How long do you have to own a stock to get dividends?

Aug 24, 2020 · It usually happens a week or more after the date of record. The most important date to know in that list is the ex-dividend date. Long story short, just buy anytime before that date and you are good to get the dividend. All you have to do is hold onto the stock until at least the ex-dividend date.

When do you go on record for a dividend?

Feb 10, 2022 · In order to receive the preferred 15% tax rate on dividends, you must hold the stock for a minimum number of days. That minimum period is 61 days within the 121-day period surrounding the ex-dividend date. The 121-day period begins 60 days before the ex-dividend date.

What happens if you buy a stock before it dividends?

How long do you have to hold a stock to get the dividend? In the simplest sense, you only need to own a stock for two business days to get a dividend payout. Technically, you could even buy a stock with one second left before the market close and still be entitled to the dividend when the market opens two business days later.

When is the best time to buy a dividend stock?

Dec 12, 2019 · The holders of record then receive the dividend on the date of payment. The stock will trade ex-dividend two business days before that date, meaning anyone buying the stock will not get the pending dividend. Instead, the seller receives the dividend because they owned the stock on the date of record. 00:00.

Do you have to hold a stock for 60 days to get a dividend?

In order to receive the upcoming dividend, the holder has to own the shares before the ex-dividend date. The minimum 60-day holding period rule also applies to mutual funds. For preferred stocks, the shares have to be held for over 90 days during a 181-day period that begins 90 days before the ex-dividend date.

When can I sell a stock and still get the dividend?

The ex-dividend date for stocks is usually set one business day before the record date. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

When should I buy stock to get dividend?

You have to buy the shares of the company before the ex-dividend date so that you get the delivery by the record date and therefore are entitled to dividends. The stock normally starts trading ex-dividend on the XD date.

Should I sell stock before or after dividend?

You must have acquired your shares before the ex-dividend date in order to receive a dividend. If you acquired your shares on or after the ex-dividend date, the previous owner will receive the dividend. Sell your shares on or after the Ex-Dividend Date and you'll receive the dividend.

What happens if I sell stock after ex-dividend date?

The ex-dividend date is the first day of trading in which new shareholders don't have rights to the next dividend disbursement. However, if shareholders continue to hold their stock, they may qualify for the next dividend. If shares are sold on or after the ex-dividend date, they will still receive the dividend.

Are dividends worth it?

Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. They provide a nice hedge against inflation, especially when they grow over time. They are tax advantaged, unlike other forms of income, such as interest on fixed-income investments.

Is it good to buy stock before dividend?

Waiting to purchase the stock until after the dividend payment is a better strategy because it allows you to purchase the stock at a lower price without incurring dividend taxes.

What is a good dividend yield?

The average dividend yield on S&P 500 index companies that pay a dividend historically fluctuates somewhere between 2% and 5%, depending on market conditions. 5 In general, it pays to do your homework on stocks yielding more than 8% to find out what is truly going on with the company.

How long do you have to hold a stock to get dividends?

How long do you have to hold a stock to get the dividend? In the simplest sense, you only need to own a stock for two business days to get a dividend payout. Technically, you could even buy a stock with one second left before the market close and still be entitled to the dividend when the market opens two business days later.

How do dividend stocks work?

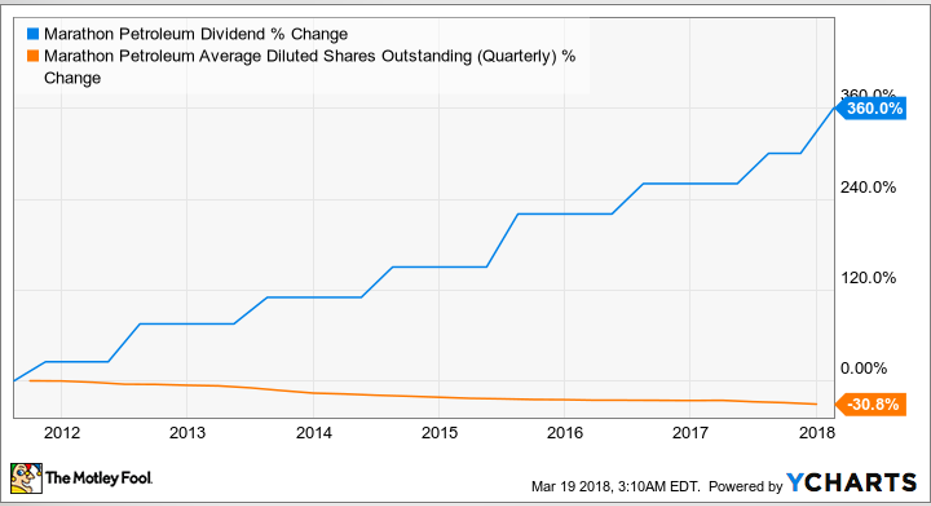

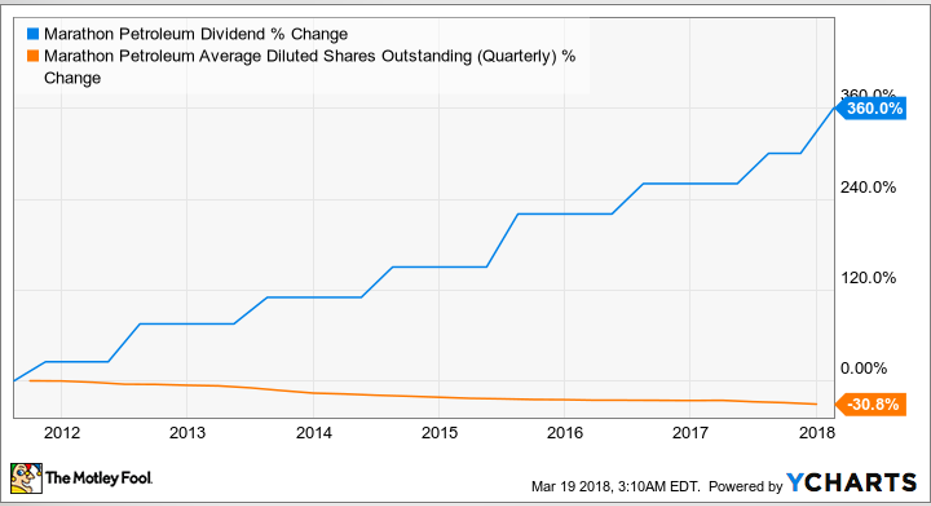

Dividend stocks distribute a portion of the company’s earnings to investors on a regular basis. Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream.

Why don't people invest in the stock market?

There are a lot of reasons why people may not want to invest in the stock market, here are a few in no particular order: They don’t have the funds to invest in the stock market. They don’t trust the market as they don’t have any financial knowledge/education. They don’t know how to invest in the stock market.

Do dividends matter?

Do Dividends Really Matter? As dividends are a form of cash flow to the investor, they are an important reflection of a company’s value. It is important to note also that stocks with dividends are less likely to reach unsustainable values. Investors have long known that dividends put a ceiling on market declines.

Pay Day

Many companies reward their shareholders by paying cash dividends, essentially a cut of a company's annual earnings paid for each share of stock owned. The date the firm's board of directors announces it will be paying a dividend is known as the declaration date.

Mark Your Calendar

The company verifies the parties which own its stock on the date of record. The holders of record then receive the dividend on the date of payment. The stock will trade ex-dividend two business days before that date, meaning anyone buying the stock will not get the pending dividend.

Mark Down

When the stock market opens on the ex-dividend date, stocks trading without a dividend are notated by an "x," signify that the buyer will not receive the pending payment. Since the the value of the company has decreased by the amount of the slated dividend payment, the value of the stock is also lowered.

Cash In

If you bought the stock before the ex-dividend date, your dividend will be mailed to you or credited to your brokerage account on the payment date. Although most companies that issue dividend stocks do so quarterly, there are exceptions. Some will pay dividends monthly, semi-annually, annually or on an irregular schedule.

How long do you have to own a stock to get dividends?

And you can sell the stock a day or two after that, once everything settles. So in theory, you only need to own the stock for a couple of days to get the dividend.

What is the ex dividend date?

The Ex-Dividend Date is the first day the stock trades without its dividend, thus ex-dividend. If you want to get the dividend payment, you need to own the stock by this day. That means you have to buy before the end of the day before the ex-dividend date to get the next dividend. In other words, it’s the cut-off date.

How long do you have to hold stock to qualify for dividends?

For common stock, shares must be held for more than 60 days throughout the 121-day time period, which begins 60 days before the ex-dividend date. Preferred stock must have a holding period of at least 90 days during the 181-day time period that begins 90 days before the stock's ex-dividend date. 1

What is the tax rate for qualified dividends?

Qualified dividends are taxed at a capital gains tax rate of 0%, 15%, or 20%, which is lower than the normal income tax rate for most individuals. Unqualified dividends are commonly taxed at the higher regular income tax rate. 1.

Who is JB Maverick?

J.B. Maverick is a novelist, scriptwriter, and published author with 17+ years of experience in the financial industry. The holding period on a stock dividend typically begins the day after it is purchased. Understanding the holding period is important for determining qualified dividend tax treatment.

Is a long term capital gain or loss?

Any asset that is held for more than one year is normally considered to be a long-term capital gain or loss. Any asset held less than one year is considered to be a short-term gain or loss. This is important because of the different tax treatments for long- and short-term capital gains.