How long will it take to Double Your Money in stocks?

S&P 500, a group of top 500 stocks in the US, has returned around 10% per year on average in the last 100 years, which means investments will take 7.2 years to double. (Source: 10.658% return per year on average from 1921 to 2021 .)

How fast will my investments double in value?

The first is the “rule of 72” – a simple rule of thumb to help you determine how fast your investments will double in value at certain rates of return. Simply divide 72 by the presumed growth rate to get a rough idea on how long it will take for your money to double. For example, an investment growing at 7.2% a year would double in 10 years.

How long will it take to double my savings to $25k?

You would ideally like that to double to $25,000 in nine years and $50,000 in 18 years. Using the rule of 72, you could figure out what average rate of return will accomplish this.

How often should you double your investment portfolio?

Dividing that expected return into 72 indicates that this portfolio should double every nine years. That's not too shabby when you consider that it will quadruple after 18 years. When dealing with low rates of return, the rule of 72 is a fairly accurate predictor.

How long does it take for stock market to double?

But by examining historical data, we can make an educated guess. According to Standard and Poor's, the average annualized return of the S&P index, which later became the S&P 500, from 1926 to 2020 was 10%. At 10%, you could double your initial investment every seven years (72 divided by 10).

Can a stock double in a day?

Penny stocks can double your money in a single trading day. Just keep in mind that the low prices of these stocks reflect the sentiment of most investors.

What is the 7 year rule for investing?

The most basic example of the Rule of 72 is one we can do without a calculator: Given a 10% annual rate of return, how long will it take for your money to double? Take 72 and divide it by 10 and you get 7.2. This means, at a 10% fixed annual rate of return, your money doubles every 7 years.

Can I double my money in 5 years?

Mutual Funds (MFs) Long term mutual funds offer 12% to 15% per annum as rate of return. Doubling money through mutual funds will take approximately 5 to 6 years.

Can you get rich off stocks?

Investing in the stock market is one of the world's best ways to generate wealth. One of the major strengths of the stock market is that there are so many ways that you can profit from it. But with great potential reward also comes great risk, especially if you're looking to get rich quick.

How quick do stocks Grow?

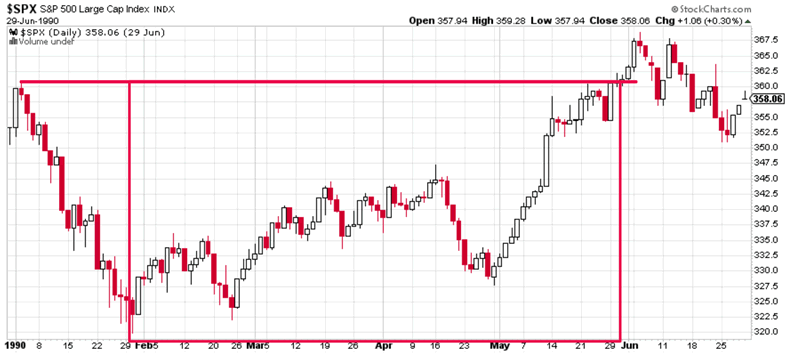

The average stock market return is about 10% per year for nearly the last century. The S&P 500 is often considered the benchmark measure for annual stock market returns.

What is the 50 30 20 budget rule?

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Will my 401k double in 10 years?

“The longer you can stay invested in something, the more opportunity you have for that investment to appreciate,” he said. Assuming a 7 percent average annual return, it will take a little more than 10 years for a $60,000 401k balance to compound so it doubles in size. Learn the basics of how compound interest works.

What is the rule of 69?

The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

Where should I invest 1000 right now?

7 Best Ways to Invest $1,000Start (or add to) a savings account. ... Invest in a 401(k) ... Invest in an IRA. ... Open a taxable brokerage account. ... Invest in ETFs. ... Use a robo-advisor. ... Invest in stocks. ... 13 Steps to Investing Foolishly.

What should I invest 30k in?

Here are 12 strategies to make your $30k grow:Take advantage of the stock market.Invest in mutual funds or ETFs.Invest in bonds.Invest in CDs.Fill a savings account.Try peer-to-peer lending.Start your own business.Start a blog or a podcast.More items...•

How much money can you make from stocks in a month?

If you owned $10,000 worth of stocks from a company that paid a 2% dividend, you would earn $200 each quarter or $66.67 per month. With the same amount of stock at 5%, you would earn $500 per quarter or $166.67 per month.

How long has the stock market doubled?

The stock market has now doubled in a little more than 15 months. As it turns out, investing during a market crash can be lucrative. To some investors, this feels way too far way too fast. To other investors, this gain may feel quaint, especially relative to some of the enormous returns we’ve seen in other securities and asset classes.

When did the stock market bottom?

The stock market bottomed on June 1, 1932 following the bone-crushing 80%+ crash that began in 1929. Stocks were basically flat for the remainder of the month but then took off like a rocketship, rising a cool 92% in July and August of 1932. By the first week of September 1932, the stock market was up more than 100%, ...

How long did the S&P 500 fall?

The S&P 500 was twice as high as the October 2002 lows by January 2007. So that was roughly 50 months or more than 4 years for a 100% gain off the bottom.

Can you enter the stock market multiple times?

You don't know if you're getting into a stock at a high or a low, because you don't know what's coming next. But you can enter the market at multiple times rather than all at once, by purchasing shares in installments.

Can you make a quick buck on the stock market?

With so much uncertainty, the lesson is clear: There's no way to make a quick buck on the stock market. Smart investors never make this their goal; instead, they play the long game. They anticipate fluctuations in the market, and handle them by investing money they can afford to leave untouched for years.

Is the stock market unpredictable?

An in-depth study from researchers at Vanguard revealed some interesting facts about the predictability (or unpredictability) of market returns. In reviewing annualized returns of the stock market since 1926, they drew several conclusions. First, they learned that "stock returns are essentially unpredictable at short horizons." They continue, "Quite frankly, this lack of predictability is not surprising given the poor track record of market-timing."

How to use the rule of 72?

How the Rule Works. To use the Rule of 72, divide the number 72 by an investment's expected annual return. The result is the number of years it will take, roughly, to double your money. For example, if the expected annual return of a bank Certificate of Deposit (CD) is 2.35% and you have $1,000 to invest, it will take 72/2.35 or 30.64 years ...

What is the rule of 72?

If you know that you need to have a certain amount of money by a certain date, for example, for retirement or to pay for your newborn child's college tuition, the Rule of 72 can give you a general idea of which asset classes you'll need to invest in to achieve your goal. First, you can use the Rule of 72 to determine how much college might cost in ...

Is Rule of 72 a good investment?

While the Rule of 72 is a good investment guideline, it only provides a framework. If you're looking for a more precise outcome, you'll need to better understand an asset's future value formula. The Rule of 72 also does not take into account the effect of investment fees, such as management fees and trading commissions, can have on your returns. Nor does it account for the losses you'll incur from any taxes you have to pay on your investment gains.

How long does it take to double your money?

For example, if you can make 10% per year, it takes 72 / 10 = 7.20 years to double your money.

How long does it take to make money in stocks?

But how long should you wait to actually make some money? Technically, you can make money in stocks in as short as 30 minutes, or as long as a couple of years. It depends on how you approach the market. Day trading, as the name suggests, only takes a day to make money.

How long does it take to swing trade?

On the other hand, long term trading takes at least a year invested on a stock. Swing trading is somewhere between the two. Most of the time, swing trading gains income from 2 weeks to a couple of months. As a general rule, the longer time you invest, the more money you can earn.

What is compound interest in stocks?

If you are starting, try to consider every different strategy. And start with little money. Compound interest is the process where the money invested is multiplied.

What is day trading?

Day traders tries predicts price movements of a stock in a day. They are going to make several trades in a day. Their goal is to be right in more trades than they lose. For simplicity, let us say they done 10 trades, their goal is to make money in at least 6 of those. For every trade, they can gain or lose money.

Can you lose money by picking stocks?

At the same time, it is possible to lose money on picking stocks. Picking individual stocks can give you returns of anywhere between negative 100% returns up to 500% and up. Long-Term trading focuses on the fundamentals of a company. Pros:

Rule of 72 Based on Different Asset Classes

- You can get a general idea of how different asset allocationmodels have performed over the years by using historic rates of return. During the 90-year period of time between 1929 and 2019, this is what the rule of 72 looks like for these different mixes of stocks and bonds. Data source: Vangu…

Pros of The Rule of 72

- The biggest positive of using this rule is that it is incredibly simple. You don't need a fancy financial calculator or computer program, just a sheet of paper, a pen or pencil, and basic math skills. You can then set some rudimentary goalsusing your calculations. Let's say that you have a goal of saving $50,000 for your child's education in 18 years. You have $12,500 that you plan on …

Limitations of The Rule of 72

- If you invested in 100% stocks over 90 years, your average rate of return would be just over 10%. In general, the longer you give your money to grow, the better a chance you have of capturing these sorts of averages. But over short periods of time, you may find that your averages fluctuate more and aren't as predictable. The average returns you get from the stock market also depend …