How much can I write off for stock market losses? The IRS only allows you to write off a maximum of $3,000 ($1,500 for married taxpayers filing separately) for capital losses in a given year. If your loss exceeds this amount, you can carry forward the remainder to write off against future years' taxes. 2

How much can you write off stock gains and losses?

If your losses exceed your gains, you can write off up to $3,000 of the excess losses each year against your income. Thus, suppose you lose $53,000 on one stock and gain $50,000 on another.

How much can you lose in trading stocks?

While theoretically you could lose an unlimited amount, in actuality losses are usually curtailed: The brokerage institutes a stop order, which essentially purchases the shares on the market for you, closing out your position and your exposure to further price increases.

Can I claim stock market losses on my taxes?

When claiming a stock market loss on your taxes, the amount you can actually claim is determined by the amount of capital gains you have for the year. You can only claim stock market losses on your taxes when you actually sell the stock, not just because the market price went down.

How do I calculate my profit or loss on stocks?

Enter the purchase price per share, the selling price per share Enter the commission fees for buying and selling stocks Specify the Capital Gain Tax rate (if applicable) and select the currency from the drop-down list (optional) Click on the 'Calculate' button to estimate your profit or loss. The Stock Calculator uses the following basic formula:

Can you lose all your money in a stock?

Technically, yes. You can lose all your money in stocks or any other investment that has some degree of risk. However, this is rare. Even if you only hold one stock that does very poorly, you'll usually retain some residual value.

What happens if you lose money in stock?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock.

Can you lose more money than you put in stocks?

Can you lose more money than you invest in shares? If you're using your own money to invest in shares, without using any advanced techniques to trade, then the answer is no. You won't lose more money than you invest, even if you only invest in one company and it goes bankrupt and stops trading.

How much money can you get back from stock losses?

If you don't have capital gains to offset the capital loss, you can use a capital loss as an offset to ordinary income, up to $3,000 per year. To deduct your stock market losses, you have to fill out Form 8949 and Schedule D for your tax return.

Do stocks Make You rich?

Can a Person Become Rich by Investing in the Stock Market? Yes, you can become rich by investing in the stock market. Investing in the stock market is one of the most reliable ways to grow your wealth over time.

Do I owe money if my stock goes down?

If you invest in stocks with a cash account, you will not owe money if a stock goes down in value. The value of your investment will decrease, but you will not owe money. If you buy stock using borrowed money, you will owe money no matter which way the stock price goes because you have to repay the loan.

How do beginners buy stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

How do beginners invest?

Best investments for beginnersHigh-yield savings accounts. This can be one of the simplest ways to boost the return on your money above what you're earning in a typical checking account. ... Certificates of deposit (CDs) ... 401(k) or another workplace retirement plan. ... Mutual funds. ... ETFs. ... Individual stocks.

Should I sell my stock at a loss?

Generally though, if the stock breaks a technical marker or the company is not performing well, it is better to sell at a small loss than to let the position tie up your money and potentially fall even further.

How are stock losses taxed?

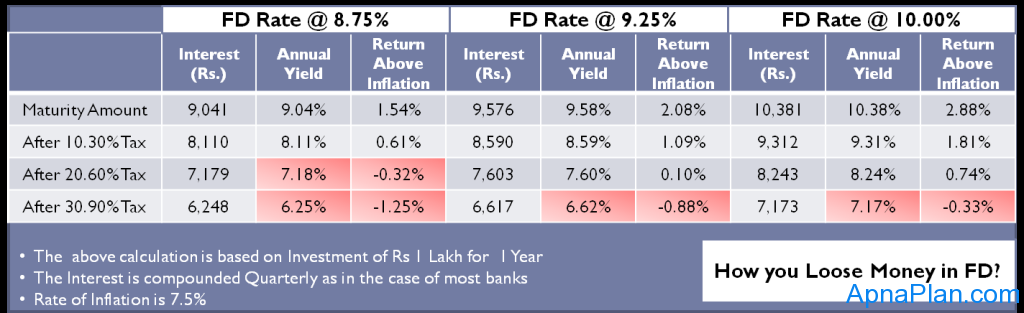

Short-term capital gains are taxed at your ordinary income rate, which can run as high as 37 percent. These rates apply to assets that you've held for less than one year. Brokerages will report your gains and losses to you and the IRS.

How do I avoid paying taxes when I sell stock?

5 ways to avoid paying Capital Gains Tax when you sell your stockStay in a lower tax bracket. If you're a retiree or in a lower tax bracket (less than $75,900 for married couples, in 2017,) you may not have to worry about CGT. ... Harvest your losses. ... Gift your stock. ... Move to a tax-friendly state. ... Invest in an Opportunity Zone.

How do taxes work on stocks?

Generally, any profit you make on the sale of a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year or at your ordinary tax rate if you held the shares for a year or less. Also, any dividends you receive from a stock are usually taxable.

What happens when a stock is declining in value?

Let’s take a look at the two possible situations when this can happen. 1. When You’re Trading on Margin. Trading on margin means borrowing money from your broker to complement your own money when buying a stock.

What happens when you borrow 50% of your money to buy a stock?

Thus, if you borrowed 50% of the money you used to buy a stock — which is a 2X leverage — and the stock falls lower than half of the price you bought it, you have lost more than your own money, and you now owe your broker.

Why are stocks so risky?

Because of what stocks stand for and how the stock market works, every stock is a risky investment. Still, some stocks are more risky than others. The following stocks are more likely to become worthless than others:

How to protect yourself in the stock market?

One good way to protect yourself in the stock market is to diversify your stock portfolio. Buying an individual stock or a few stocks from the same industry is inherently risky, but having a diversified stock portfolio reduces the risk. When looking to diversify your portfolio, these are your options:

What is penny stock?

Penny stocks are stocks that are trading at very low prices. In the past, the $1 mark was used to classify a stock as a penny stock, but recently, the Security and Exchange Commission (SEC) classifies any stock that is trading below $5 as a penny stock.

What happens to stock after bankruptcy?

In the case of a Chapter 11 bankruptcy, the company’s stock may continue to trade on the exchange, but the declaration of bankruptcy will force the price of the stock down , as investors scramble to dump the stock.

What happens when a company goes bankrupt?

When a company goes bankrupt, it is very likely that the stock price will fall to its lowest levels because investors will see the stock as being worthless. A company can file for any of two types of bankruptcy — Chapter 7 and Chapter 11 bankruptcy. If a company files for a Chapter 7 bankruptcy, it ceases to operate, ...

How to find net gain or loss in stock?

In order to find the net gain or loss of your stock holding, you will have to determine the difference between what you paid for it and ultimately what you sold it for on a percentage basis. To do so, subtract the purchase price from the current price and divide the difference by the purchase price of the stock.

Is it hard to predict a stock's gain or loss?

But it's not an exact science. There are many factors that are hard to predict, such as human emotions, overall market behavior, and global events. As such, a stock can either be a winner or a loser and depending on the outcome, an investor will have to determine the gains or losses in their portfolio. In order to find the net gain ...

Why can't a stock fall to zero?

Because stocks never trade in negative numbers, the furthest a stock can possibly fall is to zero. This puts a limit on the maximum profit that can be achieved in a short sale. On the other hand, there is no limit to how high the price of the stock can rise, and because you are required to return the borrowed shares eventually, ...

What is short sales in stock market?

Short sales are margin transactions: You are putting up just a portion of your own cash, and getting a loan for the rest, for the deal.

Can you lose more than you invest in a short sale?

You can lose more than you invest in a short sale if the stock you borrowed for the deal rises in price, instead of falling as you assumed it would.

What happens if you lose 50000 on one stock and make 50000 on another?

Thus, if you lose $50,000 on one stock and make $50,000 on another, these gains and losses will offset each other. You won't owe any taxes on your $50,000 in gains because of your equally sized losses. If your losses exceed your gains, you can write off up to $3,000 of the excess losses each year against your income.

Why are short term capital gains taxed?

Short-term gains are taxed at the highest rate under the tax code, because short-term capital gains are treated as ordinary income and taxed at your marginal tax rate. Financial advisors and accountants can help a lot here. Proper tax planning suggests you should seek to minimize or offset short-term capital gains whenever possible ...

Do short term capital gains offset long term capital gains?

The tax code is written such that short- and long-term capital gains and losses must first offset losses of the same type. Thus, short-term losses should offset short-term gains, and long-term losses would offset long-term gains. However, if your losses from one type exceed the gains of the same kind, you can apply the excess to another type ...

Can you apply a short term loss of $10,000 to a long term gain?

Thus, if you only had a short-term gain of $5,000 and a short-term loss of $10,000, you could apply the extra $5,000 of short-term losses to long-term gains.

Can you write off a loss of $3,000?

The remaining $3,000 can be written off against your ordinary income during the year. If your losses exceed your gains by more than $3,000, you'll have to carry your losses forward to future tax years. Thus, it's possible that if you take a very large tax loss in one year, you'll be able to write off a portion of your losses for years ...

Can you buy and sell without tax?

In doing so, you'll be able to buy and sell freely without consideration for differences in taxation. Save the space in your tax-deferred accounts for investments that generate a lot of taxable gains or losses, and put the most passive investments in a taxable account. Capital gains are the United States' only voluntary tax.

Should you minimize short term capital gains?

Proper tax planning suggests you should seek to minimize or offset short-term capital gains whenever possible because short-term gains are taxed at the highest rate. Of course, the best way to avoid all this trouble is to make investments in a tax-deferred account like a 401 (k) or Individual Retirement Account (IRA).

How much is a loss on a stock trade?

The loss on each stock trade equals the amount you spent to buy it, which includes brokerage fees, minus the amount you received for selling it, less brokerage fees. For example, say you bought the stock for $800, sold it for $716 and paid $8 in broker fees on both trades. Your capital loss would be $100. The IRS allows you to use your losses ...

How much can you take out of your investment loss?

However, if you've got more losses than gains, most taxpayers can take up to $3,000 of the losses as an investment loss tax deduction that year. Any additional losses must be carried over to a future tax year and used either to offset that year's gains or to claim another deduction.

How to determine if you can claim stock loss on taxes?

When claiming a stock market loss on your taxes, the amount you can actually claim is determined by the amount of capital gains you have for the year.

How much can you deduct after offsetting gains?

For example, if you have $15,000 in losses remaining after offsetting all of your gains, you can deduct $3,000 from your taxable income and then carry the extra $12,000 over to the next year. You can continue to deduct the loss in future years until you use it all.

Can I deduct losses from my AGI?

Even if you meet all the requirements, the deduction is subject to a threshold of 2 percent of adjusted gross income threshold, so any losses less than 2 percent of your AGI aren't deductible, either. These types of deductions can't be claimed from tax year 2018 through tax year 2025 under current tax law. 00:00. 00:05 20:19.

Can you use losses to offset capital gains?

The IRS allows you to use your losses to offset your capital gains for the year. The amount of losses you can use each year to offset your gains is limited only by your total gains. For example, if have $5,000 in gains for the year, you can only use $5,000 of losses to offset those gains.

Can you deduct stock losses on taxes?

Generally, you can't take a stock loss deduction on your taxes for stock market losses in a retirement plan, like an IRA or 401 (k), that is already tax deferred.

Capital Losses

Opportunity Losses

- Another type of loss is somewhat less painful and harder to quantify, but still very real. You might have bought $10,000 of a hot growth stock, and the stock is very close to what you paid for it one year later, after some ups and downs. You might be tempted to tell yourself, "Well, at least I didn’t lose anything." But that's not true. You tied up...

Missed Profit Losses

- This type of loss results when you watch a stock make a significant run-up then fall back, something that can easily happen with more volatile stocks. Not many people are successful at calling the top or bottom of a market or an individual stock. You might feel that the money you could have made is lost money—money you would have had if you had just sold at the top. Man…

Paper Losses

- You can tell yourself, “If I don’t sell, I haven’t lost anything,” or "Your loss is only a paper loss." While it's only a loss on paper and not in your pocket (yet), the reality is that you should decide what to do about it if your investment in a stock has taken a major hit. It might be a fine time to add to your holdings if you believe that the company’s long-term prospects are still good and yo…

How to Deal with Your Losses

- No one wants to suffer a loss of any kind, but the best course of action is often to cut your losses and move on to the next trade. Turn it into a learning experience that can help you going forward: 1. Analyze your choices. Review the decisions you made with new eyes after some time has passed. What would you have done differently in hindsight, and why? Would you have lost less o…