Full Answer

How much does fidelity cost per trade?

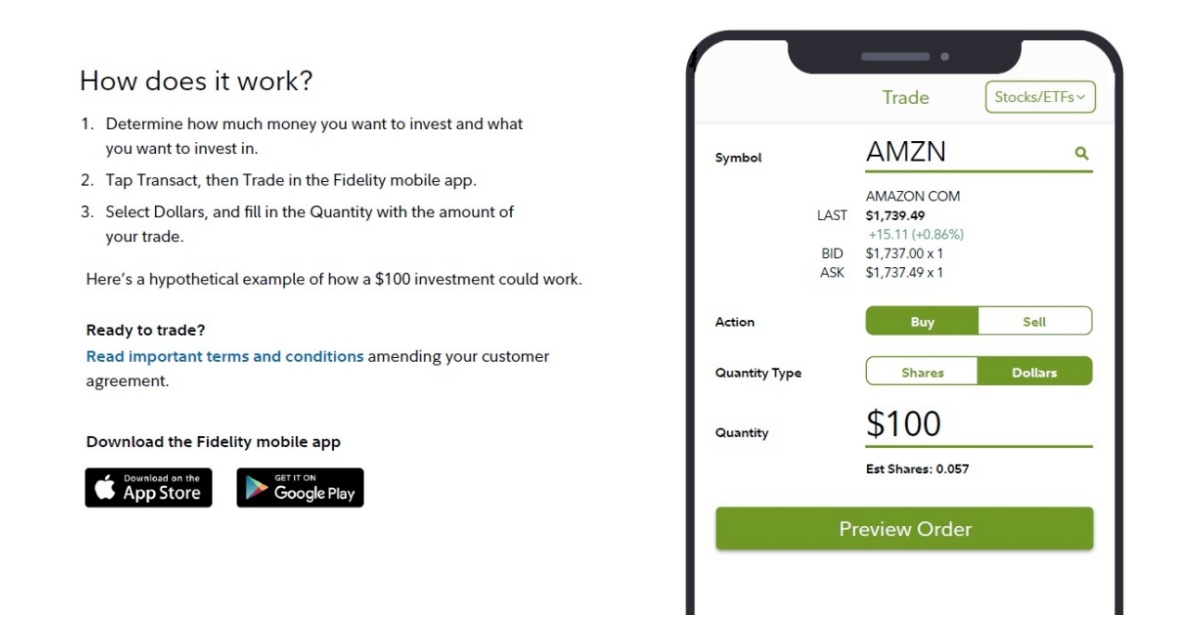

Per options trade, Fidelity charges $7.95 plus $0.75 per contract. The per-contract fee isn’t very high, but the per-trade charge is. You can find better per-trade options prices elsewhere. Fidelity offers 1,400 no-load mutual funds. Additional fees vary by mutual fund. FundsNetwork Transaction Fee funds are charged a $75 flat fee. Margin ...

Does fidelity have trade fees?

You can choose to buy or sell shares directly from the fund itself or its principal underwriter or distributor without paying a transaction fee to Fidelity. Short-term trading fee: Fidelity charges a short-term trading fee each time you sell or exchange shares of a FundsNetwork NTF fund held less than 60 days. This fee does not apply to Fidelity funds, money market funds, FundsNetwork Transaction Fee funds, FundsNetwork load funds, funds redeemed through the Personal Withdrawal Service, or ...

How much does fidelity cost?

The fee is $49.95 when transacted on-line. If a mutual fund is bought at Fidelity that does not appear on the broker’s NTF list, there is a steep $49.95 transaction fee. How Does Fidelity make money without fees? Fidelity charges no commissions for online equity, ETF or OTCBB trades. There is no per-leg commission on options trades.

Does fidelity charge trading fees?

Fidelity does not charge commission fees on trades for most securities. You can learn more about Fidelity's fee structure and schedule online. Trading Commissions and Fees. There is a fee when buying or selling shares of foreign corporations (known as foreign ordinary shares) on the over-the-counter (OTC) market that are not eligible for ...

See more

Does Fidelity charge per trade or per share?

Zero expense ratio index fundsStocks & optionsETFsBonds & CDs$0 per stock or options trade plus $0.65 per contract on options$0 per trade for all ETFs$1 per bond or CD in secondary trading and free for US Treasuries traded online4 The potential to save an average of $15 per bond5

Does Fidelity have hidden fees?

The good news is that the bait — Fidelity Zero Total Market Index Fund and Fidelity Zero International Index Fund — is as advertised: There are no hidden fees, and costs are not simply waived temporarily.

Does Fidelity have free trading?

$0.00 commission applies to online U.S. equity trades, exchange-traded funds (ETFs) and options in a Fidelity retail brokerage account only for Fidelity Brokerage Services LLC retail clients.

Are Fidelity's fees high?

Fidelity has ranked highly in our Best for Low Cost category every year. It offers commission-free online U.S. stock, ETF, and options trading—and there are no account fees or minimums to open a retail brokerage account.

How Does Fidelity make money on stock trades?

Introduction. Fidelity makes money by charging its clients fees for the management of accounts and other services. Despite being one of the largest no-commission brokers, Fidelity doesn't use the payment-for-order flow model used by so many of its peers like Charles Schwab, TD Ameritrade, and Robinhood.

Is there a fee for selling stocks?

Trade commission: Also called a stock trading fee, this is a brokerage fee that is charged when you buy or sell stocks. You may also pay commissions or fees for buying and selling other investments, such as options or exchange-traded funds.

How many trades can I make per day on Fidelity?

If you trade four or more times in five business days, and if the value of those trades is more than 6% of that period's total trading activity, you will be identified as a “pattern” day trader under FINRA Rule 4210. Thereupon, you will be required to maintain a $25,000 account minimum, or face restrictions on trading.

What percentage does Fidelity take?

Transaction Fee Pricing ScheduleMethod of purchasing a transaction fee fundTransaction fee (purchases only)Online$49.95 for most funds*Fidelity Automated Service Telephone (FAST®)25% off representative-assisted rates Maximum: $187.50 Minimum: $75Representative-assisted0.75% of principal Maximum: $250 Minimum: $100

Is Fidelity good for beginners?

Fidelity is best for: Beginner investors. Research and data. Retirement planning assistance.

Can you day trade on Fidelity?

While in a day trade call, your account will be restricted to day trading buying power of only 2 times maintenance margin excess. You have 5 business days to deposit cash or marginable securities to meet the call.

Is Fidelity better than Robinhood?

Although Robinhood is typically thought of as a beginner-friendly investing app, Fidelity actually earned the title of Best Broker for Beginning Investors and the Best App for Investing in NerdWallet's 2022 Best-Of Awards.

How much does Fidelity charge for cashing?

Free withdrawal, but wire transfers in other than USD costs 3%. Free withdrawal, but wire transfers cost $30.

How much does Fidelity charge for mutual funds?

Transaction-fee funds at Fidelity normally cost $49.95. This charge is only applied to purchases. The exact commission a mutual fund carries is displayed on its information page on Fidelity's website. In either case, the fee is not applied to sales or exchanges. A round-trip will average either $24.98 or $37.50 per leg. In either case, several other firms are cheaper, including Ally Invest, which charges $9.95 per transaction.

How many funds does Fidelity have?

Sorting through the various offerings is easy using Fidelity's user-friendly mutual fund screener. It returns over 11,500 funds that are open to new investors. Of these, roughly 3,600 come with no transaction fee. Several criteria can be chosen to search with, such as turnover ratio, inception date, standard deviation, and more. The screener's results can be sorted by various categories, including expense ratio, NTF status, Morningstar category, and more.

How much does a mutual fund need to be to be a Fidelity?

Every mutual fund at Fidelity has at least a $2,500 minimum initial purchase requirement. Certain funds have higher minimums. For example, some Fidelity institutional class funds have minimums as high as $10,000,000. American Century has several funds with a $5,000,000 minimum, and John Hancock requires $250,000 purchase amounts in several funds. Most mutual funds on the Fidelity website have a $2,500 minimum.

What is a fund pick from Fidelity?

A pre-screened group of mutual funds called Fund Picks From Fidelity is available to all the broker's clients. These securities are screened by Fidelity's investment professionals every quarter to ensure the funds beat their peers on a risk-adjusted basis.

How much does it cost to use a live agent?

Using a live agent over the phone to complete a sale in less than 2 months incurs a charge of 0.75% of principal, with a $250 maximum and a $100 minimum. Utilizing the broker's automated phone system reduces these costs by 25%.

Does Fidelity charge an annual fee?

Fidelity does not charge an annual fee for regular brokerage individual or joint taxable accounts. The firm also does not have an annual IRA fee (except for $25 annual SIMPLE IRA fee). There are no monthly account charges.

Does Fidelity have a redemption fee?

Fidelity does offer some exceptions to its short-term redemption fee policy . Fidelity funds are exempt, as are money market funds, automatic withdrawals, and all funds with loads. Also, some funds with short-term objectives may be exempt.

Choice and transparency

Access a range of investments, including stocks, options, ETFs, mutual funds, CDs, IPOs, and precious metals.

Our trading account

This full-featured brokerage account can help meet your needs as you grow as an investor.

Getting started trading

Delve into trading and learn new strategies with timely insights and guided education to help you get to your next level.

Trading insights for today's markets

To help you be more effective with your research and analysis using our trading platform and tools, we offer a breadth of educational resources.

How often can you trade with Fidelity?

Fidelity's trading fees are low which makes it suitable for you even if you trade often (i.e. multiple times a week).

What are non trading fees?

Among some others, typical non trading fees are withdrawal fee, deposit fee, inactivity fee and account fee.

How do brokers make money?

They make money by charging you at various events for various rates. Usually you need to keep an eye on these 3 types of fees: Trading fees - these are brokerage fees that you pay when you actually do a trade, i.e. buying an Apple stock or an ETF. What you pay is either a commission, a spread or financing rate.

What is spread broker?

A commission is either based on the traded volume or it is fixed. A spread is the difference between the buy price and the sell price. Financing rate or overnight rate is charged when you hold your leveraged positions for more than one day. Non-trading fees.

Can I unsubscribe from brokerage emails?

I acknowledge that my information will be used in accordance with the Privacy Policy and Cookie Policy By continuing you will receive brokerage related emails. You can unsubscribe any time from within the email.

When is the overnight rate charged?

Financing rate or overnight rate is charged when you hold your leveraged positions for more than one day.

Do online brokerages charge more than traditional brokerages?

Online brokerages in general charge much lower brokerage fees than traditional brokerages do - this is largely due to the fact that online brokerages' businesses can be much better scaled: From a purely technical standpoint it doesn't make that much of a difference for them if they have 100 or 5000 clients.

How much does Fidelity charge for wire transfers?

When completing a wire transfer where U.S. dollars are converted into a foreign currency, Fidelity charges up to 3% of principal. Also, whenever a foreign asset in a Fidelity account pays a dividend, the broker charges 1% of principal.

How much does it cost to open a Fidelity account?

Minimum to open most Fidelity accounts is somewhat high $2,500.

How much is the Fidelity short term redemption fee?

A short-term redemption fee is charged by Fidelity anytime an NTF fund with no load is sold in less than 2 months. The fee is $49.95 when transacted on-line.

How many mutual funds does Fidelity have?

Fidelity offers over 10,000 mutual funds, many of which carry no load and no transaction fee.

What is a Fidelity account?

Fidelity’s flagship account is aptly named the Fidelity Account. Here investors have access to a wide range of products and services and can link to other Fidelity accounts, such as retirement and cash management accounts.

Does Fidelity charge an additional fee for option exercises?

Many brokerage firms charge an additional fee for option exercises and assignments. Fidelity, however, simply charges its regular trading fee.

Does Merrill Edge charge extra for phone?

For example, Merrill Edge charges nothing extra for this convenient service. But Fidelity customers must pay $5 when using FAST, the firm's automated phone system.

Get the Active Trader advantage

Access our exclusive suite of sophisticated tools, services, and resources to help you unlock your full trading potential. You’ll also get access to our cutting-edge desktop trading platforms.

Tools that help you make smarter decisions

From desktop to phones, we've made it easier for you to find investments that match your criteria or easily access predefined third-party expert screens.

Investment choices to fit your strategy

No matter what you are saving for, whether it's retirement or any other goals, we offer you a broad range of options to fit your needs. With low rates, powerful tools, and research, we'll help provide the edge you need to trade with confidence.

How much does Fidelity pay for penny stock?

Fidelity Investments customers pay the broker’s normal $0 commission for penny stock trades. Orders can be submitted on the firm’s website, mobile app, or advanced desktop platform. Just follow the same procedure as you would with a regular stock. Click on the buy button to enter a bullish position, or the sell button to short the stock.

How to sell penny stock on Fidelity?

After reviewing analyst reports, the news, charts, and financial statements of your current stock, and you decide that it's now overvalued, it's time to sell. Go through the same steps outlined above to fill out the order ticket. If you place a limit order on the sell side, remember that the limit price is the lowest amount you're willing to accept, rather than the highest amount you're willing to pay.

How much does Fidelity charge for pink sheets?

Fidelity Investments charges $0 per stock or ETF trade. Along with firms in the Best Penny Stock Brokers list, Fidelity does NOT have additional fees and surcharges on Pink Sheets/OTCBB/stocks priced under $1.

What is the limit for penny stocks?

While the SEC classifies a penny stock as any equity trading under $5, most traders put the limit at $1. In either case, there are some equities on the OTC market that trade above $5. For example, Alerus Financial Corporation is an OTC stock available at Fidelity. Its most recent trade price is $19.

What is the ticker symbol for Fidelity?

The ticker symbol is ALRS. The company is in the micro-cap group, which is fairly common on the OTC market. The stock does pay a dividend, and financial statements are available on the stock’s profile page. Another example of an over-the-counter security available to Fidelity customers is ANDR.

How long does a stock order last on Fidelity?

The time in force specifies when the order should be filled and what happens it if isn't filled. Day means the order will be cancelled at the end of the trading session if the order isn't filled. GTC means good 'til cancelled. This feature will allow the order to sit in your account up to 180 days until it is completed. Choose whichever type you want. If you choose GTC, don't forget about the order; otherwise the Fidelity system could buy stock in your account 4 months later if the stock price drops below your limit price.

How to buy all the stock on a website?

Doing so will produce a handy trade ticket on the website on the left-hand side of the browser. Choose buy in the action menu. Then decide how many shares you want to purchase and type that number in the quantity field. The broker's $0 trading commission is per trade for any number of shares. Therefore, it's most cost effective to buy all the shares you want in a single trade.

What is fidelity remuneration?

The remuneration that Fidelity receives and keeps as described in this section applies to transactions and activities involving securities including, but not limited to, domestic (U.S.) equities traded on national exchanges, short sales, exchange-traded funds (ETFs), and U.S.-traded foreign secu-rities (ADRs, or American Depository Receipts, and ORDs, or Ordinaries).1 For details on foreign stock trading, see the Foreign Stocks section. Large block orders requiring special handling, restricted stock orders, and certain directed orders may carry additional fees, which will be disclosed at the time of the transaction.

What is FBS brokerage account?

FBS is the introducing broker-dealer for Fidelity brokerage accounts (“ Accounts”). Its affiliate, NFS, provides clearing and other related services on Accounts. As compensa-tion for services provided with respect to Accounts, NFS receives use of: amounts from the sale of securities prior to settlement; amounts that are deposited in the Accounts before investment; and disbursement amounts made by check prior to the check being cleared by the bank on which it was drawn. Any of the above amounts will first be net-ted against outstanding Account obligations. The use of such amounts may generate earnings (or “float”) for NFS or instead may be used by NFS to offset its other opera-tional obligations. Information concerning the time frames during which NFS may have use of such amounts and rates at which float earnings are expected to accrue is provided as follows:(1) Receipts. The deposit of amounts that settle from the sale of securities or that are deposited into an Account (by wire, check, ACH [Automated Clearing House] or other means) will generally be purchased into the Account’s core sweep vehicle by close of business on the business day that NFS receives such funds. NFS gets the use of such amounts from the time it receives funds until the core sweep vehicle purchase settles on the next business day. Note that amounts disbursed from an Account (other than as referenced in Section 2 below) or purchases made in an Account will result in a corre-sponding “cost” to NFS. This occurs because NFS provides funding for these disburse-ments or purchases one day prior to the receipt of funds from the Account’s core sweep vehicle. These “costs” may reduce or eliminate any benefit that NFS derived from the receipts described previously.

Does Fidelity charge an annual fee?

Debit Card and ATM Fees There is no annual fee for the Fidelity® Debit Card or the Fidelity HSA® debit card. You may be charged separate fees by other institutions, such as the owner of the ATM. Note: You cannot use the Fidelity HSA® debit card at an ATM.

Is Fidelity a flexible brokerage?

Fidelity brokerage accounts are highly flexible, and our cost structure is flexible as well. Our use of “à la carte” pricing for many features helps to ensure that you only pay for the features you use.

Can you trade foreign securities with Fidelity?

Retirement accounts and Fidelity BrokerageLink® accounts cannot trade foreign securities or sell short, are not eligible for margin loans, and may be subject to other rules and policies. Please see the literature for these accounts for details.

How do brokers make money?

Brokers have other ways of making money than trading commissions. For example, they get fee income from their proprietary investment products like robo-advisory services , mutual funds, and more. They collect some interest income from the funds they hold in custody. In fact, after considering the other revenue sources, commissions are generally a relatively small portion of revenue.

Does Matthew Frankel have a position in any stocks?

Matthew Frankel, CFP has no position in any of the stocks mentioned. The Motley Fool recommends Interactive Brokers. The Motley Fool has a disclosure policy.

Is Charles Schwab slashing commissions?

But when Charles Schwab ( NYSE:SCHW) announced that it was slashing its stock trading commissions from $4.95 to $0 on Oct. 1, it caught the entire financial industry off-guard. No-frills platforms like Robinhood and niche players like Interactive Brokers offering free stock trades was one thing -- a feature-packed platform that's one of the largest brokers in the industry was another story altogether.

Does Fidelity drop commissions?

Fidelity just became the fifth major broker to drop stock trading commissions in the past couple of weeks, joining some of the industry's other large players in making online trades free. This trend has been a major win for stock investors, particularly younger and beginning investors who tend to make smaller purchases.

Does Fidelity offer free stock trades?

At first glance, it may seem like this move will destroy the profits of Fidelity and the other brokers that now offer free stock trades. In Fidelity's case, the company also announced that it won't be paid for order flow based on where it sends its trades as well -- a way that some other $0 commission brokerages generate revenue.

Did Fidelity get rid of trading commissions?

Fidelity's move to get rid of trading commissions was likely made out of necessity. After several competitors did away with stock trading commissions, Fidelity would have risked losing customers if it continued to charge $4.95 for trades.

Is Fidelity a private company?

Because Fidelity has a diverse array of financial products (although it is private and we have less knowledge of its revenue structure), it's likely that it is on the lower end of the spectrum in terms of commission revenue as a percentage of its total.

How do brokers make money?

Brokers generally make most of their money through interest income on their clients’ deposits.

What is payment for order flow?

Payment-for-order-flow refers to how market makers, like Citadel Securities or Virtu Financial, pay for the first crack at executing a stock order.

Does Fidelity offer zero commission?

Fidelity Investments has joined its rivals by offering zero-commission online trades, but it’s trying to differentiate itself by not selling the right to execute trades to third-party firms, brokerage executive Kathleen Murphy told CNBC on Friday.

Is payment for order flow banned in Canada?

In 2016, the Securities and Exchange Commission raised questions about the arrangement potentially creating “conflicts of interest for broker-dealers handling customer orders.” Payment-for-order-flow is banned in Canada.

Is Fidelity a public company?

While Fidelity isn’t public, the other companies have seen their shares fall as the revenue drivers for the brokerages became even less clear. While it is not the biggest income source for online brokers, payment-for-order-flow is an increasing revenue stream.