They usually require you to buy a minimum of 1 whole stock per order. This means you probably won’t be able to invest less than the price of at least 1 Disney stock. Use that as your minimum if your calculated minimum isn’t enough. If Disney stocks are too much, you can look at other stocks instead.

Where can I buy one stock of Disney?

Walt Disney World has paused sales of select annual passes until at least 2022. Announced in a message posted to the park's website this week, the move is aimed at managing park capacity as the holiday travel season gets underway. Existing pass holders ...

Should I purchase Disney stock?

- Get a free copy of the StockNews.com research report on Walt Disney (DIS)

- Western Digital Stock is Ready to Pick Up

- 3 Brawny International Stocks to Add to Your Portfolio

- 3 Dependable Dogs of the Dow to Buy Now

- iRobot Is Starting To Look Good Again

- Insiders Shed Canada Goose In Fiscal Q3

How do you buy Disney stock?

- The Walt Disney Studios

- Walt Disney Animation Studios

- Pixar Animation Studios

- Lucasfilm Ltd.

- Marvel Studios

- Disney Music Group

- 20th Century Studios

- Searchlight Pictures

How can I Sell my Disney stock?

Sell your stock. Once the stock shows up in your brokerage account, you can sell it at any time. Contact your broker and place an order to sell the stock. When you place the order to sell, you can set conditions on how the order is executed, as well as price restrictions and time limitation on the execution of the order.

See more

Can you buy 1 share Disney stock?

Yes, you can buy and sell shares directly through The Walt Disney Company Investment Plan.

How many shares do you need to make a stock?

The number of shares you should buy depends in part on the price of the stock you want to own. For example, if you have $2,000 to invest in stock, you could only buy 10 shares of a $200 stock. If you want to own a $10 stock, you could buy 200 shares.

Is the Disney stock worth buying?

At the moment, the stock is trading at 27 times forward earnings, mostly on par with its five-year average price-to-earnings multiple of 30. The entertainment company's valuation also appears very reasonable, provided that it meets analysts' consensus forecast of 90% adjusted EPS growth in fiscal 2022.

How many shares of each stock should I have?

Not exactly, according to experts—but you should have at least 20 and possibly a minimum of 60, according to a range of research and investing experts and research. It's a big undertaking to consider your investing timeline, risk tolerance, and how much you want to allocate to each stock.

How much money do I need to invest to make $1000 a month?

Assuming a deduction rate of 5%, savings of $240,000 would be required to pull out $1,000 per month: $240,000 savings x 5% = $12,000 per year or $1,000 per month.

How many shares should a beginner buy?

Most experts tell beginners that if you're going to invest in individual stocks, you should ultimately try to have at least 10 to 15 different stocks in your portfolio to properly diversify your holdings.

How much does it cost to buy stock in Disney?

The minimal single investment amount is $200. You have the option of paying in full or in a maximum of four installments, $50 each. The purchase fees are as it follows: $20 initial Disney stock set-up fee.

Is Disney a good long term investment?

Disney's Strengths Since Disney owns some of the most well-known and beloved entertainment and media properties in the world, it may be a good long-term investment. As customers return to the company, the stock may even resume paying its dividend, which could provide another boost to the share price.

How can I invest in Disney?

There are three main ways to invest in Disney:Buy stock directly from Disney. ... Purchase individual stocks with a brokerage account. ... Invest in mutual funds, index funds, and ETFs.

Is it worth buying 1 share of stock?

While purchasing a single share isn't advisable, if an investor would like to purchase one share, they should try to place a limit order for a greater chance of capital gains that offset the brokerage fees.

How do beginners invest in stocks with little money?

One of the best ways for beginners to learn how to invest in stocks is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

Is it better to invest in one stock or multiple?

Diversifying your portfolio in the stock market is an investing best practice because it decreases non-systemic, or company-specific, risk by ensuring that no single company has too much influence over the value of your holdings.

What to consider when buying Disney stock?

If the idea of buying Disney stock makes your Mickey Mouse ears perk up, here’s what to consider first. 1. The fundamentals of Disney stock. You may be well-versed in all the Disney characters, theme parks and brands, but you’re probably less familiar with the bones of the company: its management, revenue, net income and earnings.

How much of your portfolio should be in stocks?

When it comes to stocks, one general rule is to not have more than 10% of your portfolio in a single stock.

How to build a diversified portfolio?

To build a diversified portfolio out of individual stocks, you’ll need to research 20, 30, maybe 40 companies. That takes a lot of work. Index funds and ETFs do that work for you, by tracking a market index and allowing you to hold stock in hundreds of different companies within one fund .

Is the stock market good for long term investing?

The stock market fluctuates from day to day and usually is best for long-term investing. It is not the place to stash your short-term savings, where the goal is not growth but instead to preserve what you have. You should also think about whether you have enough set aside for an emergency.

Is Disney a blue chip?

How Disney stock fits into your portfolio. You’ve looked at Disney from every angle. It’s a blue-chip stock with a solid history. But there are still risks in buying its shares. Individual stocks are always riskier investments than diversified options like index mutual funds or exchange-traded funds.

What is Disney stock?

Disney stock is a bet on the continuing popularity of American entertainment. Here's how to buy the stock that's a common gift to children or grandchildren. Menu burger. Close thin.

What is Disney brokerage account?

Brokerage Account. For those who don’t like Disney’s investment plan’s $25 market order fee or $20 batch sales fee or who want to place limit orders or stop-loss orders, a brokerageis the way to go. These accounts afford investors direct access to the investment market, including Disney stocks.

How much was Disney worth in 2007?

According to a report from Howmuch.net, a “$1,000 investment in Disney in 2007 would be worth $2,824” after 10 years. The report further details that this return outpaces that of Coca-Cola, Walmart, Microsoft and McDonald’s during the same time frame. (Past performance does not indicate future results.

What is a market order?

The first, and simplest, option is to complete a market order, which means you’re buying shares at the price when the order is processed. Investors who have a set price in mind, though, can institute a limit order. This will ensure that shares are purchased only at the specified price.

Is Disney a streaming service?

It is ABC, ESPN, National Geographic and streaming services — on top of theme parks, cruises and movie studios. Many of its businesses have been slammed by the coronavirus pandemic. Still, Disney has a track record of success that goes back almost 100 years.

Do you know how to buy Walt Disney stocks? We will explain to you how

A household name since the first Mickey Mouse cartoons was shown on TV in the 1920s, The Walt Disney Company has come up with innovative products throughout the decade.

Why Buy Disney Stock?

While the stock price of Walt Disney momentarily took a slight dip during the closures of its theme parks around the world at the onset of the 2020 pandemic, analysts sees a strong recovery period for the company.

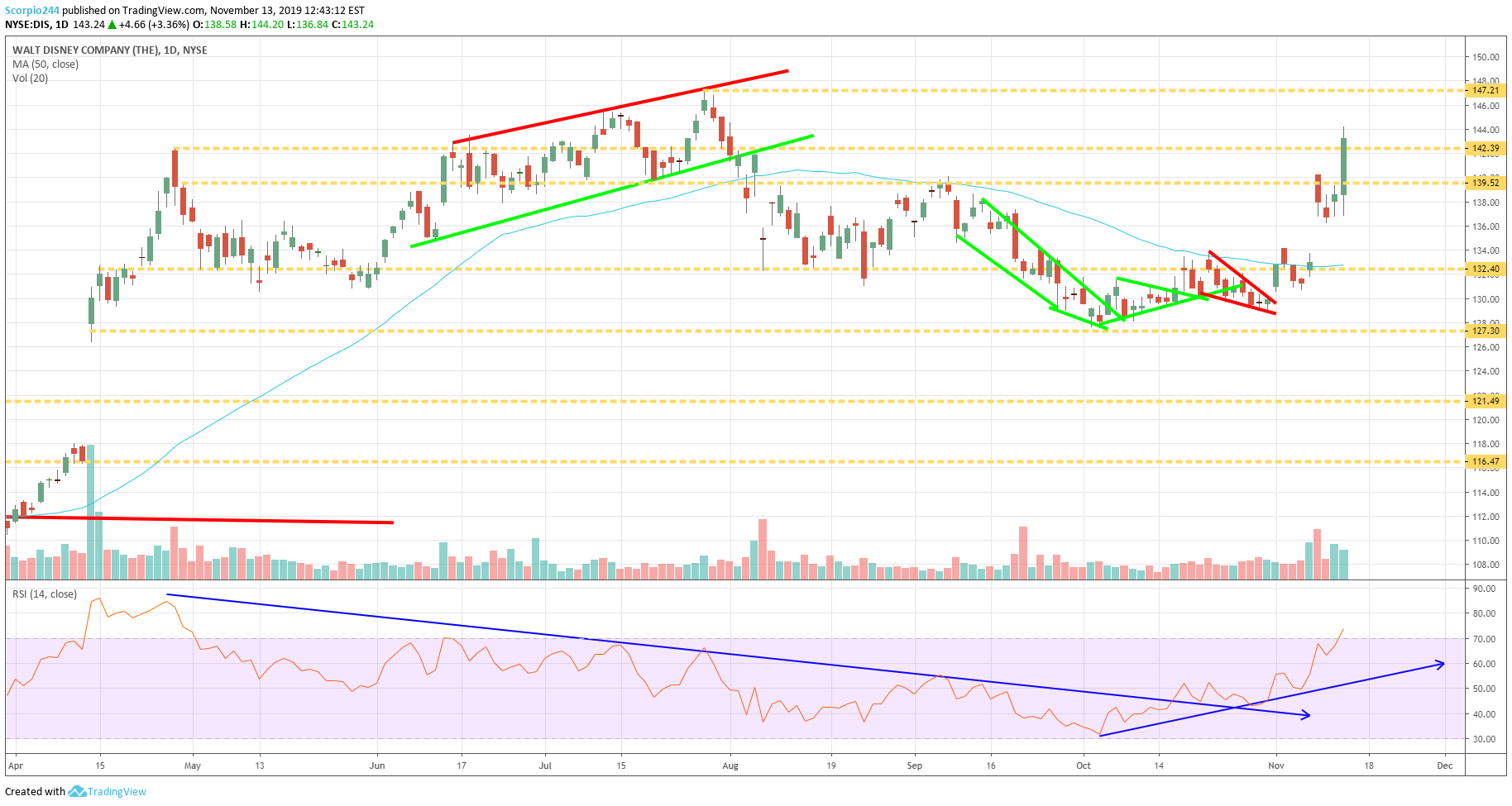

Disney Stock Performance

Walt Disney's stock performance has seen steady growth since its IPO in 1957.

Disney Stock Forecast

Below is Walt Disney’s forecast for the next year based their corporate plans and market trends and other analysis of their business model.

How to Buy Disney Stock?

For you to buy Disney stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading. Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing.

Best Brokers for Buying Disney Stocks

Below is table of the most trusted and reliable licensed brokers that offer Disney stock CFDs. All you haved to do is click on the Disney Page of your broker of choice and you'll be directed straight to their stock trading page.

Disney stock (DIS) fundamentals

Disney has an enduring appeal on Wall Street, and it manages to compete for attention with younger and flashier stocks like Apple, Tesla and Amazon. While Disney isn’t among the largest components of the S&P 500 — it’s currently hanging around the Top 20 spot — it is considered a blue-chip stock.

How Disney stock fits into your portfolio

Thanks to all of those stock splits, Disney shares remain fairly affordable for many investors, including beginners.

How to buy Disney stock in a brokerage account

If you have an online brokerage account, you can become a Disney shareholder in a matter of minutes. There are two main ways that you can buy Disney stock: Place a market order, which will be executed as soon as possible at the current market price, or place a limit order, which lets you specify the maximum price you are willing to pay.

Daily Money

Every day we publish the latest news, stories, and content on the financial topics that matter. This is your daily guide to all things personal finance.

Money.com

Money is one of the most widely recognized brands in personal finance, guiding readers to smarter decisions about investing, saving, and purchasing. Founded in 1972 as Money Magazine, Money.com is the digital home for the brand, attracting millions of readers each month.

Disney stock (DIS) fundamentals

Disney has an enduring appeal on Wall Street, and it manages to compete for attention with younger and flashier stocks like Apple, Tesla and Amazon. While Disney isn’t among the largest components of the S&P 500 — it’s currently hanging around the Top 20 spot — it is considered a blue-chip stock.

How Disney stock fits into your portfolio

Thanks to all of those stock splits, Disney shares remain fairly affordable for many investors, including beginners.

How to buy Disney stock in a brokerage account

If you have an online brokerage account, you can become a Disney shareholder in a matter of minutes. There are two main ways that you can buy Disney stock: Place a market order, which will be executed as soon as possible at the current market price, or place a limit order, which lets you specify the maximum price you are willing to pay.

About The Walt Disney Company

Walt and Roy Disney founded the Disney Brothers Cartoon Studio back in 1923. Although its originators were by far more interested in developing their product than gaining profit, the latter eventually became imminent.

Should You Buy Disney Stock?

There are several things to consider before buying any individual stocks. You should start by:

How to Buy Disney Stock?

Once you decide to buy Disney shares, the only thing left is to decide on the exact purchasing method. Currently, there are three ways to become a Disney shareholder.

How much stock do you need to buy Disney stock?

They usually require you to buy a minimum of 1 whole stock per order . This means you probably won’t be able to invest less than the price of at least 1 Disney stock. Use that as your minimum if your calculated minimum isn’t enough. If Disney stocks are too much, you can look at other stocks instead.

How much of your investment should be in Disney?

This rule says that you should never have more than 5% of your investments in the same place. That means if you’re planning to buy Disney stocks, you shouldn’t make it your only investment or your majority investment, unless you plan to do more later on.

How to get stocks on Robinhood?

Once you’ve got your Robinhood account and you’re ready to go, it’s time to get your stocks. Open up the app, or go online to the site, log into your account, and start your order. You need to make sure you make the right kind of order. Choose the option to buy stocks, not ETFs, mutual funds, bonds, or anything else.

Does Robinhood offer free stock trading?

However, Robinhood is the only one that actually offers free stock trading, so that’s something to consider before you make your choice.

Can you buy whole numbers of stocks at once?

Remember that stocks can be purchased in fractions, meaning you don’t have to buy whole numbers of stocks at once. Find out how much you can afford to invest, even if it’s $50-$100 at first, and make it happen. You can put some money towards other stocks in the future too!

Is Disney real magic?

You don’t get a lot of chances to be part of something magical. Disney may not have any real magic, but it’s still an experience that many people find to be magical. By investing in Disney stocks, you can be part of the whole experience without having to work for Disney. There’s no such thing as 100% certainty, ...

Is Robinhood a good app to buy stocks?

Click here to sign up using my referral link. Robinhood isn’t the only way to buy stock, but it’s a great place to start. Basically, Robinhood is a free mobile app that lets you invest in stocks and a lot of other things with no stock purchase fees.

How does Disney make money?

With its wealth of products and services, Disney makes money in a variety of ways: park ticket sales and merchandise, movie tickets sales, licensing, subscriptions, and vacation packages. Disney’s main competition is other media conglomerates, such as: Viacom, Inc. Time Warner Inc. Twenty-First Century Fox.

Is Disney+ a streaming service?

And in 2019, the Disney+ streaming service will launch, adding to the company’s presence in the direct-to-consumer streaming space.

Is Disney a big company?

The Walt Disney Company is one of the world’s largest and most prominent brands, dominating everything from theme parks to movie screens. If you’re a fan of the company, then you may be thinking about investing your hard-earned money with Disney.

Is Disney a blue chip?

Look at past performance: Use resources like MorningStar to track a stock’s performance and see how it’s done in the past. Disney is a blue chip stock, meaning it’s a popular stock to buy because it’s relatively stable and often pays attractive dividends.