Because most penny stocks are illiquid, a relatively small amount of buying volume can generate extreme price fluctuations, and it's common to see certain penny stocks gain 100%, 1,000% or even more in a single day. Investing in Penny Stocks Here's a beginners guide for investors taking on the penny stock market.

Full Answer

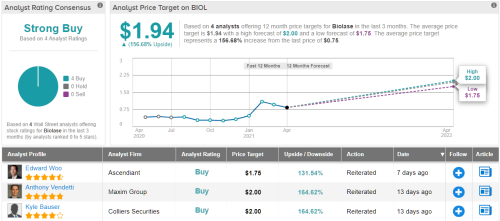

Is this penny stock on the rise?

This penny stock on the rise is in another great industry. As the U.S. is turning more to alternative energies, we are trying to rely less on traditional energy. Things like coal, oil and gas. And there aren’t many other alternatives for our energy demand.

Why do penny stocks fluctuate so much?

As a result, changes in company fundamentals or a moderately-sized purchase of a block of penny stock can cause its price to fluctuate wildly. A 10-cent rise is barely noticeable on most stocks, but it can double the value of a penny stock.

Are penny stocks risky for first-time investors?

Taking a penny stock is one of the riskier decisions that first-time investors often make . Four major factors make these securities riskier than blue-chip stocks. The key to any successful investment strategy is acquiring enough tangible information to make informed decisions.

Should you wait to invest in penny stocks?

Penny stocks are very volatile. If you are investing money that you cannot afford to lose, you should wait to invest in penny stocks. Yes, the volatility can bring you very high rewards. But, that volatility can also make the price go down fast. And that’s because there are fewer shares going around.

What is the fastest growing penny stock?

Fastest Growing Tech Penny StocksPrice ($)Revenue Growth (%)Meta Materials Inc. (MMAT)1.671,060Desktop Metal Inc. (DM)4.74577.3Sunworks Inc. (SUNW)2.52269.2

Can a penny stock go high?

Just like mid and large cap stocks, there is no limit to how high a penny stock can go. Many massive, well-established companies were once trading for less than $5 per share.

How much can penny stocks go up in a day?

The Promise of Riches. Penny stocks are spoken of as vehicles that can generate riches in small periods of time. The hysteria typically touts 1,000 percent gains within a day, an hour or a minute.

Can you get rich quick with penny stocks?

Although penny stocks have some great attributes, they are not right for everyone. These stocks truly can turn a small amount of capital into a huge sum of money pretty fast, but can just as quickly wipe that investment out.

What is the most successful penny stock Ever?

Let's look at some charts!GameStop (NYSE: GME)Sundial Growers Inc (NASDAQ: SNDL)Castor Maritime (NASDAQ: CTRM)AMC Entertainment Holdings Inc. (NYSE: AMC)True Religion (formerly NASDAQ: TRLG)Pier 1 (formerly NYSE: PIR, now OTCPK: PIRRQ)Monster Beverage Corporation (NASDAQ: MNST)Medifast Inc. (NYSE: MED)More items...•

What makes penny stocks spike?

Key Takeaways Because penny stocks have fewer shareholders, it is easy for buying and selling activity to become imbalanced. This causes prices to fluctuate. Corporate growth on more than one front, such as rising revenues and an expanded workforce, often leads to an increase in share price.

Why do penny stocks fail?

Penny stocks are high-risk securities with small market capitalizations that trade for a low price outside major market exchanges. A lack of history and information, as well as low liquidity, make penny stocks more risky.

Is it smart to invest in penny stocks?

Penny stocks are a class of low-price, high-risk public companies. They tempt highly speculative traders with the illusion of easy exponential growth, offering the chance to double, triple or quadruple their money. Don't be fooled—penny stocks are incredibly risky, with a very high potential for fraud and loss.

Do penny stocks make money?

Can you make money on penny stocks? It is possible to make money with penny stocks. Then again, it's technically possible to make money with any type of stock. Successful investors usually focus on the potential for their stock picks, regardless of price, to gain value over the long term.

What's hot in penny stocks?

Countries Shunning Russian Resources Good for Canadian Gold as Next Great Discovery LoomsSymbolCompany NameChangeSNDLSundial Growers Inc.-0.009 /-2.36%IMPPImperial Petroleum Inc.0.035 / 6.77%SOPASociety Pass Incorporated0.230 / 11.00%EVFMEvofem Biosciences Inc.0.054 / 15.76%21 more rows

What happens if you invest 1 dollar in stocks?

The initial investments you made would grow exponentially if you left the money alone. That $1 you invested on day one would eventually turn into $17.45 of value on its own -- and it would do that because as the $1 earned a return, the money would be reinvested and earn more returns, and so on over time.

What are the best stocks under $1?

Penny Stocks To Buy For Under $1ProQR Therapeutics (NASDAQ: PRQR)Cybin Inc. ( NYSE: CYBN)Statera Biopharma Inc. ( NASDAQ: STAB)Exela Technologies Inc. ( NASDAQ: XELA)Sonnet BioTherapeutics Holdings Inc. ( NASDAQ: SONN)Artelo Biosciences Inc. ( NASDAQ: ARTL)Meten Holding Group Ltd. ( NASDAQ: METX)

What is penny stock?

Key Takeaways. Penny stocks are low-value shares that often trade over-the-counter as they do not meet the minimum listing requirements of exchanges. Penny stocks can be far riskier than listed stocks and may be susceptible to manipulation.

What is penny stock management?

In real estate, it’s all about “location, location, location." For penny stocks, it’s about “management, management, management." Sound management can turn around a struggling firm and launch a startup to new heights. More importantly, experienced and ethical management that have a vested interest in the company via share ownership can provide investors with a sense of security.

How much is Monster beer worth in 2020?

If you had bought shares in the Monster Beverage Corporation ( MNST) in 1996 when it was trading at $.04 a share, you would be a happy investor today: Monster traded above $66 in 2020. 1 . If you're intrigued by the potential to find such exponential gains, it could be worth diving into the murky waters of penny stocks.

What is the growth phase of a company?

Following this initial phase is the “growth phase," in which many of these companies gain greater market attention and thus their sales and demand skyrocket.

Is penny stock an OTC?

For example, a penny stock could belong to a once-thriving company that is now on the brink of bankruptcy or has had to de-list from the larger exchanges and is now trading over-the-counter (OTC). It could also be a new company, so it has a scant market history and hasn't yet met the criteria to be listed on a major exchange.

Is penny stock worth diving into?

If you're intrigued by the potential to find such exponential gains, it could be worth diving into the murky waters of penny stocks.

Can binary stocks fall?

However, traders can still take advantage of binary-type companies when conditions are favorable, such as when commodities are booming. But investors in these areas must also realize that the stocks can fall just as quickly as they can rise.

What is penny stock?

Although they're called penny stocks, the Securities and Exchange Commission applies the term to low-capitalized companies trading for $5 a share or less. Many companies, however, do have stock trading for less than a dime. These low prices allow a risk-tolerant investor to load up on a lot of shares at a cheap price, hoping to ride a price rise of a few cents or more for a serious return.

Is there a penny stock on the New York Stock Exchange?

While there are cheap stocks available on the New York Stock Exchange and Nasdaq, many penny stocks are traded on smaller exchanges where reporting requirements and company capitalization thresholds are far less stringent than on the big boards. As a result, changes in company fundamentals or a moderately-sized purchase of a block of penny stock can cause its price to fluctuate wildly. A 10-cent rise is barely noticeable on most stocks, but it can double the value of a penny stock. Meanwhile, a 10-cent drop could wipe out most of the investment.

Do penny stocks have a buyer?

Unlike the companies on larger exchanges, penny stocks may have relative ly few investors trading shares at any given time — meaning that even though you may have realized a gain on paper, it may be difficult finding a buyer for your shares when you want to turn them into liquid assets. Investors must also be wary of "pump and dump" scams, in which an unscrupulous investor gets many other people to drive up the value of shares he already holds, then he dumps his stake for a huge profit, the stock price plummets and the other investors are left with a big loss.

Can penny stocks be traded?

Regardless of the negatives of trading in a penny stock, it is true that some savvy or lucky investors have seen their shares skyrocket in a single day, and exponential returns can be realized in relatively short periods of time. Keep your penny stock investment limited to the capital you're willing to use for high-risk stocks, and be prepared for a total loss or to be stuck with the shares for a while. But when the reward does come, it can be substantial.

Why are penny stocks so risky?

A lack of history and information, as well as low liquidity, make penny stocks more risky.

What are the fallacies of penny stocks?

There are two fallacies pertaining to penny stocks that often fool investors. The first misconception is that many of today's stocks were once penny stocks and the second is that there is a positive correlation between the number of stocks a person owns and their returns .

What is a micro cap stock?

Definitions vary, but in general, a stock with a market capitalization between $50 and $300 million is a micro cap. Anything less than $50 million is called a nano cap. 1.

What is the easiest way to manipulate stock prices?

Second, low liquidity levels provide opportunities for some traders to manipulate stock prices, which is done in many different ways—the easiest is to buy large amounts of stock, hype it up, and then sell it after other investors find it attractive. This technique is also known as pump and dump .

Where do penny stocks trade?

Instead of trading on major exchanges, penny stocks trade over the counter or on the pink sheets.

Do micro cap stocks have to file with the SEC?

For micro cap stocks, information is much more difficult to find. Companies listed on the pink sheets are not required to file with the Securities and Exchange Commission (SEC) and are thus not as publicly scrutinized or regulated as the stocks represented on the New York Stock Exchange (NYSE) and the Nasdaq.

Do micro cap companies pay to recommend stock?

Some micro cap companies pay individuals to recommend the company stock in different media such as newsletters, financial news outlets, and social media. You may receive spam email trying to persuade you to purchase a particular stock. All emails, postings, and recommendations should be taken with a grain of salt.

What do you need to know about penny stocks?

Penny Stocks, What You Need To Know. In investing, as in life, you get what you pay for. Still, some investors are drawn to the idea of penny stocks. As their name implies, these stocks promise a large reward for a small risk. This article will help you understand what penny stocks are, where you can find them, ...

What is a penny stock?

However, the Securities and Exchange Commission (SEC) defines a penny stock as one that trades for less than five dollars a share .

Why are penny stocks so attractive?

What makes penny stocks so attractive is easy to see. They promise investors a high return for a minimal investment. An investor that pays 25 cents a share would only need to see the stock rise to 50 cents a share to double their money. Some investors are equally seduced by the idea that the low cost of entry will allow them to buy a large number of shares, further increasing their potential reward. On the face of it, that sounds logical, but as we’ll explain there are other factors to consider.

How to know if a stock is worth it?

An old-school tip that can help you decide if a stock is worth your risk, particularly for beginners, is to consider paper trading. This is a very simple concept where you invest an imaginary amount of money and then track your trades on pen and paper without exposing actual money. What this can help you see is how quickly a stock is moving and how much volume is changing hands. After a couple of months of paper trading, you’ll be in a much better position to decide if investing in penny stocks is really for you.

What to remember when buying penny stocks?

Another good mantra to remember with penny stocks is to focus on companies where you may have some interest and/or expertise. While this may not sound exciting, because after all, professional athletes want to be rock stars and vice versa, it is vitally important.

Where are penny stocks listed?

To begin with, these stocks are primarily listed in two places: the Pink Sheets and the Over-the-Counter Bulletin Board (OTCBB). The pink sheets are a compilation of daily publications by the National Quotation Bureau. The companies listed on the pink sheets do not have to file with the SEC and do not need to meet minimum filing requirements, such as submitting a recent financial report. The penny stocks that are found on the OTCBB are still not listed on any of the major exchanges, but they do have to meet some minimum requirements. All this means that you, as an investor, will have a lack of information. And when it comes to deciding where to invest your money, information is power.

Is penny stock a volatile stock?

As we’ve mentioned, penny stocks are volatile. And any time you put your money into a volatile investment, there is a high degree of risk. What can make penny stocks riskier is the potential for fraud. This can manifest itself in many forms.

Conclusion

By understanding the anatomy of penny stocks you will gain the ability to position yourself to profit from 100% or higher moves in the penny stock market.

5 Reasons Why You Should Never Use Phone Apps To Trade

Using a phone trading app will result in you earning less per year. Don’t fall victim to some of the most common traps of phone investing.

5 Reasons Why The Tech Sector Grows Faster Than Other Sectors

The tech sector has exploded in value over the past 30 years. Here is why that is. This knowledge could help you profit from this trend.

Why Checking Your Stocks Everyday Is Bad

You should not be checking your stocks everyday. Doing so drastically increases your chances to lose money if your a normal investor.

How long does it take for penny stocks to rebound?

Whether it takes minutes, days, weeks, or months, the penny stock usually rebounds to former levels.

Why do penny stocks fluctuate?

Because penny stocks have fewer shareholders, it is easy for buying and selling activity to become imbalanced. This causes prices to fluctuate.

Why are stocks more prone to technical imbalances?

For example, many stocks are more prone to technical imbalances because they are more thinly traded, or they have experienced such situations numerous times in the past.

What are the factors that affect the price of penny stocks in 2021?

When it comes to low-priced shares, most investors believe that stock prices are moved by corporate earnings, acquisitions, new customers, or huge contract wins. While these influences can have an impact, there are a whole host of other factors that can drive the prices of penny stock companies.

What is the best case scenario for penny stock?

The best-case scenario is to find a small penny stock company that is capturing a greater percentage of the total share over time, while the underlying market is also growing. It is also the secret to long-term success in speculative investing.

What does it mean to be aware of the factors that are moving the price?

Being aware of the factors which are truly moving the prices means that you will be open to more opportunities than almost all other traders. Through awareness, you will have clarity. Through clarity, you can make better buying and selling decisions. Keep in mind that the price drivers discussed above can apply to blue-chip and large-cap companies, just as much as they do with penny stocks. Of course, the impacts and opportunities will be greatest when they affect the tiniest investments.

Why are penny stocks more susceptible to fraud?

Manipulation: Due to the nature of penny stocks, they are more susceptible to fraud such as "pump and dump" schemes.

What Are Penny Stocks?

Despite their name, penny stocks are classified by the SEC as stocks that trade for less than $5 per share , says Josh Simpson, a financial advisor with Lake Advisory Group.

What does Simpson say about penny stocks?

“If you are considering investing in penny stocks, you would be better off taking that money to the casino and enjoying yourself while you lose your money, ” he says. “Invest smarter. There are low-priced alternatives to penny stocks that will allow you to start investing, without having a large sum of money.”

What are some good apps to invest in the stock market?

Micro-investing apps like Acorns and Stash let you easily invest in the stock market for a small monthly subscription fee, in fractional shares as well as exchange-traded funds (ETFs). Large brokerages, like Charles Schwab and Fidelity, and smaller disruptors, like SoFi and Robinhood, also offer fractional shares.

Is penny stock volatile?

Decide how much you can lose. Yes, penny stocks are that volatile —occasionally spoken in the same breath as cryptocurrency.

Is penny stock risky?

Risks of Penny Stocks. Few penny stocks are like Nautilus, however. While you might think the risks are low when prices are also low, penny stocks tend to carry much higher risk than stocks that trade on major exchanges. This makes it easier to lose money, no matter what the size of your investment.

Can most investors handle volatility?

Most investors can’t handle that much volatility.

Is penny stock a good investment?

With so many alternatives to penny stocks that allow investors to start investing with $5 or less and still enjoy solid historical returns, there’s really no reason to see penny stocks as a wise investment.

Check The Fundamentals

Industry Life-Cycle Analysis

- Along with analyzing a company’s balance sheet, the penny stock trader should look to do an industry life-cycle analysis. Some penny stock companies are in a sector still in its “pioneering phase." This initial phase is characterized by the presence of a large number of small-sized competitors in the space, novel products and concepts, and low customer demand for the produ…

Penny Stock Industries

- Industries that offer binary outcomes for most of its companies will unsurprisingly contain a plethora of penny stocks. Binary outcomes, or “make or break” speculative plays, are found predominantly in biotech or resource sectors. The Canadian TSX Venture Exchangewas the home of many resource-based penny stocks that took off during the commodity boom of the 2000s. T…

Sound Management

- In real estate, it’s all about “location, location, location." For penny stocks, it’s about “management, management, management." Sound management can turn around a struggling firm and launch a startup to new heights. More importantly, experienced and ethical management that have a vested interest in the company via share ownership can provide investors with a sense of securi…

The Bottom Line

- Penny stocks are extremely volatile and speculative by nature. As most trade on OTC exchanges or via pink sheets, where listing standards are lax, penny stocks are susceptible to manipulation and fraud. Still, the potential to make large returns is a strong allure, driving risk-taking investors into taking positions in these securities. Though many penny stocks go bust, if an investor exerc…