Stock markets affect the economy in three critical ways:

- They allow small investors to invest in the economy.

- They help savers beat inflation.

- They help businesses fund growth.

What impact does the stock market have on the economy?

The stock market and economy relationship can be broadly characterized by investment fueling economic growth, the enabling of company ownership that increases personal wealth, and equities providing a measure of economic health. We’ll explore these three factors below. 1. Stock Market Investment can Spark Economic Growth

What are the factors affecting the stock market?

In summary, the key fundamental factors are:

- The level of the earnings base (represented by measures such as EPS, cash flow per share , dividends per share)

- The expected growth in the earnings base

- The discount rate, which is itself a function of inflation

- The perceived risk of the stock

What is the relationship between stock market and economy?

There has never been a consistent relationship between the stock market and the economy. While the two tend to loosely move in the same direction, they often act in widely different ways – particularly over shorter time periods. There are several reasons for this divergent relationship.

How does the GDP affect the stock prices?

There are three common ways of measuring GDP, each method should result in the same figure:

- Adding the total value of all goods and services produced in the economy;

- Adding all income earned by individuals and organisations in the economy;

- Adding all expenditure - consumption, investment, government expenditure and net exports

What would happen if the stock market fell?

A substantial and prolonged fall in the stock market could lead to a fall in the value of their pension fund, and it could lead to lower pension payouts when they retire. Similarly, if the stock market does well, the value of pension funds could increase.

How does wealth affect people?

Wealth effect. The first impact is that people with shares will see a fall in their wealth. If the fall is significant, it will affect their financial outlook. If they are losing money on shares they will be more hesitant to spend money; this can contribute to a fall in consumer spending.

What happens if pensions fall too much?

This means that future pension payouts will be lower. If share prices fall too much, pension funds can struggle to meet their promises. The important thing is the long-term movements in the share prices. If share prices fall for a long time, then it will definitely affect pension funds and future payouts.

Why are shares falling in 2020?

The fall in share prices since the start of the year primarily reflect concern and uncertainty over the global spread of Coronavirus. Share prices have fallen 15% and could fall further. There are good reasons to believe these share price falls do reflect a real economic shock and could be the precursor to a recession in 2020. The share price falls reflect – not market adjustment – but an awareness of disruption of supply chains, a disruption to the free movement of people and goods, and a shock to aggregate demand as consumers and business cut back on consumption and investment.

What does the fall in share price reflect?

The share price falls reflect – not market adjustment – but an awareness of disruption of supply chains, a disruption to the free movement of people and goods, and a shock to aggregate demand as consumers and business cut back on consumption and investment.

Is the stock market a source of private finance?

The stock market could be a source of business investment, e.g. firms offering new shares to finance investment. This could lead to more jobs and growth. The stock market can be a source of private finance when bank finance is limited.

Was the stock market a real economy?

Yet, daily movements in the stock market can also have less impact on the economy than we might imagine. The stock market is not the real economy.

How does the stock market affect the economy?

Three ways the stock market impacts the economy. The stock market and economy relationship can be broadly characterized by investment fueling economic growth, the enabling of company ownership that increases personal wealth, and equities providing a measure of economic health . We’ll explore these three factors below.

How does investing in the stock market help the economy?

Stock Market Investment can Spark Economic Growth. The money that investors put into companies allows enterprises to invest in growth. When a business starts out, it may have to bootstrap, or survive on little capital.

Why is the stock market important?

The stock market is important for a variety of reasons. It enables traders and investors the opportunity to profit from its moves and generate personal wealth, can provide a benchmark of a country’s commercial and industrial health, and gives businesses an opportunity to scale and prosper, benefiting the wider economy.

Why is company ownership important?

Company Ownership can Enable Impressive Returns. While representing a risk to capital, investing in stocks and major stock indices is a potential way for individual investors – not just venture capitalists – to take an ownership in successful enterprises and accumulate wealth.

What happens to stock market after a downturn?

A stock market crash can devastate the economy. When a downturn in the business cycle happens, significant amounts of value can be erased from share prices. In turn, this means lower returns and dividends for individual investors, a smaller market capitalization for businesses, less wealth for pension funds, and less funding for companies in ...

Is the stock market a reliable barometer?

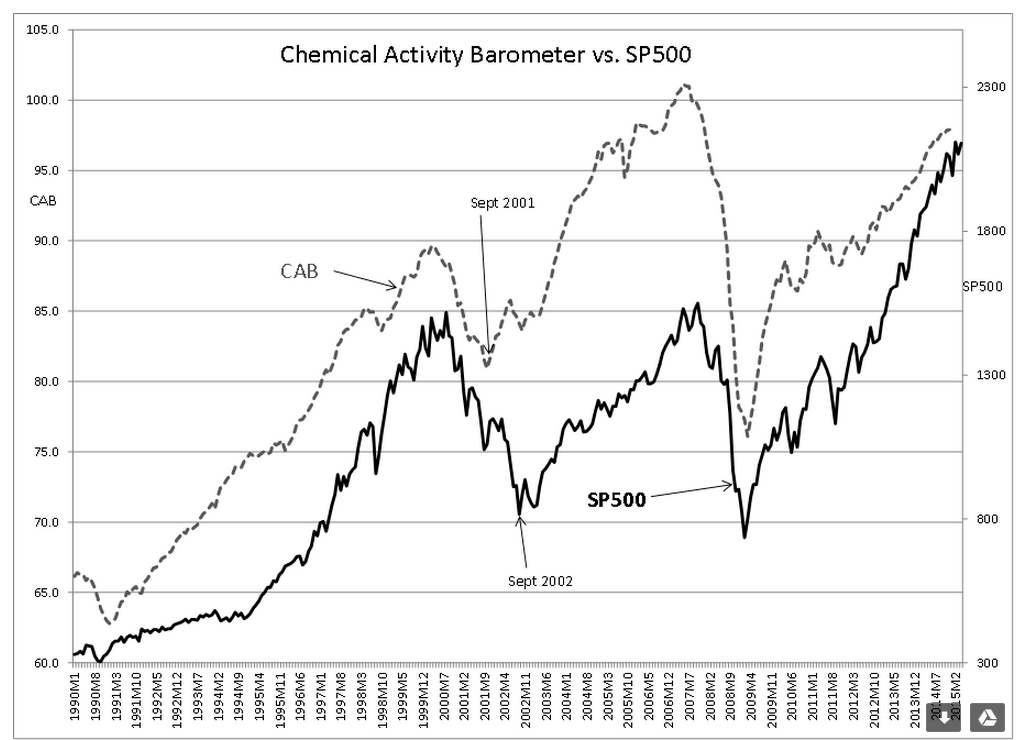

The stock market can often be viewed as a reliable economic barometer. It reveals how major companies are doing and in turn gives insight into the drivers of economic health, such as consumer spending. Rising stock prices can mean higher business and consumer confidence; falling stocks naturally the opposite.

Can a stock market crash cause a thriving economy?

Similarly, a bull run in stocks doesn’t necessarily mean a thriving economy.

How does the stock market affect the economy?

How the Stock Market affects the Economy? The increase and decrease in stock prices can influence numerous factors in the economy such as consumer and business confidence which can, in turn, have a positive or negative impact on the economy as a whole. Alternatively, different economic conditions can affect the stock market as well.

What is the effect of the movement of the stock market?

The movements in the individual prices of stocks give the stock market a volatile character. As stock prices move up or down, their volatility can have a positive or negative impact on consumers and businesses.

How are the stock market and the economy different?

The major reason for this discrepancy is the difference in the size of the two markets. The economy depends on millions of factors that can have both a positive and negative impact, while the stock market is only affected by one factor, the supply and demand of stocks.

Why is the GDP of an economy and the stock market incompatible?

The major reason for this discrepancy is the difference in the size of the two markets. The economy depends on millions of factors that can have both a positive and negative impact, while the stock market is only affected by ...

What is the difference between a stock and a stock market?

A stock is a type of security that represents an individual’s ownership in a company and a stock market is a place where an investor can buy and sell ownership of such assets.

What happens when stock prices rise?

When stock prices rise and there is a bull market, people are more confident in the market conditions, and their investment increases. They tend to spend more on expensive items such as houses and cars.

What happens when stocks are in a bull market?

In the event of a bull market or a rise in the prices of stocks, the overall confidence in the economy increases. People’s spending also increases as they become more optimistic about the market. More investors also enter the market and this feeds into greater economic development in the nation. When the prices of stock fall for a continuously ...

What is the relationship between the stock market and the economy?

The Relationship of The Stock Market And Our Economy. 2020 has been a remarkable year that continues to surprise us. On the one hand, the stock market records and its apparent recovery have been unusually swift. However, the economy has been in and remains in dismal shape. This downturn occurred due to the coronavirus, ...

What are the factors that affect stock prices?

1. The Economy. Investors look at how economic growth drives demand for the company’s products and services: the more substantial the need, the stronger the company’s revenue, cash flows, and potential valuation.

What industries were affected by the lockdown?

Specific industries and their stocks–airlines, automotive, energy hotels, brick & mortar retail, restaurants-swift ly bore the brunt of the market decline due to the coronavirus impact. On the other hand, other industries benefited from the stay-at-home lockdown measures. Those were online businesses, notably leaders in e-commerce, telemedicine, video conferencing providers, and those with potential vaccines or testing equipment. Many investors made changes to their portfolios. They sold specific stocks they anticipated would be most hurt by the lockdown, rotating into the newer winners. I made some of those changes to my portfolio. Additionally, as the market seemed riskier, I bought more dividend-bearing stocks of companies with strong balance sheets.

Why do stocks move?

Stocks move on news that conveys information related to the economy. Generally, the relationship between the stock market and our economy often converge and depart from each other. Gross domestic product, unemployment, inflation, and many other indicators reflect economic conditions.

What do you look for when buying a stock?

Investors look at specific expectations for growth in revenues, cash flow and earnings, balance sheet strength (e.g. liquidity and debt ratios), and corresponding valuation.

What does it mean when the stock market is rising?

A rising stock market may indicate favorable economic conditions for firms, resulting in higher profitability. On the other hand, a declining stock market may signal an economic downturn. Over the long term, these trends are likely to show the economy and stocks in tandem.

What is a bull market?

Generally, a bull market occurs when there is a rise of 20% or more in a broad market index over at least two months. Investopedia defines a bull market as when stock prices rise by 20% after two declines of 20% each. Let’s leave aside the bull market definitions. We have been facing a time of extremes with the coronavirus’s impact on our markets, ...

Why Does the US Economy Affect Stock Market Around the World?

For years, investors in most countries have looked to the United States for guidance.

Is the Stock Market Heading for Another Crash?

These past few weeks have been turbulent and stressful. Stock markets around the world have seen sharp declines. Amidst all the anxiety, we are all looking for an answer to the big question — have we hit rock-bottom yet?

A Way You Can Sail Through This Economic Crisis

The markets are in trouble, but you still need to know how to generate passive income in an crisis.

How does the stock market work?

The stock market works the economy in several ways, beyond acting as a symbiotic indicator. Stock purchases allow an individual investor to own part of a company. Thanks to the invention of stock markets, it’s not just the large private equity investors and institutions that can profit from the free-market economy. Investing in the stock market can also help investors beat inflation over time. Remember that over time the market has historically returned about 10 percent to its investors—that’s way more than parking it in a savings account. Though that is a good idea as well for emergencies and short-term goals. (And, of course, past performance does not necessarily guarantee future results.)

What happens when the GDP turns negative?

Everything the U.S. economy produces is measured by gross domestic product, or GDP. When the GDP’s growth rate turns negative, the economy enters a recession. When that recession lasts for several quarters it can be deemed an official depression, which happens by a secret committee.

What to invest in during a down market?

Blue-chip stocks are one. Blue-chip stocks are the big names that you know that are not likely to go anywhere soon. These stocks all have a few things in common: strong cash flows and sound financials. They’re stocks that you can own and sleep well at night regardless of the market’s ups and down s. Be aware that blue-chips generally sacrifice some growth potential in exchange for greater predictability and dividend income, but that’s what many people look for in a down market.

Why Do We Have A Stock Market?

How The Stock Market Affect The Economy?

- The increase and decrease in stock prices can influence numerous factors in the economy such as consumer and business confidence which can, in turn, have a positive or negative impact on the economy as a whole. Alternatively, different economic conditions can affect the stock market as well. Here are a few ways the stock market can affect the econo...

Other Factors

- The stock market also affects the bond market and pension funds. A large part of pension funds are invested in the stock market and a decrease in the price of shares will lower the value of the fund and affect future pension payments. This can lower economic growth as people who depend on pension income will tend to save more and this lowers spending and eventually the GDP. Whi…

Final Thoughts: Stock Market and Economy Are Not The Same

- Contrary to popular belief, the stock market and the economy are two different things. The GDP of an economy and the stock market gains are incompatible and, in fact, there is little comparison between the two. The major reason for this discrepancy is the difference in the size of the two markets. The economy depends on millions of factors that can have both a positive and negativ…