4 Benefits of Stock Splits for Companies

- Attracting Investors. As mentioned above, a stock split often attracts investors due to the reduction in stock price and lowered barrier to investing.

- Increasing Number of Shares. Rather than issuing new shares through a secondary offering, companies can increase their number of shares by performing a stock split.

- Facilitating Market Activity. ...

What is a stock split and how does it work?

A stock split is used primarily by companies that have seen their share prices increase substantially and although the number of outstanding shares increases and price per share decreases, the market capitalization (and the value of the company) does not change.

Is a stock split good or bad for investors?

One side says a stock split is a good buying indicator, signaling the company's share price is increasing and therefore doing very well. This may be true, but on the other hand, a stock split simply has no effect on the fundamental value of the stock and therefore poses no real advantage to investors.

How do you calculate stock price after a split?

An easy way to determine the new stock price is to divide the previous stock price by the split ratio. Using the example above, divide $40 by two and we get the new trading price of $20. If a stock does a 3-for-2 split, we'd do the same thing: 40/ (3/2) = 40/1.5 = $26.67.

How do you benefit from a stock split?

A company's management may initiate a buyback if they believe the stock is significantly undervalued and as a way to increase shareholder value. While a stock split doesn't immediately increase shareholder value, investors can see it as a bullish sign for the company that could over time mean a rise in the stock price.

Is it better to buy stock before or after a split?

Should you buy before or after a stock split? Theoretically, stock splits by themselves shouldn't influence share prices after they take effect since they're essentially just cosmetic changes.

Do stock splits affect anything?

A stock split increases the number of shares outstanding and lowers the individual value of each share. While the number of shares outstanding change, the overall market capitalization of the company and the value of each shareholder's stake remains the same.

Does a stock split hurt shareholders?

When a stock splits, it has no effect on stockholders' equity. During a stock split, the company does not receive any additional money for the shares that are created. If a company simply issued new shares it would receive money for these, which would increase stockholders' equity.

Do stocks rise after a split?

When a stock splits, it can also result in a share price increase—even though there may be a decrease immediately after the stock split. This is because small investors may perceive the stock as more affordable and buy the stock. This effectively boosts demand for the stock and drives up prices.

Is stock split good for investors?

Stock splits are generally a sign that a company is doing well, meaning it could be a good investment. Additionally, because the per-share price is lower, they're more affordable and you can potentially buy more shares.

What are the disadvantages of a stock split?

Greater volatility: One drawback to stock splits is that they tend to increase volatility. Many new investors may buy into the company seeking a short-term bargain, or they may be looking for a well-paying stock dividend.

Will Tesla shares split?

New York (CNN Business) Tesla shares are about to get three times less expensive. The company announced Friday that its board approved a 3-for-1 stock split, its first split since August 2020. The split would need to be approved by shareholders at the company's annual meeting in August.

What does a 4 to 1 stock split mean?

If you owned 1 share of Example Company valued at $700 per share, your investment would have a total value of $700 (price per share x amount of shares held). At the time the company completed the 4-for-1 forward split, you would now own 4 shares valued at $175 per share, resulting in a total value invested of $700.

What happens when a stock splits 2 for 1?

So with a 2-for-1 stock split, each stockholder receives an additional share for each share held, but the value of each share is reduced by half. This means two shares now equal the original value of one share before the split.

Why did Tesla do a stock split?

Tesla on Friday said it is planning a 3-for-1 stock split, partly to make its shares "more accessible" to retail investors. The announcement comes after the company's shares shed 42% of their value this year.

How many times has Amazon split its stock?

Amazon has undergone four stock splits since the company was founded on July 5, 1994. Amazon has decided to split its stock by 20 to 1 after two decades. Many companies have implemented the strategy, including big names like Apple, which split its stock five times since the company went public in 1980.

Why do you split stocks?

The best-experienced tactic at that point to bring the share prices under control is to split the stocks. While controlling the share price and increasing liquidity are the prime reasons for a common split stock, there can be other factors involved too such as compliance with local regulations.

What is a stock split?

A stock split is often considered a powerful message of a strong share price (at the highest level) to the analysts and investors alike, which further boosts the stock performance in the long run.

Why do companies list their shares on the stock market?

Listing shares on a stock market invites investors and helps a company grow with its vision. Often with the large companies, the share prices go beyond a certain point where only corporate investors can manage trading and average investors get shrugged off for a too-high share price.

What is market share price?

The market share price in an efficient economy is the true reflection of a company’s performance if it reaches a point where the BOD considers it be beyond retail investors that signal for strong company performance.

How many times has Microsoft stock split?

Microsoft for example has performed a stock split as many as nine times since it’s IPO.

Is a stock split a harmless decision?

In general, a stock split is often considered a harmless decision to equity shareholders, but the implications can be traced only if the true purpose is known. The analysis of a stock split depends on the form it takes, either a forward stock split or a reverse stock split.

Is a stock split beneficial?

Largely for any corporation, a stock split is beneficial provided the action is performed by choice. In some cases, large public firms may by regulation be compelled to perform the stock split, which may not be perceived good publically.

What Is a Stock Split?

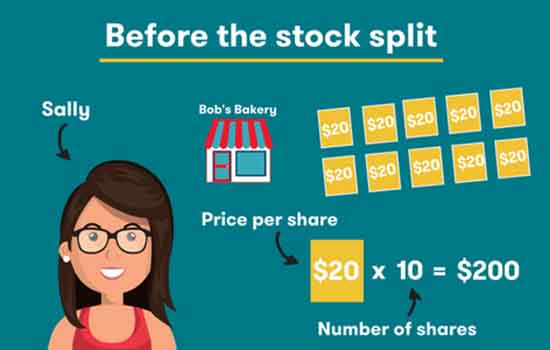

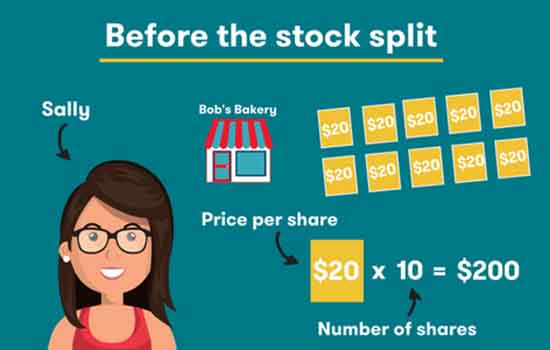

A stock split is when a company divides the existing shares of its stock into multiple new shares to boost the stock's liquidity. Although the number of shares outstanding increases by a specific multiple, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value.

How does the price per share after a 3 for 1 stock split work?

On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the price by three. This way, the company's overall value, measured by market capitalization, would remain the same.

Are stock splits good or bad?

Stock splits are generally done when the stock price of a company has risen so high that it might become an impediment to new investors. Therefore, a split is often the result of growth or the prospects of future growth, and is a positive signal. Moreover, the price of a stock that has just split may see an uptick as new investors seek the relatively better-priced shares.

Does the stock split make the company more or less valuable?

No, splits are neutral actions. The split increases the number of shares outstanding, but its overall value does not change. Therefore the price of the shares will adjust downward to reflect the company's actual market capitalization. If a company pays dividends, new dividends will be adjusted in kind. Splits are also non-dilutive, meaning that shareholders will retain the same voting rights they had prior to the split.

Can a stock split be anything other than 2-for-1?

While a 2:1 stock split is the most common, any other ratio may be carried out so long as it is approved by the company's shareholders and board of directors. These may include, for instance, 3:1, 10:1, 3:2, etc. In the last case, if you owned 100 shares you would receive 50 additional shares post-split.

What is reverse stock split?

A reverse/forward stock split is a special stock split strategy used by companies to eliminate shareholders that hold fewer than a certain number of shares of that company's stock. A reverse/forward stock split uses a reverse stock split followed by a forward stock split.

Why is liquidity important in stock?

Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers. Liquidity provides a high degree of flexibility in which investors can buy and sell shares in the company without making too great an impact on the share price. Added liquidity can reduce trading slippage for companies that engage in share buyback programs. For some companies, this can mean significant savings in share prices.

What is a stock split?

In a stock split, each existing share within a company is divided into multiple additional shares. Consequently, a company’s share count increases while the price of one single share decreases in proportion to the number the stock is split into.

How does a company do a stock split?

The process for a company to conduct a stock split from the announcement to the execution involves time and money. In the most usual cases, a company hires a bank to plan and execute a stock split which will then charge a fee. That fee might not be too considerably high relative to the company’s size but can be viewed purely as a cosmetic cost that could have been used for other purposes instead.

Why is liquidity important in stocks?

Liquidity is generally favorable to investors because it allows for high transparency and reasonable stability of stock prices.

Why are companies not more valuable after a stock split?

Companies don’t become more valuable after a stock split, simply because nothing has changed within the company’s fundamental characteristics which raises the question of whether companies would really need to conduct stock splits in the fashion that they do today.

How many shares do you own after a 3 to 1 stock split?

For instance, after a 3 to 1 stock split, investors would own three times as many shares as before since each existing share would be divided into three shares. While stock splits may seem like a superficial corporate action at first glance, they have become conventional for most companies in recent decades in order to keep share prices at a certain level.

How does a stock split affect the market?

Stock splits increase the total amount of outstanding shares by a substantial number, while the company’s market capitalization stays the same. When a company with 20 million shares is suddenly split up into 60 million shares after a stock split, the price of an existing share inevitably decreases to a more affordable level.

What would happen if a company didn't split its stock?

The firm already split its stock a few times before. If the company hadn’t decided to go the stock splitting route, the stock would now trade at very high prices and most likely be not as liquid and frequently traded as it is today.

Why do you split a stock?

Splitting the stock also gives existing shareholders the feeling that they suddenly have more shares than they did before , and of course, if the price rises, they have more stock to trade. Another reason, and arguably a more logical one, is to increase a stock's liquidity.

What Is a Stock Split?

A stock split is a corporate action by a company's board of directors that increases the number of outstanding shares. This is done by dividing each share into multiple ones—diminishing its stock price. A stock split, though, does nothing to the company's market capitalization. This figure remains the same, the same way a $100 bill's value doesn't change when it's exchanged for two $50s. So with a 2-for-1 stock split, each stockholder receives an additional share for each share held, but the value of each share is reduced by half. This means two shares now equal the original value of one share before the split.

Why is the total dollar value of the shares the same?

The total dollar value of the shares remains the same because the split doesn't add real value. The most common splits are 2-for-1 or 3-for-1, which means a stockholder gets two or three shares, respectively, for every share held.

Why do companies split their stock?

There are several reasons companies consider carrying out a stock split. The first reason is psychology. As the price of a stock gets higher and higher , some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable.

What does a 1 for 10 split mean?

Companies can also implement a reverse stock split. A 1-for-10 split means that for every 10 shares you own, you get one share. Below, we illustrate exactly what effect a split has on the number of shares, share price, and the market cap of the company doing the split.

Do splits fall in line with financial theory?

None of these reasons or potential effects agree with financial theory. A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. Splits are a good demonstration of how corporate actions and investor behavior do not always fall in line with financial theory. This very fact has opened up a wide and relatively new area of financial study called behavioral finance .

Is buying before a split a good strategy?

Historically, buying before the split was a good strategy due to commissions weighted by the number of shares you bought. It was advantageous only because it saved you money on commissions. This isn't such an advantage today since most brokers offer a flat fee for commissions.

Why do stocks split?

Typically, the underlying reason for a stock split is that the company’s share price is beginning to look expensive. Say, XYZ Bank was selling for $50 a share a couple of years ago but has risen to $100. Its investors, no doubt, are pretty happy.

Why do stocks split before dividends?

This is due to the fact that companies want to maintain the amount of dividends issued. The dividend payout ratio of a company reveals the percentage of net income or earnings paid out to shareholders in dividends.

What is short selling?

First, let’s look at short-selling, a strategy in which the investor is betting that the stock price will decline. Basically, the investor borrows shares through their brokerage account and agrees to replace them back at a later date. They immediately sell the stock on the secondary market, hoping that they’ll be able to buy the same number of shares at a lower price before the loan comes due.

What is short selling strategy?

First, let’s look at short-sellin g , a strategy in which the investor is betting that the stock price will decline. Basically, the investor borrows shares through his/her brokerage account and agrees to replace them back at a later date. She immediately sells the stock on the secondary market, hoping that s/he’ll be able to buy the same number of shares at a lower price before the loan comes due. (See " An Overview of Short Selling .")

How long after a stock split can you sell?

Keep in mind that you may not sell your stock for several years after a split, so it doesn’t hurt to do a little research and figure out if your shares were sliced up at any point after the initial purchase. Of course, you’ll want to adjust your basis each and every time the stock was split.

What does it mean when a company splits its stock?

For investors in a company, it can be pretty exciting to hear that a stock you own is about to be split, as it indicates the company's value has outgrown its share price. While it doesn’t actually make your investment any more valuable in and of itself, new investors may be attracted to the new lower share prices and bid them up. However, sometimes that initial feeling of pride that a company split its stock is followed by one of confusion as investors wonder how the stock split affects things like outstanding market orders, dividend payouts, and even capital gains taxes .

What is a dividend in stock?

A dividend, or cash payment made periodically by a company, is impacted by a stock split depending on the dividend's date of record, or the date on which one must be a shareholder to receive a dividend.

How to view stock splits?

Another way to view stock splits is to consider a dollar bill in your pocket – its value is obviously $1. Of course, if you were to "split" the dollar bill into 10 dimes, the value of the money in your pocket is still $1 – it's just in 10 pieces instead of one.

What does a stock split do?

A stock split increases the number of outstanding shares and therefore increases the liquidity of the shares.

How many shares did Valerie own before the CTC split?

For example, Valerie owned 80,000 shares before the split. Since there were 1,000,000 CTC shares outstanding at the time, her 80,000 shares represented an 8% stake in the company. Thus, every dollar of net income the firm earned essentially put eight cents into her pocket (though the company would probably not pay out its entire profit in dividends, but keep most of it as retained earnings for expansion).

Why do companies split their stock?

Basically, companies choose to split their shares so they can lower the trading price of their stock to a range deemed comfortable by most investors and increase the liquidity of the shares. Human psychology being what it is, most investors are ...

How many ways can you split a stock?

A stock can be split a variety of ways, such as 2-for-1, 3-for-1, 5-for-1, 10-for-1, or 100-for-1.

When a company's share price has risen substantially, will most public firms end up declaring a stock?

Thus, when a company's share price has risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price.

Does a stock split add real value?

Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. When a stock split is implemented, the price of shares adjusts automatically in the markets. A company's board of directors makes ...

How does stock split work?

It is calculated by multiplying the price per stock by the total number of shares outstanding.

What does it mean for investors?

While this effect may wither over time, stock splits by blue-chip companies (established, stable, and well-organized corporations) are a bullish signal for investors.