Walmart employees can purchase company stock in one of two ways: through payroll deductions or from a broker. Stock purchased through payroll deductions is known as associate stock. Current and former Walmart employees can sell their associate stock online or by phone at any time.

Is an employee stock purchase plan a good deal?

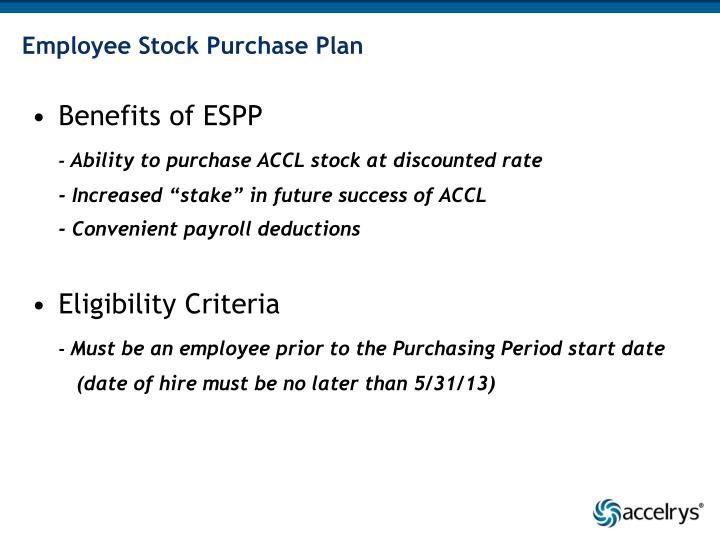

These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Should I invest in my employee stock purchase plan?

Your employer may let you buy company stock at a discounted price through an employee stock purchase plan, or ESPP. If you choose to participate, these investments can boost your bottom line and offer tax advantages, depending on when you opt to sell your holdings. The company you work for may let you purchase company stock at a discounted price.

How do I invest in Walmart stock?

Walmart Inc. turned in a solid fourth quarter and fiscal year despite supply chain issues, inflation and pandemic-related costs. The Bentonville-based retailer released its earnings report before the markets opened Thursday. Walmart posted profit of $3.6 ...

How much do Walmart employees get paid in the US?

Average Walmart Stocker hourly pay in the United States is approximately $11.68, which meets the national average. Salary information comes from 2,283 data points collected directly from employees, users, and past and present job advertisements on Indeed in the past 36 months.

How do Walmart employees buy Walmart stock?

Stock Purchase You can purchase shares of Walmart stock through Computershare, our stock transfer agent, or through any authorized brokerage firm. To receive information about our Direct Stock Purchase Plan, or to purchase stock, visit Computershare or call 1-800-438-6278.

How do employee stock purchase plans work?

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

Do Walmart employees get stocks?

For those who want to skip the middleman, direct investment is an option with Walmart shares. The company makes its stock available to investors, including Walmart employees, through the Computershare system.

Can I cash out my employee stock purchase plan?

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.

How long do you have to hold ESPP shares?

one yearThe advantage of qualifying for long-term capital gains is that these rates are usually lower than your ordinary income tax rate, but this strategy requires you to hold your shares for at least one year after you purchase them.

What happens to ESPP if you quit?

With employee stock purchase plans (ESPP), when you leave, you'll no longer be able to buy shares in the plan. Depending on the plan, withholding may occur for months before the next pre-determined purchase window.

Is Walmart associate stock purchase plan worth it?

While there are some fees associated with it, the ability to purchase stock and receive yearly dividends more than makes up for it. For anyone looking to secure their financial future, Walmart's 401(k) plan is definitely worth considering.

What happens to Walmart stock when you quit?

Your Associate Stock Purchase Plan account will remain open until you decide to close it. Close your account and sell all the shares in your account. Manage your account at Computershare.com/Walmart. If you have questions, call 800-438-6278.

How long do you have to work for Walmart to be fully vested?

7 yearsFully vested is 7 years.

Should I sell ESPP immediately?

In a nutshell: Owning company shares is a HUGE benefit, especially when you manage those shares to their greatest advantage. As a general recommendation, we suggest selling 80% to 90% of your ESPP shares immediately after purchase and using the proceeds to improve your financial situation in other ways.

Is employee stock purchase plan a good idea?

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Do you have to sell ESPP when you leave?

If I leave the company, what happens to the money that has been deducted from my paycheck to purchase ESPP shares? You will continue to own stock purchased for you during your employment, but your eligibility for participation in the plan ends.

What is the plan year?

1.16. " Plan Year " shall mean April 1 of a calendar year to March 31 of the following calendar year, or such other period as set by the Committee.

What is payroll deduction?

" Payroll Deduction " shall mean the payroll deduction from a Participant153s biweekly or weekly regular compensation (including from vacation pay and any paid leave of absence) of an amount authorized by the Participant as a Payroll Deduction Contribution.

What does "participating employer" mean?

1.13. " Participating Employer " shall mean an Affiliate whose participation in the Plan has been approved by the Committee. The Committee may require the Participating Employer to make corresponding contributions under the Plan in accordance with rules and procedures established by the Committee. The Committee, in its sole discretion, may terminate any such Affiliate153s Participating Employer status at any time and the Participants153 Accounts will be treated as if such Participants had transferred employment to an Affiliate that is not a Participating Employer as described in Section 5.3 of the Plan.

Who makes the award contribution?

3.6. Award Contributions. Award Contributions shall be made, in the Committee153s sole discretion, by either (1) the Company or the Participating Employer, as applicable, remitting to the Account Administrator on behalf of the Participant funds sufficient to purchase any shares or fractional shares of Stock that have been granted to such Participant under the Award Program or (2) the Participant receiving the Award Contribution directly as a certificate for a share or shares (as applicable) of Stock.

What does "participant" mean in a plan?

" Participant " shall mean any Associate of the Company or a Participating Employer who satisfies the eligibility requirements in Section II and who has an Account established under the Plan, and Participant shall also include any former Associate of the Company or a Participating Employer who was a Participant in the Plan at the time of his or her termination of employment until such time as an Account Closure occurs.

How do Walmart employees purchase stock?

By Mary Jane Freeman Updated March 5, 2018. Walmart employees can purchase company stock in one of two ways: through payroll deductions or from a broker. Stock purchased through payroll deductions is known as associate stock.

How to sell stock at Walmart?

Sell Stock Over the Phone. Call Computershare, Walmart's transfer agent, at 1-800-438-6278. A customer service representative will ask you to verify your identity, which may include providing your employee identification number along with your Social Security number and date of birth. Advise the representative that you want to sell your associate ...

How to check portfolio before selling stock at Walmart?

If you wish to check your portfolio or clear up any questions you may have before selling your stock, call the Walmart Participant Service Center at 1-888 968-4015. Customer service representatives are available Monday through Friday between 9 a.m. and 7 p.m. Eastern Standard Time. Advertisement.

How long does it take to get a check from associate stock?

If market is closed, your shares are sold the next day when the market reopens for business. If you requested payment by check, it can take up to 10 business days to arrive by mail, while electronic deposits take an average of two to three business days.

Does Walmart have associate stock?

Full-time and part-time associates are eligible to purchase associate stock through payroll deductions. Walmart matches all purchases you make through the Associate Stock Purchase Plan, up to 15 percent of the first $1,800 you spend on stock each year.

Dividend Direct Deposit and Reinvestment

To have your dividend check deposited directly into your checking or savings account, or to participate in a dividend reinvestment plan, visit Computershare or call 1-800-438-6278.

Financial Email Alerts

Sign up to receive financial email alerts from Walmart and stay current on our SEC filings, events, news and more.