How many shares of General Electric stock will I get after split?

An investor that had 100 shares of General Electric stock prior to the reverse split would have 13 shares after the split. What guidance has General Electric issued on next quarter's earnings?

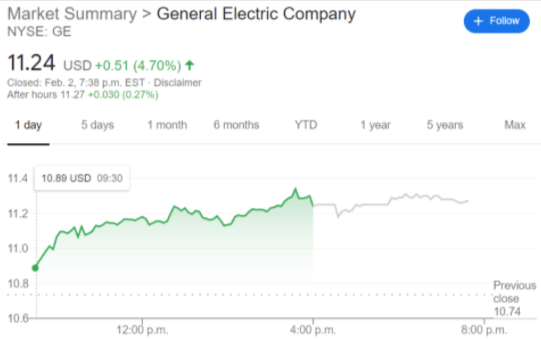

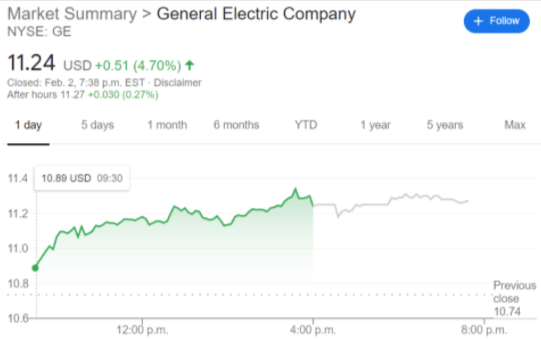

What is the price of GE stock right now?

Since then, GE stock has increased by 52.2% and is now trading at $99.95. View which stocks have been most impacted by COVID-19. When is General Electric's next earnings date?

When did GE split adjusted shares start trading?

The split adjusted shares began trading on August 2, 2021. Loading ... This chart displays the latest GE stock price for today, as well as the stock price history for up to the past five years.

What is the number of shares of common stock in GE?

This reduced the number of outstanding shares of GE common stock from approximately 8.8 billion to approximately 1.1 billion. Outstanding GE equity-based awards and shares or share units under GE benefit plans were proportionately adjusted. No fractional shares were issued in connection with the reverse stock split.

See more

Is GE stock a good buy right now?

The stock is looking like a good value now, but investors should be aware of the near-term risk. 2022 hasn't been a vintage year so farfor industrial giant General Electric (GE -0.20%).

How is GE stock split calculated?

To calculate the number of shares that you will have after the split, multiply the ratio of the stock split by the number of shares you held at the time of the split (1-for-8 ratio means 1 divided by 8 equals 0.125).

Is GE a Buy Sell or Hold?

General Electric has received a consensus rating of Moderate Buy. The company's average rating score is 2.77, and is based on 10 buy ratings, 3 hold ratings, and no sell ratings.

What can I expect from GE stock?

Investors will be hoping for strength from General Electric as it approaches its next earnings release, which is expected to be April 26, 2022. In that report, analysts expect General Electric to post earnings of $0.33 per share. This would mark year-over-year growth of 37.5%.

What happens to GE stock when company splits?

These spin-offs are not totally unlike what happens when a company splits its stock, said Kelly Shue, a finance professor at the Yale School of Management. “Your original stock is now a share in GE aviation, but you also get these special stock dividends,” Shue said. “You're still going to own all three branches.”

Has GE ever had a stock split?

Has GE Ever Split Its Stock? June 8, 1971: a 2-for-1 split of common shares. June 2, 1983: a 2-for-1 split of common shares. May 26, 1987: a 2-for-1 split of common shares.

What is the future for GE?

In power, GE believes it can grow sales at a low single-digit percentage and generate operating profit around 8% to 10%. Operating profit should be about $1.1 billion in 2022, growing to about $1.5 billion in 2023. Both numbers are a little better than Wall Street has been modeling.

Can I sell my GE stock?

If you want to sell your shares of GE stock, please contact GE's current transfer agent, Equiniti Trust Company (EQ). Note that sales are subject to a fee of $10 per transaction plus $0.15 per share sold.

Is GE a good stock to buy 2022?

In all of 2022, analysts forecast GE earnings will jump 68% as sales rebound 2%. But they now expect General Electric to surpass 2019 EPS of $5.20 only in 2024, FactSet says. Out of 22 analysts on Wall Street, 14 rate GE stock a buy. Two have a hold and no one has a sell.

Is GE stock a good long term investment?

General Electric stock performance, data by YCharts. This pullback represents an excellent buying opportunity for long-term investors. Continued turnaround progress, debt reduction, and the upcoming corporate breakup will likely drive strong gains for GE shareholders over the next several years.

How high will GE stock go?

General Electric's shares appear to be poised for a rebound, based on an analysis of the stock's sell-side analyst price targets. The mean consensus target price for GE is $124.71, which is +25% higher than the company's last traded share price of $99.95 as of January 6, 2022.

NYSE: GE

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Let's dig into the details of the conglomerate's major announcement earlier this week

General Electric ( GE 4.14% ) surprised the market earlier this week by announcing its intent to divide itself into three companies. The plan makes sense and should result in a significant release of value for investors, but there's still some risk attached. Here's the lowdown.

Two reasons why the breakup makes sense

First, following the breakup, each of the newly public offspring companies could trade at higher valuation multiples than they would be credited with as parts of the current GE due to what's now called the "conglomerate discount."

Which spinoff gets what debt?

As for the difficult question of which company will get what debt, management plans for all three companies to have investment-grade capital structures -- although it will, of course, be up to the rating agencies to ultimately decide if a company is "investment grade" or not.

A smart plan, but there are still risks

Power and renewable energy are complementary businesses that serve the electricity generation industry. Healthcare has little overlap with the rest of GE's businesses, and companies in that sector tend to command high valuations. They are also popular in the capital markets.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

When did GE pay dividends?

GE has been paying a dividend since at least 1893, according to an article in the Milwaukee Sentinel: "New York, March 31. -- The directors of the General Electric company to-day declared the regular quarterly dividend of 2 per cent., payable May 1."

When did General Electric declare a dividend?

At one point in 1912, the company even declared a special dividend of 30%! A New York Times article from June 22, 1924, describes this situation: At a quoted price of $236 [per share], General Electric common [stock] on June 17 attained the highest price in twenty-two years.

When was GE founded?

Unfortunately, it's tough to pinpoint how much said investment would be worth. Record keeping was pretty spotty back then, and most newspapers hadn't begun to regularly publish stock listings. While GE was first incorporated in 1889, the first reference to a price I could find was from a July 31, 1890, issue of the Milwaukee Journal, ...

What is the name of the company that was referred to as "Edison's General Electric"?

He seeks growth and value stocks in the U.S., in Germany, and beyond! "Edison's general electric" is how some newspapers referred to the then-fledgling company General Electric ( NYSE:GE) in the late 1800s, when the stock first began trading publicly. The famed industrial conglomerate grew quickly, becoming one of the first members ...

When did General Electric split its stock?

General Electric’s low share price, meanwhile, is a relic of its once-mighty empire. The firm last split its shares in 2000, dividing its burgeoning stock in a 3-for-1 split. Since then, the company has shrunk to a shadow of its former self. Revenue has fallen 56% since its 2009 peak to just $80 billion.

How much is Berkshire Hathaway worth?

Some companies have taken it to extremes; Berkshire Hathaway (NYSE: BRK.A) stock is worth almost $400,000 apiece (mortal investors can also buy lower-priced B-shares for $265). But in general, most companies target between $80 to $800 for a combination of prestige and reasonable affordability.

How much would $1,000 invested in Facebook be?

Cheap stocks like General Electric, however, got left behind. $1,000 invested in Facebook would have turned into over $10,000; the same amount in GE would have shrunk to $850. That started to change in mid-February when investors began to rotate back into value.

When did General Electric split its stock?

How did General Electric's stock split work? General Electric shares reverse split on the morning of Monday, August 2nd 2021. The 1-8 reverse split was announced on Monday, August 2nd 2021. The number of shares owned by shareholders will be adjusted after the market closes on Monday, August 2nd 2021.

How much did General Electric make in the quarter?

General Electric (NYSE:GE) announced its quarterly earnings data on Monday, April, 26th. The conglomerate reported $0.03 earnings per share for the quarter, topping the consensus estimate of $0.01 by $0.02. The conglomerate earned $17.12 billion during the quarter, compared to analysts' expectations of $17.66 billion.

Does General Electric have a dividend?

General Electric does not yet have a strong track record of dividend growth. The dividend payout ratio of General Electric is 400.00%. Payout ratios above 75% are not desirable because they may not be sustainable. Based on earnings estimates, General Electric will have a dividend payout ratio of 7.69% next year.