Full Answer

How much does it cost to invest in stocks?

The investor uses an online broker who charges 2% of the total trade value, with a minimum commission of $50. The total price of the shares alone is $20 * 100, or $2,000. The commission is $2,000 * 2%, or $40.

How much does it cost to buy shares in a company?

This is a listed company, not an IPO, so the shares must be purchased on a stock exchange for the current market price of $20 per share. Online brokers are giving stock investors a free ride for now. Other investments such as mutual funds will carry a fee. If the investor uses an online broker, the price will be $2,000.

Should I buy acquirer stock or cash?

For buyers without a lot of cash on hand, paying with acquirer stock avoids the need to borrow in order to fund the deal. For the seller, a stock deal makes it possible to share in the future growth of the business and enables the seller to potentially defer the payment of tax on gain associated with the sale.

What are the benefits of paying with stock when buying a company?

For the acquirer, the main benefit of paying with stock is that it preserves cash. For buyers without a lot of cash on hand, paying with acquirer stock avoids the need to borrow in order to fund the deal. For the seller, a stock deal makes it possible to share in the future growth of the business and enables...

How much does it cost to cash in stocks?

Fees & Commissions For example, a full-service brokerage might charge you $100 to sell a stock. If you only have $1,000 invested, you'd be paying a 10 percent commission to get out of the stock market. Some stock mutual funds cost nothing to sell, but others charge fees.

How much money do you get from buying stocks?

The stock market's average return is a cool 10% annually — better than you can find in a bank account or bonds. But many investors fail to earn that 10%, simply because they don't stay invested long enough. They often move in and out of the stock market at the worst possible times, missing out on annual returns.

Do you get cash for stocks?

Investors might sell their stocks is to adjust their portfolio or free up money. Investors might also sell a stock when it hits a price target, or the company's fundamentals have deteriorated. Still, investors might sell a stock for tax purposes or because they need the money in retirement for income.

How much cash is in a brokerage account?

Investors should not allocate more than 5 percent of their cash into a brokerage account, says Edison Byzyka, chief investment officer of Credent Wealth Management in Auburn, Indiana. It's possible to keep too large of an amount in a portfolio, sitting there in the sidelines.

How much cash should I invest in stocks?

Experts generally recommend setting aside at least 10% to 20% of your after-tax income for investing in stocks, bonds and other assets (but note that there are different “rules” during times of inflation, which we will discuss below). But your current financial situation and goals may dictate a different plan.

How much money should you have in cash vs stocks?

The general rule is 30% of your income, but many financial gurus will argue that 30% is much too high.

How do you get paid by stocks?

Collecting dividends—Many stocks pay dividends, a distribution of the company's profits per share. Typically issued each quarter, they're an extra reward for shareholders, usually paid in cash but sometimes in additional shares of stock.

Can you get rich off stocks?

Yes, you can become rich by investing in the stock market. Investing in the stock market is one of the most reliable ways to grow your wealth over time.

How do I turn my stocks into cash?

Order to sell shares – You need to log on to your brokerage account and choose the stock holding that you would like to sell. Place an order to sell the shares. The brokerage will raise a unique order number for the order placed. Verify the stocks you trade – Weigh all factors before closing a stock.

When I sell my stock How do I get my money?

Receiving the Money Once the proceeds from the sale of stock have been credited to your brokerage account, you must still get the money from the account. You can set up Automated Clearing House -- ACH -- transfers, which allow you to get the money to a bank account in one to two additional days.

How long does it take to cash out stocks?

How quickly you can get your cash when you sell an investment. When you buy or sell securities, the official transfer of the securities to the buyer's account or the cash to the seller's account is called "settlement." For most stock trades, settlement happens two business days after the trade is executed.

Is brokerage cash my money?

Brokerage cash is a top-line cash total in your investing account. It's the cash amount before stripping out items like unsettled trades and collateral. Buying power is the bottom-line amount of cash available to you immediately. It might be called "cash available for withdrawal" or some variant on that.

How much cash should I have on hand vs investing?

“There isn't really a general rule in terms of a number,” says Michael Taylor, CFA, vice president – senior wealth investment solutions analyst at Wells Fargo Investment Institute. “We do say it shouldn't be more than maybe 10% of your overall portfolio or maybe three to six months' worth of living expenses.”

Where can I hold cash when not invested?

High-yield bank accounts. High-yield bank accounts are usually offered by online banks. ... Money market deposit accounts. Money market accounts are a hybrid between checking and savings accounts. ... Money market funds. ... Certificates of deposit (CDs) ... U.S. government bills or notes. ... I Bonds. ... Municipal bonds. ... Corporate bonds.More items...•

How does a beginner buy stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

How much should beginners invest in stocks?

There's no minimum to get started investing, however you likely need at least $200 — $1,000 to really get started right. If you're starting with less than $1,000, it's fine to buy just one stock and add more positions over time.

How do beginners invest in stocks?

One of the easiest ways is to open an online brokerage account and buy stocks or stock funds. If you're not comfortable with that, you can work with a professional to manage your portfolio, often for a reasonable fee. Either way, you can invest in stocks online and begin with little money.

Is 20K in savings good?

A sum of $20,000 sitting in your savings account could provide months of financial security should you need it. After all, experts recommend building an emergency fund equal to 3-6 months worth of expenses. However, saving $20K may seem like a lofty goal, even with a timetable of five years.

How much savings should I have at 35?

By the time you are 35, you should have at least 4X your annual expenses saved up. Alternatively, you should have at least 4X your annual expenses as your net worth. In other words, if you spend $60,000 a year to live at age 35, you should have at least $240,000 in savings or have at least a $240,000 net worth.

How much savings should I have at 40?

Fast answer: A general rule of thumb is to have one times your annual income saved by age 30, three times by 40, and so on.

What Stock Brokers Used To Charge To Buy or Sell Stocks

I remember during the internet stocks bubble in the late 1990s when the stock market was hitting new highs, and investors were making fortunes on the stocks, everyone was excited about Etrade.

New Online Brokers

There are new, ambitious players in the discount online trading world. These companies are young and nimble, and they charge much less than the veteran online brokerage houses. How about $0 per trade? Unbelievable? The reality is that it can be that cheap to buy stocks, and most people do not realize it.

How Much Does Stock Broker Charges To Buy And Sell Stocks?

If you are paying over $0 for stock and ETF trades and over $20 for mutual funds, I encourage you to research companies in this article, such as Ally Invest and Firstrade, and make more educated decisions about where to invest.

What is the commission on stocks?

When an investor purchases or sells shares of stock, the price paid may include two components: the cost of the shares and any fee charged by the broker age firm that makes the transaction . This fee is called the commission . Online brokers have been caught in an all-out price war lately. As of May 2020, many of the major online brokers offered zero ...

What is the broker commission?

Broker Commission. The second component of a share purchase price is the broker commission, if any. Individual investors may buy and sell stock through an online broker or a full-service broker while larger institutional investors may work with an investment bank. Full-service brokerage fees vary from broker to broker.

How much does a broker charge for stock?

Most full-service brokers charge 1% to 2% of the total purchase price, a flat fee, or a combination of both, for stock purchases. They offer investors financial planning and investing advice as well as making transactions for clients.

How much is the commission on stocks in 2020?

As of May 2020, many of the major online brokers offered zero commission trades on stocks, though most charged a commission for trading mutual funds, ranging from $14.95 to $49.95 per transaction.

Do online brokers charge fees?

As noted, many online brokers have dispensed with fees for buying and selling stock shares and exchange-traded funds in this highly competitive environment. They may charge fees for other transactions, including purchases and sales of mutual funds, bonds, and futures.

Can you buy new stock on the primary market?

Newly- issued stock shares can be purchased only on the primary market for a non-negotiable price set by the company that issues them. For example, a young company that decides to go public to raise money may determine that $15 is a fair price for its shares. It issues a predetermined number of shares at this set price for a limited amount of time.

Why is volatility important in investing?

Volatility is a key factor when investing in stocks. In other words, how quickly or severely do prices whip around. High volatility can cause investors to panic sell. Stock volatility can be more than many investors want to handle on a daily basis.

How much is the S&P 500 up in 2020?

The S&P 500 is up 195% for the 10-year period ending Oct. 9, 2020—or an annualized +11.4% return. But, since it is difficult to predict which way the market will go, market timing is ill-advised. Instead, investors can allocate money to index funds via dollar-cost averaging (DCA) instead of keeping cash on the sidelines.

What factors influence volatility?

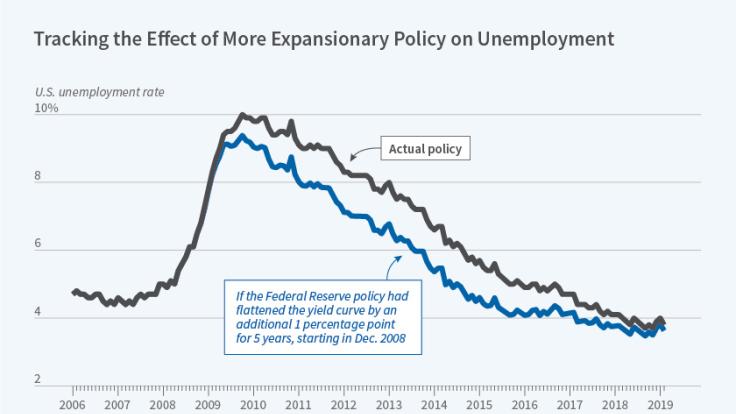

Monetary Policy. Monetary policy is another factor to follow along with volatility. It can greatly influence the market’s investment demand and how investors allocate their money. Setting interest rates low helps to stimulate borrowing while higher rates cause more investors to save.

What is the downside of holding cash?

One of the downsides of holding cash is that the buying power of your money slowly deteriorates due to inflation. Right now, the rates being paid on savings accounts and Treasuries are not keeping pace with inflation. The 10-year Treasury rate as of Oct. 8, 2020, was 0.78%.

Do stocks have a run?

Stocks have had a great run over the last decade, while the rates offered by savings accounts continued to fall. Investors are being drawn toward more risky investments in search of yield and returns. However, investors must consider volatility and current interest rates when deciding on how much to invest in cash versus stocks.

When did the Federal Reserve raise the funds rate?

In 2015, the Federal Reserve raised the federal funds rate for the first time in seven years, finally up from 0% to 0.25%. Then the federal funds rate range set by the Fed went from 0.25% to 0.50% in 2015 to 2.25% to 2.5% in December 2018.

Who is Andrea Travillian?

Andrea Travillian is an entrepreneur, financial planner, and life coach. She is the founder of Andrea Travillian Events, Smart Step, and Aspirify. Since the 2008 financial crisis, stocks have been in a prolonged bull market, generating positive returns for several years.

Why do you pay with acquirer stock?

For buyers without a lot of cash on hand, paying with acquirer stock avoids the need to borrow in order to fund the deal. For the seller, a stock deal makes it possible to share in the future growth of the business and enables the seller to potentially defer the payment of tax on gain associated with the sale.

Can a seller defer paying taxes on a deal?

Meanwhile, if a portion of the deal is with acquirer stock, the seller can often defer paying tax. This is probably the largest tax issue to consider and as we’ll see shortly, these implications play prominently in the deal negotiations. Of course, the decision to pay with cash vs. stock also carries other sometimes significant legal, tax, ...

What is a stock deal?

In stock deals, sellers transition from full owners who exercise complete control over their business to minority owners of the combined entity. Decisions affecting the value of the business are now often in the hands of the acquirer.

Do acquirers have to borrow money?

Acquirers who pay with cash must either use their own cash balances or borrow money. Cash-rich companies like Microsoft, Google and Apple don’t have to borrow to affect large deals, but most companies do require external financing. In this case, acquirers must consider the impact on their cost of capital, capital structure, credit ratios and credit ratings.

To construct a diverse portfolio of individual stocks

For practical purposes, however, you’ll want to have a lot more than the cost of one share before you open a brokerage account and start buying individual stocks. There are two main reasons:

An alternative way to invest in stocks with less money

While I don’t think there’s a specific dollar amount you need to buy individual stocks, it’s fair to say that the amount is well into the thousands.

Using the wrong broker could cost you serious money

Over the long term, there's been no better way to grow your wealth than investing in the stock market. But using the wrong broker could make a big dent in your investing returns.

About the Author

Matt is a Certified Financial Planner® and investment advisor based in Columbia, South Carolina. He writes personal finance and investment advice, and in 2017 he received the SABEW Best in Business Award.

Why is cash important in portfolio?

It can get you to stick with your investment strategy through all sorts of economic, market, and political environments by providing peace of mind. When you look at reference data sets, like the ones put together by Roger Ibbotson, you can peruse historical volatility results for different portfolio compositions.

Why is cash important in investing?

Cash facilitates all of an investor's success, even if it looks like it's not doing anything for long periods. In investing parlance, this is known as "dry powder.". The funds are there to exploit interesting opportunities—to buy assets when they are cheap, lower your cost basis, or add new passive income streams .

What percentage of Tweedy Browne's funds are cash?

As of April 13, 2020, the legendary Tweedy Browne Global Value Fund allocated 13.82% of the fund's holdings to cash, T-Bills, and money markets. 2 . Privately, wealthy people like to hoard cash, as well.

Who is the best investor in history?

The best investors in history are known for keeping large amounts of cash on hand. They know through first-hand experience how terrible things can get from time to time—often without warning. In August 2019, Warren Buffett and his firm Berkshire Hathaway held a record $122 billion in cash. 1 Charlie Munger would go years building up huge cash reserves until he felt like he found something low-risk and highly intelligent. As of April 13, 2020, the legendary Tweedy Browne Global Value Fund allocated 13.82% of the fund's holdings to cash, T-Bills, and money markets. 2

Is it prudent to have a minimum cash level?

Once you're able to move beyond dollar-cost averaging, the minimum cash levels that are considered prudent can vary. Those who open themselves up to huge exposures in search of outsized returns have a hard time escaping the fate of Long-Term Capital Management.

Who is Joshua Kennon?

Joshua Kennon is an expert on investing, assets and markets, and retirement planning. He is the managing director and co-founder of Kennon-Green & Co., an asset management firm. Read The Balance's editorial policies. Joshua Kennon.

Who is Chip Stapleton?

Chip Stapleton is a Financial Analyst, Angel Investor, and former Financial Planner & Business Advisor of 7+ years. He currently holds a Series 7, and Series 66 licenses. New investors often want to know how much cash they should keep in their portfolio, especially in a world of low or effectively 0% interest rates.

How long does it take to settle into a brokerage account?

Retaining enough of this asset in an investment portfolio is important, since many major brokerages require up to three days for money to settle into a trading account from a bank. When you take a profit and sell a stock, ...

Why is automatic deposit better than direct deposit?

Automating deposits with a monthly direct deposit from an investor's bank to the investment account is even better because it helps avoid emotional decision-making and takes out the guesswork, Loewengart says. Many raises and promotions occur in the early part of a year, so now is a good time to make a plan, he says.

What is brokerage fee?

Brokerage fee: A brokerage fee is a fee charged by the broker that holds your investment account. Brokerage fees include annual fees to maintain the brokerage account, subscriptions for premium research or investing data, fees to access trading platforms or even inactivity fees for infrequent trading. You can generally avoid brokerage account fees ...

How to avoid brokerage fees?

You can generally avoid brokerage account fees by choosing the right broker. Trade commission: Also called a stock trading fee, this is a brokerage fee that is charged when you buy or sell stocks. You may also pay commissions or fees for buying and selling other investments, like options or exchange-traded funds.

How are front end loads charged?

Loads are charged in several ways: Front-end loads: These are initial sales charges, or upfront fees. The fee will be subtracted from your investment in the fund, so if you invest $5,000 and the fund has a front-end load of 3%, your actual investment is $4,850. Back-end loads: Here’s where things can get confusing.

What is a mutual fund transaction fee?

Mutual fund transaction fee: Another brokerage fee, this time charged when you buy and/or sell some mutual funds. Expense ratio: An annual fee charged by mutual funds, index funds and exchange-traded funds, as a percentage of your investment in the fund.

What is a sales load?

Sales load: A sales charge or commission on some mutual funds, paid to the broker or salesperson who sold the fund. Management or advisory fee: Typically a percentage of assets under management, paid by an investor to a financial advisor or robo-advisor.

Why are 401(k)s so expensive?

You may have heard that 401 (k)s are expensive. That’s generally for two reasons: They offer a small selection of investments, so it’s harder to shop around for low expense ratios. And administrative costs of running the plan tend to be high.

Do brokerages charge fees?

Most brokerages charge a fee to transfer or close your account. Some brokerages will offer to reimburse transfer fees incurred by new customers. In general, you can avoid or minimize brokerage account fees by choosing an online broker that is a good match for your trading and investing style.

How much is a stock sale taxable?

Generally, any profit you make on the sale of a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less than a year. Also, any dividends you receive from a stock are usually taxable. Here’s a quick guide to taxes on stocks and how to lower those taxes.

How much can you deduct from your capital gains?

If your losses exceed your gains, you can deduct the difference on your tax return, up to $3,000 per year ($1,500 for those married filing separately).

What is long term capital gains tax?

Long-term capital gains tax is a tax on profits from the sale of an asset held for longer than a year. Long-term capital gains tax rates are 0%, 15% or 20% depending on your taxable income and filing status. Long-term capital gains tax rates are usually lower than those on short-term capital gains. That can mean paying lower taxes on stocks.

Do dividends count as qualified?

You might pay less tax on your dividends by holding the shares long enough for the dividends to count as qualified. Just be sure that doing so aligns with your other investment objectives. Whenever possible, hold an asset for a year or longer so you can qualify for the long-term capital gains tax rate when you sell.

Is dividend income taxable?

Taxes on dividends. Dividends are usually taxable income. For tax purposes, there are two kinds of dividends: qualified and nonqualified. Nonqualified dividends are sometimes called ordinary dividends. The tax rate on nonqualified dividends is the same as your regular income tax bracket.

Things to Remember About Stocks

Key Considerations

- Volatility

Volatility is a key factor when investing in stocks. In other words, how quickly or severely do prices whip around. High volatilitycan cause investors to panic sell. Stock volatility can be more than many investors want to handle on a daily basis. - Monetary Policy

Monetary policyis another factor to follow along with volatility. It can greatly influence the market’s investment demand and how investors allocate their money. Setting interest rates low helps to stimulate borrowing while higher rates cause more investors to save. However, low rate…

Cash vs. Stocks

- Investors deciding on whether to invest in stocks or hold cash will need to keep a close eye on interest rates. One of the downsides of holding cash is that the buying power of your money slowly deteriorates due to inflation. Right now, the rates being paid on savings accounts and Treasuries are not keeping pace with inflation. The 10-year Treasury rate as of Oct. 8, 2020, was …

The Bottom Line

- Where the stock market or economy is headed, and at what pace, will vary based on the investment professional you follow. While the solid returns following the financial crisis might not be replicated anytime soon, the current interest rates are low and pushing investors away from cash.