 02:50)

- Fouad Zein (last updated: 05/06/2020 21:26)

How to sell shares without a trading account?

How To Transfer Shares From One Demat Account To Another?

- Note that the shares need to be transferred along with their ISIN number. The ISIN is a 12-digit code required to identify various securities.

- The Target Client ID has to be recorded.

- Select the mode of transfer i.e. ...

How can I check my stock accounts?

To start an online transfer, you'll need:

- A statement from your current firm to reference

- Your current firm's name and account details

- Additional ownership information, if multiple account owners

- Details on individual investments you're transferring

How to account for buyback of shares?

The accounting is:

- Repurchase. To record a repurchase, simply record the entire amount of the purchase in the treasury stock account.

- Resale. If the treasury stock is resold at a later date, offset the sale price against the treasury stock account, and credit any sales exceeding the repurchase cost to the ...

- Retirement. ...

What are the rules for paying a stock warrant?

When does a grantor recognize warrants?

What are the additional conditions for an option expiration?

How long does an armadillo warrant last?

Is forfeiture of warrant instrument a disincentive?

Does Armadillo issue warrants?

See more

About this website

What is the journal entry for warrants?

What are the journal entries for the issuance of warrants? The exercise of a warrant results in one entry, which credits cash and debits the warrant's account.

How are stock warrants reported on the balance sheet?

Because a warrant holder can receive issuer shares, the issuer usually classifies warrants as equity instruments and carries their value in the warrants paid-in capital account in the stockholders' equity section of the balance sheet. Companies large and small can use warrants to raise capital.

Are warrants recorded on the balance sheet?

In accordance with the accounting guidance, the outstanding warrants are recognized as a warrant liability on the balance sheet and are measured at their inception date fair value and subsequently re-measured at each reporting period with changes being recorded as a component of other income in the statement of ...

Are stock warrants debt or equity?

Warrants are a derivative that give the right, but not the obligation, to buy or sell a security—most commonly an equity—at a certain price before expiration.

What is warrant liability on balance sheet?

Warrant Liability means, as of any day, the aggregate stated balance sheet fair value of all outstanding warrants exercisable for redeemable convertible preferred shares of Holdings determined in accordance with GAAP.

Why are warrants considered liabilities?

According to ASC 480-10-25-8 and ASC 480-10-25-14, a warrant is classified as a liability if the warrant obligates the issuer to repurchase its shares by transferring an asset.

Are warrants current liabilities?

Accordingly, the Company classified the warrants as current liabilities. The warrants are subject to remeasurement at each balance sheet date, with any change in fair value recognized as a component of other income (expense), net in the statements of operations.

What is warrant in accounting?

In financial transactions, a warrant is a written order by one person that instructs or authorises another person to pay a specified recipient a specific amount of money or supply goods at a specific date.

Are share warrants liabilities?

Although warrants typically don't require cash payments, they may be classified as liabilities.

Are warrants taxable?

Warrants issued for services are taxed, just like compensatory stock options. If you receive a compensatory warrant, you are not taxed on the receipt of the warrant as long as the warrant is priced at fair market value. When you exercise, however, any spread is taxable as ordinary income.

Is a warrant an asset?

A warrant is a securitized option. In other words, an option on an asset in the form of a security that has an official listing, and it is traded in an organized market. Its price is therefore set transparently.

Do warrants accrue interest?

A bond that has warrants attached to it usually pays out less interest than one without. This is a trade-off because the bondholder has the potential to earn more of a return if the stock price goes up while the warrant is valid. Investors pay a fee to purchase a warrant, which is collected by the company as capital.

A Complete Guide to Accounting for Warrants - Welp Magazine

Because a warrant holder can receive issuer shares, the issuer usually classifies warrants as equity instruments and carries their value in the warrants paid-in capital account in the stockholders' equity section of the balance sheet. Companies large and small can use warrants to raise capital. Warrants as Equity If the warrants are classified as liabilities,

Basics of stock warrant accounting - Simplestudies.com

When a warrant holder redeems the instrument, the holder receives stock in exchange for the warrant and the specified cash price. At redemption, the company records a debit to cash and the warrant’s additional paid-in capital.

IAS 32 — Accounting for warrants that are initially classified as ...

Date recorded: 16 Mar 2021 Background. The Committee received a submission describing a fact pattern in which an entity issues a warrant that gives the holder the right to buy the entity’s own equity instruments at a price that will be fixed at a future.

How to Calculate the Value of Stock Warrants | The Motley Fool

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium ...

ACCOUNTING FOR SHARE PURCHASE WARRANTS ISSUED VIEWPOINTS

FEBRUARY 2014 5 APPLYING IFRSs IN THE MINING INDUSTRY ACCOUNTING FOR SHARE PURCHASE WARRANTS ISSUED MEASUREMENT OF WARRANTS The measurement or valuation of a warrant, which is analogous to a call option issued by a company, is frequently

Accounting for Stock Warrants

Companies may use stock warrants in one of two ways. Firstly, they can issue stock warrants on their own to investors that are willing to invest in them. On the other hand, companies may also pay suppliers in stock warrants in exchange for the goods or services they provide.

Accounting Treatment under IAS 32 and IFRS 9

The accounting treatment for share warrants under financial instrument standards requires companies to determine whether these have characteristics of financial liability or equity. Even though share warrants result in equity settlements, they may have characteristics of financial liability. The treatment for both scenarios will differ.

Accounting Treatment under IFRS 2

When it comes to accounting for stock warrants under IFRS 2, the company issuing them must ensure two things. First, the company must recognize the fair value of the equity instrument issued or the fair value of the consideration received, based on whichever is reliably measurable.

Example

A company, Red Co., obtains services from another company, Blue Co. The value of the services obtained is $100,000. Instead of paying Blue Co. by cash, Red Co. issues stock warrants for the services. Since Red Co. issued the stock warrants in exchange for services, the IFRS 2 treatment for stock warrants will apply.

Valuation of Stock Warrants

A warrant can be valued using the binomial tree approach. Dilution needs to be taken into consideration. Basically, the valuation proceeds as follows,

Conclusion

A stock warrant gives investors the right to purchase newly issued shares of a company at a set price within a set period of time. The accounting treatment of stock warrants requires the company to determine the fair value of the stock warrant at the date of measurement.

What is a Warrant?

A warrant is a financial instrument issued by companies in exchange for an expense or payment. These instruments involve the right to buy or sell a security in the future. Usually, the underlying security is an equity instrument, which can be a company’s common stock. Warrants do not carry an obligation, though.

How does a Warrant work?

A warrant is an instrument that acts similar to options in many aspects. Companies may have several reasons why they will provide these instruments. For example, a company may issue a warrant to attract more investments for an offered stock or bond. This way, they can obtain better terms on the underlying security.

What is the Accounting for Issuance of Warrants?

As mentioned above, accounting for warrants involves two steps. The first is when a company issues these instruments to investors. For this process, the company creates an equity instrument in its accounts. Accounting standards require companies to measure this transaction at the fair value of the equity instrument issued.

What are the journal entries for the Issuance of Warrants?

The journal entries for the issuance of warrants are straightforward. As mentioned, it requires the company to recognize warrants in its accounts in exchange for compensation. The value for this transaction will depend on the fair value of that compensation or the fair value of the equity instruments.

Example

A company, ABC Co., issues stock warrants to investors. The compensation received in exchange for these warrants is $10,000. Similarly, these warrants allow the investor to purchase ABC Co.’s shares in the future for a reduced price. Regardless of the exercise options, the journal entries for the issuance of warrants will be as follows.

Conclusion

Warrants are financial instruments that come with the option to buy or sell securities at a fixed price in the future. These instruments come with an expiration date, which dictates the time until which holders can exercise them. Usually, accounting for the issuance of warrants is straightforward.

What happens to stock warrants?

The company share price will fluctuate from day to day. Stock warrants are often attached to bond sales. They act as a sort of bonus for tentative investors. If the stock price rises above the exercise price, the bondholder is in luck. They can sell the warrant at a profit.

What is stock warrant?

Stock warrants let you give a “heads-up” when you intend to exercise your warrants. The company must issue new shares to honor your right to buy them. This creates some share dilution.

How long do you have to exercise a warrant to buy stock?

That price is the “strike price.”. And there’s no obligation to buy them — only the option. The choice is yours. Typically, you have up to 15 years to exercise (use) your right to purchase the shares.

Why do you need a warrant to buy stock?

Warrants allow you to potentially buy more shares with less money. And they’re often cheaper than a company’s common stock. This can help minimize risk. And if you have a small account, you can trade shares you otherwise might not be able to afford.

What happens if you don't exercise warrants?

But if you don’t exercise your warrants by their expiration date, they’ll be worthless. You lose your original investment. Of course, if the stock price drops below your strike price, this could be the best deal for you. You don’t have to buy the shares on top of the warrants.

Why do companies give stock warrants?

Sometimes companies offer stock warrants as a benefit to employees. This can keep current workers happy and attract new talent to the team. Companies tend to put restrictions on when these warrants can be exercised. So an employee might have to stick it out a few years before realizing the benefit.

What is the difference between stock options and warrants?

The company also has the power to issue new shares through warrants. This is a common way for companies to raise funds. Stock options are not direct securities.

What is warrants used for?

A company can use warrants for equity issuance. For example, a company can issue $1 million of stock using warrants with a value of $1 million. Sometimes the company can issue shares at a very large premium, sometimes up to 50 percent, to compensate the warrant holders. The issuer can also issue warrants that are cash settled based on ...

Where are warrants paid in capital?

Because a warrant holder can receive issuer shares, the issuer usually classifies warrants as equity instruments and carries their value in the warrants paid-in capital account in the stockholders’ equity section of the balance sheet. Companies large and small can use warrants to raise capital.

What happens if a $1 million bond is traded?

If the bond is currently trading at $1 million, the issuer would record the contingent liability for the $1 million bond at $1 million. If the proceeds were used to pay a dividend, though, the issuer would use the fact of the dividend to raise the value of the bond. This would make the contingent liability worth less.

What happens if the issuer reports a transaction as a liability?

If the issuer reports the transaction as a liability, the creditor has already made a pretax profit. The issuer can then use the gain as debt issuance costs or can use the gain to lower the effective cost of borrowing. For example, assume the issuer is selling a bond with a coupon rate of 10 percent. If the issuer issues warrants, it will recognize ...

What does it mean when a bond issuer collects more than the cost of the bond?

This means the issuer collected more than the cost of the bonds. It also means the issuer has a pretax gain on the transaction. Part of the gain, however, will offset or erase the gain by lowering the effective cost of borrowing. For example, assume the issuer’s cost of borrowing is 8 percent.

Can issuers find the price of a warrant?

Some Refinements. Issuers may not always be able to find the price of the bond, especially overseas. They may try to estimate the price of the bond using the information they have available. The other option is to follow the contingent liability method to value the warrants.

Does it matter if a bond is $1 million?

It doesn’t matter if the fair value of the bond is $1 million or $2 million, the $1 million remainder is still the fair value of the bond. A company can also record the contingent liability for a known bond because it is reasonable to assume a debt issuance.

Stock Warrants Journal Entry

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. The journal entry is debiting cash and credit warrant outstanding. It is the equity component on the balance sheet.

Stock Warrants Journal Entry Example

Company ABC sells 100,000 stock warrants to investors at $ 5 per warrant. The warrant allows the investors to purchase the share at $ 20 per share while the market price is $ 25 per share. The par value of a share is $ 1 per share. As the result, all investors exercise their right and purchase the share.

What is a stock warrant?

A stock warrant is a small document that can be separated from the bond itself and separately traded or used. It acts like a stock option, giving the holder the right to purchase common stock for a specified price.

What happens if warrants are not used?

If the warrants are not used before the expiration date, the balance in the additional paid-in capital account set aside for the warrants is shifted to the additional paid-in capital account related to common stock.

What is warrant redemption?

Stock warrant redemption. When a warrant holder redeems the instrument, the holder receives stock in exchange for the warrant and the specified cash price. At redemption, the company records a debit to cash and the warrant’s additional paid-in capital. At the same time, it records a credit to common stock for the par value ...

Is a warrant redeemable for a specified period of time?

4. Warrant expiration. Generally, warrants are only redeemable for a specified period of time.

Do warrants have a fair value?

Sometimes, only the warrants have a known fair value. If this is the case, that amount is allocated to the warrants, and the rest of the price is allocated to the bond. Other times, the fair value of the bond is also known, in which case the amounts recorded are based on the proportion of the known values.

What is a stock warrant?

A stock warrant gives holders the option to buy company stock at the exercise price until the expiration date and receive newly issued stock from the company.10 min read. 1.

Why invest in warrants?

The main reason to invest in stock warrants is leverage. When the price of the underlying security rises, the percentage increase in the value of the warrant is greater than the percentage increase in the value of the underlying security.

What is strike price?

First, understand some basic terminology: The strike price, also called the exercise price, is the price the warrant holder pays for the underlying stock when exercising the warrant. When the warrant is issued, the strike price is higher than the market price of the underlying security at the time.

How are warrants and options similar?

Although warrants and options are similar, there are some important differences: When option holders exercise an option, the holder either sells or buys shares to or from an investor in the stock market. With a warrant, the holder sells or buys directly to or from the issuing company, not the investor.

How do warrants work?

They are a method of determining how much exposure the holder has to the underlying shares by using the warrant to gauge the exposure, rather than the stocks or shares themselves . The conversion ratio is the number of warrants that are needed to buy or sell one stock.

How many warrants do you need to buy one share?

For example, if the conversion ratio to buy a stock is 5:1, this means the holder needs 5 warrants to purchase one share. Warrants have an expiration date, when the right to exercise no longer exists. Warrants differ depending on which country you are in. For example, an American style warrant enables the holder to exercise at any time before ...

What are the advantages of warrants?

There are many advantages to purchasing a warrant. The first benefit is that warrant prices are lower. In contrast, the leverage and possible gains they offer is larger, often making it a good return on investment.

What are the rules for paying a stock warrant?

The two main rules to account for stock warrants are that the issuer must: Recognize the fair value of the equity instruments issued or the fair value of the consideration received, whichever can be more reliably measured; and. Recognize the asset or expense related to ...

When does a grantor recognize warrants?

The grantor usually recognizes warrants as of a measurement date. The measurement date is the earlier of: The date when the grantee’s performance is complete; or. The date when the grantee’s commitment to complete is probable, given the presence of large disincentives related to nonperformance.

What are the additional conditions for an option expiration?

The following additional conditions apply to more specific circumstances: Option expiration. If the grantor recognizes an asset or expense based on its issuance of warrants to a grantee, and the grantee does not exercise the warrants, do not reverse the asset or expense. Equity recipient.

How long does an armadillo warrant last?

In another arrangement, Armadillo issues warrants that vest in five years. The option agreement contains a provision that the vesting period will be reduced to six months if a project on which the grantee is working is accepted by an Armadillo client by a certain date.

Is forfeiture of warrant instrument a disincentive?

Note that forfeiture of the warrant instrument is not considered a sufficient disincentive to trigger this clause. If the grantor issues a fully vested, nonforfeitable warrant that can be exercised early if a performance target is reached, the grantor measures the fair value of the instrument at the date of grant.

Does Armadillo issue warrants?

Armadillo Industries issues fully vested warrants to a grantee. The option agreement contains a provision that the exercise price will be reduced if a project on which the grantee is working is completed to the satisfaction of Armadillo management by a certain date.