To buy stock using Cash App Investing:

- Tap the Investing tab on your Cash App home screen

- Tap the search bar and enter a company name or ticker symbol

- Select the company whose stock you want to buy

- Press Buy

- Select a preset amount or tap ... to enter a custom amount

- Follow the prompts to verify your personal information

- Confirm with your PIN or Touch ID

How to buy and sell stock using cash app?

To buy stock using Cash App Investing:

- Tap the Investing tab on your Cash App home screen

- Tap the search bar and enter a company name or ticker symbol

- Select the company whose stock you want to buy

- Press Buy

- Select a preset amount or tap ... to enter a custom amount

- Follow the prompts to verify your personal information

- Confirm with your PIN or Touch ID

How to make money off Cash App stocks?

- Go to the Investing tab on your Cash App home screen

- Select Bitcoin

- Select Buy

- Select an amount or ... to enter a custom amount

- Confirm with your PIN or Touch ID

Is Cash App a good investing app?

Tips for Avoiding a Scam

- Don’t pay for big items with Cash App. Though discerning what’s a scam and what’s not can be difficult, there are a few ways to boost the security of your ...

- Change your Cash App pin and password. ...

- Double-check who you’re sending to. ...

How to buy stocks on Cash App right now?

It has essentially rebuilt the entire consumer real estate experience and has made buying and selling of property possible ... Square’s answer to consumer financial service needs is its Cash App. Now, SQ stock currently trades at $236.89 as of 2:02 ...

Does buying stock on Cash App work?

Stock can be purchased using the funds in your Cash App balance. If you do not have enough funds available, the remaining amount will be debited from your linked debit card.

How does selling stocks WORK ON Cash App?

Cash App Investing has a minimum sale amount of $1. You can sell all or some of the stock that you own. If you place a sell order that is close to the total amount you own (98% or more), you must sell all of your holdings or choose a lower amount to sell.

How do I get my money from Cash App stocks?

Selling StockTap the Investing tab on your Cash App home screen.Scroll down to Stocks Owned.Select the company whose stock you want to sell.Press Sell.Select a preset amount or tap ... to enter a custom amount.Confirm with your PIN or Touch ID.

Can you cash out stocks at any time?

There are no rules preventing you from taking your money out of the stock market at any time. However, there may be costs, fees or penalties involved, depending on the type of account you have and the fee structure of your financial adviser.

What happens when you sell a stock?

Short-term and long-term capital gains taxes Generally speaking, if you held your shares for one year or less, then profits from the sale will be taxed as short-term capital gains. If you held your shares for more than one year before selling them, the profits will be taxed at the lower long-term capital gains rate.

When can I sell my stock on Cash App?

No, you cannot purchase or sell stocks on Cash App at any time; there is a timetable for selling and purchasing stocks on Cash App, which operates Monday through Friday from 9:30 a.m. to 4:00 p.m. EST (Excluding Holidays).

When should you cash out stocks?

Investors might sell a stock if it's determined that other opportunities can earn a greater return. If an investor holds onto an underperforming stock or is lagging the overall market, it may be time to sell that stock and put the money to work in another investment.

How long does it take to sell stock and get money?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

What is cash app investing?

Cash App Investing is one of the several services you can access on the Cash App platform, a product of California-based financial technology company Square. You can use Cash App to transfer money to your contacts or withdraw cash at an ATM. Cash App has been adding more services since its debut in 2013 and as its competition with PayPal’s Venmo intensifies. How does Cash App Investing work, exactly?

How old do you have to be to open a cash app?

You must be 18 years or older to open a Cash App Investing account. Personal information, including your name, social security number, U.S. residential address, and employment status, is required when setting up a Cash App Investing account.

How to send, receive and add money on the Cash App

Sending, receiving and adding money on Cash App is as easy as one-two-three. Let’s first take a look at how to send money.

Does Cash App have a limit?

Like most peer-to-peer transfer services, Cash App has limits. There are limits on sending, spending, receiving and withdrawals. To increase your Cash App sending limit, you’ll need to verify your account.

Does Cash App charge any fees?

One of Cash App’s strong points is its lack of fees. But, depending on how you use it, there may be some situations where you’ll have to pay. Let’s take a closer look.

Cash Card - What is it and how to use it

Cash App also offers their very own Visa debit card, called a “Cash Card”.

Can you get a refund on Cash App?

Cash App transactions happen at lightning speed, which is a useful aspect of it. But when it comes to refunds, it can also make things a bit tricky.

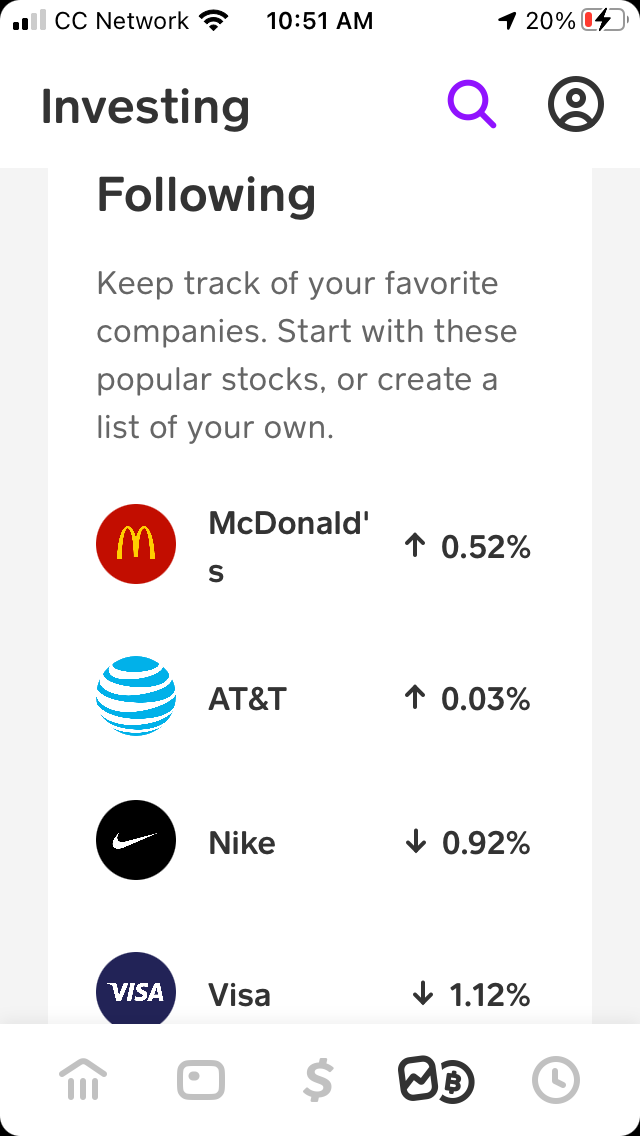

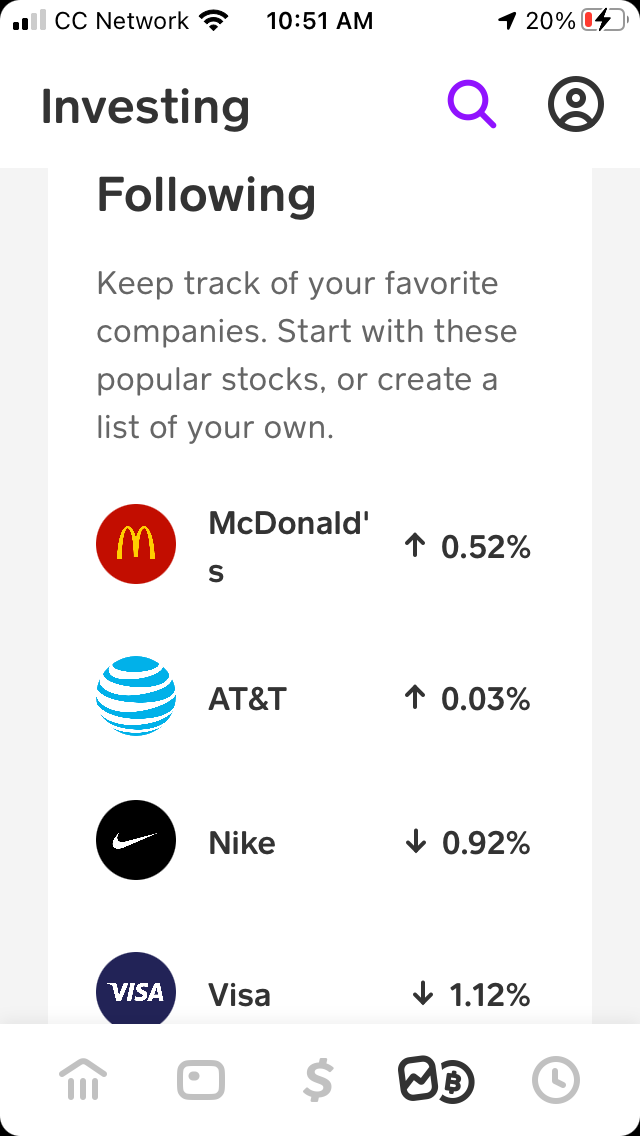

Investing on Cash App

One of Cash App’s unique features when compared to other peer-to-peer sending apps is that you can use it to invest in stocks and even Bitcoin. That’s right - you can finally join the world of stocks!

Sending money internationally, spending abroad and saving on fees all the way. Meet Wise!

As previously mentioned, with the help of Wise, you could save yourself a lot in extra fees when sending and spending money abroad.

Start with stocks

With just $1, you can buy what's known as fractional shares, or smaller pieces of stocks comission-free. Choose from a broad range of stocks and funds.

Break into bitcoin

Try out bitcoin or add to an existing trove. Buy and sell, send some to friends and family, or transfer your funds to another digital wallet on the blockchain.

Common questions

Want to know more about how investing works? We’ve answered some common questions to help you get you started.

Is It Good to Sell Stock On Cash App?

Absolutely! Cash App is a safe investing app that’s made with beginner investors in mind. It’s a perfect starting point for those looking to dip their toes into the stock market.

How Do Stocks Work On The Cash App?

You can easily buy and sell stock on Cash App using the money in your balance. However, if your funds aren’t sufficient, the remaining amount will be charged from your linked card.

How to Buy Stock On Cash App

The buying process takes only a few easy steps. Just open the Cash App. Click on the Investing tab. Then, pick the search bar and type in a company’s ticker symbol or stock name.

How to Sell Stock On Cash App

To sell stock on Cash App, first launch your Cash App on your smartphone. Select the Investing tab from the home screen. Then, scroll down to the My Portfolio option. This is where things get a little complicated.

How Long Does it Take to Sell Stock On Cash App?

The funds of the stock sale will land into your Cash App account and you can easily see it in your balance once you sell stock on Cash App.

Pros and Cons of Cash App

Cash App makes a perfect option for new investors to start investing small amounts through fractional share buys.

FAQs

A: Opening a Cash App investing account to sell stock on Cash App is 100% free.

What is cash app investing?

Cash App Investing is designed for beginning investors who want to dip their toes into the stock market by investing small amounts of money in blue-chip (high-quality) stocks. It isn't well-suited for investors who like to analyze stocks on their own, as it doesn't have access to third-party stock research.

How to invest in cash app?

This brokerage is right for you if: 1 You're a beginning investor. Cash App Investing is clearly designed with beginning investors in mind, particularly those who want to invest a small amount of money in stocks. It is not intended for experienced investors, or those who want tons of features. 2 You already use Cash App. It can be very useful to keep your finances in as few different places as possible, and if you're already a fan of Cash App's other functions, it could be a good reason to invest through Cash App Investing rather than Robinhood or a competing brokerage. 3 You don't care about options, margin, or mutual funds. Cash App Investing allows you to trade stocks. That's all. If you want any other type of investment vehicle (besides bitcoin), you should look elsewhere. 4 You want a standard brokerage account. If you need to open an IRA or any investment account other than a standard taxable brokerage account, or if you want a joint account, you'll need to open it somewhere else.

Is Square investing a cash app?

To be fair, Square has hinted that it will add features to Cash App Investing over the coming months and years. After all, this is a very young investment platform. In its current state, Cash App Investing might not be an excellent fit for investors who want some of the more "traditional" features of other brokerages, such as the ability to open a tax-advantaged retirement account or access to stock research reports from major firms. Here are some alternatives if Cash App doesn't match your needs.

Does Cash App support margin trading?

However, there are some cases where it can make sense, and many active investors like having margin access. At this point, Cash App Investing doesn't support margin trading.

Does Cash App have mutual funds?

Cash App Investing allows investors to buy and sell stocks (and bitcoin, elsewhere in the Cash App), but does not support mutual funds, stock options, or bonds. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs.

Is there a trading platform for cash app?

There is not a desktop or web-based trading platform at this time. The Cash App is known for user-friendliness, and is highly regarded for its security and speed. It's currently rated 4.5 out of 5 in Apple's App Store and 4.2 out of 5 in the Google Play store.

Is Cash App a commission free platform?

It doesn't offer trading in options, mutual funds, and other products that generally still have commissions, so for the time being, Cash App Investing is a totally commission-free platform. Stocks and ETFs. Options.

Roommate charged back 4 months of rent and left me

So I’ve been living in an apartment with someone I consider to be a very close friend of mine. We got a year lease and for the first few months everything was fine. About 4 months ago she told me she was having money problems and asked if I could cover for her part of the rent.

I got locked out from buying crypto?

All I did was put in my information and now I can't buy anything. I just joined

Everything

For some months now, my cashapp wouldn’t let me link my bank or card. Just recently, I wanted to withdraw the money but couldn’t do so. I also have money invested in the stocks section. As of about 4 days ago my account was disabled. I can’t even send or receive money on the account.