What is the best way to short a stock?

Short Squeeze Penny Stocks To Watch

- Harbor Custom Development Inc. (NASDAQ: HCDI) Shares of Harbor Custom Development are no stranger to big moves. ...

- Kala Pharmaceuticals Inc. (NASDAQ: KALA) Unlike Harbor, Kala Pharmaceuticals has been relatively flat this month. ...

- Vertex Energy Inc. ...

- Leap Therapeutics Inc. ...

- Katapult Holdings Inc. ...

How do you short sell a stock?

- Shorting is the process of selling stock short. When you short a stock, you sell stock that you borrowed from your broker at a set price. ...

- Covering happens when you close the short sale transaction. ...

- Margin is the way you purchase stocks to be sold short. ...

How to short stocks for beginners?

3 Possible Trades On Netflix Stock

- Buy NFLX Shares At Current Levels Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing ...

- Buy An ETF With NFLX As A Holding Readers who do not want to commit capital to Netflix stock but would still like to have exposure to the shares ...

- Bear Put Spread

Should the average investor sell short stocks?

Use this information to your advantage and time your short sales accordingly. For most investors, short selling should only be one part of an overall investing and wealth management strategy that includes portfolio management, diversified holdings, short-term and long-term funds and ETFs, and other investments, such as real estate.

What is the penalty for short selling?

Rs. 1,00,000 per client, whichever is lower, subject to a minimum penalty of Rs....Short Reporting of Margins in Client Margin Reporting Files.Short collection for each clientPenalty percentage(< Rs 1 lakh) And (< 10% of applicable margin)0.5%(= Rs 1 lakh) Or (= 10% of applicable margin)1.0%

Who pays out when you short a stock?

Since their shares have been sold to a third party, the short-seller is responsible for making the payment, if the short position exists as the stock goes ex-dividend.

Can you short on Robinhood?

Shorting stocks on Robinhood is not possible at present, even with a Robinhood Gold membership, the premium subscriptions which allows Robinhood investors to use margin for leveraging returns. Instead, you must either use inverse ETFs or put options.

How long can you be short on a stock?

There is no mandated limit to how long a short position may be held. Short selling involves having a broker who is willing to loan stock with the understanding that they are going to be sold on the open market and replaced at a later date.

What is short selling in stock market?

Short selling refers to the process of selling a security not owned by the investor with the intention of buying it back at a later date at a cheaper price. Since the investor doesn’t own the security, he typically borrows it from a broker/dealer and short sells it in the market.

What happens if the stock price falls?

If the stock price has fallen, the investor will make a profit in the deal. The investor also has to pay a fee to the lender for the borrowed stock, which is known as the borrowing costs.

What is the uptick rule in stock market?

This is called the uptick rule. This rule is put in place to limit the volatility of fluctuations in the market.

Do you have to deposit margin in short selling?

Similar to margin trading, an investor is required to deposit a margin in case of short selling also. This is because the rise in the stock price, instead of fall as expected by him, will expose the investor to losses, which otherwise will have to be covered by the broker/dealer.

Can brokers create leverage?

With this rule in place, the brokers can create only a limited amount of leverage. In the UK, instead of uptick rule, the leverage is limited using the capital adequacy norms. Since the capital of a firm is limited, there is a limit on the total risk and the degree of leverage. Similar to margin trading, an investor is required to deposit ...

What happens when a stock falls short?

If the stock price falls, you’ll close the short position by buying the amount of borrowed shares at the lower price, then return them to the brokerage. Keep in mind that to earn a profit, you’ll need to consider the amount you’ll pay in interest, commission and fees.

What is shorting strategy?

Investors may use a shorting strategy as a form of speculation. In other words, it’s a high-risk maneuver that could possibly yield high returns in exchange for taking on exceptional risk. Where a long-term investor may base their decision on thorough examination of the company’s financials, management and future potential, ...

What is the short selling controversy?

Short-selling controversy. Short-sellers receive all kinds of criticism. They've been accused of hurting businesses, manipulating public opinion and spreading rumors about a company or stock. It's even been implied that short-sellers are almost unpatriotic for not supporting publicly traded companies.

How long can you hold on to a borrowed stock?

You can maintain the short position (meaning hold on to the borrowed shares) for as long as you need, whether that’s a few hours or a few weeks. Just remember you’re paying interest on those borrowed shares for as long as you hold them, and you’ll need to maintain the margin requirements throughout the period, too.

What happens when you short a stock?

When you short a stock, you expose yourself to a large financial risk. One famous example of losing money due to shorting a stock is the Northern Pacific Corner of 1901. Shares of the Northern Pacific Railroad shot up to $1,000.

How does shorting stock work?

How Shorting Stock Works. Usually, when you short stock, you are trading shares that you do not own. For example, if you think the price of a stock is overvalued, you may decide to borrow 10 shares of ABC stock from your broker. If you sell them at $50 each, you can pocket $500 in cash.

What happens if you buy 10 shares of a stock for $250?

If the price of the stock goes down to $25 per share, you can buy the 10 shares again for only $250. Your total profit would be $250: the $500 profit you made at first, minus the $250 you spend to buy the shares back. But if the stock goes up above the $50 price, you'll lose money.

What is the rule for shorting a stock?

Shorting a stock has its own set of rules, which are different from regular stock investing, including a rule designed to restrict short selling from further driving down the price of a stock that has dropped more than 10% in one day , compared to the previous day's closing price. 4.

What is short selling?

Shorting stock, also known as "short selling," involves the sale of stock that the seller does not own or has taken on loan from a broker. 1 Investors who short stock must be willing to take on the risk that their gamble might not work.

Why do you short a stock?

Usually, you would short stock because you believe a stock's price is headed downward. The idea is that if you sell the stock today, you'll be able to buy it back at a lower price in the near future.

What happens if a stock goes up to $50?

But if the stock goes up above the $50 price, you'll lose money. You'll have to pay a higher price to repurchase the shares and return them to the broker's account. For example, if the stock were to go to $250 per share, you'd have to spend $2,500 to buy back the 10 shares you'd owe the brokerage.

What does shorting a stock mean?

The process of shorting a stock is exactly like selling a stock that you already own. If you sell shares that you don’t own, then your sell order initiates a short position, and the position will be shown in your portfolio with a minus in front of it.

What is short selling?

What short selling is and how it works. Buying a stock is also known as taking a long position. A long position becomes profitable as the stock price goes up over time, or when the stock pays a dividend. But short selling is different. It involves betting against a stock and profiting as it declines in price.

What happens when you buy a stock back?

When you buy the stock back, you automatically return it to the lender and close the short position. If you buy the stock back at a lower price than you sold it at, then you pocket the difference and make a profit. The process of shorting a stock is exactly like selling a stock that you already own.

What is put option?

Many traders prefer to bet against stocks using options contracts called put options. The put option gains value as the stock price goes down. Unlike short selling, your maximum loss on a put option is 100%. It will go to zero if the stock doesn’t drop below a certain price by the time the put option expires.

What happens if a stock goes down?

If the stock goes down, the trader makes a profit, but there are several major risks involved. Because of the various risks, short selling can lead to big losses and is considered much riskier than simply buying and holding stocks.

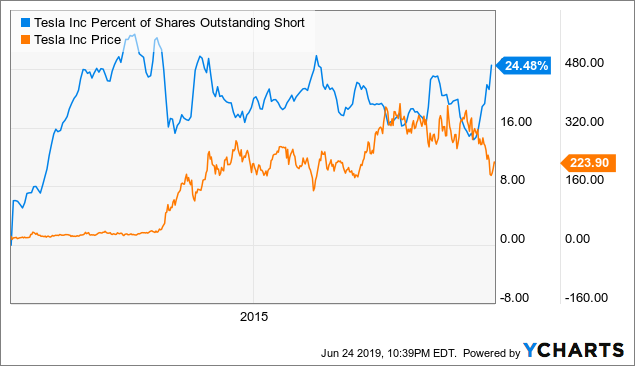

How much did Tesla stock increase in three months?

It increased from about $250 per share to over $900 per share in three months.

How does short selling work?

Here’s how short selling works: A short seller borrows a stock, then sells it immediately on the open market and gets cash in return. After some time, the short seller buys the stock back using cash and returns it to the lender.

How to short a stock?

In order to use a short-selling strategy, you have to go through a step-by-step process: 1 Identify the stock that you want to sell short. 2 Make sure that you have a margin account with your broker and the necessary permissions to open a short position in a stock. 3 Enter your short order for the appropriate number of shares. When you send the order, the broker will lend you the shares and sell them on the open market on your behalf. 4 At some point, you'll need to close out your short position by buying back the stock that you initially sold and then returning the borrowed shares to whoever lent them to you, via your brokerage company. 5 If the price went down, then you'll pay less to replace the shares, and you keep the difference as your profit. If the price of the stock went up, then it'll cost you more to buy back the shares, and you'll have to find that extra money from somewhere else, suffering a loss on your short position.

How does short selling work?

Here's how short selling can work in practice: Say you've identified a stock that currently trades at $100 per share. You think that stock is overvalued, and you believe that its price is likely to fall in the near future. Accordingly, you decide that you want to sell 100 shares of the stock short. You follow the process described in the previous section and initiate a short position.

Can short sellers close their positions?

In addition, short sellers sometimes have to deal with another situation that forces them to close their positions unexpectedly. If a stock is a popular target of short sellers, it can be hard to locate shares to borrow.

Is shorting a stock better than selling?

Shorting a stock can also be better from a tax perspective than selling your own holdings, especially if you anticipate a short-term downward move for the share price that will likely reverse itself.

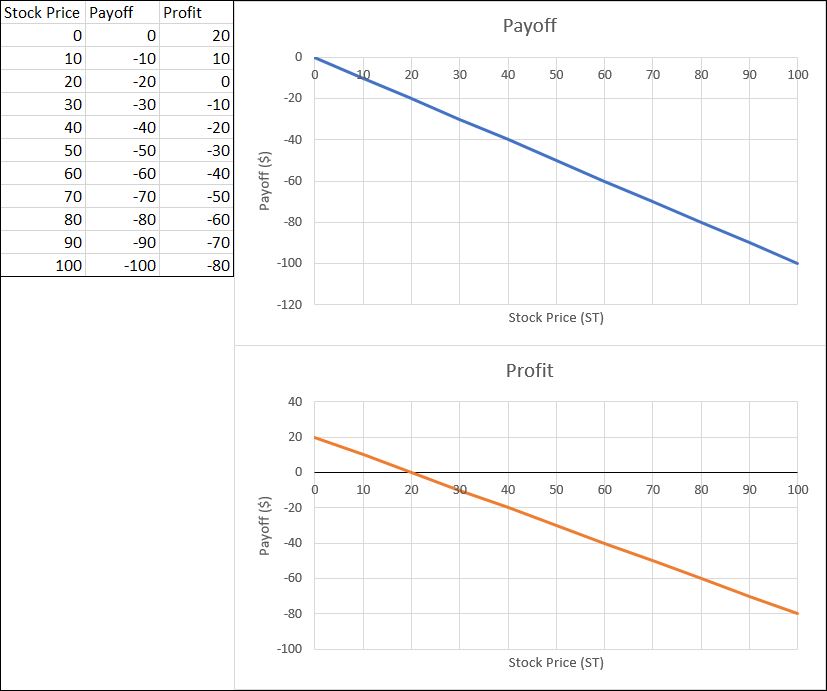

How to Calculate a Short Sale Return

To calculate the return on any short sale, simply determine the difference between the proceeds from the sale and the cost associated with selling off that particular position. This value is then divided by the initial proceeds from the sale of the borrowed shares.

Examples of Returns on Short Sales

The following table clarifies how different returns are calculated based on the change in stock price and the amount owed to cover the liability .

The Bottom Line

When calculating the return of a short sale, one must compare the amount that the trader is entitled to keep, with the initial amount of the liability. Had the trade in our example turned against the short seller, they would not only owe the amount of the initial proceeds, but they would also be on the hook for the excess amount.

What is short sale?

A short sale involves the sale of borrowed securities. These securities must be first located and loaned to the short seller in a margin account. While the shares are being borrowed, the short seller must pay interest and other charges on the loaned shares.

What is a stock loan fee?

A stock loan fee, or borrow fee, is a fee charged by a brokerage firm to a client for borrowing shares. A stock loan fee is charged pursuant to a Securities Lending Agreement (SLA) that must be completed before the stock is borrowed by a client (whether a hedge fund or retail investor ). A stock loan fee can be contrasted with a stock loan rebate, ...

Why do you borrow stock?

Stock is generally borrowed for the purpose of making a short sale. The degree of short interest, therefore, provides an indication of the stock loan fee amount. Stocks with a high degree of short interest are more difficult to borrow than a stock with low short interest, as there are fewer shares to borrow. Stock loan fees may be worth paying ...

What is the goal of a short seller?

The goal of the short seller is to sell the securities at a higher price and then buy them back at a lower price. These transactions occur when the securities borrower believes the price of the securities is about to fall, allowing them to generate a profit based on the difference in the selling and buying prices.

How does a stock loan work?

As short sellers immediately sell the borrowed stock, the borrower must reassure the lender by putting up collateral such as cash, treasuries, or a letter of credit from a U.S. bank.

How much equity do you need to short on TD Ameritrade?

In order to short sell on TD Ameritrade, you must have a margin-enabled, non-retirement account with at least $2,000 in marginable equity. The equity required to maintain your short position may vary based on the market price of the security you shorted, and if the short position moves against you your account could face a margin call, ...

Does TD Ameritrade mark short positions?

TD Ameritrade will also mark to market your short positions at the end of each day, meaning that if the position moves against you (the stock price increases) your short balance will become more negative and your short position will reflect an unrealized loss. If this happens, you may be required to post additional cash to your account to cover ...