Full Answer

Does Coca Cola pay a dividend?

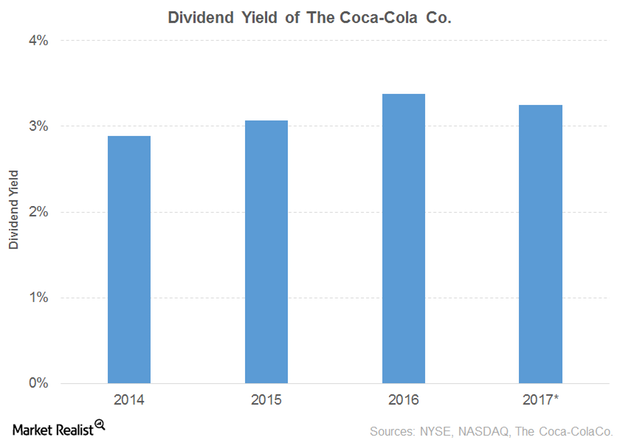

Coca-Cola pays a quarterly dividend of $0.42 per share, resulting in a dividend yield of 3.07 percent. The company’s dividend payout ratio, or the percentage of earnings paid out as dividends, has risen to over 100% in recent years.

When will Coca Cola pay next dividend?

When does the Company pay dividends? | The Coca-Cola Company. The Company normally pays dividends four times a year, usually April 1, July 1, October 1 and December 15. Shareowners of record can elect to receive their dividend payments electronically or by check in the currency of their choice. You can select your desired payment method by accessing your account online through Investor Centre at www.computershare.com/coca-cola or by contacting Computershare at 888-COKESHR (888-265-3747) or ...

How much dividend does Coca Cola pay?

Coca-Cola (NYSE:KO) pays investors a reliable dividend that yields about 3% per year. That’s better than the 1.6% yield you can expect from the average S&P 500 stock. However, income investors can secure an even higher payout without taking on much more risk.

Does Coca Cola Company (the) (KO) pay dividends?

weight management market document offers an in-depth investigation of the market driving factors, opportunities, restraints, and challenges for obtaining the crucial insight of the market. Such brilliant report has been prepared by a team of enthusiastic analysts, skilled researchers and experienced forecasters who work meticulously for the same.

Is Coca-Cola a good dividend stock?

When considering the merits of investing in Coca-Cola as a dividend stock, we can easily list the positive points: KO has paid a dividend for 60 consecutive years. KO has increased its dividend for more than 25 consecutive years.

How much dividend does Coca-Cola give you?

Coca-Cola KO –0.23% (ticker: KO) said this week it is raising its annual dividend to $1.76 a share from $1.68, an increase of nearly 5%. That equates to 44 cents on a quarterly basis, up from 42 cents.

What month does Coca-Cola pay dividends?

What Months Does Coca Cola Pay Dividends? On the other hand, the company's dividends are not quarterly or every 3 months. Coca Cola dividends are paid in April, then July, October, and December.

How much was Coca-Cola's last dividend?

Dividend History for Coca-Cola Co. (ko)Ex-Div. DateAmountYield9/14/2020$0.413.2%6/12/2020$0.413.6%3/13/2020$0.413.4%9/13/2019$0.402.9%35 more rows

What stock pays the highest dividend?

Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream....25 high-dividend stocks.SymbolCompany NameDividend YieldMOAltria Group Inc.6.66%OKEONEOK Inc.5.68%UVVUniversal Corp.4.96%LAMRLamar Advertising Co4.90%21 more rows•Jun 1, 2022

What stock pays the best dividend?

9 highest dividend-paying stocks in the S&P 500:Philip Morris International Inc. (PM)Vornado Realty Trust (VNO)Simon Property Group Inc. (SPG)International Business Machines Corp. (IBM)Oneok Inc. (OKE)Kinder Morgan Inc. (KMI)AT&T Inc. (T)Altria Group Inc. (MO)More items...

Is Coke a good stock to buy?

The average one year price target of 14 analysts rating the company is $65.53. The average price target of the nine analysts that rated the company following the most recent earnings release is $66.00. Coke has a forward P/E of 24.63x, very near its 5-year average P/E of 24.37x. The company's 5-year PEG is 2.74x.

How long do you have to hold a stock to get the dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

What is a good dividend yield?

What is a good dividend yield? In general, dividend yields of 2% to 4% are considered strong, and anything above 4% can be a great buy—but also a risky one. When comparing stocks, it's important to look at more than just the dividend yield.

What stocks pay dividends monthly?

7 best monthly dividend stocks for a steady income stream:EPR Properties (EPR)Horizon Technology Finance Corp. (HRZN)LTC Properties Inc. (LTC)Main Street Capital Corp. (MAIN)Pembina Pipeline Corp. (PBA)PennantPark Floating Rate Capital Ltd. (PFLT)Stellus Capital Investment Corp. (SCM)

Does Amazon pay a dividend?

Amazon's lack of a dividend certainly has not hurt investors to this point, as Amazon has been a premier growth stock. Over the past 10 years, Amazon stock generated returns above 30% per year. But for income investors, Amazon may not be an attractive option due to the lack of a dividend payment.

What is Coca-Cola's dividend yield?

The current dividend yield for Coca-Cola (NYSE:KO) is 2.72%. Learn more on KO's dividend yield history.

How much is Coca-Cola's annual dividend?

The annual dividend for Coca-Cola (NYSE:KO) is $1.76. Learn more on KO's annual dividend history.

How often does Coca-Cola pay dividends?

Coca-Cola (NYSE:KO) pays quarterly dividends to shareholders.

When is Coca-Cola's next dividend payment?

Coca-Cola's next quarterly dividend payment of $0.44 per share will be made to shareholders on Friday, July 1, 2022.

When was Coca-Cola's most recent dividend payment?

Coca-Cola's most recent quarterly dividend payment of $0.44 per share was made to shareholders on Friday, April 1, 2022.

Is Coca-Cola's dividend growing?

Over the past three years, Coca-Cola's dividend has grown by an average of 2.50% per year.

What track record does Coca-Cola have of raising its dividend?

Coca-Cola (NYSE:KO) has increased its dividend for the past 61 consecutive years.

When did Coca-Cola last increase or decrease its dividend?

The most recent change in Coca-Cola's dividend was an increase of $0.02 on Thursday, February 17, 2022.

What is Coca-Cola's dividend payout ratio?

The dividend payout ratio for KO is: 73.95% based on the trailing year of earnings 71.26% based on this year's estimates 66.92% based on next ye...

How much did Coca Cola pay in dividends in 2019?

The company spent $6.8 billion on dividends in 2019, fueled by $9.4 billion in free cash flows. Coca-Cola's market cap passed that level in the summer of 1985. In other words, Coke sent out enough dividend payments last year to cover the company's entire market value at the introduction of New Coke.

How many times has Coca Cola split?

If you reinvested your dividend checks along the way, the return would have doubled again. Coca-Cola's stock has split 13 times over the years. One original share from 1919 has now grown into 9,216 stubs, and each one was worth $47.80 at the close of Friday's trading. That works out to $1.1 million for a $100 investment.

1. Bristol Myers Squibb

Drug manufacturer Bristol Myers Squibb currently pays its shareholders a quarterly dividend of $0.49, a yield of 3.2%. Last month, the company also raised its dividend payments by 8.9%, marking the 12th consecutive year the company has hiked its payouts.

2. Royal Bank of Canada

Another safe dividend stock is Royal Bank of Canada. It's not often that you can lock in a great yield with a top bank stock, but that's exactly the situation investors can take advantage of right now. With a dividend yield of around 4%, RBC pays you more than Coca-Cola does while providing you with lots of safety as one of Canada's top banks.

3. Verizon Communications

The highest yield on this list belongs to telecom giant Verizon, which today pays its shareholders a yield of 4.3%. In September, it hiked its dividend payments for the 14th year in a row, from $0.615 to $0.6275.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.