- Another common way for accounting for treasury stock is the par value method.

- Other Liabilities – In this section, the user will itemize any other liability that has not been entered on this Liabilities and Capital Menu.

- Some corporations employ stock splits to keep their stock price competitive in the market.

Why would the treasury stock be negative on a balance sheet?

Feb 27, 2022 · When you are looking over a balance sheet, you will run across an entry under the shareholders' equity section called treasury stock. The dollar amount of treasury stock shown on the balance sheet refers to the cost of the shares a firm has issued and then taken back at a later time, either through a share repurchase program or other means.

Where on the balance sheet does treasury stock appear?

Oct 27, 2020 · Treasury stock shows up as a debit, or minus, in stockholders’ equity on the corporate balance sheet. Because treasury stock is stated as a minus, subtractions from stockholders’ equity indirectly lower retained earnings, along with overall capital. Since both retained earnings and treasury stock are reported in the stockholders’ equity section of the …

Does treasury stock have a credit balance?

Treasury stock is reported within the balance sheet as: Multiple Choice a long-term investment. an account contra to owners’ equity. an account contra to retained earnings. a …

What should treasury stock be reported as?

How does treasury stock appear on the balance sheet?

On the balance sheet, treasury stock is listed under shareholders' equity as a negative number. It is commonly called "treasury stock" or "equity reduction". That is, treasury stock is a contra account to shareholders' equity.

How do you account for treasury stock?

You record treasury stock on the balance sheet as a contra stockholders' equity account. Contra accounts carry a balance opposite to the normal account balance. Equity accounts normally have a credit balance, so a contra equity account weighs in with a debit balance.Mar 26, 2016

How is treasury stock shown on the balance sheet quizlet?

Treasury Stock is listed in the stockholders' equity section on the balance sheet. The cost of treasury stock is deducted from total paid-in capital and retained earnings in determining total stockholders' equity.

Why is treasury stock negative on the balance sheet?

When stock is “retired” into Treasury Stock cash or some form of debt is used to pay for the stock, the diminishment of the cash asset or the addition of a liability to pay for the stock requires an entry into Equity that diminishes it. For that reason, Treasury Stock is always a negative entry to Equity.

How do you record treasury stock purchases?

The company can record the purchase of treasury stock with the journal entry of debiting the treasury stock account and crediting the cash account. In this journal entry, the par value or stated value of the stock, as well as the original issued price, is not included with recording the purchase of the treasury stock.

How do you record common stock?

Upon issuance, common stock is recorded at par value with any amount received above that figure reported in an account such as capital in excess of par value. If issued for an asset or service instead of cash, the recording is based on the fair value of the shares given up.

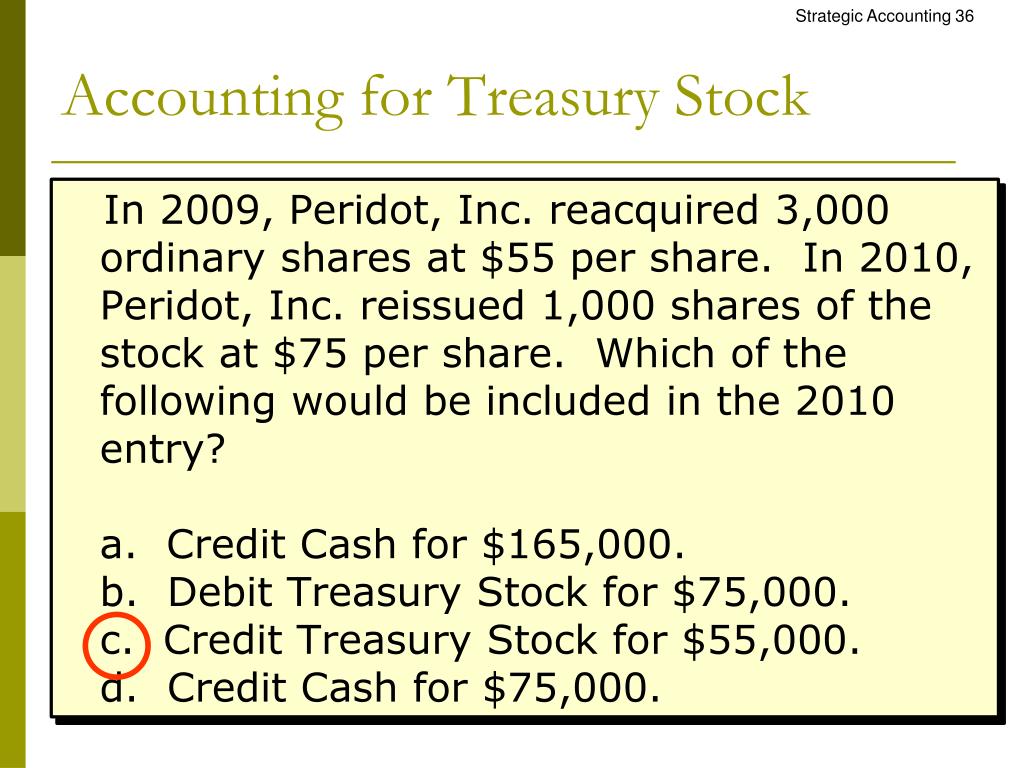

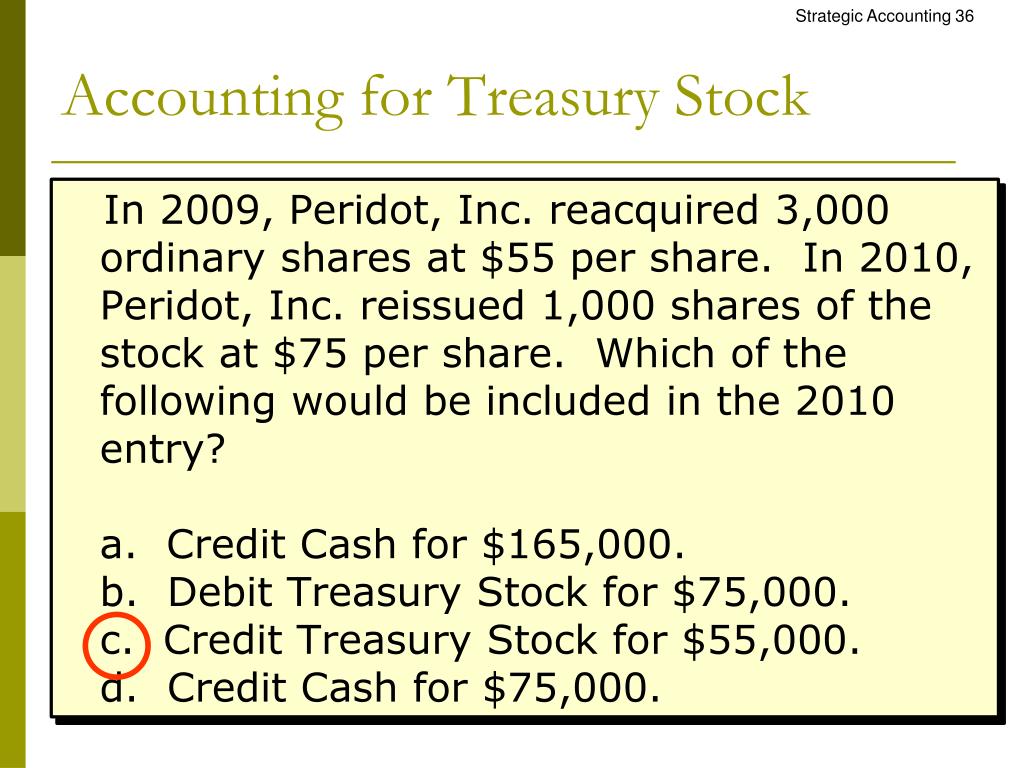

When treasury stock is purchased treasury stock is quizlet?

The purchase of treasury stock is recorded at its cost in the treasury stock account and when treasury shares are reissued they are remove from the treasury stock account at their cost. company reports the treasury stock account as a contra account to the related common stock account that has been repurchased.

Is issuing stock a debit or credit?

Issuing common stock generates cash for a business, and this inflow is recorded as a debit in the cash account and a credit in the common stock account. The proceeds from the stock sale become part of the total shareholders' equity for the corporation but do not affect retained earnings.

What is treasury stock?

Treasury stock is a contra equity account recorded in the shareholder’s equity section of the balance sheet. Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholder’s equity by the amount paid for the stock. Treasury stock, also known as treasury shares or reacquired stock refers ...

What happens to treasury stock when it is resold?

If the treasury stock is later resold, the cash account is increased through a debit and the treasury stock account is decreased, increasing total shareholder’s equity, through a credit. Stockholders benefit, as they can purchase more shares — typically below current market prices.

What is the effect of recording a treasury stock transaction?

Thus, the effect of recording a treasury stock transaction is to reduce the total amount of equity recorded in a company’s balance sheet.

What is cash account in APIC?

The cash account is credited in the total amount paid out by the company for the share repurchase. The net amount is included as either a debit or credit to the treasury APIC account, depending on whether the company paid more when repurchasing the stock than the shareholders did originally.

What is contra equity?

When a company buys back shares, the expenditure to repurchase the stock is recorded in a contra equity account. This is a balance sheet account that has a natural debit balance. The cost of buying these shares is deducted from the stockholders’ equity balance. Although stockholders’ equity is reduced, the corporation’s earnings per share typically ...

How does treasury stock affect the balance sheet?

The corporation’s cost of treasury stock reduces the corporation’s cash and the total amount of stockholders’ equity. Transactions involving treasury stock can affect two accounts in the stockholders’ equity section of the balance sheet. One is “common stock.”.

What happens when a corporation cancels treasury stock?

When a corporation cancels treasury stock, along with being unavailable for resale, its value must be subtracted from the “Paid-in Capital — Treasury Stock” account, reducing stockholders’ equity. If the treasury stock account is insufficient to complete the accounting transaction, the shortfall must be taken from the retained earnings account, further reducing stockholders’ equity.