Economic effects of the stock market

- Wealth effect. The first impact is that people with shares will see a fall in their wealth. If the fall is...

- Effect on pensions. Anybody with a private pension or investment trust will be affected by the stock market, at least...

- Confidence. Often share price movements are reflections of what is happening in the economy. E.g.

What impact does the stock market have on the economy?

The stock market and economy relationship can be broadly characterized by investment fueling economic growth, the enabling of company ownership that increases personal wealth, and equities providing a measure of economic health. We’ll explore these three factors below. 1. Stock Market Investment can Spark Economic Growth

What are the factors affecting the stock market?

In summary, the key fundamental factors are:

- The level of the earnings base (represented by measures such as EPS, cash flow per share , dividends per share)

- The expected growth in the earnings base

- The discount rate, which is itself a function of inflation

- The perceived risk of the stock

What is the relationship between stock market and economy?

There has never been a consistent relationship between the stock market and the economy. While the two tend to loosely move in the same direction, they often act in widely different ways – particularly over shorter time periods. There are several reasons for this divergent relationship.

How does the GDP affect the stock prices?

There are three common ways of measuring GDP, each method should result in the same figure:

- Adding the total value of all goods and services produced in the economy;

- Adding all income earned by individuals and organisations in the economy;

- Adding all expenditure - consumption, investment, government expenditure and net exports

What is the relationship between stock market and economy?

The stock market is where investors can buy and sell shares of publicly traded companies. The economy represents how money is being made and spent by a country's citizens, companies, and governments. Economic growth is typically measured by gross domestic product (GDP).

Why are stock markets important for the economy?

It helps individuals earn a profit on their income when they invest in the stock market and allows firms to spread their risks and receive large rewards. It also enables the government to increase spending through the tax revenue they earn from corporations that trade on the stock exchange.

Does stock market reflect economy?

The stock market is often a sentiment indicator and can impact gross domestic product (GDP). GDP measures the output of all goods and services in an economy. As the stock market rises and falls, so too, does sentiment in the economy.

Is stock market a good indicator of economic growth?

The stock market has traditionally been viewed as an indicator or "predictor" of the economy. Many believe that large decreases in stock prices are reflective of a future recession, whereas large increases in stock prices suggest future economic growth.

How does the stock market benefit society?

The prices determined by trading in the stock market serve as signals that help allocate society's scarce savings to the most promising new investment projects and help discipline managers to make the best use of the productive capacity already under their control.

Why do people invest in the stock market?

The rule of thumb is that stock prices increase 7% a year on average after taking inflation into account. 1 That's enough to compensate most investors for the additional risk of owning stocks rather than bonds (or keeping the money in a savings account).

How much do stocks increase in a year?

The rule of thumb is that stock prices increase 7% a year on average after taking inflation into account. 1 That's enough to compensate most investors for the additional risk of owning stocks rather than bonds (or keeping the money in a savings account).

What makes the stock market attractive?

What Makes the U.S. Stock Market Attractive. U.S. financial markets are very sophisticated and make it easier to take a company public than in other countries. Information on companies is also easy to obtain. That raises the trust of investors from around the world.

What happens if you don't invest in the stock market?

Even if you don't invest, the stock market's health affects you. Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

Why do we need stock market?

Stocks allow the individual investor to own part of a successful company. Without stock markets, only large private equity investors and financial institutions could profit from America's free market economy.

What does lower stock prices mean?

Lower stock prices mean less wealth for businesses, pension funds, and individual investors. Companies can't get as much funding for operations and expansion. When retirement fund values fall, it reduces consumer spending.

What is the drawback of IPO?

The drawback is that the founders no longer own the company; the stockholders do. Founders can retain a controlling interest in the company if they own 51% of the shares. Stocks indicate how valuable investors think a company is.

How does a stock market crash affect the economy?

When a downturn in the business cycle happens, significant amounts of value can be erased from share prices. In turn, this means lower returns and dividends for individual investors, a smaller market capitalization for businesses, less wealth for pension funds, and less funding for companies in the near future.

What is DailyFX?

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Why do people invest in stocks?

While representing a risk to capital, investing in stocks and major stock indices is a potential way for individual investors – not just venture capitalists – to take an ownership in successful enterprises and accumulate wealth. This capital can then be reinvested or spent, impacting the economy. Stocks have historically proven the best way to beat inflation in the long term, with some indices showing triple digit returns since the beginning of the century.

Why is the stock market important?

The stock market is important for a variety of reasons. It enables traders and investors the opportunity to profit from its moves and generate personal wealth, can provide a benchmark of a country’s commercial and industrial health, and gives businesses an opportunity to scale and prosper, benefiting the wider economy.

How does investing in the stock market help the economy?

Stock Market Investment can Spark Economic Growth. The money that investors put into companies allows enterprises to invest in growth. When a business starts out, it may have to bootstrap, or survive on little capital.

What does rising stock prices mean?

Rising stock prices can mean higher business and consumer confidence; falling stocks naturally the opposite. If an index such as the tech-centric Nasdaq is on a bull run, this might suggest a range of things, for example: investor confidence in demand for electronics, and faith in the financial strength of the tech giants such as Microsoft and Apple that have a larger impact on the index due to market cap weighting.

How much money did Facebook make in 2012?

In 2012, Facebook’s global revenue was already some $5 billion, with around 5,000 employees on the payroll. However, the company’s IPO that year raised in excess of $16 billion, which helped build the company to a market cap of $630 billion by January 2020, with 2018 figures showing some $55 billion in global revenue and more than 40,000 employees ...

How the Stock Market Affect the Economy?

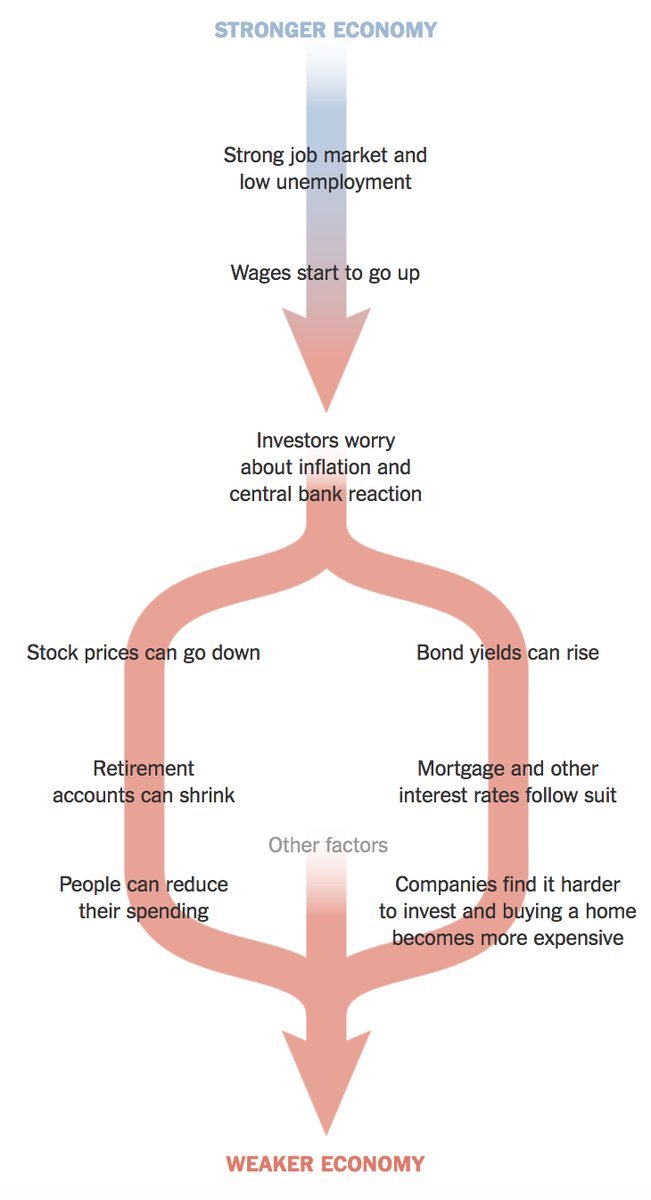

The increase and decrease in stock prices can influence numerous factors in the economy such as consumer and business confidence which can, in turn, have a positive or negative impact on the economy as a whole. Alternatively, different economic conditions can affect the stock market as well.

Why is the GDP of an economy and the stock market incompatible?

The major reason for this discrepancy is the difference in the size of the two markets. The economy depends on millions of factors that can have both a positive and negative impact, while the stock market is only affected by ...

What is the effect of the movement of the stock market?

The movements in the individual prices of stocks give the stock market a volatile character. As stock prices move up or down, their volatility can have a positive or negative impact on consumers and businesses.

What happens when stock prices rise?

When stock prices rise and there is a bull market, people are more confident in the market conditions, and their investment increases. They tend to spend more on expensive items such as houses and cars.

What happens when stocks are in a bull market?

In the event of a bull market or a rise in the prices of stocks, the overall confidence in the economy increases. People’s spending also increases as they become more optimistic about the market. More investors also enter the market and this feeds into greater economic development in the nation. When the prices of stock fall for a continuously ...

How does a decrease in the price of pensions affect the economy?

A large part of pension funds are invested in the stock market and a decrease in the price of shares will lower the value of the fund and affect future pension payments. This can lower economic growth as people who depend on pension income will tend to save more and this lowers spending and eventually the GDP.

What to do when there is a depression in the stock market?

When there is a depression in the stock market, people look for other assets to invest their money in such as bonds or gold. They often provide a better return on investment than shares in the stock market. Remember, it is always important to diversify your investment portfolio and spread your risk.

What happens when stock prices fall?

In contrast, when stock prices fall for a considerable period (known as the bear phase), they mostly affect negatively. Individuals may lose their optimism, with news reports on these price drops creating a sense of panic in the market. As a result, investors losing money are reluctant to spend more or turn to lower-risk assets, leading to a fall in consumer spending.

How do markets get volatile?

The markets get their volatile character from the price fluctuations of individual stocks. As prices increase or decrease, market volatility influences businesses and consumers. During a bull phase, the stock prices go up. More often than not it boosts the economy’s overall confidence. Likewise, consumer spending also rises as individuals become more optimistic regarding the market and buy more goods and services. So, businesses offering these products and services begin to produce and sell more.

What happens when the stock market crashes?

As a result, they can move out of shares and turn to invest in bonds or gold. In fact, these investment instruments are known to offer higher returns during periods of uncertainty.

How does the stock market affect a company?

The Stock Market and Business Operations. The stock market's movements can impact companies in a variety of ways. The rise and fall of share price values affects a company’s market capitalization and therefore its market value. The higher shares are priced, the more a company is worth in market value and vice versa.

What happens when stocks rise?

When stocks rise, people invested in the equity markets gain wealth. This increased wealth often leads to increased consumer spending, as consumers buy more goods and services when they're confident they are in a financial position to do so.

What is the stock market?

Defined as the market in which equity shares of publicly-traded businesses are bought and sold, the stock market measures the aggregate value of all publicly-traded companies. Comprehensively, this can be represented by the Wilshire 5000, but generally, most analysts and investors focus on the S&P 500. Both indexes can be valuable tools for gauging the health of the overall economy, though occasionally stocks may be misleading.

Why do stocks rise?

A rising stock market is usually aligned with a growing economy and leads to greater investor confidence. Investor confidence in stocks leads to more buying activity which can also help to push prices higher. When stocks rise, people invested in the equity markets gain wealth. This increased wealth often leads to increased consumer spending, ...

How does stock performance affect issuance decisions?

Share issuance decisions can also be affected by stock performance. If a stock is doing well, a company might be more inclined to issue more shares because they believe they can raise more capital at the higher value. Stock market performance also affects a company’s cost of capital.

What is the effect of expanding business activity on the stock market?

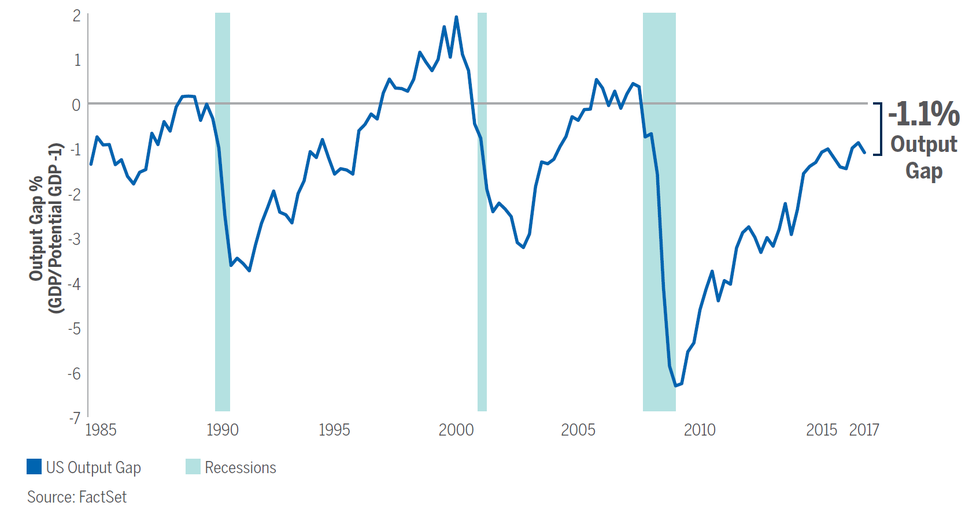

Expanding business activity usually increases valuations and leads to stock market gains. Historically, steep market declines preceded the Great Depression in the 1930s as well as the Great Recession of 2007–2009. However, some market crashes, most famously Black Monday in 1987, were not followed by recessions.

What happens when a company's stock falls?

Companies may also have substantial capital investments in their stock which can lead to problems if the stock falls. For example, companies may hold shares as cash equivalents or use shares as backing for pension funds. In any case, when shares fall, the value decreases, which can lead to funding problems.

Why are stocks mispriced?

Sometimes stock may be mispriced because of the psychology involved in decision-making known as “behavioral finance.” This discipline can offer behavioral/emotional or cognitive biases to explain why markets or stocks are moving in a certain way. Learning about these biases can help us to shift away from these tendencies away and invest more wisely.

Why do we need an emergency fund?

When the markets initially plunged, we suggested that investors not sell stocks in panic unless they needed to do so for liquidity purposes. Having an emergency fund is essential in providing liquidity so that you cover your living expenses during unforeseen events. I think we can agree that the coronavirus was such an event. We pointed to the Great Recession as a recent example of why you should avoid selling stocks at a market bottom.

Why do stocks move?

Stocks move on news that conveys information related to the economy. Generally, the relationship between the stock market and our economy often converge and depart from each other. Gross domestic product, unemployment, inflation, and many other indicators reflect economic conditions.

What does it mean when the stock market is rising?

A rising stock market may indicate favorable economic conditions for firms, resulting in higher profitability. On the other hand, a declining stock market may signal an economic downturn. Over the long term, these trends are likely to show the economy and stocks in tandem.

How was the economic downturn different from previous recessions?

From the start, this economic decline was different from previous recessions. Our economy’s downturn was event-driven by a coronavirus, but that doesn’t make it less devastating. Economic activity ceased as many remained sequestered at home. When unemployment rises, consumers spend less, and businesses suffer. Layoffs and furloughs resulted, mostly if workers could not work remotely. Essential workers were feverishly needed to do jobs despite the threat of the virus. They weren’t shopping either.

What should a company's value reflect?

Typically, a company’s value should reflect the present value of its future cash flows. Investors should consider several factors that affect whether the stock is overvalued or undervalued to calculate future cash flows. There are three key fundamental factors that affect stock prices.

What is a bull market?

Generally, a bull market occurs when there is a rise of 20% or more in a broad market index over at least two months. Investopedia defines a bull market as when stock prices rise by 20% after two declines of 20% each. Let’s leave aside the bull market definitions. We have been facing a time of extremes with the coronavirus’s impact on our markets, ...

Why Do We Have A Stock Market?

How The Stock Market Affect The Economy?

- The increase and decrease in stock prices can influence numerous factors in the economy such as consumer and business confidence which can, in turn, have a positive or negative impact on the economy as a whole. Alternatively, different economic conditions can affect the stock market as well. Here are a few ways the stock market can affect the econo...

Other Factors

- The stock market also affects the bond market and pension funds. A large part of pension funds are invested in the stock market and a decrease in the price of shares will lower the value of the fund and affect future pension payments. This can lower economic growth as people who depend on pension income will tend to save more and this lowers spending and eventually the GDP. While a fall in share prices has a negative impact on the economic …

Final Thoughts: Stock Market and Economy Are Not The Same

- Contrary to popular belief, the stock market and the economy are two different things. The GDP of an economy and the stock market gains are incompatible and, in fact, there is little comparison between the two. The major reason for this discrepancy is the difference in the size of the two markets. The economy depends on millions of factors that can have both a positive and negative impact, while the stock market is only affected by one factor, t…