What happened to the stock market in 1998?

Historic losses wipe out market's gains for 1998 as global turmoil mounts. NEW YORK (CNNfn) - Frantic selling pounded Wall Street Monday, sending the Dow industrials 512 points lower and the Nasdaq Composite into its worst one-day point loss in history as a global economic rout showed no signs of abating.

What happened to the stock market in 2001?

As the new millennium came, the stock market reached record highs, but suddenly stalled and became very volatile. For the next year there was little direction. This volatility soon gave way to a sell-off in 2001 as panic began to set in.

What was the stock market like in the 90s?

It was during the mid-to-late 90s that everyone was a stock trader. With the Internet becoming popular and the easy access to buying and selling stocks for the Average Joe, people were flooding into the market looking for the next company that was going to double or triple in the next three months.

Will Internet stocks be easier to follow in 1999?

The Internet sector may be a new game in 1999, but that doesn't mean it'll be any easier to follow. Nothing better reflected 1998's wild stock market ride than the action that took place in Internet stocks. Individual investors moved stocks like never before.

What was the stock market in 1998?

In 1998, the S&P 500 plunged just under 20%, similar to 2018, rallied sharply off the low, and then experienced a 4.29% pullback. After failing to hold the breakout to new all-time highs, the market found its footing and tacked on some impressive gains.

How many stocks are there total?

The 3 largest stock exchanges by market cap, the NYSE, Nasdaq, and Shanghai Stock Exchange, have 7,754 4,448 and 2,014 tradable names, respectively, in August 2021. Surprisingly, however, data from Benzinga shows a grand total of 5,866.

What happened to the stock market in 1998?

In 1998, the collapse of hedge fund Long Term Capital Management rattled the markets, and required a $3.5 billion bailout engineered by the Fed. This fund engaged in algorthmic trading strategies devised by some of the, purportedly, best quants on Wall Street, yet still failed.

What was the Dow in 1998?

8,630.76Dow Jones - DJIA - 100 Year Historical ChartDow Jones Industrial Average - Historical Annual DataYearAverage Closing PriceYear Close19988,630.769,181.4319977,447.017,908.3019965,739.636,448.2766 more rows

Are there a finite number of stocks?

At any given time there are a finite number of shares outstanding, or available to trade, on any given company. The more stock you buy, the higher your percentage of ownership (or equity) in that firm will be.

How many stocks are there in the USA?

The average value for the USA during that period was 5403 companies with a minimum of 2401 companies in 1979 and a maximum of 8090 companies in 1996. The latest value from 2019 is 4266 companies.

What is the longest bear market in history?

According to Seeking Alpha — which analyzed every bear market since 1928 — the longest-ever bear market occurred in 1973-74, when it lasted 630 days, or about 21 months. The stock market shed about 48% during that period. The second-longest bear market, from 1980-82, lasted 622 days.

What was the worst stock market crash?

1929 stock market crash The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

What is the largest drop in stock market history?

Largest point changes The largest point drop in history occurred on March 16, 2020, when concerns over the ongoing COVID-19 pandemic engulfed the market, dropping the Dow Jones Industrial Average 2,997 points.

What was the Nasdaq in 1998?

Capping one of its best years ever, the Nasdaq rose 25.75 to 2,192.70, bringing its gain for the year to 39.6 percent. The S&P 500 index fell 2.54 to 1,229.39, closing the year with a gain of 26.7 percent.

What happened to the stock market in 1990?

The Dow Jones Industrial Average dropped 18% in three months, from 2,911.63 on July 3 to 2,381.99 on October 16,1990. This recession lasted approximately 8 months. Lasting approximately twenty years, through at least the end of 2011, share and property price bubble bursts and turns into a long deflationary recession.

Will the Stock Market Crash 2022?

Stocks in 2022 are off to a terrible start, with the S&P 500 down close to 20% since the start of the year as of May 23. Investors in Big Tech are growing more concerned about the economic growth outlook and are pulling back from risky parts of the market that are sensitive to inflation and rising interest rates.

Stock market returns since 1998

If you invested $100 in the S&P 500 at the beginning of 1998, you would have about $735.66 at the beginning of 2022, assuming you reinvested all dividends. This is a return on investment of 635.66%, or 8.64% per year .

Full monthly data

The table below shows the full dataset pertaining to a $100 investment, including gains and losses over the 289-month period between 1998 and 2022.

Data Sources

The information on this page is derived from Robert Shiller's book, Irrational Exuberance and the accompanying dataset, as well as the U.S. Bureau of Labor Statistics' monthly CPI logs.

90 Year Market Chart

The following quarterly 90-year bar chart shows the 1998 market correction which occurred during the 1988-1999 bull market .

20-year Market Chart

The following chart shows the 1998 bear market on a 20-year chart with the S&P 500 index plotted as a monthly bar chart.

3-year Market Chart

The 1998 market correction is shown again with a shorter time-frame on a 3-year chart plotted as a weekly bar chart.

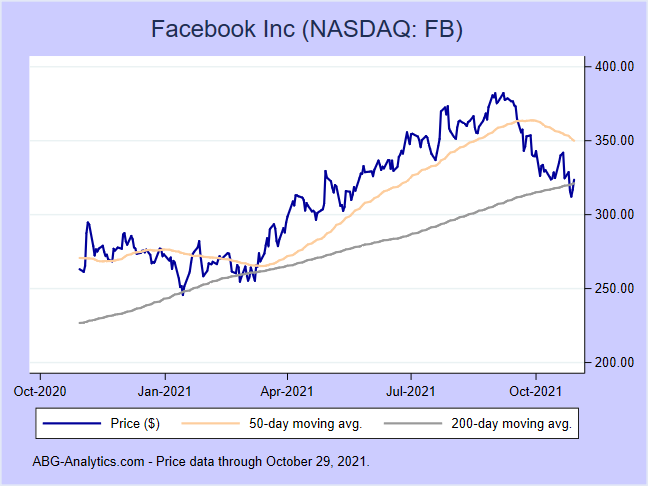

Market Chart: Rallies and Pullbacks

The 1998 market correction is shown again with a 3-year line chart and two moving average indicators.

How does down year affect the market?

The market's down years have an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss.

What is the average annualized return of the S&P 500?

Between 2000 and 2019, the average annualized return of the S&P 500 Index was about 8.87%. In any given year, the actual return you earn may be quite different than the average return, which averages out several years' worth of performance. You may hear the media talking a lot about market corrections and bear markets:

How much money would you lose if you invested $1,000 in an index fund?

If you invested $1,000 at the beginning of the year in an index fund, you would have 37% less money invested at the end of the year or a loss of $370, but you only experience a real loss if you sell the investment at that time.

Is the stock market cruel?

On the other hand, if you try and use the stock market as a means to make money fast or engage in activities that throw caution to the wind, you'll find the stock market to be a very cruel place. If a small amount of money could land you big riches in a super short timespan, everybody would do it.

Can you stay out of stocks during a bear market?

No one knows ahead of time when those negative stock market returns will occur. If you don't have the fortitude to stay invested through a bear market, then you may decide to either stay out of stocks or be prepared to lose money, because no one can consistently time the market to get in and out and avoid the down years.

A Glimpse of Our Future by Looking at the Past?

Some claim that there is a four year cycle that the market follows, and there is some evidence to that. Of course, nothing is certain and the time periods of the cycle can vary, but there is some truth to it all.

2005 – Today

Most of 2005 was nothing to write home about as the markets were basically drifting sideways. Once 2006 rolled around, the market again started to rally. For the next two years, the DJIA tacked on over 30% and set new record highs.

The Big Picture

As investors, most of us tend to forget about all of the good years and only focus on the bad. The broad markets have been heading up for about four years, so the thoughts of what happened in 1999-2002 are well behind us.