How much do stock broker jobs pay per month?

This is the equivalent of $2,620/week or $11,355/month. While ZipRecruiter is seeing annual salaries as high as $400,000 and as low as $14,000, the majority of Stock Broker salaries currently range between $25,000 (25th percentile) to $250,000 (75th percentile) with top earners (90th percentile) making $400,000 annually across the United States.

How much do Wall Street traders make?

Traders who are less experienced and newer to the field can earn this salary. Traders with years of experience can make a salary that easily averages about $224,000 per year. The top 10 percent of traders who work on Wall Street have salaries that approach $300,000 per year.

Is day trading worth it?

Day trading is not worth it for the vast majority of day traders. Anecdotally, it's been widely estimated that 95% of day traders ultimately lose money, and it's been empirically demonstrated that about the same percentage of unprofitable day traders continues despite losing money.

How much money can I make forex day trading?

How much money can you make trading forex? Excellent traders can earn between 20% – 50% annually trading forex. Earnings depend on trading expectancy, position size, and consistency. For example, if an excellent trader manages $100 000, the maximum allowed drawdown is 5% ($5000), he can earn $20 000 annually.

How much risk do day traders take?

What is the reward to risk ratio for stock market?

How many round turn trades are there in a month?

What is the reward to risk ratio for day trading?

See more

About this website

How much do stock traders make a day?

If you pay for your charting/trading platform, or exchange entitlements then those fees are added in as well. Therefore, with a decent stock day trading strategy, and $30,000 (leveraged at 4:1), you can make roughly: $7,500 – $2000 = $5,500/month or about a 18% monthly return.

How much does a Stock Trader make on average?

How much does a Stock Trader make? The average Stock Trader in the US makes $101,224. The average bonus for a Stock Trader is $14,532 which represents 14% of their salary, with 100% of people reporting that they receive a bonus each year.

How much do stock traders make a week?

Day Trader SalaryAnnual SalaryWeekly PayTop Earners$150,000$2,88475th Percentile$100,000$1,923Average$80,081$1,54025th Percentile$37,500$721

Do stock traders make money?

Whether they're trading for themselves or working for a trading shop and using the firm's money, day traders typically don't get paid a regular salary. Instead, their income is derived from their net profits.

Can you make 100k a year day trading?

Starting Capital of 100k – 250k Average Day Trader Salary = 20% annual return. This breaks down to 20k to 50k for an annual salary. Above Average Day Trader Salary = 50% annual return. This breaks down to 50k to 125k.

Can you live off day trading?

Yes, living off day trading income is very much possible, but it can be very difficult to achieve. In fact, it's not necessarily easier or less demanding than doing a regular 9-5 job, and you are not even sure that you can be consistently profitable enough to sustain your lifestyle.

How can I earn 10k per day in stocks?

10000 every day for rest of the months. At the end of every month you will have good money. You can take some part of it every month to buy shares in long term portfolio companies....To gain from downward movement:Selling shares in cash segment.Buying Put Options.Selling Futures segment.

How much can a beginner trader make?

It can go up to Rs 1 lakh a month or even higher if you are skilled enough and your strategies are in place.

Is trading a good career?

If you are one of these people who like working alone, or at your own pace, trading is the perfect career for you. Everything you do – from the trades you take to the money you earn – stays under your control if you're a trader.

How much money do day traders with $1000 accounts make per day on average?

Over here, if you set up an account with $1,000, most of these brokers will give you a minimum of four times leverage. That means you can day trade with $4,000. Some of them will even give you up to six times. That means you could day trade with up to $6,000.

Why do 90 of traders fail?

Fear of Missing Out (FOMO) The second most important reason why many traders fail is the Fear of Missing Out (one of the most tremendous psychological mistakes you can make). This is where they see other traders doing well and decide to get into the business as well.

Can we earn 50000 per day in stocks?

You have a capital of 5000 rupees. So it's impossible to make 50,000 rupees in a single trade unless and until the company you're trading with reports huge profits to see 1000 times its growth potential.

Nationwide, A Rather Average Base Salary

One thing that should be noted about trading stocks is that the world of Wall Street is actually worlds away from what stock traders earn in other...

Wall Street Salaries: A Bubble All Their Own

There’s a reason that each stock trading opening on Wall Street attracts not hundreds, but actually thousands, of highly qualified applicants: The...

An Excellent Way to Earn Big and Control Corporate Fortunes

Wall Street traders are paid highly because they have their hands on the country’s economic pulse at all times. Their moves determine the value of...

How To Get a 10% Monthly Return Day Trading - The Balance

To accomplish this, place a profit target that is a greater distance from your entry point than your stop loss is. For example, if you buy a stock at $10 and place a stop loss at $9.95 (this risk would represent approximately 1% of your account capital, based on your position size), then your target would need to be placed near $10.08.If you lose, you lose $0.05 per share, but if you win, you ...

How much risk do day traders take?

Professional day traders—those who do it for a living—typically keep the risk on each trade very small, at usually less than 1% of their trading capital. 1 For example, if trading a $30,000 stock account, don't risk more than $300 per trade (1% of $30,000). For more see, Determining Proper Position Size When Day Trading Stocks .

What is the reward to risk ratio for stock market?

A reward-to-risk ratio of 1.5 is fairly conservative and reflective of the opportunities that occur each day in the stock market.

How many round turn trades are there in a month?

Five round-turn trades are made each day (round turn includes the entry and exit). There are 20 trading days in the month, 4 so that means taking 100 round-turn trades per month. Commissions and fees are $30, round trip ($15 in and $15 out). Margin, or 4:1 leverage, is used on the account.

What is the reward to risk ratio for day trading?

The reward to risk ratio of 1.5 is used because it is fairly conservative and reflective of the opportunities that occur all day, every day in the stock market. The starting capital of $30,000 is also an approximate balance to start day trading stocks; more is recommended if you wish to trade higher-priced stocks.

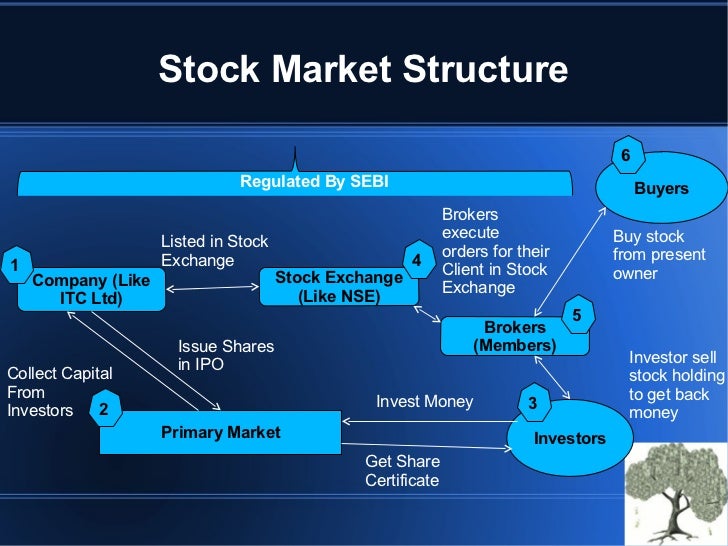

What is a stock trader?

A stock trader is a person who attempts to make a profit from buying securities, such as stock shares, and selling them at a later date for a higher price. Stock traders can either be private individuals looking to invest their earnings or professionals who trade on behalf of a trading company.

What do stock traders do?

Although every stock trader's general activity is buying and selling stock, they have a variety of methods for making their trades. Based on these methods, some of the most widely encountered types of traders are:

How much do stock traders make?

According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year. They can also expect to make an average commission of around $25,000 per year. Professionals in this role can also earn benefits, such as a flexible schedule, family leave and the option to work from home.

Top stock trader salaries by state

These are the 10 U.S. states with the highest average salaries for stock traders, according to Indeed Salaries:

Stock trader education requirements

There are no official educational requirements for stock traders, as companies who hire them tend to have their own extensive training programs. However, having a degree in finance or accounting can help you perform the role and convince hiring managers to choose you over other job candidates.

Stock trader work environment

A stock trader's work environment varies depending on the situation. Unlike other related jobs in finance or banking, stock traders operate individually and technology allows them to perform trades from any location with a functioning internet connection.

Why are Wall Street traders paid so much?

Wall Street traders are paid highly because they have their hands on the country’s economic pulse at all times. Their moves determine the value of millions of 401 (k) retirement plans, as well as college endowments, executive salaries, and more. It’s often said that great power demands great responsibility.

How does a trader work?

How They Work. Professional traders generally spend long days on the job. There is a lot of prep work before the trading day begins. Few people have not seen movies or documentaries of the rush that occurs when the “bell rings.”. At that point, traders begin receiving orders and assessing the markets.

What is stock market?

Simply put, stock markets are places where investors buy and sell stocks. A stock is a share of ownership in a company. Individuals do not customarily trade their own stocks, however. They trade through a stock exchange company.

What happens if a big investor suddenly dumps stocks?

A big investor who suddenly “dumps” stocks in a company can cause panic selling. Brokers must understand market trends and long-term investments. A lot of education and experience is necessary to make intelligent and timely trades and to avoid these panic situations.

How much does the middle 50 percent make?

Those in the middle 50 percent earn a slightly higher salary, often around $57,600 each year. The highest earners nationwide, on average, take home $66,600 per year. Those numbers are nothing to sneeze at since they’re between $10,000 and $20,000 more than the median American wage.

Do traders get bonuses?

Some traders earn high salaries and do not generally receive bonuses. This type of trader has emerged because more and more investing is done with the predictions of computer programs that model investments through data projections. Traders develop and run these computer systems and are paid well to do so.

Do Wall Street traders get pensions?

One thing that’s worth noting in this instance is that most Wall Street traders, even though they receive bonuses, don’t receive anything close to the stock options and other perks are given to most corporate executives. They do, however, receive healthy retirement packages or even pensions.

How much do day traders make?

If you research further, you will find that the average salary for day traders across the US is $89,496. A lot also depends on which investment firm, financial institution, or bank you are working for. As a top trader for Citi, you can earn as much as $435,000.

How do day traders make money?

Day traders earn profit by purchasing tradable securities such as currencies, commodities, and stocks, holding them for anywhere between a few minutes to a few hours, and then selling them. They enter and exit multiple trade positions in the course of one day.

What factors influence a day trader's daily or monthly earnings?

Several factors influence a day trader’s daily or monthly earnings, and some of them are as follows: Earnings vary depending on whether a day trader is trading independently or for a financial institution. Traders working for hedge funds or banks don’t have to risk their own money.

What do day traders do?

Day traders who have more capital end up trading stocks, but some of them trade currencies or futures even with a smaller capital. The earnings depend on their starting capital and the markets they trade. Day traders who start with a smaller capital tend to earn lesser than those who start with a larger capital.

What is day trading for proprietary firms?

Day trading for proprietary firms is a different cup of tea. The prop firm gives you access to its systems, software, and capital only after you undergo in-house training. But you don’t get any annual review, base salary, paid time off, and health benefits. Instead, you get to split profits with the proprietary form; and this split could be anywhere in the range of 20% to 50%.

What happens if you underperform in investing?

If you underperform, the investment firm will have nothing to do with you. On the other hand, if you do perform well and make around $300,000 in profits for the company, you could get a salary of $100,000. The biggest benefit of trading for a company, other than the regular pay check, is that you can trade risk free.

How long does it take to get broke as a day trader?

If your starting capital is less than $50,000 and you have to pay bills every month, you will find yourself broke in 6 – 24 months.

How much does a Stock Market Trader make?

As of Jan 29, 2022, the average annual pay for a Stock Market Trader in the United States is $62,706 a year.

What are Top 10 Highest Paying Cities for Stock Market Trader Jobs

We’ve identified 10 cities where the typical salary for a Stock Market Trader job is above the national average. Topping the list is San Mateo, CA, with Berkeley, CA and Daly City, CA close behind in the second and third positions.

What are Top 5 Best Paying Related Stock Market Trader Jobs in the U.S

We found at least five jobs related to the Stock Market Trader job category that pay more per year than a typical Stock Market Trader salary. Top examples of these roles include: Options Trader, Equity Options Trader, and Stock Options Trader.

Top searched states for Stock Market Trader Salaries

By clicking the button above, I agree to the ZipRecruiter Terms of Use and acknowledge I have read the Privacy Policy, and agree to receive email job alerts.

What are the factors that impact day trader earnings?

Other important factors that impact a day trader's earnings potential include: Markets you trade: Different markets have different advantages. Stocks are generally the most capital-intensive asset class. Individuals can start trading with less capital than with other asset classes, such as futures or forex.

How much capital do day traders need?

These rules require margin traders who trade frequently to maintain at least $25,000 in their accounts, and they cannot trade if their balance drops below that level. 2 This means day traders must have sufficient capital on top of the $25,000 to really make a profit.

What factors influence your earnings potential?

An important factor that can influence earnings potential and career longevity is whether you day trade independently or for an institution such as a bank or hedge fund. Traders working at an institution don't risk their own money and are typically better capitalized, with access to advantageous information and tools.

What factors determine upside in day trading?

Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck. Experienced day traders tend to take their job seriously, remaining disciplined, and sticking with their strategy.

Can day traders hold positions overnight?

They rarely hold positions overnight. The goal is to profit from short-term price movements. Day traders can also use leverage to amplify returns, which can also amplify losses. Setting stop-loss orders and profit-taking points—and not taking on too much risk—is vital to surviving as a day trader.

Is day trading a hobby?

Day trading is not a hobby or occasional activity if you are serious about trading to make money. While there is no guarantee you will make money or be able to predict your average rate of return over any period of time, there are strategies you can master to help you lock in gains while minimizing losses.

Do day traders need to be prepared?

Most day traders should be prepared to risk their own capital. In addition to required balance minimums, prospective day traders need access to an online broker or trading platform and software to track positions, do research and log trades. Brokerage commissions and taxes on short-term capital gains can also add up.

How Much Do Professional Trade Make A Year

The annual earning of a professional trader depends on the trader’s strategy, country’s overview, market situation, risk management, and type of services the trader provides.

How Much Does A Professional Stock Trader Make

The amount of money a professional stock trader makes depends on capital, trading strategy, risk management, and the value of the stock itself.

How Much Does a Good Trader Make

A good trader is consistent and has a strong grip on emotions. He is fully aware of the risk factor involved in the financial war of trading. Good traders are mostly day traders or full-time traders. But swing trading is also profitable if you stick to the right strategy.

How Much Does An Average Trade Make

The amount an average trader makes per month depends on his trading strategy, trading type, skills, and capital.

How Much Do Professional Trader Makes A Day

For pro traders making 10 percent to 20 percent is quite possible with a decent win rate. If the win rate is 50%, making 10 percent is possible with a risk-reward ratio of 3 to 4 by risking 1% of the account balance.

How Many Pips Do Professional Traders Make

Most of the professional traders think in terms of % of account risk vs % of account profit target. Pips are counted when you have a specific pip target and stops.

The Ending Lines

It’s evident from the above post that professional trading is a good career choice. They can make a decent amount if they are offering services as a trader to a certain firm. If they are trading on their own it is also profitable.

How much risk do day traders take?

Professional day traders—those who do it for a living—typically keep the risk on each trade very small, at usually less than 1% of their trading capital. 1 For example, if trading a $30,000 stock account, don't risk more than $300 per trade (1% of $30,000). For more see, Determining Proper Position Size When Day Trading Stocks .

What is the reward to risk ratio for stock market?

A reward-to-risk ratio of 1.5 is fairly conservative and reflective of the opportunities that occur each day in the stock market.

How many round turn trades are there in a month?

Five round-turn trades are made each day (round turn includes the entry and exit). There are 20 trading days in the month, 4 so that means taking 100 round-turn trades per month. Commissions and fees are $30, round trip ($15 in and $15 out). Margin, or 4:1 leverage, is used on the account.

What is the reward to risk ratio for day trading?

The reward to risk ratio of 1.5 is used because it is fairly conservative and reflective of the opportunities that occur all day, every day in the stock market. The starting capital of $30,000 is also an approximate balance to start day trading stocks; more is recommended if you wish to trade higher-priced stocks.