Preferred stock normally is recorded at the top of the shareholders' equity section on the balance sheet. When a company issues shares of preferred stock, it records a credit to preferred stock in the amount of the sales proceeds, and a debit to cash, increasing both the equity account of the preferred stock and the cash account, which is a special asset account.

How to find the best preferred stocks?

When looking for the best preferred stock ETFs, here are 3 key elements to keep an eye out for:

- Low expenses

- High dividend yield

- Sufficient liquidity

How to calculate preferred stock outstanding?

You can calculate outstanding shares by:

- Finding the company’s total number of preferred stock, common stock outstanding, and treasury stock.

- Add the number of preferred stock and common stock outstanding, then subtract the number of treasury shares from that total.

- Alternatively, you can calculate the weighted average of outstanding shares.

How much does preferred stock cost?

Generally, the dividend is fixed as a percentage of the share price or a dollar amount. This is usually a steady, predictable stream of income. If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day.

What are the different types of preference shares?

The Fund seeks to achieve its investment objectives by investing in preferred ... net asset value per share as well as other information can be found at https://www.ftportfolios.com or by calling 1-800-988-5891. We sell different types of products and ...

How are preferred shares recorded on the balance sheet?

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation.

How are preferred stock dividends recorded?

When a stock dividend on preferred shares is paid in another class of stock, the issuer should record the fair value of the shares issued in retained earnings.

Is preferred stock recorded as a liability?

Yes. The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. Accordingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

Where are preferred stocks reported?

This value sometimes represents the initial selling price per share and is used to figure its dividend payments. A company reports the total par value of preferred stock on the first line of the capital stock subsection.

Where does preferred stock go on income statement?

The amount received from issuing preferred stock is reported on the balance sheet within the stockholders' equity section. Only the annual preferred dividend is reported on the income statement.

Is preferred stock an asset liability or equity?

Preferred stock is a class of equity that gives holders specific privileges. For example, preferred stockholders receive dividends before holders of other classes of capital, particularly common stockholders.

Is preferred equity debt on balance sheet?

Sometimes, preferred stock have characteristics that resemble debt, such as fixed rate dividends and a redemption date. The IFRS requires companies to report preferred stock with debt characteristics under debt on the balance sheet and treat any associated dividends as interest in the income statement.

What Is a Preferred Stock?

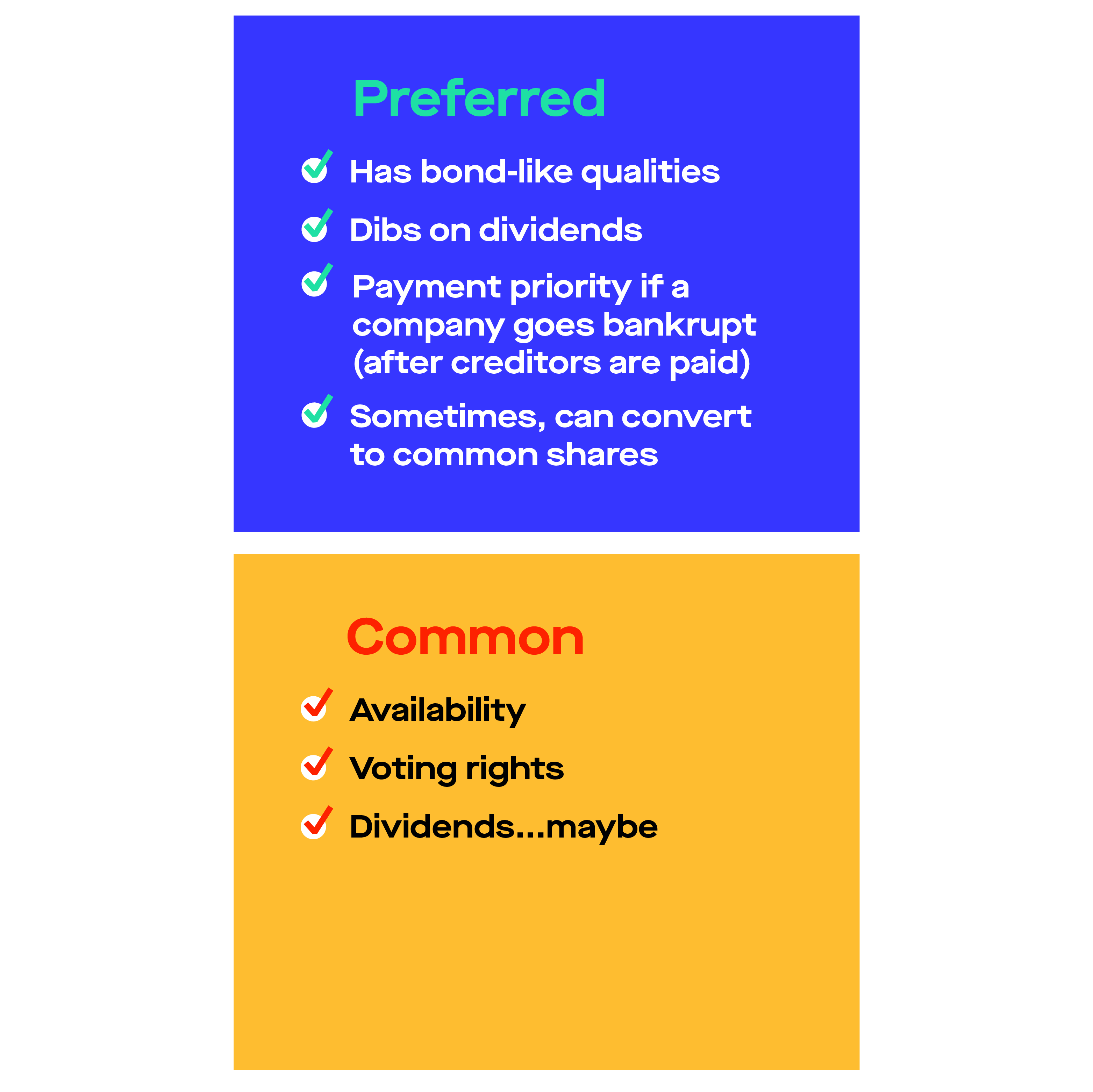

The term "stock" refers to ownership or equity in a firm. There are two types of equity— common stock and preferred stock. Preferred stockholders have a higher claim to dividends or asset distribution than common stockholders. The details of each preferred stock depend on the issue.

Why do preferred stock issuers issue preferred stock?

Some issue preferred shares because regulations prohibit them from taking on any more debt, or because they risk being downgraded. While preferred stock is technically equity, it is similar in many ways to a bond issue; One type, known as trust preferred stock, can act as debt from a tax perspective and common stock on the balance sheet. 4 On the other hand, several established names like General Electric, Bank of America, and Georgia Power issue preferred stock to finance projects. 5 6 7

What Are the Advantages of a Preferred Stock?

A preferred stock is a class of stock that is granted certain rights that differ from common stock. Namely, preferred stock often possesses higher dividend payments, and a higher claim to assets in the event of liquidation. In addition, preferred stock can have a callable feature, which means that the issuer has the right to redeem the shares at a predetermined price and date as indicated in the prospectus. In many ways, preferred stock shares similar characteristics to bonds, and because of this are sometimes referred to as hybrid securities.

What is an adjustable rate dividend?

Adjustable-rate shares specify certain factors that influence the dividend yield, and participating shares can pay additional dividends that are reckoned in terms of common stock dividends or the company's profits. The decision to pay the dividend is at the discretion of a company's board of directors. Unlike common stockholders, preferred ...

What is the highest ranking of preferred stock?

The highest ranking is called prior, followed by first preference, second preference, etc. Preferred shareholders have a prior claim on a company's assets if it is liquidated, though they remain subordinate to bondholders.

Which has a higher claim on distributions?

Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders.

Do preferred shares have voting rights?

Preferred shares usually do not carry voting rights, although under some agreements these rights may revert to shareholders that have not received their dividend. 1 Preferred shares have less potential to appreciate in price than common stock, and they usually trade within a few dollars of their issue price, most commonly $25. Whether they trade at a discount or premium to the issue price depends on the company's credit-worthiness and the specifics of the issue: for example, whether the shares are cumulative, their priority relative to other issues, and whether they are callable. 2

How does preferred stock work?

To illustrate how preferred stock works, let's assume a corporation has issued preferred stock with a stated annual dividend of $9 per year. The holders of these preferred shares must receive the $9 per share dividend each year before the common stockholders can receive a penny in dividends. But the preferred shareholders will get no more than the $9 dividend, even if the corporation's net income increases a hundredfold. ( Participating preferred stock is an exception and will be discussed later.) In times of inflation, owning preferred stock with a fixed dividend and no maturity or redemption date makes preferred shares less attractive than its name implies.

What is preferred stock?

Preferred stock that earns no more than its stated dividend is the norm and it is known as nonparticipating preferred stock. Occasionally a corporation issues participating preferred stock. Participating preferred stock allows for dividends greater than the stated dividend.

What is the par value of preferred stock?

Par Value of Preferred Stock. The dividend on preferred stock is usually stated as a percentage of its par value. Hence, the par value of preferred stock has some economic significance. For example, if a corporation issues 9% preferred stock with a par value of $100, the preferred stockholder will receive a dividend of $9 (9% times $100) ...

Why is par value important?

In each of these examples the par value is meaningful because it is a factor in determining the dividend amounts. If the dividend percentage on the preferred stock is close to the rate demanded by the financial markets, the preferred stock will sell at a price that is close to its par value.

How much does a 9% preferred stock sell for?

In other words, a 9% preferred stock with a par value of $50 being issued or traded in a market demanding 9% would sell for $50. On the other hand, if the market demands 8.9% and the stock is a 9% preferred stock with a par value of $50, then the stock will sell for slightly more than $50 as investors see an advantage in these shares.

What happens if a corporation has 10% preferred stock?

If a corporation has 10% preferred stock outstanding and market rates decline to 8%, it makes sense that the corporation would like to eliminate the 10% preferred stock and replace it with 8% preferred stock . On the other hand, the holders of the 10% preferred stock bought it with the assumption of getting the 10% indefinitely.

What is the purpose of a preferred stock indenture?

Corporations are able to offer a variety of features in their preferred stock, with the goal of making the stock more attractive to potential investors. All of the characteristics of each preferred stock issue are contained in a document called an indenture.

What is preferred stock?

A preferred stock is a type of “hybrid” investment that acts like a mix between a common stock and a bond. Like common stocks, a preferred stock gives you a piece of ownership of a company. And like bonds, you get a steady stream of income in the form of dividend payments (also known as preferred dividends ).

How long does it take to sell preferred stock?

While common stocks can be sold in a matter of seconds, preferred stocks can take days or sometimes even weeks to find a buyer willing to take them off your hands . . . and that’s when things are going well. Good luck trying to sell a preferred stock of a struggling company . . .

How much do preferred stock dividends pay?

A preferred stock’s dividend payments are usually higher than bond payments and they’re set at a fixed rate, usually somewhere between 5–7%. 1 They’re also paid out before common stock dividends, but after bondholders receive their payments. This makes them very attractive to investors looking to replace bonds that are barely beating inflation with an investment that brings in better returns.

What happens if a company misses a dividend payment?

So if a company misses three straight dividend payments of $10, that means they would add $30 on top of the next dividend payment owed to you.

What are the drawbacks of preferred stock?

Here’s another drawback to preferred stocks: Even though preferred stockholders technically have a piece of ownership in a company, they have no voting rights like common stakeholders do. That means they don’t really get any say in how the company is run.

Why are preferred stocks getting closer to investors?

In a world where bond returns are barely enough to keep pace with inflation, some investors are looking for an alternative that will help them receive a reliable income stream. That’s why preferred stocks are getting a closer look by some investors.

What do you get when you cross a common stock with a bond?

Do you know what you get when you cross a common stock with a bond? (Nope, this is not the start of some lame dad joke). You get something called a preferred stock.

When is preferred stock recognized?

Preferred stock should be recognized on its settlement date (i.e., the date the proceeds are received and the shares are issued) and is generally recorded at fair value. When preferred shares are sold in a bundled transaction with other instruments, such as warrants, the proceeds received should be allocated to the preferred stock and other instruments issued. How the proceeds are allocated depends on the accounting classification of the other instruments issued. See FG 8.3.1 for information on warrants issued with preferred stock.

What happens to preferred stock when it goes bankrupt?

If preferred stock is sold using an escrow arrangement in which cash is deposited in an escrow account for the purchase of the shares, the issuer should determine who owns the escrow account in the event of the investor’s bankruptcy. If the investor’s creditors have access to the escrow cash in the event of its bankruptcy, the cash held in escrow should not be recorded on the issuer’s balance sheet, and the preferred stock subject to the escrow account should not be recorded until the escrowed cash is legally transferred to the issuer and the shares are delivered to the investor.

What are the disadvantages of preferred stock vs common stock?

One of the main disadvantages of preferred stock compared to common stock is its limited potential to benefit from increases in earnings. A participation right allows a preferred stockholder to receive additional income when dividends are paid to common shareholders.

When preferred shares are sold in a bundled transaction with other instruments, such as warrants, should the proceeds be?

When preferred shares are sold in a bundled transaction with other instruments, such as warrants, the proceeds received should be allocated to the preferred stock and other instruments issued. How the proceeds are allocated depends on the accounting classification of the other instruments issued.

Can preferred shares be sold?

Preferred shares may be sold for future delivery through a forward sale contract. In a forward sale contract, the investor is obligated to buy (and the issuer is obligated to sell) a specified number of the issuer’s shares at a specified date and price.

Where is preferred stock recorded?

Preferred stock normally is recorded at the top of the shareholders' equity section on the balance sheet. When a company issues shares of preferred stock, it records a credit to preferred stock in the amount of the sales proceeds, and a debit to cash, increasing both the equity account of the preferred stock and the cash account, ...

What is preferred stock?

Preferred stock is classified as an item of shareholders' equity on the balance sheet. The issuance of preferred stock provides a capital source for investment uses. Preferred stock can be further classified based on the particular type of stock, such as convertible or non-convertible preferred stock. Classification provides as much detailed and ...

What is shareholders equity?

Shareholders' equity is an important money source companies use to finance their asset purchases. Preferred stock, common stock and retained earnings are the three main components of shareholders' equity. Any change in shareholders' equity simultaneously affects either an asset item or a liability item. For example, an increase in shareholders' ...

Where are liability items placed on a balance sheet?

Furthermore, all liability items are placed on the top right, and items of shareholders' equity are placed on the bottom right. The left side of a balance sheet customarily is referred to as the debit side and the right side as the credit side.

What is balance sheet?

A balance sheet is a two-column configuration of various business transaction items. All items for assets are placed on the left side, and items for liabilities and shareholders' equity are put on the right side. Furthermore, all liability items are placed on the top right, and items of shareholders' equity are placed on the bottom right. The left side of a balance sheet customarily is referred to as the debit side and the right side as the credit side. To increase the dollar amount of a debit or credit item, a debit or credit entry is made on the respective item. To decrease the dollar amount of a debit or credit item, you make a credit or debit entry on the respective item.

What is preferred stock?

For common stockholders, preferred stock is often another possible method of achieving financial leverage in the same manner as using money raised from bonds and notes. The term “preferred stock” comes from the preference that is conveyed to these owners.

What percentage of companies have preferred stock?

Question: Some corporations also issue a second type of capital stock referred to as preferred stock. Probably about 10–15 percent of companies in the United States have preferred stock outstanding but the practice is more prevalent in some industries.

Why is the cost of treasury stock negative?

Because the cost of treasury stock represents assets that have left the business, this account balance is shown within stockholders’ equity as a negative amount, reflecting a decrease in net assets instead of an increase.

Why do corporations repurchase stock?

Corporations can also repurchase shares of stock to reduce the risk of a hostile takeover. If another company threatens to buy enough shares to gain control, the board of directors of the target company must decide if acquisition is in the best interest of the stockholders 1. If not, the target might attempt to buy up shares of its own treasury stock in hopes of reducing the number of owners in the market who are willing to sell their shares. It is a defensive strategy designed to make the takeover more difficult to accomplish. Plus, as mentioned above, buying back treasury stock should drive the price up, making purchase more costly for the predator.

How much was Chauncey's purchase of Treasury stock?

Most companies appear to use the cost method because of its simplicity. The acquisition of these shares by Chauncey is recorded at the $1.2 million (three hundred thousand shares at $4 each) that was paid.

Why do you buy treasury stock?

Buying treasury stock reduces the supply of shares in the market and , according to economic theory, forces the price to rise. In addition, because of the announcement of the repurchase, outside investors often rush in to buy the stock ahead of the expected price increase. The supply of shares is decreased while demand for shares is increased.

What is capital in excess of par value?

Companies often establish two separate “capital in excess of par value” accounts—one for common stock and one for preferred stock. They are then frequently combined in reporting the balances within stockholders’ equity.

Why is preferred stock called preferred stock?

It sports the name “preferred” because its owners receive dividends before the owners of common stock. On a classified balance sheet, a company separates accounts into classifications, or subsections, within the main sections. Preferred stock is classified as part of capital stock in the stockholders’ equity section.

How does a company report the par value of preferred stock?

A company reports the total par value of preferred stock on the first line of the capital stock subsection. Total par value equals the number of preferred stock shares outstanding times the par value per share. For example, if a company has 1 million shares of preferred stock at $25 par value per share, it reports a par value of $25 million.

What is par value in preferred stock?

If a company sells preferred stock at par value, the par value account is the only preferred stock account on the balance sheet. If it sells preferred stock for a higher price, the extra amount is “additional paid-in capital” and is reported a couple of lines below par value. Using the previous example, assume the company initially sold its ...

How does preferred stock value fluctuate?

Because dividends are paid at a fixed percentage, preferred stock’s market value fluctuates based on factors such as changes in market interest rates. When interest rates are higher than the dividend rate on a company’s preferred stock, the market value is usually less than the amount on the balance sheet. When the dividend rate is higher than interest rates, the preferred stock becomes a hot item, and the market value exceeds the balance sheet amount.

What is stockholders equity?

Stockholders’ Equity Section. Stockholders’ equity is funding that a company doesn’t have to pay back. The stockholders’ equity section of the balance sheet lists two main classifications: capital stock and retained earnings.

When interest rates are higher than dividends, what happens to the market value of a preferred stock?

When the dividend rate is higher than interest rates, the preferred stock becomes a hot item, and the market value exceeds the balance sheet amount. 00:00.

What is retained earnings in capital stock?

Retained earnings represent the profits that have been reinvested into the company. Under capital stock, the money that preferred stock owners have forked over is shown in one or two accounts called “par value” and “additional paid-in capital.”

How to determine if preferred stock is a liability?

The first step to determine the appropriate accounting classification for preferred stock is to evaluate the instrument’s provisions to determine whether the share should be classified as a liability because it is a mandatorily redeemable financial instrument or is required to be classified as a liability based on another provision in ASC 480.

What is convertible preferred stock?

Convertible preferred stock may contain settlement provisions that cause it to be a liability pursuant to ASC 480. For example, a convertible preferred share that requires the delivery of a variable number of shares upon conversion could be within the scope of ASC 480-10-25-14a through ASC 480-10-25-14c. That guidance requires preferred stock that will result in the delivery of a variable number of shares that have a value solely or predominantly based (at inception) on (1) a fixed monetary amount, (2) variations in something other than the fair value of the issuer’s equity shares, or (3) variations inversely related to changes in the fair value of the issuer’s equity shares to be accounted for as a liability. See FG 5.5 for additional information on the application of ASC 480.

What is contingently redeemable preferred stock?

Contingently redeemable preferred stock is redeemable only upon the satisfaction of a specified contingency. For example, the following instruments are contingently redeemable.

How to determine if a convertible instrument has a BCF?

To determine whether a convertible instrument contains a BCF, an issuer should compare the conversion price and the issuer’s stock price on the commitment date. The conversion price is calculated by dividing the proceeds allocated to the convertible instrument by the number of shares into which the instrument is convertible. Often, the conversion price is the same as the instrument’s contractual conversion rate; however, in some cases, the conversion price does not equal the stated conversion rate. For example, when detachable warrants are issued with a convertible instrument, the issuer should allocate the proceeds between the convertible instrument and the warrants. This reduces the proceeds allocated to the convertible instrument and as a result, lowers the conversion price.

When an issuer concludes that a conversion option should be separated from its host instrument and accounted for as?

When an issuer concludes that a conversion option should be separated from its host instrument and accounted for as a derivative, it should be accounted for as a freestanding derivative instrument under the guidance in ASC 815. That is, it should be classified on the balance sheet as a derivative liability at fair value with any changes in its fair value recognized currently in the income statement. The preferred stock host should be accounted for using the guidance applicable to similar nonconvertible preferred stock. See FG 5.4.4 for more information on accounting for separated instruments.

When are put options callable?

31 Oct 2020. Due to the higher cost of issuing preferred stock, it is often callable by the issuer after a certain period (e.g., after five years). In addition, put options provide holders with liquidity and protection upon the occurrence of specified events.

Is a mandatorily redeemable financial instrument a liability?

A mandatorily redeemable financial instrument shall be classified as a liability unless the redemption is required to occur only upon the liquidation or termination of the reporting entity.