2017 was a great year for the stock market, with the Dow Jones Industrials posting gains of more than 25% and the broader-based S&P 500 scoring a 20% rise. Yet those gains paled in comparison to the massive returns that the 10 best stocks in 2017 managed to post.

...

The S&P 500's return can fluctuate widely year to year.

How did the stock market perform in 2017 and 2018?

In 2017 the S&P 500 finished the year up 21.7% in terms of total return. In 2018 the S&P 500 finished the year down 4.4% in terms of total return. In 2017 the S&P 500 trailed ex-U.S. stock markets by almost 6%. In 2018 the S&P 500 beat ex-U.S. stock markets by more than 9%. In 2017 it was almost impossible to lose money in the stock market.

How much has the stock market gone up under Trump?

The Dow Jones Industrial Average, made up of 30 large corporations, was up 56.7% during Trump’s time in office. And the NASDAQ composite index, made up of more than 3,000 companies including many in the technology sector, more than doubled under Trump — up 138.2% since he took office.

Is it difficult to make money in the stock market in 2018?

In 2018 it was difficult to make money in the stock market, especially towards the end of the year. In 2017 there was an astonishing lack of volatility or losses in stocks. In 2018 the markets reminded us that losses are a natural part of investing in risk assets.

Why is the stock market booming?

The booming stock market is the result of resurgent economic growth and blockbuster corporate profits. The biggest catalyst was likely the sweeping tax cuts President Trump just signed into law, which over time will save corporate America billions on what they owe Uncle Sam.

How much does the stock market gain each year?

about 10%The average return of the stock market over the long term is about 10%, as measured by the S&P 500 index. This long-term historical average is a more reasonable expectation for stock market returns, compared to the 14.5% annualized 10-year performance on the S&P 500 over the past decade, through March 31, 2022.

How much has the stock market increased in the last 10 years?

Looking at the S&P 500 from 2011 to 2020, the average S&P 500 return for the last 10 years is 13.95% (11.95% when adjusted for inflation), which is a little over the annual average return of 10%.

What is the 10 year average return on the Dow Jones?

15.03%Looking at the annualized average returns of these benchmark indexes for the ten years ending June 30, 2019 shows: S&P 500:14.70% Dow Jones Industrial Average: 15.03% Russell 2000: 13.45%

How much has the stock market gained since 2015?

Stock market returns since 2015 This investment result beats inflation during this period for an inflation-adjusted return of about 90.80% cumulatively, or 9.21% per year.

What was the average rate of return on stocks in 2021?

The S&P 500's average annual returns over the past decade have come in at around 14.7%, beating the long-term historic average of 10.7% since the benchmark index was introduced 65 years ago....The S&P 500's return can fluctuate widely year to year.YearS&P 500 annual return202018.4%202128.78 more rows•May 26, 2022

What was the average rate of return for 2021?

Wealthy Americans are pretty optimistic about their long-term investment returns, expecting to earn average annual returns of 17.5% above inflation from their portfolios. That's according to a new survey from Natixis that surveyed households that have over $100,000 in investable assets in March and April of 2021.

Will the stock market go up in 2021?

The S&P 500 stock index had a great run in 2021, rising more than 25 percent — on top of its 16 percent gain during the first year of the pandemic. The index hit 70 new closing highs in 2021, second only to 1995, when there were 77, said Howard Silverblatt, an analyst at S&P Dow Jones Indices.

How much has the stock market dropped in 2022?

Major indexes have notched big declines in 2022 as high inflation, rising interest rates and growing concerns about corporate profits and economic growth dent investors' appetite for risk. The blue-chips are down 18% this year, while the S&P 500 is down 23% and the tech-heavy Nasdaq Composite has fallen 32%.

How long did it take for stock market to recover after 2008?

The S&P 500 dropped nearly 50% and took seven years to recover. 2008: In response to the housing bubble and subprime mortgage crisis, the S&P 500 lost nearly half its value and took two years to recover. 2020: As COVID-19 spread globally in February 2020, the market fell by over 30% in a little over a month.

Will the stock market Crash 2022?

Stocks in 2022 are off to a terrible start, with the S&P 500 down close to 20% since the start of the year as of May 23. Investors in Big Tech are growing more concerned about the economic growth outlook and are pulling back from risky parts of the market that are sensitive to inflation and rising interest rates.

What is a reasonable annual return from stock market?

Generally speaking, if you're estimating how much your stock-market investment will return over time, we suggest using an average annual return of 6% and understanding that you'll experience down years as well as up years.

How much has the market gone up this year?

Performance5 Day-2.48%1 Month-6.63%3 Month-11.77%YTD-15.46%1 Year-11.69%

What happened in 2017?

The year 2017 was eventful, to say the least. President Trump and Congress tried, without success, to repeal the Affordable Care Act, known as Obamacare. However, the new year-end tax law included the elimination of the individual health insurance mandate. The U.S. economy started slowly but picked up steam as the year progressed. Ten years after its onset, the financial crisis officially came to an end in 2017. The gross domestic product expanded at an annual rate of 3.2% in the third quarter. The unemployment rate fell from 4.7% to 4.1%, while upwards of 2 million new jobs were added. The Federal Reserve, based on the strength of the economy and labor market, began to roll back its stimulus program and raised interest rates three times during the year. The stock market reached several historic highs in 2017. Consumer income rose and purchases increased, but inflation remained stubbornly below 2.0%. Business investment expanded in 2017 and is expected to surge in 2018. The year ended with the passage of sweeping tax reform legislation.

What is the economy like in 2018?

The year 2018 is off to a rousing start, with the passage of major tax overhaul legislation that could impact consumer and business income and equities. The U.S. economy, which got off to a slow start in 2017, picked up steam throughout the year and enters 2018 in pretty good shape. The U.S. economy as well as major world economies are expected to continue to grow this year. The Fed has indicated that it expects to raise interest rates three times this year despite stubborn inflationary expansion. The housing market should continue to grow, especially if builders pick up the pace of new residential construction to add to dwindling inventory. However, political unrest continues to plague Washington, with the cloud of the Russian investigation hanging overhead as we begin 2018.

How many days were the S&P 500 down in 2018?

In 2017 there wasn’t a single trading day in which the S&P 500 was up or down 2% or more. In 2018 there were 16 trading days where stocks were down 2% or worse, including four days in the 3% range, and one 4% down day.

How many down months were there in 2018?

In 2017 there wasn’t a single down month in the entire year. Going back to 1926, that’s never happened in the history of the stock market. In 2018 there were 4 down months and they were all relatively large drops (-3.6%, -2.8%, -6.8% and -9.0%).

Is it possible to lose money in the stock market in 2017?

In 2017 it was almost impossible to lose money in the stock market. In 2018 it was difficult to make money in the stock market, especially towards the end of the year. In 2017 there was an astonishing lack of volatility or losses in stocks. In 2018 the markets reminded us that losses are a natural part of investing in risk assets.

How does down year affect the market?

The market's down years have an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss.

What is the average annualized return of the S&P 500?

Between 2000 and 2019, the average annualized return of the S&P 500 Index was about 8.87%. In any given year, the actual return you earn may be quite different than the average return, which averages out several years' worth of performance. You may hear the media talking a lot about market corrections and bear markets:

How much money would you lose if you invested $1,000 in an index fund?

If you invested $1,000 at the beginning of the year in an index fund, you would have 37% less money invested at the end of the year or a loss of $370, but you only experience a real loss if you sell the investment at that time.

When does a bear market occur?

A bear market occurs when the market goes down over 20% from its previous high. Most bear markets last for about a year in length. 1 .

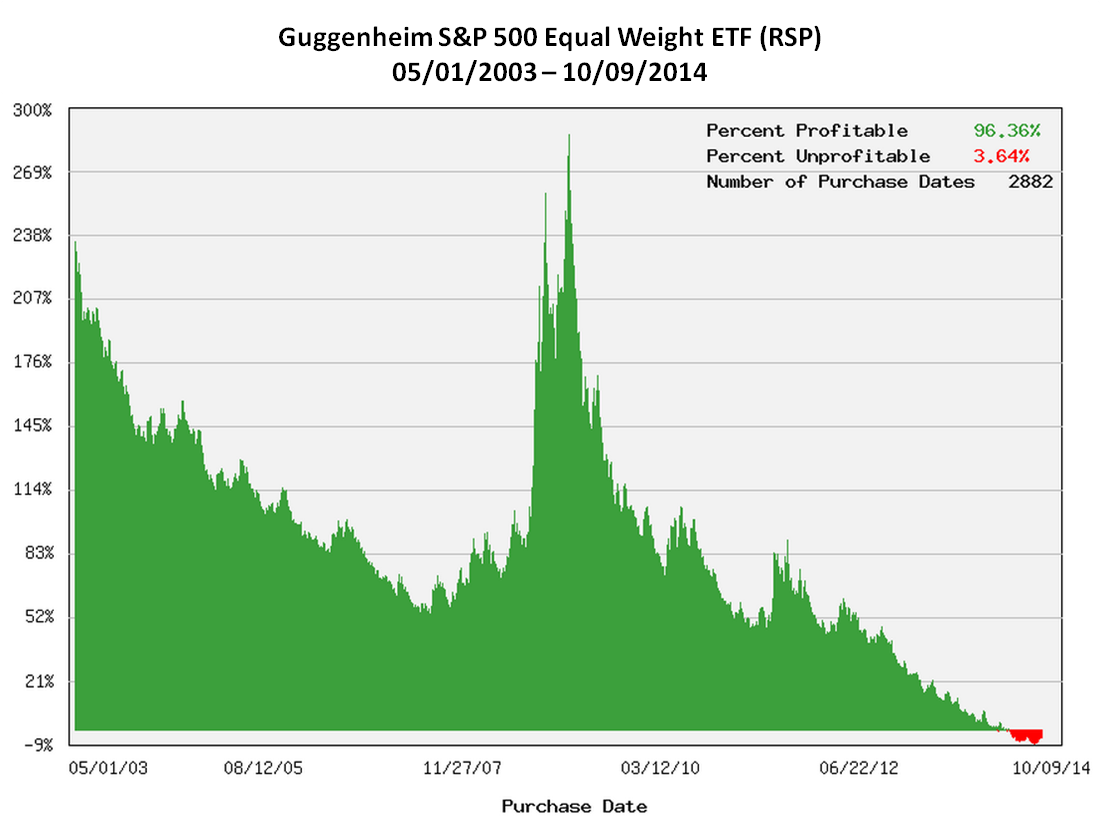

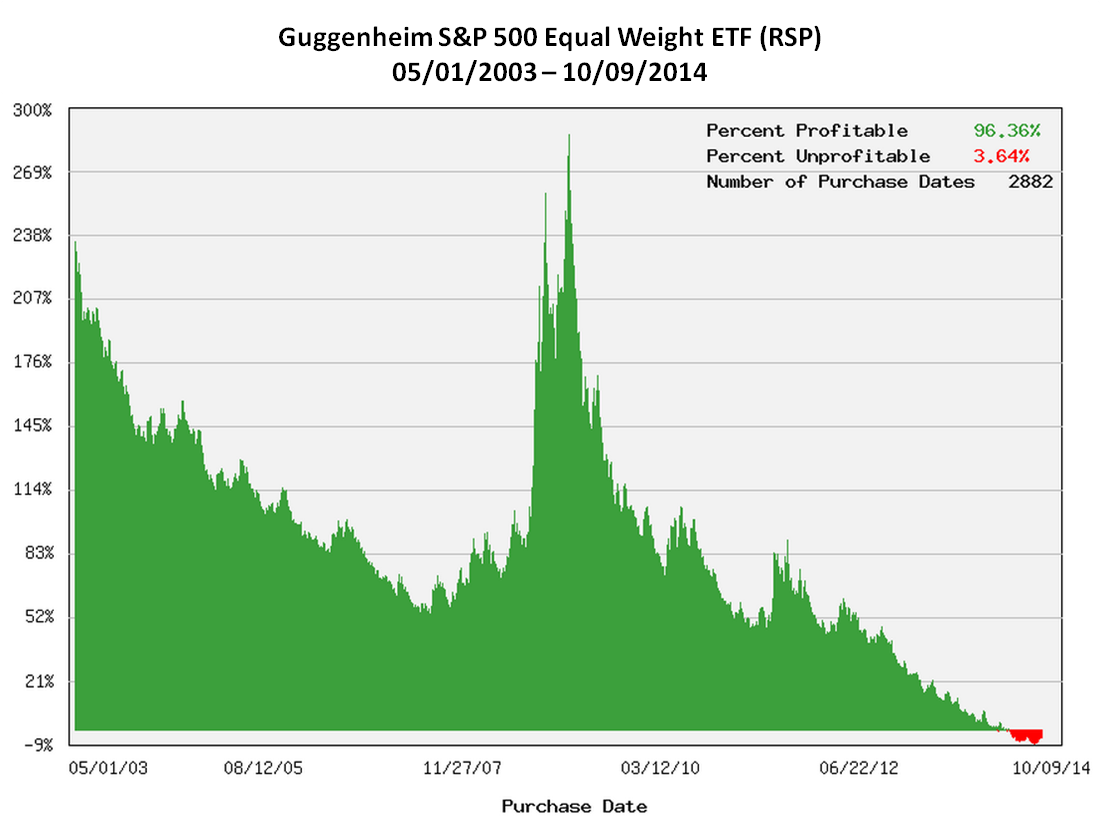

When to look at rolling returns?

You can alternatively view returns as rolling returns, which look at market returns of 12-month periods, such as February to the following January, March to the following February, or April to the following March. Check out these graphs of historical rolling returns, for a perspective that extends beyond a calendar year view.

Is the stock market cruel?

On the other hand, if you try and use the stock market as a means to make money fast or engage in activities that throw caution to the wind, you'll find the stock market to be a very cruel place. If a small amount of money could land you big riches in a super short timespan, everybody would do it.

Can you stay out of stocks during a bear market?

No one knows ahead of time when those negative stock market returns will occur. If you don't have the fortitude to stay invested through a bear market, then you may decide to either stay out of stocks or be prepared to lose money, because no one can consistently time the market to get in and out and avoid the down years.

Is M&A good for small cap stocks?

Being aware of the likelihood of M&A can be extremely useful, especially among the small-cap stocks that often become targets for much larger players in their respective industries. Finally, it's often valuable to look at losing stocks to see whether their losses are justified.

Does Dan Caplinger have a position in any of the stocks mentioned?

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Prev.

The online leader showed continued dominance while also making a big purchase

Throughout 2017, Amazon.com ( AMZN -1.57% ) looked as unbeatable as Mike Tyson during his heyday. The online retailer has grown despite the improved performance of some of its bigger rivals, and it made a smart move into brick-and-mortar by buying Whole Foods Market.

What happened

Through the first three quarters of its fiscal 2017, Amazon raised sales from $64 billion last year to over $72 billion in 2017. It also established its Alexa-powered devices as the prevailing standard for non-phone voice assistants and continued to grow its Amazon Web Services Business.

NASDAQ: AMZN

Delivery has been a key advantage for Amazon. Image source: Amazon.com.

So what

The improved efforts of its rivals, most notably Wal-Mart, meant that Amazon entered the year with some questions about whether it could keep up its torrid growth pace. Those questions were answered, and investors clearly liked what they saw.

Now what

Amazon has to fully integrate Whole Foods into its operations. That's not a major challenge, but it does require figuring out how to use those physical locations to increase its local same-day delivery.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.