How much does it cost to buy 100 shares of Google?

Table of Contents. Investing in a stock generally requires you to pay the share price multiplied by the number of shares bought. If you wanted 100 shares of Google (GOOG), now Alphabet Inc., it would cost around $108,000 (100 * $1080.00) as of March 2018.

Is Google stock a buy or sell?

Google Stock: Is It A Buy Now? Google stock owns an Accumulation/Distribution Rating of D-minus. That rating analyzes price and volume changes in a stock over the past 13 weeks of trading. The rating, on an A+ to E scale, measures institutional buying and selling in a stock.

How many shares of stock should you buy for $3000?

While $3,000 seems like a hefty price for one share of stock, the number of shares you buy isn't what really matters. For example, Apple executed a 4-for-1 stock split in August. For each share worth about $500, shareholders received four shares worth about $125 each.

How much would you lose if you invested in Google stock?

However, if you owned a call option of 100 shares of Google you would have only lost the premium paid. If you paid $61.20 per share for a call option of 100 shares of Google, you would have only lost $6,120 instead of $47,500.

How much does it cost to buy into Google stock?

If you're wondering how much it costs to buy Google stock, the price is high — over $1770 per share. In other words, you'll need over $17,700 to buy 10 shares or $177,000 to buy 100. That said, you can start investing in Google stock one share at a time.

How much would I have if I invested $1000 in Google?

Currently, Alphabet has a market capitalization of $1.86 trillion. Buying $1000 In GOOGL: If an investor had bought $1000 of GOOGL stock 15 years ago, it would be worth $12,296.42 today based on a price of $2821.60 for GOOGL at the time of writing.

Is Google stock a buy sell or hold?

IBD's Composite Rating combines five separate proprietary ratings into one easy-to-use rating. The best growth stocks have a Composite Rating of 90 or better. Google stock holds an entry point of 3,031.03 on a daily chart. As of June 21, GOOGL stock is not in a buy zone amid volatility in the tech sector.

How much will Google stock be worth in 5 years?

Based on our forecasts, a long-term increase is expected, the "GOOGL" stock price prognosis for 2027-06-16 is 5238.090 USD. With a 5-year investment, the revenue is expected to be around +134.01%. Your current $100 investment may be up to $234.01 in 2027.

Where should I invest $1000 right now?

7 best stocks to buy with $1,000:Microsoft Corp. (MSFT)Alphabet Inc. (GOOG, GOOGL)Amazon.com Inc. (AMZN)Berkshire Hathaway Inc. (BRK. A, BRK.B)Meta Platforms Inc. (META)JPMorgan Chase & Co. (JPM)Bank of America Corp. (BAC)

Is it worth investing in Google?

Google is one of the most successful stocks of the 21st century, launching at just over $50 a share in August 2004 before reaching a 2019 value of just over $1,125 class A per share value.

What will Google stock be worth in 2025?

According to the latest long-term forecast, Google price will hit $2,500 by the end of 2022 and then $3,000 by the end of 2024. Google will rise to $3,500 within the year of 2025, $4,000 in 2026 and $5,000 in 2027.

How can I buy Google stock?

How to Buy Google Stock SharesOpen a brokerage account. Brokerage accounts are trading accounts that you can open with a brokerage company. ... Execute a buy order. The next step is initiating a buy order to purchase shares of Google stock. ... Consider buying mutual funds or ETFs instead.

Does Google stock pay dividends?

Many technology companies pay dividends, or regular cash distributions from earnings, to their shareholders. Alphabet (GOOGL), the parent company of Google, isn't one of them.

Can Google stock hit $5000?

Google isn't just one the largest and most powerful companies in the world right now – it is also one of the most highly diversified too, with a portfolio of businesses representing a plethora of segments, many of which offer promising growth opportunities in the future.

What will Google stock price be in 2030?

Based on long term forecasts, the price of Alphabet (GOOG) will increase to $3,000 by the end of 2022 then $3,500 in 2023. Alphabet stock will keep rise to $4,500 in 2025, $5,800 in 2027 and $6,800 in 2030.

Is Google a buy in 2022?

Google stock price prediction Based on the data compiled by Tip Ranks at the time of writing on 3 May 2022, nine Wall Street analysts rated the stock a 'buy'. Their consensus 12-month Google stock price target was $3,356.67, with the price projection varying from the low of $3,000 to the high of $3,750.

Is Alphabet stock a Buy, Sell or Hold?

Alphabet stock has received a consensus rating of buy. The average rating score is and is based on 95 buy ratings, 4 hold ratings, and 0 sell ratings.

What was the 52-week low for Alphabet stock?

The low in the last 52 weeks of Alphabet stock was 2,038.03. According to the current price, Alphabet is 109.09% away from the 52-week low.

What was the 52-week high for Alphabet stock?

The high in the last 52 weeks of Alphabet stock was 3,029.06. According to the current price, Alphabet is 73.40% away from the 52-week high.

What are analysts forecasts for Alphabet stock?

The 99 analysts offering price forecasts for Alphabet have a median target of 2,752.81, with a high estimate of 4,183.00 and a low estimate of 1,65...

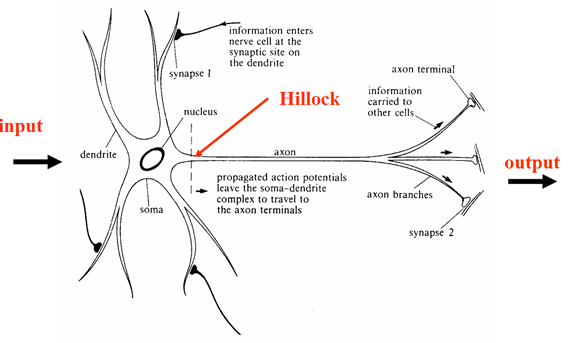

Google Option Chain

For illustrative purposes, take a look at the option chain of Google taken from Nasdaq as of September 3, 2014. The option is an American call option .

An Options Example

If you have a short-term investment horizon, you could probably take a call option expiring on October 18, 2014, as shown in the table above. The strike price is the price at which you have the right but not the obligation to buy the stock. The price you pay to have this option is the premium price or the last price.

Opportunity and Protection

Another benefit of investing in Google or any other company using options is the protection an option carries if the stock falls sharply. The fact you don't own the stock, only the option to buy the stock at a certain price, protects you if the stock takes a plunge.

The Bottom Line

Using options is a cost-effective way to gain exposure to a stock without risking a lot of capital and still be protected on the downside. One of the main drawbacks is the liquidity of the option contract itself.

How to Buy Google Stock

Before you get too far down the road of buying Google stock, you first need to decide which kind of Google stock you want to buy. That’s right. Shares of Google—or rather its parent company, Alphabet, Inc.—comes in two main flavors: GOOGL and GOOG.

Wealthfront

Because you likely can’t afford a whole share of GOOG or GOOGL, at least not right away, you’ll need to decide on how much (and how) you want to invest. Ask yourself these questions to figure out your ideal initial investment.

How to Sell Google Stock

When you’re ready to sell your Google stock, the process is as easy as buying your shares. Simply log into your broker’s trading platform and enter the ticker symbol and the number of shares or dollar amount you want to sell.

How to Invest in Google with an Index Fund

Investing in any individual stock, even Google, is a risky bet. That’s why financial advisors recommend a diversified approach that involves investing in tens, if not hundreds, of stocks.

How much did Google buy in the fourth quarter?

In the fourth quarter, Google bought $7.9 billion of its own shares. It also purchased $7.9 billion in the September quarter and $6.9 billion in the June quarter. Google has about $15.4 billion remaining in a stock buyback authorization.

How much will YouTube revenue be in 2025?

Amazon and Microsoft ( MSFT ). Bank of America forecasts that YouTube's subscription business will reach $18 billion in revenue by 2025, up from $5 billion in 2020.

How has Google harmed competition?

The Justice Department charged that Google has harmed competition and consumers by monopolizing internet search and search-related advertising. Due to its huge cash holdings, GOOGL stock has shrugged off three fines totaling $9.3 billion levied by the European Union on antitrust grounds.

What is Google's AI?

At a Google developers conference in mid-May, the company demonstrated how it uses AI tools in a wide range of applications, including Google Workspace, Google Maps, virtual reality, voice-based search and photos.

When will Google stop supporting third party cookies?

While Google has expanded into cloud computing and consumer hardware, digital advertising still makes up the lion's share of revenue. Google on June 24 said it would delay plans to have its Chrome internet browser stop supporting third-party cookies by late 2023, two years later than its initial timeframe.

Is Amazon taking Google stock?

Amazon is taking market share from Google stock in internet search-related advertising, said a report from market research firm eMarketer. With Amazon gaining ground in digital advertising, Google in 2020 made a big change in how it handles e-commerce listings.

Is Google Cloud a competitor to Amazon?

Google's cloud computing business, meanwhile, lags rivals Amazon and Microsoft. Google brought in Thomas Kurian, a former Oracle ( ORCL) executive, to improve performance in the corporate market. Bulls say Google Cloud Platform is beginning to take share as it focuses on security, open source software and data analytics.

How much of the search market is Google?

As of October 2019, Google search controls 88.3% of the U.S. search market, according to gs.statcounter.com. Moreover, that same source pegs the company's current share of the global market at 92.8%.

Is Alphabet stock going to outperform?

There are good reasons to believe that Alphabet stock will continue to outperform the market for some time. In addition to having growth potential left in its more established businesses, the company's newer and more newly monetized businesses have potentially huge runways for growth.

How much of Amazon's sales are online?

Its ability to take chances is a hallmark of innovation and a reason why it comes out on top, despite sometimes failing. Amazon now accounts for almost 40% of all online sales in the U.S., according to Statista. That massive scale would make it challenging for anyone else to catch up.

Is it better to invest in high growth or low risk stocks?

But a mixture of high growth and value stocks, or low- and high-risk stocks, is a better way to succeed as an investor. However, if you already own a range of stocks, adding $3,000 to own a position in Amazon could further diversify your holdings.