Data on a blockchain ledger is signed, encrypted and cross-checked by the network. To hack into the ledger, you’d need access to each device holding a copy of the transaction history. By limiting the potential for data breaches, blockchain technology bolsters consumer — and investor — trust in a company over competitors.

Full Answer

How is blockchain being used in the mortgage industry?

How it’s using blockchain in lending: The Liquid Mortgage platform directly connects borrowers with lenders. With Liquid Mortgage, borrowers have a single blockchain platform that helps them track and manage payments and protects their data using encryption. Lenders have smart contract abilities and real-time transaction data.

How is figure using blockchain in lending?

How it’s using blockchain in lending: Figure combines artificial intelligence and blockchain to help members access lines of credit and home loans. Figure’s Home Equity Plus platform connects borrowers with home loans in minutes.

How is liquid mortgage using blockchain in lending?

How it’s using blockchain in lending: The Liquid Mortgage platform directly connects borrowers with lenders. With Liquid Mortgage, borrowers have a single blockchain platform that helps them track and manage payments and protects their data using encryption.

What is blockchain in alternative lending?

These real-time contracts validate and record transactions without the use of pricey lawyers and banks, and the decentralized nature of alternative lending lets borrowers access a larger pool of competitive financing offers. Here are 11 companies at the forefront of blockchain in lending.

How do loans work on blockchain?

How crypto lending works. A cryptocurrency-backed loan uses digital currency as collateral, similar to a securities-based loan. The basic principle works like a mortgage loan or auto loan — you pledge your crypto assets to obtain the loan and pay it off over time.

Can blockchain payments be traced?

Are bitcoin transactions anonymous? No. Bitcoin transactions can be traced, as demonstrated by the recent bust in Manhattan as well as last year's Colonial Pipeline hack, in which authorities were able to recoup some of the ransom payment from the attackers.

How does blockchain keep track of balance?

Tracking Your Wallet Balance The blockchain system doesn't keep track of account balances at all; it only records each and every transaction that is verified and approved. The ledger in fact does not keep track of balances, it only keeps track of every transaction broadcasted within the bitcoin network (Fig. 4).

How does blockchain traceability work?

Blockchain-based traceability has the potential to identify counterfeits or fake transactions, tracking/tracing product origin, and supply chain activities at the same time can ease paperwork processing (Kshetri, 2018, Tu et al., 2017).

Can the FBI track Bitcoin?

The trail of Bitcoin addresses allegedly links all that money to online illegal drug sales tracked by FBI and Interpol. If Bitcoin's privacy shortcomings drive users away, the currency will quickly lose its value. But the demand for financial privacy won't disappear, and new systems are already emerging.

Can police track Bitcoin transactions?

Although it is reported that most bitcoin transactions (98.9%) are not associated to criminal activity, the birth of cryptocurrency has provided individuals with new mediums to facilitate criminal activity. As a digital currency, there is no way to track or identify who is sending or receiving Bitcoin.

What records all the transactions in a blockchain?

The Ledger records all the transactions in the blockchain after undergoing a process of agreement using any of the consensus algorithms. All or a group of validators come to a unified agreement and once the block is full it is appended to the blockchain.

How does Bitcoin network know your balance?

Bitcoin operates with a public ledger where value assignments are tracked. Every bitcoin gets first assigned to a miner who can sell that bitcoin, generating a value assignment registered on the ledger. It is possible to estimate how many bitcoins a user has.

What type of records can be stored in a blockchain?

Name the two types of records that are present in the blockchain database? These records are block records and transactional records. Both these records can easily be accessed, and the best thing is, it is possible to integrate them with each other without following the complex algorithms.

What type of transaction Cannot be stored in blocks on a blockchain?

Answer: A transaction that assigns copyright ownership to a song cannot be stored in blocks on block chain.

Which blockchain is used by Amazon?

Amazon Managed Blockchain supports two popular blockchain frameworks, Hyperledger Fabric and Ethereum.

Is blockchain really anonymous?

Satoshi Nakamoto had presented the currency as anonymous: For bitcoin transactions (buying, selling, sending, receiving etc.), users employ pseudonyms, or addresses — alphanumeric cloaks that hide their real identities.

What is salt blockchain?

SALT blockchain-based lending gives investors access to cash without having to sell their cryptocurrency holdings. Investors can borrow a portion of the total amount held as collateral . However, there are risks to the borrower since cryptocurrency prices can fluctuate wildly.

How does the value of a crypto loan fluctuate?

Since the collateral being used to secure the loan is a cryptocurrency, the total value of the digital assets can fluctuate as the market price of the crypto changes over time. In other words, the value of the collateral can rise and fall, depending on the price changes of the underlying cryptocurrency.

What is salt lending?

SALT is an acronym for Secured Automated Lending Technology. SALT lending provides a platform where members can receive a loan by using a digital asset or cryptocurrency as collateral.

How long is a salt loan?

The loan term can range from three months to 12 months and SALT does not charge an origination fee for setting up the loan. Borrowers are charged interest on the loan, as they would be on any other loan. The interest rate charged can vary from as low as 4.95% to 22.95%.

Can you use crypto as collateral?

Borrowers can only use blockchain-based cryptocurrencies as collateral. In other words, the borrower must have the ownership of their crypto recorded on a public, permissioned blockchain. Some of the digital assets that can be used as collateral for SALT loans include: 2.

Is a loan approval based on credit score?

Also, the loan approval is not based on the borrower's credit score, which is a numerical representation of a person's ability to pay back their debts on time and in full. Typically, traditional lending from a bank would require pay stubs to prove a source of income and a credit check, including a minimum credit score.

Does salt loan require credit check?

Requirements for SALT Loan Approval. Since there are assets securing the loan, the lender has no risk since the crypto assets can be liquidated if the borrower fails to repay the loan—a process called default. As a result, there is no credit check of the borrower's credit history. 4.

What is blockchain technology?

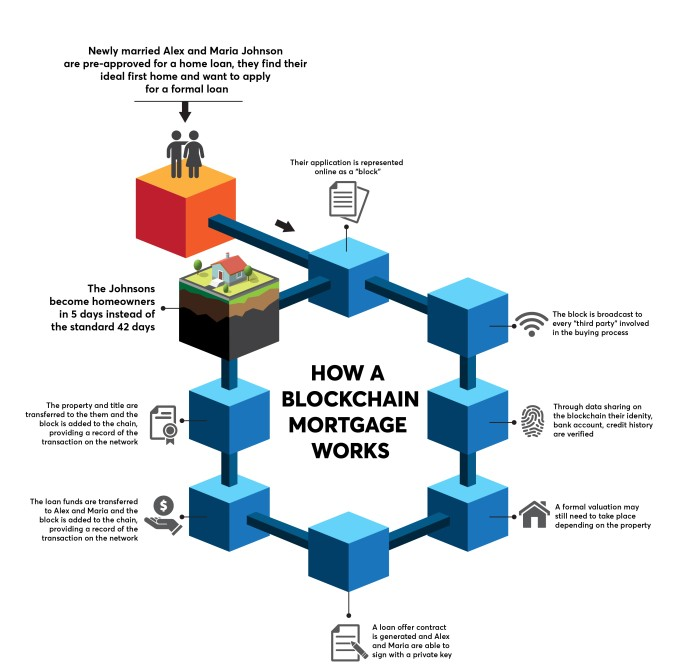

Blockchain technology is a record-keeping system that is rocking the financial and business world. The "blockchain" refers to a chain of digital blocks that record information and transactions in real time. The information in a "block" includes number figures, including the date, time, and dollar amounts of a transaction.

Why is blockchain used in cryptocurrency?

Second, it saves money. Using blockchain reduces the regular fees associated with currency transactions. Third, it is the fastest way to get paid. With a cryptocurrency transaction, payment is immediate once all parties have met all the stipulations.

What are the benefits of blockchain lending?

Another benefit of lending through blockchain is the ability to become a banker without the overhead.

Why is blockchain important?

First, blockchain technology is entirely transparent. There is virtually no way to fudge or alter the books. Second, it saves money. Using blockchain reduces the regular fees associated with currency transactions.

What is the interest rate on Bitcoin?

However, the most-used platform is Unchained Capital, which operates like SALT, but the interest rates are higher at 10 to 14 percent. This rate is excellent for lenders but may not be the best for borrowers.

What is the process of giving a block a unique identification code called?

Hashing is the process of giving the block a unique identification code called a "hash.". The newly added block is also given the hash of the most recent block in the system to which it is "chained.". Blockchain technology can be a daunting topic to tackle, and one might even wonder why it is necessary.

When was blockchain invented?

Nakamoto invented the blockchain technology in 2008 as an open source software to meet this need.

How long does it take to get approved for blockchain?

Instead of paying exorbitant processing fees and waiting up to 60 days for loan approval, individuals and small businesses can now apply and receive approval for a blockchain-based loan in a matter of minutes. In fact, it's estimated that the burgeoning alternative lending industry will loan to 20.7% of small businesses by 2020.

What is blockchain based smart contract?

Blockchain-based smart contracts ensure that both loan seekers and lenders agree to fair and feasible terms regarding things like proof-of-funds and payment planning.

How does salt lending work?

SALT Lending. How it’s using blockchain in lending: SALT uses blockchain’s flexibility to offer cash loans that leverage digital assets. By leveraging Bitcoin, Ether or even Dogecoin, borrowers can lock into cash loans from 1-36 months with an APR as low as 5.99%.

How does WeTrust use blockchain?

WeTrust. How it’s using blockchain in lending: WeTrust uses blockchain to leverage social capital and personal trust networks in financial lending. By eliminating third-parties, credit and loan seekers rely on social safety networks to verify and approve responsible loans.

When did FIC issue the first digital bond?

Industry impact: FIC issued the first digital corporate bond on blockchain in November 2018. Used as a small test before FIC expands its services, Capstone Intelligent Solutions agreed to issue a one-year, U.S. dollar-denominated private placement on the blockchain. Figure.

Where is liquid mortgage located?

Liquid Mortgage. Location: Denver, Colorado. How it’s using blockchain in lending: The Liquid Mortgage platform directly connects borrowers with lenders. With Liquid Mortgage, borrowers have a single blockchain platform that helps them track and manage payments and protects their data using encryption.

What is blockchain transaction?

This is achieved by using consensus algorithms. Blockchains establish the conditions under which a transaction or asset exchange can occur.

What is blockchain in computing?

What is blockchain? Blockchain is a new computing architecture that was initially created to power the cryptocurrency application Bitcoin. The architecture is both a network and a database, optimised for real-time, global, synchronisation of transactions and related data.

How long does it take to process a real estate transaction?

Processing times are typically around 40 working days from offer acceptance to sale completion.

Is banking transactional?

In most areas, including mortgage lending, banking has become more transactional and it remains of utmost importance that all parties can achieve trust and consensus around transactions to mitigate: the money/assets/value will not be delivered. will not be of the required quality.

Do you have to be vetted to write on a blockchain?

On a public blockchain, everyone has permission to write information (and read only the transactions they have permission to do so); whereas, in a permissioned or private blockchain participants need to be vetted by an authority and granted permission to read and write records.

Identifying risk

Counterparty default risk can be mitigated if the lending agent indemnifies against borrower default. Indemnification is a standard industry practice, so it may be argued that material loss due to borrower default is quite unlikely.

Get in touch

Jim is the managing director of the Deloitte Center for Financial Services, where he is responsible for defining the marketplace positioning and development of the Center’s eminence and key activities... More

What is blockchain in banking?

A Blockchain is a digital record of transactions. The name was derived from its structure, in which the individual records called blocks are linked together in a single list called a chain. Each of these data blocks is secured and bound to each other using cryptographic principles—the Blockchain technology warrants facilitation of fast, ...

What are the uses of blockchain?

The term Blockchain has been widely discussed for the past few years. The importance of using this concept in day-to-day business transactions has increased recently in scope because the cost incurred for an organization is decreasing, allowing the technology to be used in many beneficial ways. The major areas and sectors where Blockchain application can be used effectively are: 1 Sharing medical data 2 Music royalties tracking 3 Voting mechanism, and 4 Real estate processing platform

Does technology kill banking?

At the same time, the technology won’t kill the concept of Banking, as anyone can use it for integrating their product to their advantage. Already some banks in Japan, Korea have started using this technology for their payment transactions.

Blockchain could be the technology that leads to more efficient and secure financial services

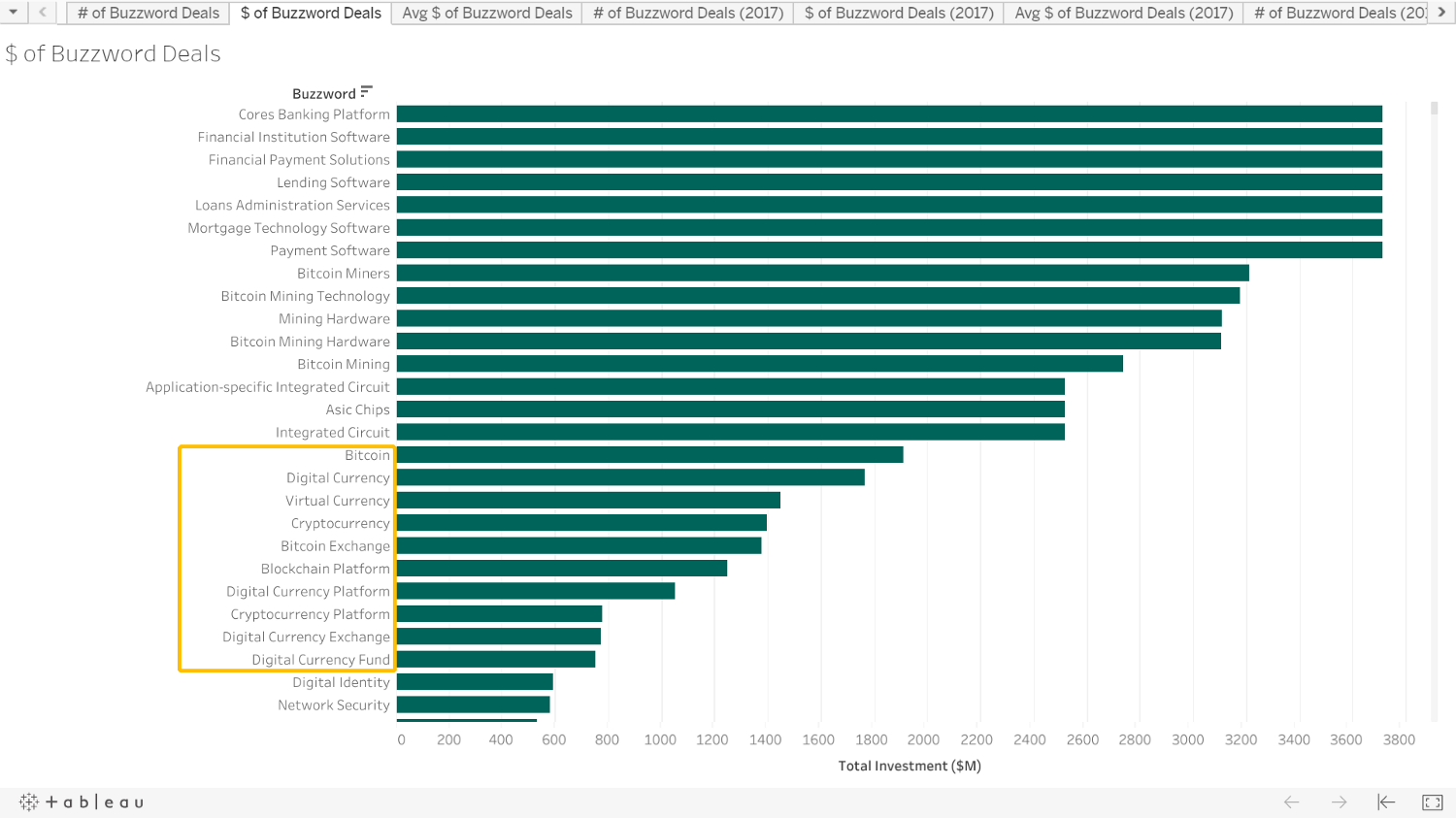

On the back of substantial recent growth, the cryptocurrency market is now worth trillions of dollars. Much of that success comes from all the potential uses for its underlying blockchain technology.

Uses for blockchain in the financial services industry

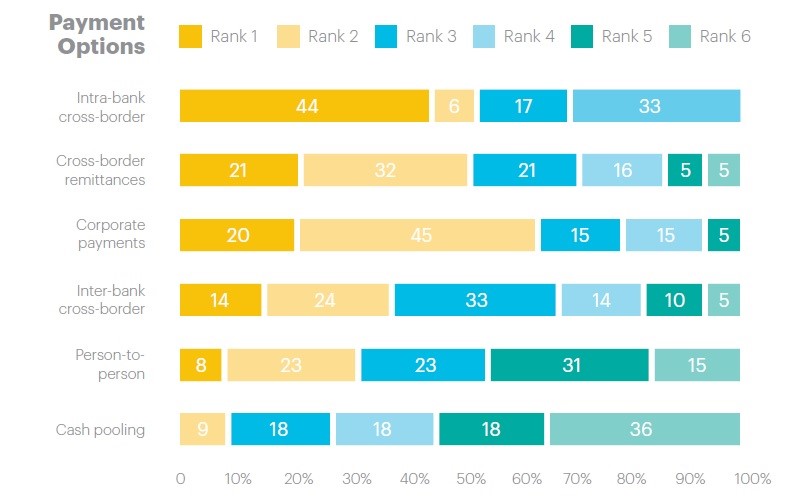

Here are a few of the many uses for blockchain in the finance industry:

Impact of blockchain on the financial services industry

With the advantages it offers, blockchain could have a massive impact on the financial services industry. Here are the main benefits of blockchain in finance:

Financial companies that promote the use of blockchain

Blockchain technology has been rapidly gaining acceptance in the finance industry. There are dozens of financial companies -- from smaller companies to the biggest names in the industry -- that invest in blockchain stocks and/or promote the use of blockchains.

Challenges of implementing blockchain for financial companies

We've looked at the uses and advantages of blockchain in the finance industry, but there are also several challenges to implementing blockchain:

The future of blockchain in finance

At this point, we're still in the early stages of both blockchain's development and its use in the financial services industry. Two of the biggest blockchain developments to look out for are improvements in transaction processing and interoperability, both of which should make it more useful for financial institutions.