The issuance of stock for a non-cash item is essentially a non-cash financing activity that should be disclosed at the bottom of the statement of cash flows or in a separate note to the statement. To learn more about such disclosure, read non-cash investing and financing activities article. More from Stockholder's equity (explanations):

Full Answer

How do you prepare a statement of stockholders’ equity?

Since the statement includes net income/loss, a company must prepare it after the income statement. Like any other financial statement, the statement of stockholders’ equity will have a heading showing the name of the company, time period and title of the statement. Usually, the statement is set in a grid pattern.

What is an equity statement?

An equity statement – also referred to as a statement of owner’s equity or statement of changes in equity – is a financial statement that a company is required to prepare along with other important financial documents at the end of a reporting period.

How is the issuance of stock reported on the financial statements?

The issuance of stock for a non-cash item is a non-cash financing activity that should be disclosed at the bottom of the statement of cash flows or in a separate note to the statement. For further information about such disclosure, read non-cash investing and financing activitiesarticle.

How do you calculate stockholders equity?

Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus retained earnings. It also represents the residual value of assets minus liabilities. By rearranging the original accounting equation, we get Stockholders Equity = Assets – Liabilities.

How do you account for issuing stock?

Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. Those proceeds are allocated first to the par value of the shares (if any), with any excess over par value allocated to additional paid-in capital.

Does issuing stock go on income statement?

Issuing stocks doesn't affect an income statement, but the transaction flows into accounts that interrelate with a statement of profit and loss -- the other name for an income statement.

How are issued stocks reported on the financial statements?

Preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on the balance sheet in the stockholders' equity section. Information regarding the par value, authorized shares, issued shares, and outstanding shares must be disclosed for each type of stock.

How does issuing stock affect equity?

Money you receive from issuing stock increases the equity of the company's stockholders. You must make entries similar to the cash account entries to the Stockholder's Equity account on your balance sheet.

Is issuing stock an inflow or outflow?

When a company issues and sells stock, say, to the public, to dividend reinvestment plan shareholders, or to executives exercising their stock options, the money it collects is considered cash flow from financing activities.

How does issuing equity affect financial statements?

When your company issues equity, the money raised appears on the cash flow statement, and the balance sheet reflects both the cash raised and the equity issued. However, an equity issuance does not affect the income statement.

What is the journal entry for issuing shares?

Issuance of shares having no par value is recorded by debiting cash and crediting common stock or prefered stock. However if board of directors of the company assigns a value to shares orally, such value is called stated value and the journal entries will be similar to par value stock.

What is the journal entry for issuing common stock?

A company issues common stock to raise money, so the debit will always be to cash. There will always be a credit to common stock for the # of shares issued x the par value. Additional paid-in capital (APIC) is the plug.

Does issuing stock increase retained earnings?

Issuing common stock generates cash for a business, and this inflow is recorded as a debit in the cash account and a credit in the common stock account. The proceeds from the stock sale become part of the total shareholders' equity for the corporation but do not affect retained earnings.

Does issuing stock increase return on equity?

The Influence of Stockholders' Equity ROE rises when average common equity falls and falls when equity rises. The components of common equity include retained earnings and the proceeds from issuing common stock. The retained earnings amount is the accumulated net income after paying common and preferred dividends.

Why does issuing shares increase equity value?

When new stock is issued and a company takes in revenue from the sale of that stock, that revenue becomes an asset. Since stockholders' equity is measured as the difference between assets and liabilities, an increase in assets can also increase stockholders' equity.

Is issuing shares an asset?

No, common stock is neither an asset nor a liability. Common stock is an equity.

What is owner's equity statement?

The statement of owner’s equity reports the changes in company equity, from an opening balance to and end of period balance. The changes include the earned profits, dividends, inflow of equity, withdrawal of equity, net loss, and so on.

What is the statement of changes in equity?

Statement of Retained Earnings The statement of retained earnings provides an overview of the changes in a company's retained earnings during a specific accounting cycle. It is structured as an equation, such that it opens with ...

What changes are generally reflected in the equity statement?

The changes that are generally reflected in the equity statement include the earned profits, dividends, inflow of equity, withdrawal of equity, net loss, and so on.

What is the opening balance in equity?

Opening Balance: The opening balance is the ending balance of the previous year’s statement of shareholder’s equity. All further additions and subtractions in the current financial year are made to the opening balance in the equity statement.

What is equity in business?

Equity, in the simplest terms, is the money shareholders have invested in the business. It constitutes a part of the total capital. Capital Capital is anything that increases one’s ability to generate value. It can be used to increase value across a wide range of categories, such as financial, social, physical, intellectual, etc.

What is a fiscal year?

Fiscal Year (FY) A fiscal year (FY) is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. Profit & Loss Statement. Profit and Loss Statement (P&L) A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a.

How long is a fiscal year?

Fiscal Year (FY) A fiscal year (FY) is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. , after accounting for all operating and non-operating expenses.

What is a statement of stockholders equity?

Statement of Stockholders Equity (or statement of changes in equity) is a financial document that a company issues under its balance sheet. The purpose of this statement is to convey any change (or changes) in the value of shareholder’s equity in a company during a year. It is a required financial statement from a US company, ...

How many rows are there in a stockholder's equity statement?

Usually, the statement is set in a grid pattern. The statement typically consists of four rows – Beginning Balance, Additions, Subtractions and Ending Balance.

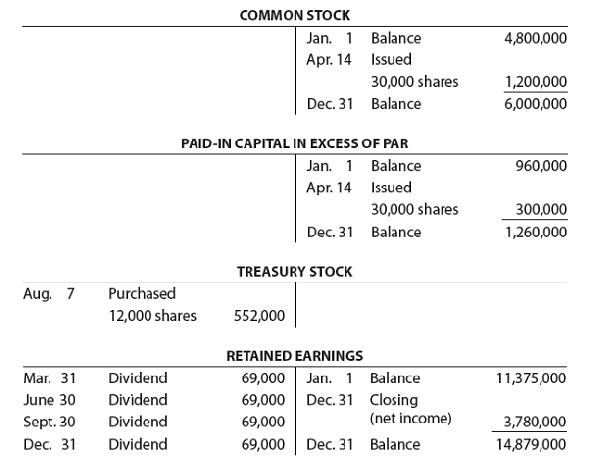

How does cash dividend affect retained earnings?

Payment of cash dividend lowers the retained earnings of the company . Net income increases the retained earnings, whereas net loss decreases it. Treasury stock purchase increases the stock component and brings down the net shareholders’ equity.

Why do companies issue statements?

Usually, a company issues the statement towards the end of the accounting period to give information to the investors about the equity position and sentiment towards the company. The statement allows shareholders to see how their investment is doing. It also helps the management to make decisions regarding the future issuances of stock shares.

How to prepare a statement?

In this method, all items are listed in a single column, starting with the opening balance of shareholders’ equity and then adjusting for any changes during the period. The number of rows is similar to in the grid one.

What is the ending balance in stockholders equity?

The last line of the statement of stockholders’ equity will have the ending balance, which is the outcome of the beginning balance, additions, and subtractions. There could be more rows depending on the nature transactions a company may have.

What is retained earnings?

The amount that a company keeps aside after paying all the expenses and dividends is known as retained earnings. A company may use retained earnings for various purposes such as re-investing, expanding, new product launch and so on. An increase or decrease in retained earnings directly affects the stockholder’s equity.

What is issue stock?

Issued stock refers to the shares that the company is able to sell.

When a company reissues treasury stock, is it obliged to offer the stock to

When the company chooses to reissue treasury stock, it is not obliged to offer the stock to existing shareholders first. The company must first offer any additional stock being issued on a date after the original date of issue to existing shareholders on a pro rata basis.

Why do companies buy back their own shares?

A company can decide to buy back its own shares in order either to withdraw the shares from circulation or reissue them. In some instances, the repurchasing of shares has the effect of supporting current shareholders by boosting the company's stock price.

What is vesting period in ESO?

One of them is referred to as a vesting period, which means that a period of time must pass before the ESO holder can exercise their rights. For example, the company could stipulate that an employee can only sell 20 percent of their options each year for five years.

What is an ESO option?

Employee Stock Options. A company can also issue an employee stock option (ESO) as part of an employee's compensation package. The employee then has the option of exercising the stock option, ideally at a time when the company's share price on the market is higher than the ESO's exercise price.

Why do companies repurchase their stock?

There are sometimes other motivations behind a company's decision to repurchase stock, including to prevent a takeover. Additionally, the company may feel its shares are currently undervalued on the market.

What is preferred stock?

Preferred shares: Combine features of equity and debt. Give their owners priority over common shareholders when dividends are paid. Can be converted into common stock. Whether a company issues common shares or preferred stock, it records the transaction in the stockholder's equity section of its balance sheet.

What is the purpose of calculating stockholders equity?

Calculating stockholders equity is an important step in financial modeling. This is usually one of the last steps in forecasting the balance sheet items. Below is an example screenshot of a financial model where you can see the shareholders equity line completed on the balance sheet.

What are the components of stockholders equity?

Stockholders Equity is influenced by several components: 1 Share Capital – amounts received by the reporting entity from transactions with its owners are referred to as share capital#N#Share Capital Share capital (shareholders' capital, equity capital, contributed capital, or paid-in capital) is the amount invested by a company’s#N#. 2 Retained Earnings – amounts earned through income, referred to as Retained Earnings and Accumulated Other Comprehensive Income (for IFRS only). 3 Net Income & Dividends – Net income increases retained earnings while dividend payments reduce retained earnings.

How to calculate retained earnings?

To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in retained earnings for a specific period.

Why are debt holders not interested in equity?

Therefore, debt holders are not very interested in the value of equity beyond the general amount of equity to determine overall solvency. Shareholders, however, are concerned with both liabilities and equity accounts because stockholders equity can only be paid after bondholders have been paid.

What is a share capital?

Share Capital (contributed capital) refers to amounts received by the reporting company from transactions with shareholders. Companies can generally issue either common shares or preferred shares. Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

How many dates are there for dividends?

There are four key dates in terms of dividend payments, two of which require specific accounting treatments in terms of journal entries. There are various kinds of dividends that companies may compensate its shareholders, of which cash and stock are the most prevalent. Date. Explanation.

What is authorized number of shares?

The number of shares authorized is the number of shares that the corporation is allowed to issue according to the company’s articles of incorporation. The number of shares issued refers to the number of shares issued by the corporation and can be owned by either external investors or by the corporation itself.

How does a stock issuance work?

A typical stock issuance involves a company announcing an offering and then having underwriters gauge interest among potential investors and set a price per share. Once you know how many shares the company is issuing and at what price, it's easy to calculate the proceeds.

How does common stock affect shareholder equity?

The common stock account increases by an amount equal to the number of shares multiplied by each share's par value. This is typically less than the proceeds of the issuance.

How does stock issuance affect the balance sheet?

Accounting for stock issuances. In general, a stock issuance affects three accounts on the balance sheet. First, the proceeds that the company receives from the stock issuance increase the cash account. In rare cases, companies issue stock in exchange for redeeming debt or for tangible assets rather than cash, which requires changing different ...

Why are stock issuances important?

Stock issuances are important ways for companies to get the capital they need. By knowing how to calculate and account for them properly, you'll learn to recognize them when you see them in a company's financial statements.

How is shareholders' equity determined?

In its simplest form, shareholders' equity is determined by calculating the difference between a company's total assets and total liabilities. The statement of shareholders' equity highlights the business activities that contribute to whether the value of shareholders' equity goes up or down.

What is shareholders equity?

The statement of shareholders' equity is a financial document a company issues as part of its balance sheet. It highlights the changes in value to stockholders' or shareholders' equity, or ownership interest in a company, from the beginning of a given accounting period to the end of that period.

What happens to common stock when a company liquidates?

If a company needs to liquidate, holders of common stock will get paid after preferred stockholders and bondholders. Like preferred stock, common stock is typically listed on the statement of shareholders' equity at par value. Treasury stock. Treasury stock is stock that the issuing company repurchases. A company might repurchase its own stock in ...

What is preferred stock?

This is a special type of stock, or ownership stake in a company, that offers holders a higher claim on a company's earnings and assets than those who own the company's common stock. Preferred stockholders will typically be entitled to dividends before holders of common stock can receive theirs.

Why do companies repurchase their own stock?

A company might repurchase its own stock in an attempt to avoid a hostile takeover or boost its stock price. Shareholders' equity is reduced by the amount of money spent to repurchase the shares in question. Additional paid-up capital. Also known as contributed capital, additional paid-up capital is the excess amount investors pay over ...

What is retained earnings?

Retained earnings. Retained earnings are the total earnings a company has brought in that have not yet been distributed to shareholders. This figure is calculated by subtracting the amount paid out in shareholder dividends from the company's total earnings since inception.

Do preferred stock holders have voting rights?

Holders of preferred stock do not have voting rights in the issuing company. Common stock. This is a type of stock, or ownership stake in a company, that comes with voting rights on corporate decisions. Common stockholders are lower down on the list of priorities when it comes to paying equity holders. If a company needs to liquidate, holders of ...

Why do companies sell equity?

A company sells equity units -- or stocks -- to keep operational coffers flush with capital at a time when it doesn't generate enough revenues to weather a bad economy, produce quality products and deal with competitors head-on.

What is a stockholder account?

"Stockholder" or "shareholder" is the name business reporters give to a person or company that pours money into a company's operating activities.

What is a P&L statement?

If senior executives promised rosy performance in earlier utterances, a P&L is the data summary you review to evaluate whether they remain true to their words. In an income statement, a business displays revenues, expenses and net income -- or loss, if expenses exceed revenues. Money an organization derives through share issuance is not revenue. The corporation makes money by selling goods or providing services, not through cash inflows from investors.

Does stock issue affect income statement?

Issuing stocks doesn't affect an income statement, but the transaction flows into accounts that interrelate with a statement of profit and loss -- the other name for an income statement.

Is there a link between stock issuance and income statement?

There's a subtle linkup between stock issuance and an income statement although both items are distinct. When a company closes its books, accountants transfer net income into the retained earnings account -- which is a component of a stockholders' equity statement, similar to common stock and additional paid-in capital.

What is stockholder equity?

Posted in: Stockholder's equity (explanations) Companies need long term fixed assets (land, building and vehicles etc.) to carry out various business activities. One way to acquire these assets is to purchase them for cash and another way is to acquire them in exchange of company’s stock.

When is the fair market value of land readily determinable?

When the fair market value of land is readily determinable: (3). When the land is valued by an independent professional: Companies may also use their treasury stock to acquire non-cash assets. If treasury stock is used, the fair value of the treasury stock or the fair value of non-cash asset should be used for valuation.

Is treasury stock a non-cash item?

The cost of treasury stock should not be used for this purpose. The issuance of stock for a non-cash item is a non-cash financing activity that should be disclosed at the bottom of the statement of cash flows or in a separate note to the statement.

Is stock issued for non cash?

Issuing stock for non-cash tangible and intangible assets is common among companies but valuation often becomes a major problem in such transactions. The general rule is to record these transactions on the basis of fair market value of the non-cash asset acquired or the fair market value of the stock issued whichever can be more clearly ...

Components of Stockholders Equity

Applications in Personal Investing

- With various debt and equity instruments in mind, we can apply this knowledge to our own personal investment decisions. Although many investment decisions depend on the level of risk we want to undertake, we cannot neglect all the key components covered above. Bonds are contractual liabilities where annual payments are guaranteed unless the issuer defaults, while di…

Applications in Financial Modeling

- Calculating stockholders equity is an important step in financial modeling. This is usually one of the last steps in forecasting the balance sheet items. Below is an example screenshot of a financial model where you can see the shareholders equity line completed on the balance sheet. To learn more, launch our financial modeling coursesnow!

Learn More

- Thank you for reading CFI’s guide to Stockholders equity. To keep learning and advancing your career, the following resources will be helpful: 1. Free Reading Financial Statements Course 1. How to Link the 3 Financial Statements 2. Financial Statement Analysis Guide 3. Financial Modeling Guide 4. How to be a Great Financial Analyst