Ayan, The "stock price" the question refers to is the company's own stock price as given by the stock market. That has no impact on the balance sheet since balance sheet only reflects book value of its stocks and not market value. This kind of stock is present in the Shareholder Equity account of the balance sheet.

How are stock prices evaluated on a balance sheet?

Stock prices should be evaluated by the last quote listed if trading during the day, or by the listed close price if trading after hours. According to the writers for the SEC, a balance sheet shows a business's assets opposite liabilities and shareholder equity at any given time.

How does the stock market affect the balance sheet?

The balance sheet shows the values of assets, liabilities and capital at a particular point in time. Therefore, fluctuations in the price of the company’s stock don’t affect values on the balance sheet. For assets that are marked to market, market values can reflect the values shown on subsequent balance sheets.

What happens when a company takes shares off the balance sheet?

If shares no longer have value, a company removes them from its balance sheet. 1 Treasury stock is the cost of shares a company has bought back. When a firm buys back stock, it may resell them later to raise cash, use them in an acquisition, or retire the shares.

What does the balance sheet display?

The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity. It can also be referred to as a statement of net worth, or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. As such, the balance sheet is divided ...

How is stock shown on the balance sheet?

Common stock on a balance sheet On a company's balance sheet, common stock is recorded in the "stockholders' equity" section. This is where investors can determine the book value, or net worth, of their shares, which is equal to the company's assets minus its liabilities.

What does stock price reflect?

The stock's price only tells you a company's current value or its market value. So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller. If there are more buyers than sellers, the stock's price will climb. If there are more sellers than buyers, the price will drop.

Is share price the same as stock price?

A share price is the price of a single share of a number of saleable equity shares of a company. In layman's terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for.

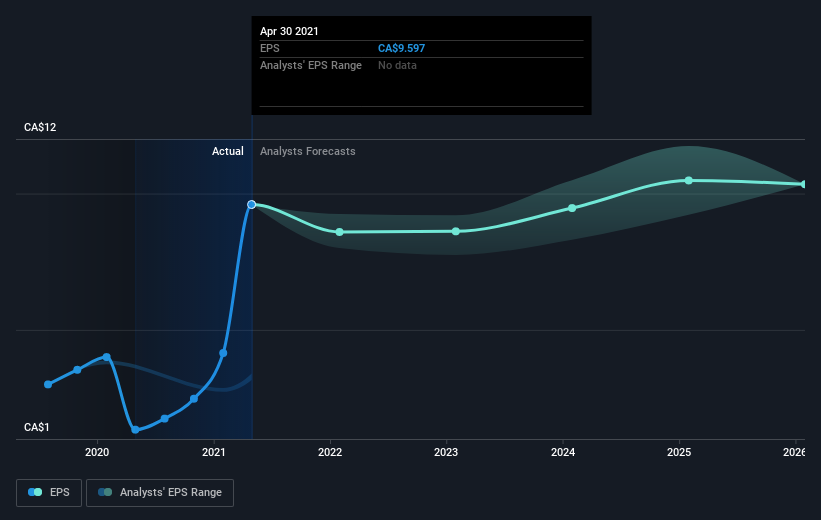

How do you value a stock price?

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

What is the difference between market price per share and book value per share?

This calculation provides a glimpse at the value per common share at a specific point in time based on the company's recorded assets and liabilities. In contrast, market price per common share represents the amount investors are willing to pay to purchase or sell the stock on the securities market.

What is shareholders equity?

Essentially, shareholders' equity, also referred to as stockholders' equity, is equal to total assets less total liabilities. Advertisement.

What side of the balance sheet shows accounts payable?

The left side of the balance sheet displays the company’s debts, which include accounts payable and notes payable The total assets on the right, must equal total liabilities and stockholder’s equity, on the left.

What is common stock on a balance sheet?

Recording Common Stock on a Balance Sheet. A company’s balance sheet reflects its financial position for a specific period, usually over the course of a fiscal quarter or year. A balance sheet is divided into the three main accounts of assets, liabilities and stockholder’s equity. Common stock is recorded in the stockholder’s equity section ...

Where is common stock recorded?

Common stock is recorded in the stockholder’s equity section of a balance sheet.

Is common stock the same as market value?

It is not the same as market value. Companies cannot issue common stock shares for less than its par or stated value. When common stock has an assigned par or stated value, multiply the number of shares outstanding by the par or stated value per share.

Why is the balance sheet important?

The balance sheet is a very important financial statement for many reasons. It can be looked at on its own, and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

What is the balance sheet equation?

The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Image: CFI’s Financial Analysis Course. As such, the balance sheet is divided into two sides (or sections). The left side of the balance sheet outlines all of a company’s assets. Types of Assets Common types of assets include current, non-current, physical, ...

What are current liabilities?

Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year. A company shows these on the. Three Financial Statements. Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows.

What is leverage ratio?

Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet, income statement, or cash flow statement. Excel template.

What is current debt?

Current Debt On a balance sheet, current debt is debts due to be paid within one year (12 months) or less. It is listed as a current liability and part of. Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest).

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are. and is key to both financial modeling. What is Financial Modeling Financial modeling is performed in Excel to forecast a company's financial performance.

Where is cash liquid on a balance sheet?

The most liquid of all assets, cash, appears on the first line of the balance sheet . Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities.

Why can't companies carry treasury stock on the balance sheet?

That's because it is a way of taking resources out of the business by the owners/shareholders, which in turn, may jeopardize the legal rights of creditors . At the same time, some states don't allow companies to carry treasury stock on the balance sheet at all, instead requiring them to retire shares. California, meanwhile, does not recognize ...

Why do companies buy back their stock?

Companies buy back their stock to boost their share price, among other objectives. When the company buys back its shares, it has a choice to either sit on those reacquired shares and later resell them to the public to raise cash, or use them in an acquisition to buy competitors or other businesses. 2 .

What are some examples of treasury stocks?

One of the largest examples you'll ever see of treasury stock on a balance sheet is Exxon Mobil Corp. , one of the few major oil companies and the primary descendant of John D. Rockefeller's Standard Oil empire. 5

What is Treasury stock?

Treasury stock is the cost of shares a company has reacquired. When a company buys back stock, it may resell them later to raise cash, use them in an acquisition, or retire the shares. There’s some discussion around whether treasury stock should be carried on the balance sheet at historical cost or at the current market value.

Is Treasury stock carried at historical cost?

From time to time, certain conversations take place in the accounting industry as to whether or not it would be a good idea to change the rules for how companies carry treasury stock on the balance sheet. At present, treasury stock is carried at historical cost. Some think it should reflect the current market value of the company's shares.

Why do analysts evaluate stock prices?

Analysts evaluate the trajectory of stock prices in order to gauge a company’s general health. They likewise rely on earning histories, and price-to-earnings (P/E) ratios, which signal whether a company’s share price adequately reflects its earnings. All of this data aids analysts and investors in determining a company’s long-term viability.

Why is a company concerned about its stock price?

The prevention of a takeover is another reason a corporation might be concerned with its stock price. When a company's stock price falls, the likelihood of a takeover increases, mainly due to the fact that the company's market value is cheaper. Shares in publicly traded companies are typically owned by wide swaths of investors.

Why are share prices so high?

Companies with high share prices tend to attract positive attention from the media and from equity analysts. The larger a company's market capitalization, the wider the coverage it receives. This has a chain effect of attracting more investors to the company, which infuses it with the cash it relies on to flourish over the long haul.

Why are stock options important?

For this reason, the existence of stock options is vitally important to stimulating a company's health. Otherwise put, executives stand to personally gain when they make strategic decisions that benefit a company's bottom line, which ultimately helps stockholders grow the value of their portfolios.

Why do creditors favor companies with higher prices?

Such healthy companies are better able to pay off long-term debt, which usually means they’ll attract lower-interest-rate loans, which consequently strengthens their balance sheets.

Why should a company not overissue new shares?

A company should be careful not to over-issue new shares, because an overabundance of shares circulating in the market may diminish demand, where there’s simply not enough buyers to gobble up the shares, which could ultimately depress the stock price.

What is balance sheet in accounting?

Balance sheet is statement of asset and liabilities at particular point of time. Stock of the company is an asset, which was converted to cash during IPO/fund raising process. So once the stock is sold by company and cash is collected, the asset has changed hands.

How does the balance sheet help a company?

1. It enables the company to raise capital easily in the market, if necessary at a huge premium. The company can reduce its debt portfolio in the balance sheet. The company can undertake expansion. 2.

Why does Agwin's balance sheet increase?

Agwin the balance sheet size will increase because of this. 3. The company can effectively thwart any attempts of it being acquired, if the company shares are high in value. The balance sheet is kept in tact.

How is a company's share price determined?

After a company goes public, and its shares start trading on a stock exchange, its share price is determined by supply and demand for its shares in the market. If there is a high demand for its shares due to favorable factors, the price will increase.

What happens when a stock is sold?

When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When a second share is sold, this price becomes the newest market price, etc.

How to calculate market cap?

Market cap is calculated by taking the current share price and multiplying it by the number of shares outstanding. For example, a company with 50 million shares and a stock price of $100 per share would have a market cap of $5 billion.

How is the market cap determined?

A company's market cap can be determined by multiplying the company's stock price by the number of shares outstanding. The stock price is a relative and proportional value of a company's worth.

What is market cap?

While market cap is often used synonymously with a company's market value, it is important to keep in mind that market cap refers only to the market value of a company's equity , not its market value overall (which can include the value of its debt or assets).

What is the difference between a big and small cap stock?

Stocks are often classified according to the company's respective market value; "big-caps" refer to company's that has a large market value while "small-caps" refer to a company that has a small market value. 0:38.

Does market cap measure equity?

Although it is used often to describe a company (e.g. large-cap vs. small-cap ), market cap does not measure the equity value of a company. Only a thorough analysis of a company's fundamentals can do that. Market capitalization is an inadequate way to value a company because the basis of it market price does not necessarily reflect how much a piece of the business is worth. Shares are often over- or undervalued by the market; the market price determines only how much the market is willing to pay for its shares (not how much it is actually worth).