What Happens to Stock Price When Short Interest Evaporates?

- About Short Interest. When an investor shorts a stock, he expects its price to decline. ...

- A Short Squeeze. When demand increases for a stock that has a lot of short interest, it causes the price of the stock to rise.

- The Short Ratio. ...

- Exception to Share Price Influence. ...

What happens when a stock has a lot of short interest?

When demand increases for a stock that has a lot of short interest, it causes the price of the stock to rise. In such a case, short sellers must cover their short positions to avoid losses by repurchasing the shares.

Do short sellers influence a stock's price?

Short sellers getting into and out of a stock may or may not influence the share price. For example, a short squeeze is more likely to happen with small capitalization stocks than large ones. Capitalization refers to the number of shares a company has outstanding multiplied by the company's stock price.

How do interest rate cuts affect the stock market?

If interest rate cuts affect the stock market, this can usually be tracked through the S&P 500 and traders can make buying or selling decisions based on this. Around the time of Federal Open Market Committee (FOMC) announcements, there can be significant volatility on S&P 500 stocks, signaling the potential for short-term trading opportunities.

What is the impact of short positions on the stock market?

If the amount of shares in short positions is small compared to the float (the number of shares in the market place) then the impact of these short positions is small. If the short interest is large compared to the float then behavior of the short interest holders can have a large impact on the market price of that company's shares.

What does short interest tell you about a stock?

Short interest is used as a sentiment indicator: an increase in short interest often signals that investors have become more bearish, while a decrease in short interest signals they have become more bullish. Stocks with an extreme level of short interest, however, may be viewed by contrarians as a bullish signal.

How do shorts keep stock price down?

Short sellers are wagering that the stock they are short selling will drop in price. If the stock does drop after selling, the short seller buys it back at a lower price and returns it to the lender. The difference between the sell price and the buy price is the short seller's profit.

What happens to stock price after a short squeeze?

Understanding Short Squeezes Eventually, the seller will have to buy back shares. If the stock's price has dropped, the short seller makes money due to the difference between the price of the stock sold on margin and the reduced stock price paid later.

Do Stocks Go Up After shorts cover?

When a stock is heavily shorted, and more investors are buying shares, the stock price is pushed up. As a result of the increase in stock price, short sellers start buying to cover their position in an effort to minimize their losses as the price continues to rise.

How do you tell if a stock price is being manipulated?

Here are 10 ways to recognize if your stock is being manipulated by hedge funds and Wall Street parasites.Your stock is disconnected from the indexes that track it. ... Nonsense negativity on social media. ... Price targets by random users that are far below the current price. ... Your company is trading near its cash value.More items...•

Is a pump and dump illegal?

Pump-and-dump is an illegal scheme to boost a stock's or security's price based on false, misleading, or greatly exaggerated statements. Pump-and-dump schemes usually target micro- and small-cap stocks.

How do you predict a short squeeze?

Scanning for a Short Squeeze Essentially, there are three conditions that must be fulfilled: The number of shares short should be greater than five times the average daily volume. The shares short as a percentage of the float should be greater than 10% The number of shares short should be increasing.

What is the most shorted stock?

Most Shorted StocksSymbol SymbolCompany NameFloat Shorted (%)BYND BYNDBeyond Meat Inc.40.17%VERV VERVVerve Therapeutics Inc.38.69%BGFV BGFVBig 5 Sporting Goods Corp.37.73%ICPT ICPTIntercept Pharmaceuticals Inc.37.73%42 more rows

Are short squeezes rare?

Short squeezes are somewhat rare. In order for a short squeeze to occur, there must be a large number of short-sellers that together hold a significant number of shares short.

When should shorts be covered?

There are no set rules regarding how long a short sale can last before being closed out. The lender of the shorted shares can request that the shares be returned by the investor at any time, with minimal notice, but this rarely happens in practice so long as the short seller keeps paying their margin interest.

Is short covering bullish or bearish?

Below are the essential features of short covering in the share market: Opportunity –The trader is bearish and expects a fall in the price of the underlying asset. Short Position –The trader has borrowed shares and sold them for a lower price. In this case, the profit potential is limited whereas the risk is unlimited.

How long can you hold a short position?

There is no mandated limit to how long a short position may be held. Short selling involves having a broker who is willing to loan stock with the understanding that they are going to be sold on the open market and replaced at a later date.

How does short interest affect stocks?

Let's say that Microsoft's short interest increased by 10% in one month. This means that there was a 10% increase in the number of people who believe the stock price will decrease. Such a significant shift provides good reason for investors to find out more. We would need to check the current research and any recent news reports to see what is happening with the company and why more investors are selling its stock.

What happens when you sell a short stock?

When an investor sells a stock short the price of the stock tends to go down - just as it does with any sale. When that position is "Covered" by buying sufficient shares to retire the short position the price of the stock tends to go up - just as with any purchase.

How to short a stock?

Think of it this way, to short a stock, the speculator must borrow shares from his/her broker and sell those shares. Once their target price has hit, they would buy shares from the open market to pay back the broker.

What happens when the stock price rises?

The more it rises, the larger the number of shares that are being shorted and therefore the greater the downward pressure on price.

What is short squeeze?

Here is a perfect example of what is called a short squeeze, where all the short positions are trying to cover at the same time but they are not enough shares being traded.

What is short interest of floot?

This is an indicator name “Short interest of floot”. it is sentiment indicator. it is also use as a contra indicator.

Can short interest be high?

Short interest can often be high too, yet price continue up. It's not an assured sign. You really should dig up the short interest chart of the stock. Overlay with your normal chart and then…up to you how you analyse that.

What is short interest?

Short interest refers to the number of shares sold short but not yet repurchased or covered. The short interest of a company can be indicated as an absolute number or as a percentage of shares outstanding. The short interest is looked at by investors to help determine the prevailing market sentiment toward a stock.

How to short a stock?

Below indicates the process of shorting a stock: 1. Borrow the stock. The trader will typically contact their broker, who will locate another investor who owns the stock to borrow the stock from them with the promise to return the stock at a predetermined later date. The brokerage may also loan the trader the stock from its own equity holdings .

What is signaling in stock market?

Signaling. Signaling Signaling refers to the act of using insider information to initiate a trading position. It occurs when an insider releases crucial information about a company that triggers the buying or selling of its stock by people who do not ordinarily possess ...

What is a service charge on a stock?

Service Charge A service charge, also called a service fee, refers to a fee collected to pay for services that relate to a product or service that is being purchased. and/or interest to the broker for borrowing the stock.

What is a long and short position?

Long and Short Positions In investing, long and short positions represent directional bets by investors that a security will either go up (when long) or down (when short). In the trading of assets, an investor can take two types of positions: long and short. An investor can either buy an asset (going long), or sell it (going short).

What is common stock?

Common Stock Common stock is a type of security that represents ownership of equity in a company. There are other terms – such as common share, ordinary share, or voting share – that are equivalent to common stock. .

Is short interest a determinant of investment decisions?

Although short interest is important to investors, it should not be the sole determinant when making investment decisions.

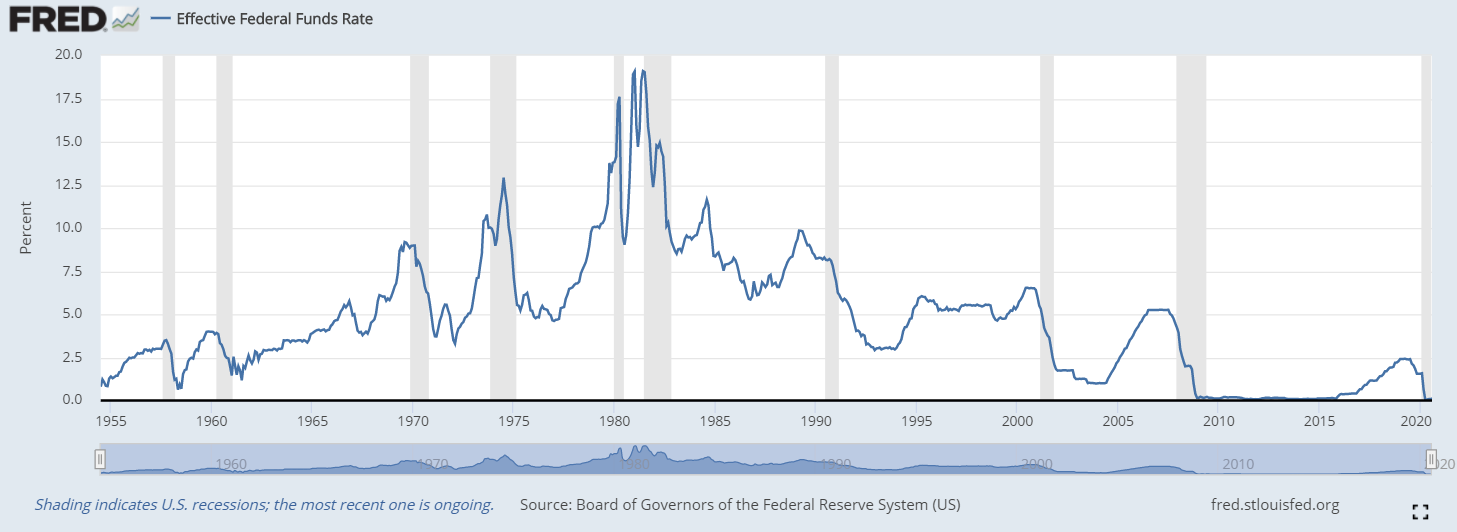

How do higher interest rates affect stock prices?

Higher interest rates tend to negatively affect earnings and stock prices (with the exception of the financial sector). Understanding the relationship between interest rates and the stock market can help investors understand how changes may impact their investments.

What Happens When Interest Rates Rise?

When the Federal Reserve acts to increase the discount rate, it immediately elevates short-term borrowing costs for financial institutions. This has a ripple effect on virtually all other borrowing costs for companies and consumers in an economy.

Why do credit card interest rates increase?

Because it costs financial institutions more to borrow money, these same financial institutions often increase the rates they charge their customers to borrow money. So individuals consumers are impacted through increases to their credit card and mortgage interest rates, especially if these loans carry a variable interest rate. When the interest rate for credit cards and mortgages increases, the amount of money that consumers can spend decreases.

How does the business cycle affect the market?

At the onset of a weakening economy, a modest boost provided by lower interest rates is not enough to offset the loss of economic activity; stocks may continue to decline.

What is interest rate?

Interest rates refer to the cost someone pays for the use of someone else's money. When the Federal Open Market Committee (FOMC), which consists of seven governors of the Federal Reserve Board and five Federal Reserve Bank presidents, sets the target for the federal funds rate —the rate at which banks borrow from and lend to each other overnight—it ...

What is the opposite effect of a rate hike?

A decrease in interest rates by the Federal Reserve has the opposite effect of a rate hike. Investors and economists alike view lower interest rates as catalysts for growth—a benefit to personal and corporate borrowing. This, in turn, leads to greater profits and a robust economy.

What happens to the stock market when a company is cut back?

If a company is seen as cutting back on its growth or is less profitable—either through higher debt expenses or less revenue—the estimated amount of future cash flows will drop. All else being equal, this will lower the price of the company's stock.

What happens to stock prices when interest rates decrease?

When interest rates decrease, it’s cheaper for companies to borrow capital with the aim of achieving growth, and this may encourage stock prices to rise. 2.

How are stocks affected by interest rates?

There are two main ways in which stocks are affected by interest rates: directly and indirectly. Here is a summary of how businesses, and therefore stocks, are affected by changes to interest rates: 1. Businesses are directly affected by bank rates because they affect the amount a company can afford to borrow. ...

What are interest rates and why do they change?

Put simply, interest is the cost of borrowing money. There are different types of interest rates that will affect the stock market – the main distinction is:

What is the overall impact of interest rates?

Interest rates are set with the intention of having a particular impact on the economy. As a general rule:

What is the rate at which banks lend to each other?

Bank rates: This is the rate at which banks lend to each other. It’s also the rate that directly influences the stock market. In the US, this is called the Fed Funds rate. Consumer interest rates: These are the rates charged on loans for consumers, such as a mortgage, or car finance.

Why do central banks have volatility?

When central banks are due to announce changes in interest rates, this in and of itself can cause volatility around the markets. As mentioned previously, the stock market is quick to react to changes in interest rates, so traders will often be making their projections ahead of major central bank announcements.

How do central banks control inflation?

Central banks will try to control these functions by setting bank rates (the target interest rate for banks lending money to other banks from their reserve balances) in an effort to keep inflation in check. A central mandate of the Federal Reserve Bank (the Fed) is to maintain stable prices and employment, chiefly through the control of interest rates.

How does short squeeze affect stocks?

A short squeeze is also most likely to affect stocks with small public float: the number of shares available to trade. With fewer available shares to trade, heightened short interest can cause significant downward pressure on a stock; the opposite is true if shorts have to cover their position in a stock with little float. 00:00. 00:05 09:16.

How to short a stock?

To short a stock, he borrows money using a margin account to buy the shares at a high price. The stock may come from the broker's inventory, another customer or another brokerage firm. To close the short position, the investor must buy the stock back, called "covering.". If the stock drops in price, the investor gets to buy ...

What does short squeeze mean in stock market?

For example, a short squeeze is more likely to happen with small capitalization stocks than large ones. Capitalization refers to the number of shares a company has outstanding multiplied by the company's stock price.

What is short ratio?

The short ratio is a metric that investors use to gauge sentiment on a particular stock or the overall market. The ratio divides the number of shares sold short by the average daily trading volume. The ratio represents the number of days it takes short sellers on average to repurchase the borrowed shares. If an exchange has a short interest ratio ...

What is short selling?

However, some investors profit when the value of a stock goes down, referred to as short selling. Short interest reflects the number of investors who expect the price of a stock to decline.

What happens when a stock drops in value?

If the stock increases in value, the investor has to buy the stock at a higher price, which means he loses money.

Why do stock prices fluctuate?

Stock prices fluctuate because of supply and demand. High demand for a stock causes its price to go up. Too much supply causes a stock's price to decline. Investors buying and holding a stock until it appreciates is a common practice. However, some investors profit when the value of a stock goes down, referred to as short selling.

What is short interest?

Short Interest is a measure of the total number of shares/units of an investment security that have been sold short and remain outstanding (meaning they have not yet been repurchased or covered to close out the short position). Traders typically sell an investment security short if they anticipate price declines.

Why do investors short?

Furthermore, some investors short an investment as a hedging strategy to protect a long position. Long investors might in fact assess higher levels of Short Interest as a reason to do more diligent research for themselves to ensure they understand what is causing others to bet against the stock.

Why do short squeezes happen?

A short squeeze often happens because short sellers panic about potential losses if the stock price rises.

How to calculate short interest?

To calculate Short Interest for a stock, divide the number of shares sold short by the float, which is the total number of shares available for the public to buy . Another term for Short Interest is short float percentage, which is the percentage of the float that is borrowed.

What does it mean when an investment security has a high level of short interest?

If an investment security has a high level of Short Interest, or a sudden increase in Short Interest, it doesn't necessarily mean that the investment security will soon fall in price. It just means that more investors are betting that that the investment security will fall in price.

What does it mean to short sell a security?

Short selling, or to "sell short," means that an investor, or short seller, borrows shares/units of an investment security, usually from a broker, and sells the borrowed security, expecting that the share price will fall. If the share price does fall, the investor buys those same shares/units back at a lower price and can make a profit. The short seller then returns the borrowed security to the lender.

Can shorting be a risk?

Warning: Shorting is not for the faint of heart, and can expose investors to unlimited losses. Markets are unpredictable and short sellers can end up losing money if the security price goes up instead of down as they expected.

Why is shorting a stock not a good strategy?

Shorting a stock is not a commonly used strategy by the majority of investors. Firstly, because of the considerable amount of risk involved. In order to be successful, an investor needs to know what’s going to happen in the future and needs good timing. Plus, in the long run, the stock market tends to go up instead of going down.

What is shorting a stock?

There is a limit on profit, however. Since a stock can only fall to $0. To summarize, shorting a stock is the sale of shares that the seller does not own. Most of the time, these shares are borrowed from a broker. If the price of the stock falls, the shares can be bought back for less than they were sold for.

How do you tell if a stock is shorted?

Look for information such as: Shares Short, Short Ratio, Short % of Float, Short % of Shares Outstanding, Days to Cover, Short Interest, and % of Float Shorted.

What is a short sale? What does short selling involve?

Your prediction is that because of the overvaluation, the price is likely to drop. Your strategy here, when short selling, would be to borrow a certain number of such shares from your broker and then sell those shares on the open market.

What risks are involved with short selling?

As you might have sensed, short-selling comes with a significant amount of risk. When buying a stock, an investor can lose the entire amount they invested. For that to happen, things would have to go really bad. With short sales, an investor can lose an infinite amount of money because the price of the stock might keep rising indefinitely. In the worst-case scenario, investors might end up owing money to their brokerage.

What is short squeeze?

A short squeeze is when a heavily shorted stock begins to rise in price due to buyers rushing in to purchase shares. This might force the short sellers to cover their positions or face a margin call. The buying of the short sellers can exasperate the popularity of the stock and cause it to rise even further.

What is short selling?

Shorting a stock, or “short selling” refers to making money on stock when its price is falling. The process is pretty simple. An investor borrows shares of stock, sells them, and then buys the shares back. Hopefully at a lower price.