Key Takeaways:

- After-hours trading occurs outside regular market hours.

- Electronic communication networks (ECNs) rather than traditional markets match potential buyers and sellers.

- After-hours trading is more volatile and risky. Prices change during after hours, and the opening price the following day may not be the same as in the after-hours market.

Can I buy stock after hours?

Samsung Securities, the brokerage arm of Samsung Group, and Blue Ocean Technologies, a US-based after-hours trading ... Samsung Securities clients can trade US stocks for 20 hours and 30 minutes ...

What is the NASDAQ after hours?

There are also pre-market and after hours trading sessions available, also known as Extended Markets. For Nasdaq, pre-market trading hours are 4:00 am to 9:30 am, Eastern Time Zone. After hours runs from 4:00 pm to 8:00 pm, Eastern Time Zone.

How to trade stocks after hours?

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

- Bullish confidence. The basic principle behind the VORTECS™ Score is a comparison between the asset’s trading conditions right now and those in the past.

- KEEP: A weekly return of +58.64% after a VORTECS™ Score of 92. ...

- MNW: A weekly return of +54.63% after a VORTECS™ Score of 90. ...

- LEO: A weekly return of +52.56% after a VORTECS™ Score of 91. ...

What is the stock market after hours?

After-hours trading (some times abbreviated as AHT) refers to buying or selling securities outside of the standard trading hours. Each exchange has their own official trading hours. For the two largest stock markets, the NYSE and the NASDAQ, standard trading hours are from 9:30 AM to 4:00 PM. Pre-market trading is very similar to After-Market ...

Why do some stocks trade after hours?

Reasons to Trade Stocks After Hours Being able to trade after the market closes lets traders react quickly to news events. For instance, companies often release earnings after the market closes. An extended hours trade can take advantage of this before the regular markets can react.

How does after-hours trading effect opening price?

The development of after-hours trading (AHT) has had a major effect on the price of the stock between the closing and opening bells because it means that transactions are happening and shifting the prices of stocks even after-hours.

Is there a benefit to after-hours trading?

There are several potential benefits for after-hours trading: Convenience: Some traders simply aren't able to place trades during the normal session due to their schedules. The after-hours session allows them to check out the current quotes and potentially place a trade at a more convenient time.

How do you know if a stock will go up the next day?

The closing price on a stock can tell you much about the near future. If a stock closes near the top of its range, this indicates that momentum could be upward for the next day.

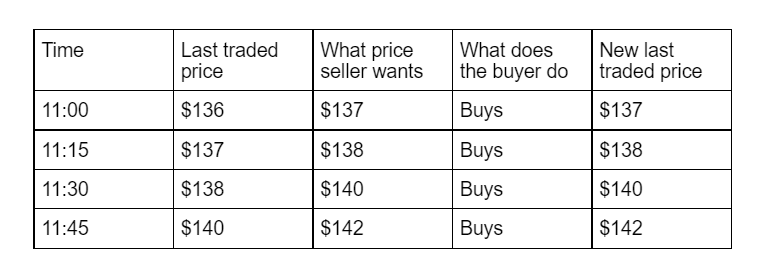

Why do stock prices change every second?

Stock prices change every second according to market activity. Buyers and sellers cause prices to change and therefore prices change as a result of supply and demand. And these fluctuations, supply, and demand decide between its buyers and sellers how much each share is worth.

What is the downside to after-hours trading?

The major risks of after-hours trading are: Low liquidity. Trade volume is much lower after business hours, which means you won't be able to buy and sell as easily, and prices are more volatile. Wide bid-ask spreads.

What time of day should I buy stocks?

The opening 9:30 a.m. to 10:30 a.m. Eastern time (ET) period is often one of the best hours of the day for day trading, offering the biggest moves in the shortest amount of time. A lot of professional day traders stop trading around 11:30 a.m. because that is when volatility and volume tend to taper off.

What time does after hours trading start?

What Is After-Hours Trading? After-hours trading starts at 4 p.m. U.S. Eastern Time after the major U.S. stock exchanges close. The after-hours trading session can run as late as 8 p.m., though volume typically thins out much earlier in the session.

When does stock fall after hours?

This means that it is quite possible for a stock to fall sharply in the after-hours only to rise once the regular trading session resumes the next day at 9:30 a.m., should many big institutional investors have a different view of the price action during the after-hours trading session.

Why is the spread wide in after hours?

It is not unusual for the spreads to be wide in the after-hours. The spread is the difference between the bid and the ask prices. Due to fewer shares trading, the spread may be significantly wider than during the normal trading session.

What is after hours trading?

After-hours trading is something traders or investors can use if news breaks after the close of the stock exchange. In some cases, the news, such as an earnings release, may prompt an investor to either buy or sell a stock.

When did Nvidia report earnings?

Nvidia reported quarterly results on February 14. 1 The stock was greeted by a big jump in price, rising to nearly $169 from $154.50 in the 10 minutes following the news.

Is it bad to put a limit order on stock after hours?

Since after-hours trading can have a significant impact on a stock's price, it's not a bad idea to put a limit order on any shares you intend to buy or sell outside of regular trading periods.

Is after hours trading risky?

If liquidity and prices weren’t enough of a reason to make after-hours trading risky, the lack of participants makes it even riskier. In some cases, certain investors or institutions may choose simply not to participate in after-hours trading, regardless of the news or the event.

What is after hours trading?

After-hours trading occurs after the market closes when an investor can buy and sell securities outside of regular trading hours. Trades in the after-hours session are completed through electronic communication networks (ECNs) that match potential buyers and sellers without using a traditional stock exchange .

How does price change after hours affect stock?

Typically, price changes in the after-hours market have the same effect on a stock as changes in the regular market: A one-dollar increase in the after-hours market is the same as a one-dollar increase in the regular market.

What time does the stock market open?

The New York Stock Exchange and the Nasdaq Stock Market in the United States trade regularly from 9:30 a.m. to 4:00 p.m. ET, with the first trade in the morning creating the opening price for a stock and ...

What is the difference between pre-market and after-hours market?

In other words, the price you will receive is the price that someone in the after-hours or pre-market is willing to pay.

Is there a risk in trading after hours?

While there can be great benefits to investors and traders participating in after-hours markets, the risks are significant. Anyone participating in after-hours market activity should be mindful of those risks.

Do stocks open at the same price as after hours?

However, once the regular market opens for the next day's trading (when most individual investors will have the opportunity to sell), the stock may not necessarily open at the same price at which it traded in the after-hours market.

What is after hours trading?

After hours trading is a key weapon in the sophisticated stock market investor's armory. It makes up one part of the extended hours equation, along with premarket trading.

What time does the stock market close?

The stock market opens at 9.30 a.m. ET, and closes at 4 p.m. ET.

Why is premarket trading so lucrative?

The reason premarket trading can be lucrative is not just because earnings reports also come out before the open, as there is often other big market-moving news too . For example, Murphy noted that the Labor Department's monthly jobs report comes out at 8:30 a.m., typically on the first Friday of the month.

What is stock futures?

Stock futures are a type of futures contract. Stock index futures are used as an indicator of the future direction of the stock market, so they can give after hours investors important clues on how they should trade. The contracts are based on the future value of an index, such as the Dow Jones Industrial Average or the S&P 500.

What time does Wells Fargo trade after hours?

The specific rules on after hours trading can differ from brokerage to brokerage. Many brokers let customers trade from 4 p.m. ET to 8 p.m. ET, however there are exceptions. One such example is Wells Fargo, which offers extended hours from 4:05 p.m. ET until 5 p.m. ET.

Why do we trade after hours?

On the one hand, it allows you to trade on news events before many other investors. However, there are increased risks as the volume of shares traded is much lower.

Can you trade through your normal trading account?

In addition, brokerage representatives often get in touch so investors understand the risks associated with extended-hours trading. Once this is complete, you can trade through your normal trading account.

What is after-hours stock trading?

Extended-hours stock trading is just one more way that you can trade stocks online. Stocks on the New York Stock Exchange and the Nasdaq are available for trade in extended hours, but only the largest and most in-demand stocks regularly trade during these periods.

How to make after-hours stock trades

Making an after-hours stock trade is easy to do, nearly as simple as a trade during regular hours, though there are certain other risks (see below). Here’s how to do it:

What are the risks of after-hours stock trading?

After-hours trading presents some risks for investors looking to take advantage of it:

Bottom line

After-hours stock trading allows you to place trades outside normal market hours, but that doesn’t mean you should place trades then. In many cases, the market is too thin and illiquid, and you run the risk of getting a less-than-ideal price when you could otherwise trade hours later and get the going rate in a robust market.

What time is after market trading?

When Are After-Market Trading Hours? After-market or post-market trading hours are generally from 4:00 to 8:00 PM. The start of after-market hours will depend on the brokerage you use. Some brokers don’t facilitate after-hours trading until 4:15 PM, while others begin just a few minutes after the market closes.

Why is there a limit on after hours trading?

If the stock hits that price, they’ll buy or sell accordingly. The reason for this limitation during after-hours trading is simply because there is less activity.

What time does extended hours trading occur?

Extended-hours trading can be segmented into two parts. Post-market trading occurs between 4:00 and 8:00 PM, while pre-market trading occurs any time before the markets open at 9:30. These two timeslots of activity (post and pre-market trading) are also referred to as extended hours trading or electronic trading hours (ETH).

What is Marketbeat news?

MarketBeat is an online news and information source about the stock market, finance, and economics. While many of our visitors are seasoned traders and financiers, we are also dedicated to providing beginning investors with authoritative, comprehensive, and digestible information about the stock market.

Why do stock prices fluctuate?

Every stock sale is a negotiation, and because there are more risks present in the after-hours market, prices can fluctuate even more that they would during normal market hours. Because there are fewer buyers and sellers, the laws of supply and demand can wreak havoc on stock price stability.

What happens after markets are open?

There are far more transactions going on when markets are open. Consequently, after markets have less activity and trade volume. You may have a hard time finding a buyer to convert your shares to cash liquidity, or a seller to give you the number of shares you need.

Why are early hours important for traders?

These early hours can provide huge gains to traders who are already abreast of current events, especially those that are already transpiring in other time zones (if applicable). While the rest of the world may be sleeping, these traders want to be the early bird that gets the proverbial worm.

What time does after market trading start?

In the U.S., this trade window usually lasts from 4 p.m. to around 8 p.m. For early risers, there’s also pre-market trading hours that begin before 9:30 a.m.

Why do stocks react differently to news after hours?

Stocks may react differently to market or political news after hours, possibly resulting in more dramatic price swings. Even worse, a stock may not trade at the same price when the market opens the next day as it did when you bought or sold it after hours.

What is after market trading?

After-market trades are completed through electronic communication networks, or ECNs. These frameworks make it possible for buyers and sellers to connect without the aid of a traditional stock exchange. Both individual and institutional investors can gain access to an ECN. ECN trading is a relatively simple process.

Why is it important to trade after hours?

As the late afternoon and early evening approaches, though, after-hours trades can help you get caught up. This allows you to still be an active trader on a schedule that works best for you.

Why do traders trade after hours?

There are a couple of reasons you might consider trading after hours. First, rather than being forced to trade within the confines of a schedule, after-market trading allows for increased convenience. This is especially helpful for those that don’t have the time to monitor the market or make trades during the day.

Can you trade stocks after hours?

Not all stocks are actually able to be traded after hours. So if some breaking news releases, you might be out of luck if that company’s shares are unavailable during after-market sessions. Or, if you’re waiting until the end of the day to trade for the sake of convenience, your choices may be limited.

Is after market trading a service?

The short answer is no, after-market trading isn’t a service every brokerage provides. If the brokerage you use does offer it, it’s important to understand the rules for what you can and can’t trade. For example, brokerages usually only allow you to use limit ordersto buy, sell or short stocks.

What is After-Hours Stock Trading?

As a stock trader, one of the most important things that you need to know is when to show up to trade and when to leave.

How does After-Hours Stock Trading Work?

After-Hours trading works exactly the same way as trading during regular business hours in the sense that traders and investors are able to buy or sell securities, however, there are a couple of differences to keep in mind before starting.

Who Can Trade During The After-Hours Session?

As we mentioned earlier, after-hours trading used to be accessible only to high net worth clients and institutional investors, however, these days most retail brokerages provide traders and investors with access to the after-hours markets.