That means the options-related profits could buy more shares, causing greater dilution when those are added to common shares to figure diluted earnings per share. If the $80 figure were used, earnings per share should be lower and the stock price could therefore fall.

What happens to eps if common stock is diluted?

If dilution increases the number of common stock shares to 400,000, EPS declines to $2.50 per share. Here are several securities that can be converted into shares of common stock:

What is the diluted EPS formula?

The Diluted EPS formula is equal to Net Income less preferred dividends, divided by the total number of diluted shares outstanding (basic shares outstanding plus the exercise of in-the-money options, warrants, and other dilutive securities).

What is the difference between dilutive EPs and dilutive securities?

Dilutive securities aren’t common stock, but instead securities that can be converted to common stock. Converting these securities decreases EPS, thus, diluted EPS tends to always be lower than EPS. Dilutive EPS is considered a conservative metric because it indicates a worst-case scenario in terms of EPS.

Why is it important to report basic and diluted EPS?

Reporting basic EPS is required because it increases the comparability of earnings between different companies. Diluted EPS is required to reduce moral hazard issues. Without diluted EPS, it would be easier for the management to mislead shareholders regarding the profitability of the company.

How do stock options affect earnings per share?

If the stock price is $10 and the exercise price is $5, each option could make its owner a $5 profit. That is enough to buy ½ of a share. Hence, each option creates ½ share that is added to the total number of common shares outstanding in order to calculate diluted earnings per share.

Do you include unvested options in diluted EPS?

Diluted earnings per share include any dilutive effects of stock options, unvested restricted stock units, unvested performance shares, and unvested restricted stock.

Which of these is a likely cause of diluted EPS being lower than basic EPS?

Diluted EPS will always be lower than basic EPS if the business creates a profit, because the profits have to be split among more shares.

Do stock options get diluted?

Stock dilution can also occur when holders of stock options, such as company employees, or holders of other optionable securities exercise their options. When the number of shares outstanding increases, each existing stockholder owns a smaller, or diluted, percentage of the company, making each share less valuable.

Can stock options be anti dilutive?

Publicly traded companies can offer either dilutive or anti-dilutive securities. These terms commonly refer to the potential impact of any securities on the stock's earnings per share.

When we take into account the dilutive effect of stock options rights and warrants in the calculation of EPS The method used is called the?

65. When we take into account the dilutive effect of stock options, rights, and warrants in the calculation of EPS, the method used is called the: A. Optional method.

What does diluted EPS tell?

Diluted earnings per share (diluted EPS) calculates a company's earnings per share if all convertible securities were converted. Dilutive securities aren't common stock, but instead securities that can be converted to common stock.

What is diluted EPS and why is that important?

Diluted EPS is important for shareholders simply because it lays down the earnings that a shareholder would get in the worst of the scenarios. If a public listed entity has more of different stock types in its capital framework, it should provide information pertaining to both diluted EPS and Basic EPS.

Effect of Convertible Debt on Diluted Earnings Per Share

Upon conversion, the numerator (net income) of the basic EPS formula increases by the amount of interest expense net of tax associated with those i...

Effect of Convertible Preferred Stock

Upon conversion, the numerator of the basic EPS formula would increase by the amount of the preferred dividends. If converted, there would be no di...

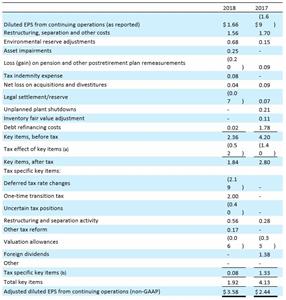

Colgate Diluted EPS Analysis

We note the following in Colgate’s Earnings Per Share schedulesource – Colgate 10K filings 1. Basic EPS Calculation Methodology – Basic earnings pe...

How Useful Is Diluted EPS to The Investors?

1. Diluted Earnings Per Share isn’t very popular among investors because it is based on a “what if” analysis. But it’s quite popular among financia...

Why do analysts calculate diluted EPS?

The reason that analysts and investors calculate diluted EPS is that basic EPS may overstate the actual amount of earnings per share that a common shareholder is entitled to. Companies frequently have dilutive securities outstanding like options and warrants that will increase the total number of shares outstanding when converted.

Does conversion of options into shares add additional net income?

Since the conversion of option into shares won’t add any additional net income to the business, the increased share count makes the conversion dilutive. Options may have been granted to employees, for example, that are in-the-money (strike price is below the current market price) but have not been converted yet.

Can you take fully diluted shares?

It should be noted that you can take the fully diluted number of shares outstanding as the denominator if you want to be the most conservative. It could be overly conservative though, as some of the options may be far out-of-the-money and never convert into shares. For this reason, it’s better to do take the steps.

What are the components of a stock option?

It typically consists of four components: the strike price, the expiry date, the lot size, and the share premium. read more.

What is anti dilutive securities?

Anti-dilutive Securities Anti dilutive securities refer to the financial instruments initially available as convertible securities and not ordinary shares. However, converting such shares into ordinary stocks results in the higher earnings per share or an increase in shareholders' voting power. read more.

What is diluted EPS?

Basic EPS. Diluted EPS. Shows how much of the company’s earnings are attributable to each common share.

Why is EPS important?

The EPS figure is important because it is used by investors and analysts to assess company performance, to predict future earnings, and to estimate the value of the company’s shares. The higher the EPS, the more profitable the company is considered to be and the more profits are available for distribution to its shareholders.

Why is basic EPS required?

Reporting basic EPS is required because it increases the comparability of earnings between different companies. Diluted EPS is required to reduce moral hazard. issues.

What is a potential ordinary share?

A potential ordinary share describes any financial instrument that can lead to one or more common shares in the future. Thus, a potentially dilutive share is one that decreases EPS because the denominator value for the number of shares increases. As mentioned before, potential ordinary shares include:

What is EPS in accounting?

What is Earnings per Share (EPS)? Earnings per share (EPS) is a key metric used to determine the common shareholder’s. Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus. portion of the company’s profit.

What is EPS in IFRS?

portion of the company’s profit. EPS measures each common share’s profit allocation in relation to the company’s total profit. IFRS uses the term “ordinary shares” to refer to common shares. The EPS figure is important because it is used by investors and analysts to assess company performance, to predict future earnings, ...

Is diluted EPS bigger than basic EPS?

Basic EPS is always larger than diluted EPS. Diluted EPS is always smaller than basic EPS.

How are employee stock options impacted by the FASB?

Accounting for employee stock options is affected by whether outstanding options are viewed as equity or liabilities. The common perception is that the FASB's recommended treatment (per SFAS No. 123), which is based on the options-as-equity view, results in representative financial statements. We argue that this treatment distorts performance measures for three reasons. First, the deferred taxes associated with nonqualified options should also be included as equity, but are not. Second, since unexpected share price changes affect optionholders and equityholders differently, combining their interests provides an average earnings effect that is not representative for either group. We show that efforts to isolate the interests of common stockholders via diluted earning per share calculations (per SFAS No. 128) are inherently incapable of identifying wealth transfers between stockholders and optionholders. Finally, projections of future cash flow statements prepared under SFAS No. 95 overstate cash flows to current equityholders by the pretax value of projected option grants. We show that these distortions can be avoided simply by accounting for options as liabilities at grant and thereafter recognizing changes in option values (similar to the accounting for stock appreciation rights). Our analysis of stock option accounting leads to two, more general implications: (1) all securities other than common shares should be treated as liabilities, thereby simplifying the equity versus liability distinction, and (2) these liabilities should be recorded at fair values, thereby obviating the need to consider earnings dilution.

When did the EPS standard change?

In February 1997 , the Financial Accounting Standards Board adopted new reporting rules for earnings per share. The new standard replaces "primary" EPS with "basic" EPS and makes a minor adjustment in the computation of "fully diluted" EPS. A comparison of the extent to which basic, primary, and fully diluted EPS explain variation in stock prices for a large sample of NYSE- and Amex-listed firms from 1989 to 1995 suggests that analysts and investors are likely to be no worse off under the new standard than under the old and may, in fact, have access to better information under the new standard because of its enhanced disclosure requirements.

What is diluted earnings per share?

The value of earnings per share if all these convertible securities (executive stock options, equity warrants, and convertible bonds) were converted to common shares is called dilu ted earnings per share (EPS). It's calculated and reported in company financial statements.

How does dilution affect shareholders?

After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing.

What is Treasury stock method?

The Treasury stock method is used to calculate diluted EPS for potentially dilutive options or warrants. 3 The options or warrants are considered dilutive if their exercise price is below the average market price of the stock for the year.

How much would the share count increase after 6,000 shares are repurchased?

Share count would increase by 4,000 (10,000 - 6,000) because after the 6,000 shares are repurchased, there is still a 4,000 share shortfall that needs to be created. Securities can be anti-dilutive. This means that, if converted, EPS would be higher than the company's basic EPS.

What is a share dilution?

What Is Share Dilution? Share dilution happens when a company issues additional stock. 1 Therefore, shareholders' ownership in the company is reduced, or diluted when these new shares are issued. Assume a small business has 10 shareholders and that each shareholder owns one share, or 10%, of the company.

What is secondary offering?

Secondary offerings are commonly used to obtain investment capital to fund large projects and new ventures. Shares can also be diluted by employees who have been granted stock options. Investors should be particularly mindful of companies that grant employees a large number of optionable securities.

Why is dilution important for retail investors?

Because dilution can reduce the value of an individual investment, retail investors should be aware of warning signs that may precede potential share dilution, such as emerging capital needs or growth opportunities. There are many scenarios in which a firm could require an equity capital infusion.

Why is diluted EPS important?

Diluted EPS. The term diluted EPS exists because there are securities that can be converted into common stock shares. Diluted EPS assumes that any security that can be converted into common stock is converted. Keep in mind, however, that diluted EPS assumes that the dollar amount of earnings available to shareholders does not change.

What is EPS in stock?

Common shares: Basic EPS applies to company earnings that are available for common stock shareholders. Shareholders can benefit by receiving a portion of earnings as a cash dividend, and higher earnings may also result in a higher stock price per share. EPS focuses on common shareholders only. Weighted average common stock shares outstanding: The ...

What happens if you retire stock?

Retiring Stock Shares. Alternatively, a business can repurchase common stock shares and retire them, meaning that the shares are no longer outstanding. If shares are retired and the dollar amount of earnings stays the same, basic and diluted EPS will increase.

How to calculate earnings per share?

The basic calculation for earnings per share is (Earnings per common share) / (Weighted average common stock shares outstanding). Note the following: 1 Net income: Earnings refer to net income generated in the income statement and posted as an increase to equity in the balance sheet. 2 Common shares: Basic EPS applies to company earnings that are available for common stock shareholders. Shareholders can benefit by receiving a portion of earnings as a cash dividend, and higher earnings may also result in a higher stock price per share. EPS focuses on common shareholders only. 3 Weighted average common stock shares outstanding: The average is computed as [ (beginning balance) + (ending balance)] / 2, and the average is typically computed on annual basis.

What are the most time-consuming questions related to EPS?

The most time-consuming questions related to EPS involve calculating weighted average shares of common stock outstanding. These questions include transactions during the year that increase or decrease the number of shares outstanding.

Why do companies issue more common stock?

Issuing Stock. Companies may issue more common stock shares to raise capital; this transaction increases the weighted average number of shares. When a business issues more common stock shares but the dollar amount of earnings stays the same, basic and diluted EPS will decrease.

What is stock option?

Stock Options. Many companies offer stock options as a form of additional compensation to employees. As an example, assume that Sally is the CFO of a company, and she is granted the right to buy 500 shares of company stock at a price of $50 per share. If the market price of the stock moves to $65 a share, Sally can profit by exercising her right ...

Abstract

We investigate whether corporate executives’ stock repurchase decisions are affected by their incentives to manage diluted earning per share (EPS).

1. Introduction

This paper investigates whether corporate executives’ stock repurchase decisions are affected by their incentives to manage diluted earning per share (EPS). We provide evidence on two main predictions.

2. Hypothesis development

We first derive the conditions under which executives buy back shares to achieve a desired level of EPS growth. For the moment, we assume that using cash for repurchases has no earnings effect. We relax this assumption in Section 2.2.

3. Research design

We estimate the following regression to test our principal hypothesis: (1) REPUR =a 1 +a 2 NUM_EPS +a 3 GRANT_DIL +a 4 OUTS_DIL +a 5 EX_DIL +a 6 EX_PROCEED +a 7 ESOEX +a 8 OTHISSUE +a 9 DEV_LEV + ∑ b i CONTROL i, where

4. Sample and descriptive statistics

Our sample consists of the 357 Compustat firms classified as S&P 500 Industrial firms for the years 1996–1999. 14 1996 is the first year in which detailed ESO data are required footnote disclosures (per SFAS 123; FASB, 1995) and 1999 is the last year in which complete data are available at the time of our analysis.

5. Empirical findings

Table 4 presents the results of estimating models (1), (2), (3), and (4). We use a Tobit model to estimate the regression equations because some firms do not repurchase shares ( Greene, 1990 ).

6. Executive versus non-executive options

Fenn and Liang (2000) argue that firms with relatively more ESOs are more likely to pay out cash as stock repurchases than as dividends and examine the relation between executive option holdings and stock repurchases.

Capital Structures

Basic and Diluted EPS

- There are two different types of earnings per share: basic and diluted. Reporting basic EPS is required because it increases the comparability of earnings between different companies. Diluted EPS is required to reduce moral hazardissues. Without diluted EPS, it would be easier for the management to mislead shareholders regarding the profitability o...

Basic EPS Formula

- Net income available to shareholders for EPS purposes refers to net income less dividends on preferred shares. Dividends payable to preferred shareholders are not available to common shareholders and must be deducted to calculate EPS. There are two kinds of preferred shares that we need to know about: cumulative and non-cumulative. For cumulative preferred shares, the pr…

Calculating Diluted EPS

- When calculating for diluted EPS, we must always consider and identify all potential ordinary shares. A potential ordinary share describes any financial instrument that can lead to one or more common shares in the future. Thus, a potentially dilutive share is one that decreases EPS because the denominator value for the number of shares increases. As mentioned before, potential ordin…

Video Explanation of Earnings Per Share

- Watch the short video below to quickly understand the main concepts covered here, including what earnings per share is, the formula for EPS, and an example of EPS calculation.

Importance of Earnings Per Share

- Investors purchase the stocks of a company to earn dividends and sell the stocks in the future at higher prices. The earning capability of a company determines the dividend payments and the value of its stocks in the market. Hence, the earnings per share (EPS) figure is very important for existing and prospective common shareholders. However, a company’s real earning capability c…

Stock Options – Good Or Bad?

- Many companies today issue stock options and warrants to their employees as part of their benefits package. Would such a benefit be appealing to you or are they simply a marketing tactic? Although the benefits can prove to be useful, they also come with limitations. Let us take a look at the advantages and disadvantages of stock option benefits.

Additional Resources

- Thank you for reading CFI’s guide to Earnings Per Share (EPS). To increase your knowledge and advance your career, see the following free CFI resources: 1. Stockholders Equity 2. Retained Earnings 3. Earnings Season 4. Weighted Average Shares Outstanding