Disney Historical Annual Stock Price Data

| Year | Average Stock Price | Year Open | Year High | Year Low |

| 2017 | 106.3582 | 106.0800 | 115.8400 | 96.9300 |

| 2016 | 97.4618 | 102.9800 | 106.6000 | 88.8500 |

| 2015 | 107.8355 | 93.7500 | 121.6900 | 90.9600 |

| 2014 | 84.4812 | 76.2700 | 95.5000 | 69.9900 |

Full Answer

Is Disney a good stock to buy?

- Pros of buying DIS.

- Cons of buying DIS.

- Getting the timing right.

How much does one share of Disney stock cost?

One analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty-one have assigned a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of “Buy” and an average target price of $196.93. Shares of DIS stock opened at $154.89 on Monday.

Should you buy Disney stock?

Should You Invest in Disney Right Now?

- Parks and experiences are recovering slowly. When Disney reported its fourth-quarter and fiscal year 2021 earnings in November, it was the first report since the beginning of the pandemic for ...

- Disney+ flexes its muscles. Early in 2021, Disney was riding high with its Disney+ streaming service. ...

- Full recovery may not be quick. ...

How much is a Disney stock?

Walt Disney World opened to the public on Oct. 1, 1971, after years of construction. The theme park owned by the Walt Disney Co (NYSE: DIS) is now the most visited theme park in the world. The park celebrated its 50th anniversary in 2021. Here is a look at ...

See more

What was the price of Disney stock in 2008?

DIS - The Walt Disney CompanyDateOpenClose*Jan 19, 200921.4620.61Jan 12, 200922.3021.46Jan 05, 200923.5122.31Dec 29, 200822.1523.9265 more rows

What was Disney Stock price 2005?

26.3047Compare DIS With Other StocksDisney Historical Annual Stock Price DataYearAverage Stock PriceAnnual % Change200734.2773-5.81%200629.565442.97%200526.3047-13.78%57 more rows

What was Disney's highest stock price ever?

After hitting its all-time high (to that point) of $151.64 on Nov. 26, 2019, Disney stock fell as low as $79.07 per share in March of 2020.

What was Disney stock worth in 2004?

YearBeginning PriceEnding Price200316.3123.33200423.3327.80200527.8023.97200623.9734.2743 more rows

What was Disney stock price in 2011?

Disney shares started the 2010s trading at around $32. The stock dipped as low as $28.19 by late 2011 on concerns about rising streaming competition from Netflix, Inc.

How many times has Disney stock split in the last 20 years?

Has DIS Ever Split its Stock? Disney has split its stock 7 times: July 9, 1998: a 3-for-1 split. May 15, 1992: a 4-for-1 split.

What is Disney's 2021 worth?

203.61 billion U.S. dollarsIn 2021, the Walt Disney Company held assets worth a total of over 203.61 billion U.S. dollars. In the same year, the American media company generated global revenue of 67.41 billion U.S. dollars.

Does Warren Buffett own Disney stock?

Warren Buffett bought 5% of Disney for a mere $4 million in 1966, and netted a separate 3.6% stake in the media group when it bought Capital Cities/ABC in 1995. The famed investor sold his Disney stock within three years on both occasions; if he'd held onto the combined 8.6% stake, it would be worth $24 billion today.

What is Disney's 2022 worth?

$178.02BHow much a company is worth is typically represented by its market capitalization, or the current stock price multiplied by the number of shares outstanding. Disney net worth as of June 24, 2022 is $178.02B.

Will Disney stock pay dividends in 2021?

Disney CFO Christine McCarthy declared the company's intention to pay a dividend again: "In light of the ongoing recovery from the COVID-19 pandemic as well as our continued prioritization of investments that support our growth initiatives, the board decided not to declare or pay a dividend for the first half of fiscal ...

What is the average return on Disney stock?

Trailing ReturnsTotal Return %1-Day10-YearDIS3.698.62Industry3.6210.56Index3.1613.23

What was Disney stock in 1992?

A look back at Disney's stock splitsYearPre-split priceNo. of shares1973$214.508001986$142.6332001992$152.8712,8001998$11138,4002 more rows•Jul 17, 2016

How much did Disney spend on dividend checks in 2016?

This is no dilly-dallying hobby but a major destination for the funds that the Mickey Mouse cash machine generates. In fact, Disney only spent $2.3 billion on dividend checks in 2016 along with $4.8 billion on the capital costs of running and improving its theme parks, cruise ships, and other physical properties.

How much did Disney buy backs in 2016?

Disney's buybacks, by the numbers. In fiscal year 2016, Disney spent $7.5 billion on share buybacks. The company canceled 73.8 million shares at an average price of $101.60 per share. Only 5% of these buybacks were matched by newly printed share stubs under Disney's stock-based compensation programs.

How much did it cost to build Shanghai Disneyland?

The recently opened Shanghai Disneyland park cost about $300 million to build and the Disney World Animal Kingdom park reportedly ran up a $1 billion pre-opening bill. The company announced two new cruise ships in March, expected to launch in 2021 and 2023 at a cost of roughly $2 billion.

Is Disney throwing money into its capital expense budget?

Disney is already throwing a ton of cash into its capital expense budget. Those new cruise ships don't come cheap, and a brand-new park in China is a huge move. Doing too much at once could backfire due to the immense scale of Disney's existing infrastructure.

Is Disney a shareholder friendly company?

It's a shareholder-friendly policy as long as there aren't any objectively better places to spend the same cash.

Is Disney debt to equity?

But that's not the case at all. Disney's debt-to-equity ratio is either comparable to or much lower than what you'll find elsewhere in the capital-intense resort and media industries. The company is actually working to optimize its balance sheet by adding more debt while interest rates are low.

How many stock splits have Disney had?

Let’s take a look. Since Disney’s IPO, there have been six stock splits. The highest pre-split price was $214.50 in January 1973, while the lowest pre-split price was $105.00 in November 1967. Many companies like to use the $100.00 mark as a threshold for stock splits.

How many times has Disney split its stock?

Due to the massive increase in the Disney stock price, the company has split its shares six times since the IPO.

How does a stock split work?

A stock split increases the number of a company’s outstanding shares by issuing more shares to existing shareholders. For instance, if a company—let’s call it Company A—has 10 million shares outstanding, a two-for-one stock split would give existing shareholders an additional share for each one they already own.

What is the 52 week range of Disney stock?

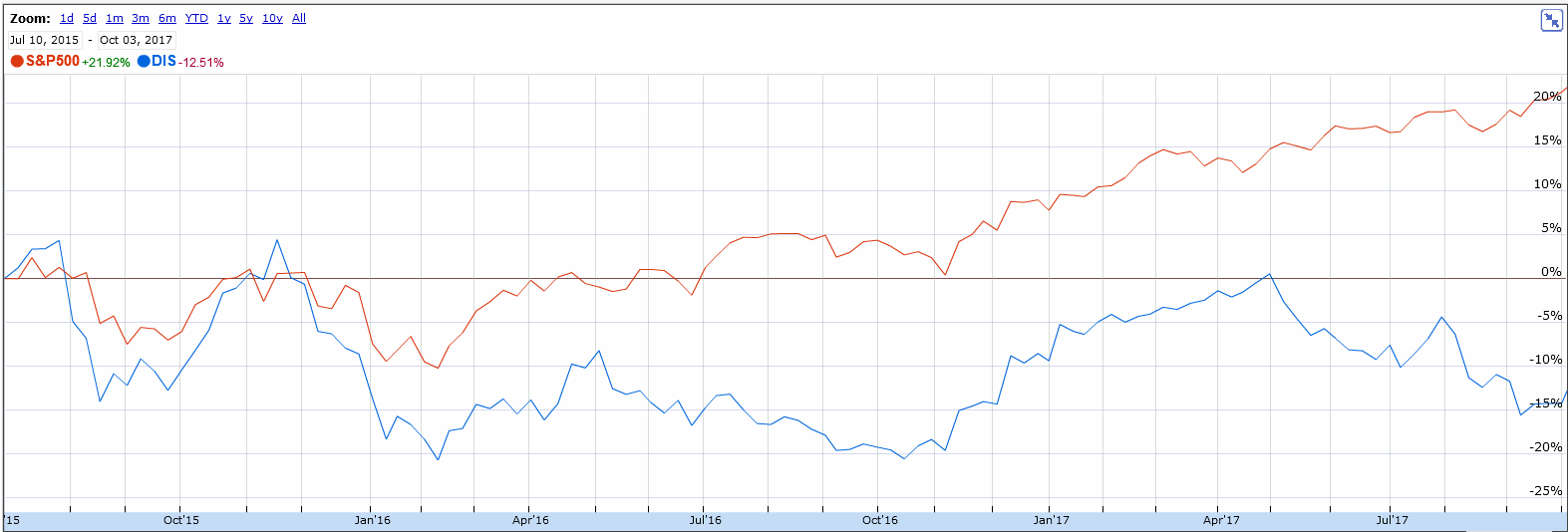

The 52-week range of Disney shares is $90.32 to $115.12. One of the reasons behind Disney stock’s downturn was the performance in the company’s “Media Networks” segment. You see, while Disney has been putting out blockbuster films one after another, the company’s business is much more than just making movies.

What is Disney's biggest segment?

As a matter of fact, Disney’s Media Networks segment —which includes networks like ABC, ESPN, and the Disney Channel, among other businesses—is currently the company’s biggest segment. In Disney’s most recent fiscal year, the segment was responsible for generating more than 40% of the company’s total revenue.

Is Disney a studio?

And this shouldn’t come as a surprise, given that Disney started out as a studio making animation. This business could be hugely profitable, but is not known to have the same stability and durability as, say, a business that’s making toothpaste and toilet paper.

Does Berkshire have a class A stock?

Berkshire’s “Class A” shares have never split, and are now trading at a whopping $245,910.00 apiece. Still, the company created a new class of stock—the “Class B” shares in 1996—to make investing in Berkshire more feasible for small investors.

How much was Disney worth in 2007?

It estimates that a $1,000 investment in Disney in 2007 would be worth $2,824 as of October 31. Disney’s performance came in just shy of Google’s holding company, Alphabet’s. In the graphic below, the blue dots are equivalent to a $1,000 initial investment, and the pink dots equal the investment’s current total value.

Did Disney buy Fox?

However, some Wall Street execs feel optimistic about Disney’s announcement that it will buy parts of Twenty-First Century Fox in a deal worth $52.4 billion in stock. Among other acquisitions, the company will take on Fox’s movie studios, networks Nat Geo and FX, and stakes in Hulu and regional sports networks.