How might the expected return of each stock relate to its riskiness? The return of each stock influences the stock’s riskiness. The higher the risk, the higher the stock’s return.

How does risk relate to expected and realized returns?

Risk and return are inextricably related. Higher returns generally can be achieved only by taking more risk, but because the risk exists, the higher expected returns may not result in higher realized returns. If inflation is considered, even money market securities have some risk.

What are the roles of actual returns and expected returns in investment planning?

key takeaways. Actual return refers to the de facto gain or loss an investor receives or experiences on an investment or portfolio. Actual return can also refer to the performance of pension plan assets. The opposite of actual return is expected return.

How do you find the expected rate of return on a stock?

An investor can find the expected rate of return by taking all of the potential outcomes and multiplying them by the chances that they will occur, and then adding them together to find the total expected rate of return.

What can be expected to happen when stocks having the same expected risk do not have the same expected return?

What can be expected to happen when stocks having the same expected risk do not have the same expected return? At least one of the stocks becomes temporarily mispriced. Dividends that are expected to be paid far into the future have: Lesser impact on current stock price due to discounting.

What is the purpose of expected return?

Expected return is simply a measure of probabilities intended to show the likelihood that a given investment will generate a positive return, and what the likely return will be. The purpose of calculating the expected return on an investment is to provide an investor with an idea of probable profit vs risk.

What is expected return in simple words?

The expected return is the profit or loss that an investor anticipates on an investment that has known historical rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these results.

How are returns reflected in the financial instruments How are they related to risk?

In investing, risk and return are highly correlated. Increased potential returns on investment usually go hand-in-hand with increased risk. Different types of risks include project-specific risk, industry-specific risk, competitive risk, international risk, and market risk.

How do you find the expected return and standard deviation of a stock?

The expected return is calculated by multiplying the weight of each asset by its expected return. Then add the values for each investment to get the total expected return for your portfolio. Hence, the formula: Expected Portfolio Return = (Asset 1 Weight x Expected Return) + (Asset 2 Weight x Expected Return)...

How do you calculate expected return and volatility for a stock portfolio?

The basic expected return formula involves multiplying each asset's weight in the portfolio by its expected return, then adding all those figures together. In other words, a portfolio's expected return is the weighted average of its individual components' returns.

How risk and return are related to each other give one example?

Understanding risk and return. Some investments are riskier than others – there's a greater chance you could lose some or all of your money. For example, Canada Savings Bonds (CSBs) have very low risk because they are issued by the government of Canada.

What type of risk is relevant for determining the expected return?

The systematic risk principle states: The expected return on an asset depends only on its systematic risk. systematic portion is relevant in determining the expected return (and the risk premium) on that asset.

What is the relationship between risk and return explain with the help of a graph?

High levels of uncertainty (high risk) are associated with high potential returns. The risk/return graph is the balance between the desire for the lowest possible risk and the highest possible return. Below chart will show the type of funds come in which part of risk-return graph.

Alex Sharpe's Portfolio Solution Essay

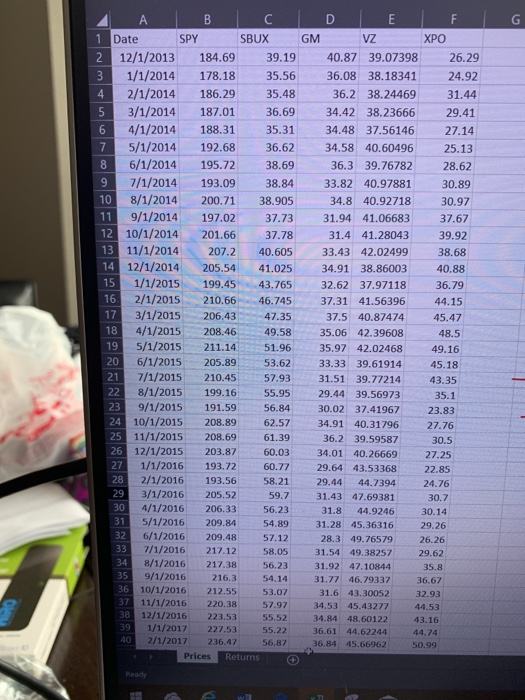

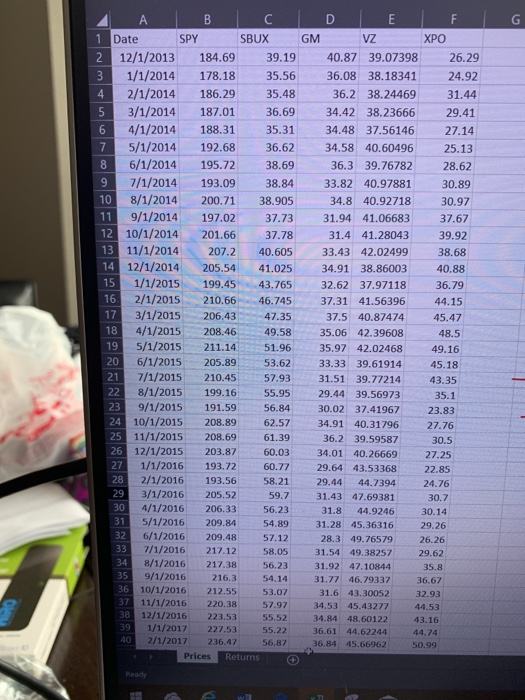

Alex Sharpe’s Portfolio 1. Returns and Risk Estimate and compare the returns and variability (i.e. annual standard deviation over the past five years) of Reynolds and Hasbro with that of the S&P 500 Index.

Portfolio

w rP os t S 908N20 ALEX SHARPE'S PORTFOLIO op yo Professor Colette Southam wrote this case solely to provide material for class discussion. The author does not intend to illustrate either effective or ineffective handling of a managerial situation.