Preferred Stock Valuation Conclusion

- Preferred stock is a company’s form of equity that can be used to fund project expansions.

- This formula requires two variables: annual dividend per share of preferred stock and the rate of return required

- Annual dividend per share of preferred stock is computed by multiplying the face value of the stock and the stated...

How do you calculate the value of preferred stock?

- $5 ÷ (0.10 - 0)

- Simplified, this becomes $5 ÷ 0.10 = $50.

- In this scenario, if you wanted to earn a 10% rate of return, you couldn't pay more than $50 for the preferred stock. ...

Does preferred stock cost more than common stock?

That means it will be subject to supply and demand forces in the market. In theory, preferred stock may be seen as more valuable than common stock, as it has a greater likelihood of paying a dividend and offers a greater amount of security if the company folds. This Excel file can be used for calculating the cost of preferred stock.

What companies have preferred stock?

Preferred Stocks Directory

- Preferred shares are shares issued by a corporation as part of its capital structure.

- Preferred stock have a “coupon rate” — the interest rate you will be paid. ...

- Dividends are either cumulative — meaning that dividends continue to accrue if they have been suspended, but they are not paid until the company decides to pay them after suspension ...

How much does preferred stock cost?

Generally, the dividend is fixed as a percentage of the share price or a dollar amount. This is usually a steady, predictable stream of income. If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day.

How are preferred stocks valued quizlet?

-Preferred stock can be valued using the constant-growth model. How is the discount rate used to value a stock related to the expected return on the stock? Assume the stock price fairly reflects the stock's value. The discount rate should equal the expected rate of return.

What factors determine the value of a share of preferred stock?

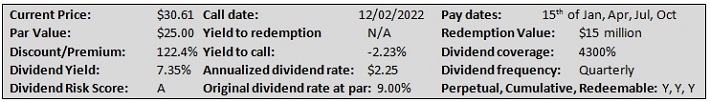

Section 4.01 states the most important factors in determining the value of preferred stock are its yield and dividend coverage and the payment protection of its liquidation preference.

Do preferred shares change in value?

Because preferred stocks' par values are fixed and do not change, preferred stock dividend yields are more static and less variable than common stock dividend yields. You calculate a preferred stock's dividend yield by dividing the annual dividend payment by the par value.

Does equity value include preferred stock?

Equity value is concerned with what is available to equity shareholders. Debt and debt equivalents, non-controlling interest, and preferred stock are subtracted as these items represent the share of other shareholders.

Why do investors buy preferred stock?

Most shareholders are attracted to preferred stocks because they offer more consistent dividends than common shares and higher payments than bonds. However, these dividend payments can be deferred by the company if it falls into a period of tight cash flow or other financial hardship.

Is preferred stock worth more than common stock?

Preferred stock may be a better investment for short-term investors who can't hold common stock long enough to overcome dips in the share price. This is because preferred stock tends to fluctuate a lot less, though it also has less potential for long-term growth than common stock.

What happens when preferred stock matures?

' When the shares mature, the company gives you back the cash value of the shares when issued. Maturity dates give you some downside protection, since no matter how low the price goes while you're holding a preferred stock, at maturity you will get back the issue price (unless the company goes bankrupt or liquidates).

What are the two ways preferred stock can be valued?

In this lesson, we're going to examine two ways in which preferred stock can be valued, the dividend discount approach, and the Gordon growth model.

How is fixed dividend preferred stock valued?

Fixed dividend preferred stock is valued with the dividend discount approach, which uses the traditional discounting formula to calculate the present value of the stream of dividend payments .

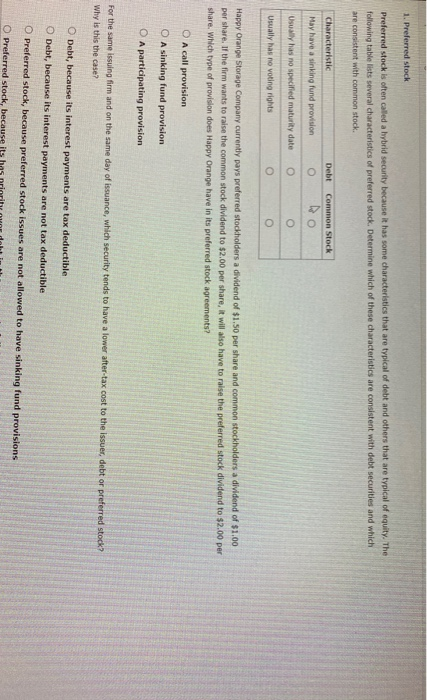

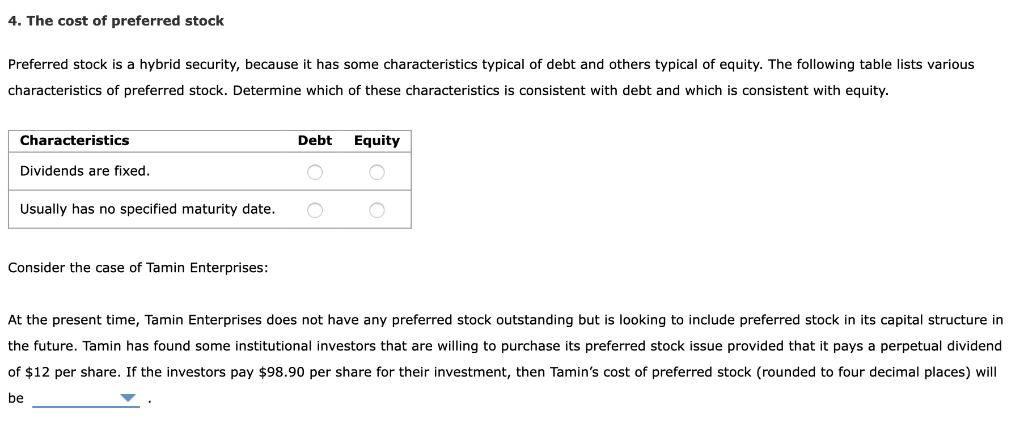

Why is preferred stock considered a hybrid?

It's like equity in that it provides ownership and it's like debt in that preferred dividends are like the interest payments debt holders receive. It's called preferred stock because preferred stockholders get preferential treatment when it comes to receiving their dividend. Preferred stockholders are paid after the bondholders (those who own bonds issued by the company) but before the holders of common stock. So preferred stock is perceived to be less risky than common stock since there might not be anything left over after the preferred stockholders get paid.

How does Fred conclude that the value of this investment is the dividend?

Fred concludes that the value of this investment is the dividend since it will be paid before the common shareholders get anything. He can put a dollar value on it by using the dividend discount approach, which uses the traditional discounting formula to calculate the present value of the stream of dividend payments. It looks like this:

What is preferred dividend?

Preferred dividends typically pay a fixed dividend, meaning the dividends stay the same. They don't vary with how well the company does. Common stock, on the other hand, has a more flexible dividend, increasing when the company does well or skipped altogether when times are bad.

Does Fred buy Big Blue stock?

Fred is evaluating an investment in Big Blue Company preferred stock. They pay a fixed dividend, which, as you recall, means the dollar amount hasn't changed in years. The share price hasn't changed much either, but Fred isn't concerned about that. If he was looking for price appreciation he would buy Big Blue common stock. Instead, Fred just wants a stable, low-risk investment that he can use later to finance college for his kids.

Is preferred stock less risky than common stock?

So preferred stock is perceived to be less risky than common stock since there might not be anything left over after the preferred stockholders get paid.

What is preferred stock?

Preferred stocks are equity securities that share many characteristics with debt instruments. Preferred stock is attractive as it offers higher fixed-income payments than bonds with a lower investment per share. Preferred stock often has a callable feature which allows the issuing corporation to forcibly cancel the outstanding shares for cash.

Why do companies issue preferred stock?

A company may choose to issue preferreds for a couple of reasons: 1 Flexibility of payments. Preferred dividends may be suspended in case of corporate cash problems. 2 Easier to market. Preferred stock is typically bought and held by institutional investors, which may make it easier to market during an initial public offering.

What is an ARPS stock?

Adjustable-Rate Preferred Stock (ARPS). These preferreds pay dividends based on several factors stipulated by the company. Dividends for ARPS are keyed to yields on U.S. government issues, providing the investor limited protection against adverse interest rate markets.

Why do preferred bonds have unlimited life?

Preferreds technically have an unlimited life because they have no fixed maturity date, but they may be called by the issuer after a certain date. The motivation for the redemption is generally the same as for bonds — a company calls in securities that pay higher rates than what the market is currently offering. Also, as is the case with bonds, the redemption price may be at a premium to par to enhance the preferred's initial marketability.

What is a participating preferred stock?

Participating. This is preferred stock that has a fixed dividend rate. If the company issues participating preferreds, those stocks gain the potential to earn more than their stated rate. The exact formula for participation will be found in the prospectus. Most preferreds are non-participating.

How to calculate current yield on preferred stock?

For example, if a preferred stock is paying an annualized dividend of $1.75 and is currently trading in the market at $25, the current yield is: $1.75 ÷ $25 = .07, or 7%. In the market, however, yields on preferreds are typically higher than those of bonds from the same issuer, reflecting the higher risk the preferreds present for investors.

How much can you deduct from preferred stock?

Corporations that receive dividends on preferred stock can deduct 50% to 65% of the income from their corporate taxes. 1 .

What is preferred stock?

Preferred stock is an element of shareholder equity that has characteristics of both equity and debt. A preferred share carries additional rights above and beyond those conferred by common stock. Preferred shareholders may have an advantage over common stock shareholders in dissolution, bankruptcy or liquidation, for instance.

What are the factors that determine the value of a preferred stock?

The value of any investment is directly influenced by two significant factors: the amount of income or cash flow generated by the entity and the risk to a hypothetical willing buyer (not under a compulsion to buy and aware of all the relevant facts) who would purchase the shares (invest). The process of determining the value of preferred stock is not entirely different from common stock, except the risk is assessed based on the individual characteristics of the preferred shares and their impact on the income or cash flow.

How to determine required dividend yield?

To determine the required dividend yield, the appraiser needs to perform an analysis similar to a market-based approach. Section 4.02 of revenue ruling 83-120 says, “The adequacy of the dividend rate should be determined by comparing its dividend rate with the dividend rate of high-grade publicly traded preferred stock.” If the subject security has a lower yield than the high-grade publicly traded preferred stock you compare it with in your analysis, the security would sell below par value in order to raise the effective yield, and vice versa.

How to value a business with common and preferred shares?

To value a business having both common and preferred shares, CPAs should value the preferred shares first and deduct that value from the entire equity of the entity.

What happens if an appraiser believes a discount or premium is necessary?

If the appraiser believes a discount or premium is necessary, either increase the appropriate yield to apply to the preferred stock’s dividends or take a discount from the value determined by applying a yield unadjusted for marketability considerations. PRODUCTS, SCOPE, SKILLS.

Why is return on equity important?

The return-on-equity ratio is useful in measuring the operational performance of an entity. A higher ratio generally reflects a better run and more profitable enterprise. Under some circumstances this ratio may yield misleading results, however, so use it only in conjunction with other analyses. For example, the pretax-return-on-total-capitalization ratio can be a useful measure of profitability; the higher the ratio, the greater the ability to pay the preferred dividend.

Do preferred shares have dividends?

Preferred shares also generally have a dividend requirement, which makes them appear similar to debt. The dividend structure usually has rights attached to it, such as whether the dividends are cumulative or whether the shares participate in enterprise earnings.

Why do people buy preferred stock?

Investors buy preferred stock to bolster their income and also get certain tax benefits.

What are the advantages of preferred stock?

Depending on your investment goals, preferred stock might be a good addition to your portfolio. Some of the main advantages of preferred stock include: 1 Higher dividends. In general, you can receive higher regular dividends with preferred shares. Payouts are also usually greater than what you’d receive with a bond because you’re assuming more risk. 2 Priority access to assets. If the company goes bankrupt, preferred shareholders are in line ahead of common shareholders, but still behind bondholders. 3 Potential premium from callable shares. Because preferred stock is callable, the company can buy it back. If the callable price is above the par value, you may receive more than you paid for the preferred stock. 4 Ability to convert preferred stock to common stock. When you buy convertible shares, you can trade in your preferred stock for common stock. If the value of the common stock drastically rises, you could convert your shares and benefit from its appreciation while investing in a less risky asset.

How to calculate preferred stock dividend?

You calculate a preferred stock’s dividend yield by dividing the annual dividend payment by the par value.

Why are preferred stocks more stable than common stocks?

With preferred stock, your gains are more limited. That’s because like bond prices, preferred stock prices change slowly and are tied to market interest rates. Preferred stocks do provide more stability and less risk than common stocks, though.

What is preferred stock par value?

Like bonds, shares of preferred stock are issued with a set face value, referred to as par value. Par value is used to calculate dividend payments and is unrelated to preferred stock’s trading share price. Unlike bonds, preferred stock is not debt that must be repaid. Income from preferred stock gets preferential tax treatment, ...

What happens to preferred stock in bankruptcy?

Preferred stock’s priority ahead of common stock also extends to bankruptcy. If a company goes bankrupt and is liquidated, bondholders are repaid first from the remaining assets, followed by preferred shareholders. Common stockholders are last in line, although they’re usually wiped out in bankruptcy.

Why would a company recall a preferred stock?

A company might recall and reissue a preferred stock to reduce the dividend payment to match current interest rates. Companies may also recall and reissue bonds for similar reasons.

How much dividend do you get from preferred stock?

Suppose that you buy 1,000 shares of preferred stock at $100 per share for a total investment of $100,000. Each share of preferred stock pays a $5 dividend, resulting in a 5% dividend yield (you get this percentage by dividing the $5 dividend by the $100 stock price). That means that you collect $5,000 in dividend income on your $100,000 investment every year. For this example, assume that this is a simple form of preferred stock and not one of the subtypes.

What is the difference between common stock and preferred stock?

The biggest difference between the two has to do with the rights and perks they bestow upon their owners. When you buy shares of stock, you are also buying a small piece of ownership in a company, and the type of stock you buy will dictate your role, mostly with regard to voting rights and dividend payments. 1

What happens to preferred stock when it goes bankrupt?

The basic tenet of preferred stock is that it will receive dividend payments before common stock. If the company declares bankruptcy, and has to liquidate all of its assets, holders of preferred stock will receive payouts before holders of common stock see a dime.

What are the two types of stocks?

If you're new to investing, you might not be aware that not all stocks are the same form. The two main types of stocks are common stock and preferred stock . The biggest difference between the two has to do with the rights and perks they bestow upon their owners. When you buy shares of stock, you are also buying a small piece of ownership in a company, and the type of stock you buy will dictate your role, mostly with regard to voting rights and dividend payments. 1

What is a perpetuity stock?

Since the example involves a simple form of preferred stock, you own what is known as a "perpetuity," which is a stream of equal payments paid at regular intervals without an end date. There is a simple formula for valuing perpetuities and basic growth stocks called the Gordon Growth model, or the Gordon dividend discount model .

What is intrinsic value of preferred stock?

Intrinsic value calculations for preferred stock are based on your annual dividend, the growth rate, and your required rate of return.

What is intrinsic value?

Intrinsic value is the focus here, and unlike other methods, it does not look at the larger market, or current trading prices, or past patterns; nor does it attempt to predict future prices. Instead, it bases a stock's value on what an investor will pay for it.

What is preferred stock?

Preferred stock is a type of stock that companies issue that has preference over common stocks of the company. There are many types of preferred stock that a company may issue. These include convertible preferred stock, cumulative preferred stock, participating preferred stock, redeemable preferred stock as the main types but may also include other types. The valuation of Preferred stock can be valued by using two models depending on whether the dividends paid on the preferred stock are fixed or are expected to grow in the future.

When are preferred stockholders preferred?

Similarly, the preferred stockholders are also preferred when the company is liquidated. This means in case of liquidation, the preferred stockholders of compensated first, before other stockholders. These features of the preferred stock make the stock more attractive to any risk-averse potential investors than the common stock of a company.

What are the disadvantages of preferred stock?

The preferred stock of a company may also come with some disadvantages. For investors, the preferred stock does not come with any voting rights. This means that the preferred stockholders of the company do not have the right to participate in the decision-making process of a company. Furthermore, while the preferred stockholders are guaranteed a fixed dividend rate, which is advantageous when the company is not making a lot of profits or is in a loss, it may be disadvantageous when the company is making huge profits. This means that when the company’s earnings increase significantly, the common stockholders of the company will receive more dividends than the fixed dividends paid to preferred stockholders.

How are convertible preferred stocks converted?

Convertible preferred stocks are converted based on a pre-determined ratio. For example, the company may give 1 common share for every 2 preferred stocks held by the investor. The company may also convert the shares based on the value of the preferred stock. For example, the company may give 2 common shares for every $100 ...

Why do companies issue participating preferred stock?

Often times, companies issue participating preferred stock to discourage investment in the company because these stocks are not attractive to potential shareholders. This is mostly used when a company wants to block a takeover of the company.

What is it called when a company issues shares?

They are also called shareholders of the company . When these shareholders buy the stocks of the company, they are given part ownership of the company based on the number of shares of the company they own. These shares also come with voting rights that allow the shareholders to contribute to the decision-making process of the company.

How many common shares can a company give for every $100?

For example, the company may give 2 common shares for every $100 of preferred stock held by the investor. Convertible shares are generally beneficial to take up when, at the date of maturity, the market price of the common stock of the company exceeds the market value of the convertible preferred stock.

Unique Features of Preferred Shares

- Preferred shares differ from common shares in that they have a preferential claim on the assets of the company. That means in the event of a bankruptcy, the preferred shareholders get paid before common shareholders.1 In addition, preferred shareholders receive a fixed payment th…

Growing Dividends

- If the dividend has a history of predictable growth, or the company states a constant growth will occur, you need to account for this. The calculation is known as the Gordon Growth Model. V=D(r−g)V=\frac{D}{(r-g)}V=(r−g)D By subtracting the growth number, the cash flows are discounted by a lower number, which results in a higher value.

Considerations

- Although preferred shares offer a dividend, which is usually guaranteed, the payment can be cut if there are not enough earnings to accommodate a distribution; you need to account for this risk. The risk increases as the payout ratio (dividend payment compared to earnings) increases. Also, if the dividend has a chance of growing, then the value of the shares will be higher than the result …

The Bottom Line

- Preferred shares are a type of equityinvestment that provides a steady stream of income and potential appreciation. Both of these features need to be taken into account when attempting to determine their value. Calculations using the dividend discount model are difficult because of the assumptions involved, such as the required rate of return, growth, or length of higher returns. Th…