5-year, 10-year, 20-year, 30-year Average Stock Market Return

| Period | Average stock market return | Average stock market return adjusted for ... |

| 5 years (2016 to 2020) | 13.95% | 11.95% |

| 20 years (2001 to 2020) | 7.45% | 5.3% |

| 30 years (1991 to 2020) | 10.72% | 8.29% |

What is the average stock market return over 30 years?

Average Market Return for the Last 30 Years. When we add another decade to the mix, the average return inches closer to the annual average of 10%. Looking at the S&P 500 for the years 1991 to 2020, the average stock market return for the last 30 years is 10.72% (8.29% when adjusted for inflation).

How do you calculate stock market returns?

Part 1 Part 1 of 3: Calculating Stock Returns Download Article

- Determine a period in which to measure returns. The period is the timeframe in which your stock price varies.

- Choose a number of periods. The number of periods, n, represents how many periods you will be measuring within your calculation.

- Locate closing price information. ...

- Calculate returns. ...

How to get good return in stock market?

- Invest in Futuristic companies with low debt.

- Be an investor and avoid frequent trading

- Invest systematically over long term

- Do not try to time the market. Nobody can. Just invest when you have liquidity.

- Set definite goals for each buy

How much return can you expect from stock market?

What Is a Good Rate of Return?

- Gold. For the most part, gold hasn’t gained much in real value over the long term. ...

- Cash. Money, or fiat currencies, can depreciate in value over time. ...

- Bonds. From 1926 through 2018, the average annual return for bonds was 5.3.%. ...

- Stocks. Since 1926, the average annual return for stocks has been 10.1%. ...

- Real Estate. ...

What is a good stock market average return?

Expectations for return from the stock market Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. However, keep in mind that this is an average. Some years will deliver lower returns -- perhaps even negative returns.

What is the average rate of return on stocks over time?

Average annual return of the S&P 500 Over the long term, the average historical stock market return has been about 7% a year after inflation.

What is the average rate of return on stocks in 2020?

The S&P 500's return can fluctuate widely year to yearYearS&P 500 annual return2018-4.4%201931.5%202018.4%202128.76 more rows•May 26, 2022

Does money double every 7 years?

According to Standard and Poor's, the average annualized return of the S&P index, which later became the S&P 500, from 1926 to 2020 was 10%. At 10%, you could double your initial investment every seven years (72 divided by 10).

What is the average 10 year return on the stock market?

Average Market Return for the Last 10 Years Looking at the S&P 500 from 2011 to 2020, the average S&P 500 return for the last 10 years is 13.95% (11.95% when adjusted for inflation), which is a little over the annual average return of 10%.

What is the average stock market return over 3 years?

The S&P 500 index is a basket of 500 large US stocks, weighted by market cap, and is the most widely followed index representing the US stock market. S&P 500 3 Year Return is at 28.68%, compared to 50.15% last month and 58.09% last year. This is higher than the long term average of 22.52%.

What is the average stock market return for 2021?

26.89%The S&P 500 average return is 10.67% annualized since the inception of its modern structure in 1957....Stock Market Returns By Year.YearRate of Return202126.89%202016.26%201928.88%2018-6.24%6 more rows•May 27, 2022

How much does the average person invest in stocks?

As of 2021, the top 10 percent of Americans owned an average of $969,000 in stocks. The next 40 percent owned $132,000 on average. For the bottom half of families, it was just under $54,000. In terms of what percent of Americans own stocks, the answer is about 56%, down from a high of 62% in 2007.

What is the benchmark for annual returns?

The S&P 500 is often considered the benchmark measure for annual stock market returns. Though 10% is the average stock market return, returns in any year are far from average. Here’s what new investors starting today should know about stock market returns.

How to make money when stocks are running high?

However, when stocks are running high, remember that the future is likely to be less good than the past. It seems investors have to relearn this lesson during every bull market cycle. 2. Become more optimistic when things look bad.

What is the S&P 500 index?

https://www.nerdwallet.com/article/investing/inflationThe S&P 500 index comprises about 500 of America's largest publicly traded companies and is considered the benchmark measure for annual returns. When investors say “the market,” they mean the S&P 500.

Can you earn less if you trade in and out of the market?

If you trade in and out of the market frequently, you can expect to earn less, sometimes much less . Commissions and taxes eat up your returns, while poorly timed trades erode your bankroll. Study after study shows that it’s almost impossible for even the professionals to beat the market.

Average stock market returns

In general, when people say "the stock market," they mean the S&P 500 index. The S&P 500 is a collection -- referred to as a stock market index -- of just over 500 of the largest publicly traded U.S. companies. (The list is updated every quarter with major changes annually.) While there are thousands more stocks trading on U.S.

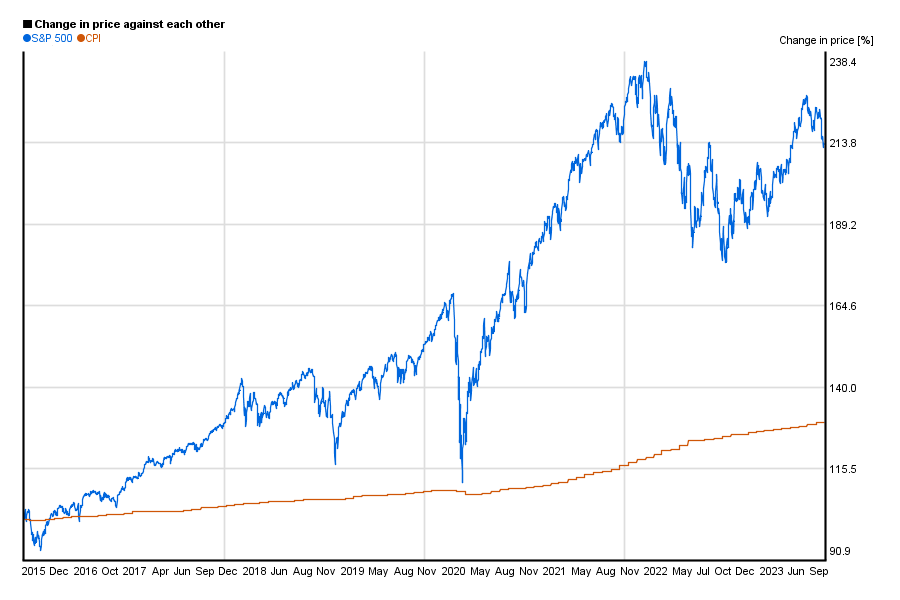

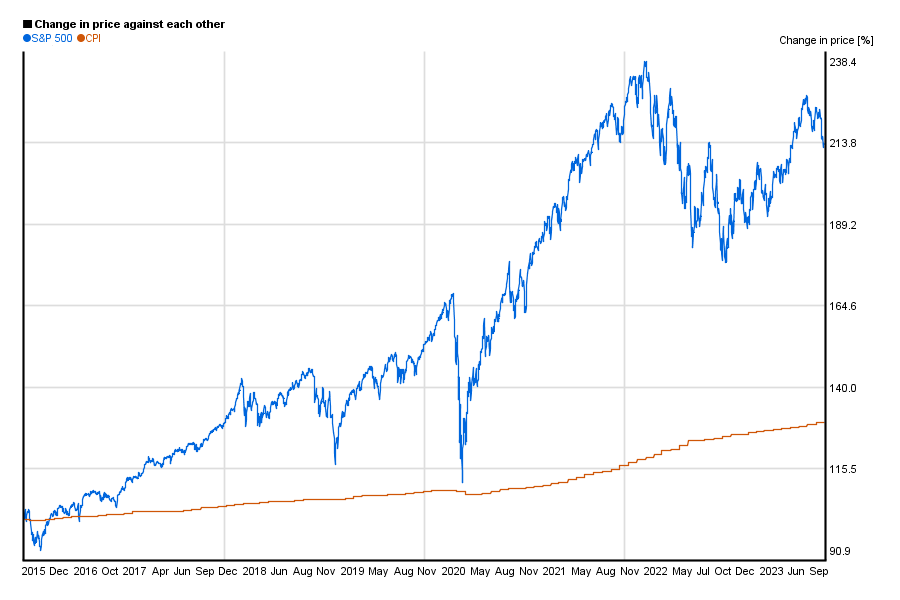

10-year, 30-year, and 50-year average stock market returns

Let's take a look at the stock market's average annualized returns over the past 10, 30, and 50 years, using the S&P 500 as our proxy for the market.

Stock market returns vs. inflation

In addition to showing the average returns, the table above also shows useful information on stock returns adjusted for inflation. For example, $1 invested in 1972 would be worth $46.69 today.

Why is the S&P 500 considered the market?

To investors, the S&P 500 Index is referred to as “the market.” This is because it consists of 500 large publicly traded companies in the United States. As such, investing in the S&P 500 is considered the trusted path for investors around the globe.

What is Warren Buffet's S&P 500 gain?

From 1965 through 2018, the S&P 500 Index compounded annual gain is 9.7% . For the 2018 year-end, it’s 10% for the 10-year average return. The rate includes dividends.

Does Bankrate have a calculator?

Bankrate has a calculator tool. We used it to determine the figures in our example of how to reach your retirement plan investment financial goals.

Do you lose money when you trade?

When you trade often, you’ll spend a lot of time losing money. No matter how much experience you have, the more you trade, the more money you lose in taxes and commissions.

Can you earn interest in bear markets?

It’s also vital to know how to handle your stocks in times of market volatility and calmness. Yes, you can earn interest confidently in both bullish and bear markets, so go ahead and start investing – but know that to beat the average stock market return you’ll have to make smart investing decisions.

Historical Return on Investment

The stock market as we know it today was established in 1792, but analysts have really only tracked market returns for the last 100 years or so. The aggregate average return over that time? A nice round 10%.

Consider Incremental Return Over Time

The 10% stock market average is a figure accounted over roughly a century. However, if you look at a stock chart over the past 100 years, you’ll see a pattern of exponential growth. The market has, in fact, grown at a more rapid pace in recent years. This makes calculating average return on stocks a bit trickier.

Security Type Affects Total Return

Another important factor to remember about a 10% average is that it’s a broad market average. It accounts for total market return. This is an accurate benchmark if you invest in a broad-market index fund. However, if you invest in a specific sector or type of security, you’ll need a different benchmark.

Track the Real Rate of Return

One of the best practices for any investor is to track their current rate of return against the market’s current performance. If you’re indexed, the numbers should be the same, indicating that you’re pacing the market. For those seeking to beat the market, consider a few indicators:

Remember, the Market is Dynamic

10% is a nice round number that anyone can understand as they seek to pace or beat the average return on stocks. But it’s important to look at real numbers to get a sense of how well the market is actually performing. If the market is down 4% and you’re up 5%, you’re still beating the average, if only for that day, week or month.

What is the average annualized return of the S&P 500?

Between 2000 and 2019, the average annualized return of the S&P 500 Index was about 8.87%. In any given year, the actual return you earn may be quite different than the average return, which averages out several years' worth of performance. You may hear the media talking a lot about market corrections and bear markets:

How does down year affect the market?

The market's down years have an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss.

How much money would you lose if you invested $1,000 in an index fund?

If you invested $1,000 at the beginning of the year in an index fund, you would have 37% less money invested at the end of the year or a loss of $370, but you only experience a real loss if you sell the investment at that time.

When does a bear market occur?

A bear market occurs when the market goes down over 20% from its previous high. Most bear markets last for about a year in length. 1 .

When to look at rolling returns?

You can alternatively view returns as rolling returns, which look at market returns of 12-month periods, such as February to the following January, March to the following February, or April to the following March. Check out these graphs of historical rolling returns, for a perspective that extends beyond a calendar year view.

Is the stock market cruel?

On the other hand, if you try and use the stock market as a means to make money fast or engage in activities that throw caution to the wind, you'll find the stock market to be a very cruel place. If a small amount of money could land you big riches in a super short timespan, everybody would do it.

Can you stay out of stocks during a bear market?

No one knows ahead of time when those negative stock market returns will occur. If you don't have the fortitude to stay invested through a bear market, then you may decide to either stay out of stocks or be prepared to lose money, because no one can consistently time the market to get in and out and avoid the down years.

How to get the average return on your investment?

The best way to get the average return on your investments is long-term buy-and-hold investing. Investing experts, including Warren Buffett and investing author and economist Benjamin Graham, say the best way to build wealth is to keep investments for the long term, a strategy called buy-and-hold investing .

How much did the S&P 500 increase in 2019?

While the S&P 500 fell more than 4% between the first and last day of 2018, values and dividends increased by 31.5% during 2019. However, when many years of returns are put together, the ups and downs start to even out.

What is the best way to build wealth?

Investing experts, including Warren Buffett and investing author and economist Benjamin Graham, say the best way to build wealth is to keep investments for the long term, a strategy called buy-and-hold investing .

How much did Berkshire Hathaway gain in the S&P 500 in 2020?

Berkshire Hathaway has tracked S&P 500 data back to 1965. According to the company's data, the compounded annual gain in the S&P 500 between 1965 and 2020 was 10.2%. While that sounds like a good overall return, not every year has been the same.

Does the S&P 500 represent the whole market?

The average annual return from the S&P 500 doesn't necessarily represent the whole market or all investments. There are many stock market indexes, including the S&P 500. This index includes 500 of the largest US companies, and some investors use the performance of this index as a measure of how well the market is doing.

What is the average expense ratio of mutual funds?

In 2019, the average mutual fund expense ratio was 0.45%. 4.

How long do you have to hold investments to reduce taxes?

Depending on the type of account you have, as well as how long you hold individual investments, taxes can reduce the value of your return. If you have a taxable brokerage account, you will pay ordinary income tax rates on gains from investments you hold for less than a year—these are called short-term capital gains.

What is benchmarking in investing?

The benchmark is only a starting place. You need to consider other factors, including the investments you’re in, your tolerance for risk, how long you’ll be invested for, inflation, and taxes. Past performance does not guarantee future results.

How does inflation affect buying power?

Inflation will affect the buying power of your earnings. Over time, what you can buy with a dollar is typically less than what it is today . For example, if you adjust a 10% stock market return for an inflation rate of 3%, the real rate of return is actually 7%.

What is 10% rule?

Since the 10% rule is based on decades of data, it includes many years when the stock market returned less than 10% (as well as many when it returned more). That’s why it should only be used for long-term planning purposes like saving for retirement or your child’s education.

Do management fees reduce your tax return?

If you’re paying someone to manage your portfolio , just like taxes, the fees you pay also reduce your return. Management fees vary depending on the type of services you need and the firm you use.