Full Answer

How do I make big money in the stock market?

Here are three of the biggest:

- 'I’ll wait until the stock market is safe to invest.' This excuse is used by investors after stocks have declined, when they’re too afraid to buy into the market. ...

- 'I’ll buy back in next week when it’s lower.' This excuse is used by would-be buyers as they wait for the stock to drop. ...

- 'I’m bored of this stock, so I’m selling.'

How to make a lot of money in stock market?

Key Points

- Investing in the stock market is one of the best ways to build wealth over the long term.

- Choosing the right investments is the first step to successful investing.

- With enough time and consistency, it's possible to accumulate $1 million or more.

Is it hard to make money in the stock market?

Seems like it's ridiculously easy to make money from the stock market. All I have to do is literally pick any stock that is being hyped up on this subreddit (TSLA, NIO, XPEV, PLTR, etc...) and you are more or less guaranteed absurd returns, more than what people make for a few months at their full time jobs.

How much money can you earn in investing in stock?

If the multiple stays at 20 then a dollar invested in stocks earns a nickel, and that nickel can be reinvested in additional earning power. You wind up compounding your earnings at a 5% rate. The Vanguard High-Yield Corporate Bond fund ( VWEAX) has averaged a return of 11.9% over the last five years.

How much money is on the stock market?

US$93.7 trillionThe total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. As of 2016, there are 60 stock exchanges in the world.

How much money is in the US stock market?

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018.

How much money can you make in the stock market?

The stock market's average return is a cool 10% annually — better than you can find in a bank account or bonds. But many investors fail to earn that 10%, simply because they don't stay invested long enough. They often move in and out of the stock market at the worst possible times, missing out on annual returns.

How much money is in the stock market daily?

Reuters/Steve Marcus If you've ever wondered just how much currency is traded on average each and every day, we have some good news. Thanks to HSBC, citing data from the Bank of International Settlements (BIS), we have the answer. It's $5,100,000,000,000.

How can I invest in $100 stock?

Our 6 best ways to invest $100 starting todayStart an emergency fund.Use a micro-investing app or robo-advisor.Invest in a stock index mutual fund or exchange-traded fund.Use fractional shares to buy stocks.Put it in your 401(k).Open an IRA.

How much money has left the stock market?

More than $7 trillion has been wiped out from the stock market this year - CNN.

How can I earn 10k per day in stocks?

10000 every day for rest of the months. At the end of every month you will have good money. You can take some part of it every month to buy shares in long term portfolio companies....To gain from downward movement:Selling shares in cash segment.Buying Put Options.Selling Futures segment.

Can stocks make you rich?

Investing in the stock market is one of the world's best ways to generate wealth. One of the major strengths of the stock market is that there are so many ways that you can profit from it. But with great potential reward also comes great risk, especially if you're looking to get rich quick.

Can you become a millionaire from stocks?

It's not always easy to become a stock market millionaire, but it is possible. While you don't need to be wealthy to make a lot of money by investing, you do need the right strategy. Strategy is key to building wealth in the stock market, and it's simpler than you might think to generate wealth.

Can you make a living day trading?

The answer is yes. There are half a million people in India day trading for a living. Do you feel day trading is a way to make easy money? Or, you may think it does not need as much work as a regular job.

How much do day traders make per month?

Day Trader SalaryAnnual SalaryMonthly PayTop Earners$126,500$10,54175th Percentile$95,500$7,958Average$75,861$6,32125th Percentile$33,000$2,750

How much can you make from stocks in a month?

If you owned $10,000 worth of stocks from a company that paid a 2% dividend, you would earn $200 each quarter or $66.67 per month. With the same amount of stock at 5%, you would earn $500 per quarter or $166.67 per month.

How much do you need to make to beat the market?

So as a minimum, to beat the market we could say, you need to make at least 6% per year and at best 15.5%.

How much is the 38th richest man in the world?

Rated by Forbes as the 38th richest man in the world, a self-made billionaire with a net worth of $8 Billion. Annual Compound Rate of return of 28.6% Profit. So it would seem over the long-term if you can achieve a rate of return close to 25%, you are doing extremely well; in fact, you are among the best of the best.

How much is Warren Buffet worth?

Warren Buffet is the 2nd Richest man in the world, according to Forbes, with an estimated net worth of $72 Billion. He is a self-made billionaire who made it all from investments in stocks of companies.

Is it possible to get rich fast?

Getting rich quick. This is a popular one, but almost impossible, except for those that are extremely dedicated and extremely lucky.

How long does it take for the stock market to make money?

Over longer stretches of time (10–15+ years), the market almost always makes money.

How much do stocks return?

Stocks generally return 7–10% per year over long periods of time. In any given year, they could do far better or far worse than that. Over longer stretches of time (10–15+ years), the market almost always makes money.

How important is compound returns in stock market?

When it comes to the power of compound returns in the stock market, there are five very important takeaways: The longer you’re invested in the market, the more your money will grow. The higher your annual investing returns, the more your money will grow.

How does investing affect your money?

The longer you’re invested in the market, the more your money will grow. The higher your annual investing returns, the more your money will grow. Small improvements in your investment returns can make a huge difference in your wealth over time.

How much has the stock market returned in the last 100 years?

Most analysts agree that historically the stock market has returned an average of 7% — 10% per year over the last 100+ years.

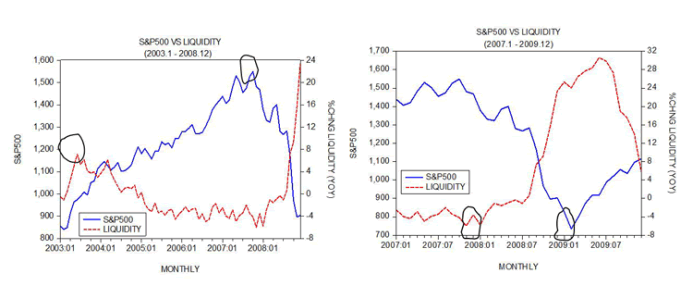

What was the S&P 500's loss in 2008?

For example, in 2008 the S&P 500 (a collection of the 500 biggest companies on the market) returned a devastating -38.5% loss as the stock market crashed. The very next year, it rallied for a strong +23.5% return.

How much is the ending balance of $8,704,668?

If we run the same scenario for the full 60 years, your previous ending balance of $8,704,668 now becomes an astounding $33,382,980.

How are money market investments traded?

Money market investments are traded via phone and computer (over-the-counter) directly between banks and brokerage firms . Stock Market. Common stock represents a fraction of a percent ownership in the underlying company. It continues to exist until the company either goes out of business or merges with another company.

What is money market?

The money market has nothing to do with currency trading. It is actually the short-term end of the bond market, and money market investments are essentially short-term loans to banks and corporations that pay interest and return principal at maturity.

What is the best strategy to employ if you're talking about NSE options?

Well best strategy to employ if you're talking about NSE options here is focus on news. Keep in touch with stock market news like

How to find the maximum volume of an option in a stock?

Once you know which stock you're betting on simply go to nse website and that stock in search bar on the top of it. Once you're on that stock page simply look for “Option Chain”. Now you will get a list of option contract. It will have both Call option and put option. Here look for the maximum volume option WHOSE PREMIUM AMOUNT IS IN YOUR INVESTMENT BUDGET as higher the volume more safe the trade is.

What are the two major stock exchanges in India?

The two main stock exchanges for Equity Trading in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). BSE is the oldest stock exchange in Asia and claims to have the largest number of listed companies in the world.

Where is the most of the world's money traded?

Most of the money is traded at a few major stock exchanges in the world like London stock exchange, New york stock exchange, Mumbai stock exchange and Tokyo stock exchange etc. Where the most of the currency in the world is under play by the major banks and investment firms of the world.

Who publishes global data on stocks traded by $ value?

The World Bank publishes global data on stocks traded by $ value here.

What is more important than how much money you have to start investing?

What's more important than how much money you have to start investing is learning how to pick the best stocks. Stocks have the potential for big gains if you know which ones to pick at the right time. There are two components to the right time: the stock itself and the current trend of the overall stock market.

How is big money made?

Remember, the big money is made by using sound buy and sell rules for a concentrated portfolio of individual stocks, while also understanding the broader market trend .

What does O'Neil say about keeping track of stocks?

As O'Neil notes in his book, "Keep things manageable. The more stocks you own, the harder it is to keep track of all of them."

What is the best investment for diversification?

Although most investors gravitate toward two investment types—individual stocks or stock funds, such as mutual funds or exchange-traded funds ( ETF )—experts typically recommend the latter to maximize your diversification.

Can you buy exposure to a single share?

Funds, on the other hand, let you buy exposure to hundreds (or thousands) of individual investments with a single share. While everyone wants to throw all of their money into the next Apple (AAPL) or Tesla (TSLA), the simple fact is that most investors, including the professionals, don’t have a strong track record of predicting which companies will deliver outsize returns.

Do brokerages offer both types of accounts?

Most brokerages (but not all) offer both types of investment accounts, so make sure your company of choice has the account type you need. If yours doesn’t or you’re just starting your investing journey, check out Forbes Advisor’s list of the best brokerages to find the right choice for you.

Can you buy individual stocks?

An individual share of a single stock, for instance, can cost hundreds of dollars .

Can you take out money from a taxable account?

Meanwhile, plain old taxable investment accounts don ’t offer the same tax incentives but do let you take out your money whenever you want for whatever purpose. This lets you take advantage of certain strategies, like tax-loss harvesting, that involve you turning your losing stocks into winners by selling them at a loss and getting a tax break on some of your gains. You can also contribute an unlimited amount of money to taxable accounts in a year; 401 (k)s and IRAs have annual caps.

Why do we invest in stocks?

Investing lets you take money you're not spending and put it to work for you. Money you invest in stocks and bonds can help companies or governments grow, and in the meantime it will earn you compound interest. With time, compound interest takes modest savings and turns them into serious nest eggs - so long as you avoid some investing mistakes.

What is the starting balance for investing?

Your principal, or starting balance, is your jumping-off point for the purposes of investing. Most brokerage firms that offer mutual funds and index funds require a starting balance of $1,000. You can buy individual equities and bonds with less than that, though.

What is investment calculator?

Whether you're considering getting started with investing or you're already a seasoned investor, an investment calculator can help you figure out how to meet your goals. It can show you how your initial investment, frequency of contributions and risk tolerance can all affect how your money grows.

What is the default rate of return on Smartasset?

So how do you know what rate of return you'll earn? Well, the SmartAsset investment calculator default is 4% . This may seem low to you if you've read that the stock market averages much higher returns over the course of decades.

Do you want to keep adding to your investments?

Once you've invested that initial sum, you'll likely want to keep adding to it . Extreme savers may want to make drastic cutbacks in their budgets so they can contribute as much as possible. Casual savers may decide on a lower amount to contribute. The amount you regularly add to your investments is called your contribution.

Is there a trade-off between risk and return?

In investing, there's generally a trade-off between risk and return. The investments with higher potential for return also have higher potential for risk. The safe-and-sound investments sometimes barely beat inflation, if they do at all. Finding the asset allocation balance that's right for you will depend on your age and your risk tolerance.

Is it a good idea to not invest?

It’s a good idea not to wait to start putting your money to work for you . And remember that your investment performance will be better when you choose low-fee investments. You don't want to be giving up an unreasonable chunk of money to fund managers when that money could be growing for you. Sure, investing has risks, but not investing is riskier for anyone who wants to accrue retirement savings and beat inflation.