How to Make Money with Options

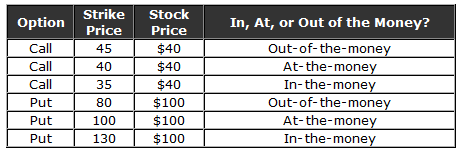

- In the money. . For the buyer of an options contract, calls are profitable when the price of the underlying stock is...

- Out of the money. . For the buyer of an options contract, calls are unprofitable when the strike price is higher than...

- At the money. . This is when the underlying stock price is the same as the strike price. So here’s...

How much money can you make trading options?

Trading Options for a Living: Can I Make It?

- Trading options for a living? ...

- First and foremost, make sure you study options

- Determine whether you are long or short biased

- Determine your risk management tolerance

- Find out what options strategy you’re drawn to most

- What are you looking to make per year?

- Break it down to daily income goals

How much money can you earn in investing in stock?

If the multiple stays at 20 then a dollar invested in stocks earns a nickel, and that nickel can be reinvested in additional earning power. You wind up compounding your earnings at a 5% rate. The Vanguard High-Yield Corporate Bond fund ( VWEAX) has averaged a return of 11.9% over the last five years.

How much money have you made from investing in stocks?

- The longer you’re invested in the market, the more your money will grow.

- The higher your annual investing returns, the more your money will grow.

- Small improvements in your investment returns can make a HUGE difference in your wealth over time.

- The more you can avoid paying taxes on your investment gains, the more your money will grow.

How to make the most money trading options?

The Basics of Options Profitability

- Basics of Option Profitability. A call option buyer stands to make a profit if the underlying asset, let's say a stock, rises above the strike price before expiry.

- Option Buying vs. Writing. ...

- Evaluating Risk Tolerance. ...

- Option Strategies Risk/Reward. ...

- Reasons to Trade Options. ...

- Selecting the Right Option. ...

- Option Trading Tips. ...

- The Bottom Line. ...

How do you make money from options?

Investors can generate income through a process of selling puts on stocks intended for purchase. For example, if XYZ stock is trading at $80 and an investor has interest in purchasing 100 shares of the stock at $75, the investor could write a put option with a strike price of $75.

How much can you make from option?

How much does an Options Trader make? The average Options Trader in the US makes $167,386. The average bonus for an Options Trader is $14,315 which represents 9% of their salary, with 100% of people reporting that they receive a bonus each year.

Is selling options a good way to make money?

Conclusion. Selling options is a great way to make extra money with a quicker path to 6-figures than dividend investing. Even if you aren't in the position to make 6-figures, you can quickly put yourself in a position to make an extra $100 or even $1,000 each month selling options.

Can you make more money with options or stocks?

Short answer: Yes. But should you? As we mentioned, options trading can be riskier than stocks. But when done correctly, it has the potential to be more profitable than traditional stock investing or it can serve as an effective hedge against market volatility.

Does Warren Buffett sell options?

But it isn't the only thing he does. He also profits by selling “naked put options,” a type of derivative. That's right, Buffett's company, Berkshire Hathaway, deals in derivatives.

Can you live off trading options?

Trading options for a living is possible if you're willing to put in the effort. Traders can make anywhere from $1,000 per month up to $200,000+ per year. Many traders make more but it all depends on your trading account size.

Is options trading just gambling?

There's a common misconception that options trading is like gambling. I would strongly push back on that. In fact, if you know how to trade options or can follow and learn from a trader like me, trading in options is not gambling, but in fact, a way to reduce your risk.

Are options better than stocks?

Advantages of trading in options While stock prices are volatile, options prices can be even more volatile, which is part of what draws traders to the potential gains from them. Options are generally risky, but some options strategies can be relatively low risk and can even enhance your returns as a stock investor.

Do you have to buy 100 shares of stock with options?

Options trading and volatility are intrinsically linked to each other in this way. On most U.S. exchanges, a stock option contract is the option to buy or sell 100 shares; that's why you must multiply the contract premium by 100 to get the total amount you'll have to spend to buy the call.

Who is the richest option trader?

Dan Zanger holds a world record for his trading one-year stock market portfolio appreciation, gaining over 29,000%. In under two years, he turned $10,775 into $18 million.

Are stock options worth it?

How much your stock options are worth hinges on how much you bought them for at the discounted rate, and how much you sold them for. If a company is growing and the stocks are rising in value, then your stock options will be worth more than you paid for them.

How can I make money fast with options?

3:0414:38Is it Easy to Make Weekly Income Through Options ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipTen call if the SPX goes to three thirty fifteen. You would receive five hundred dollars in yourMoreTen call if the SPX goes to three thirty fifteen. You would receive five hundred dollars in your account if the index closes at thirty ten or lower your call expires worthless.

What should I look for when trading options?

Here are some of the most important aspects to look at when choosing assets to trade options on: 1. Liquidity . Liquidity is probably the most important aspect to look at when trading (options).

What is the most important aspect to look at when trading options?

Liquidity is probably the most important aspect to look at when trading (options). Liquidity measures how easy or hard you can enter and exit positions in an asset. Highly liquid assets usually have a huge volume, very tight Bid/Ask spreads and are thus very easy to enter and exit. If you choose to trade an illiquid asset, you will potentially have trouble entering and exiting position (s) and there will be bad pricing. Therefore, it is very important to focus on very liquid assets with lots of volume.

How does insurance make money?

The insurance makes money because the big majority of all insurances aren’t ‘necessary’. Most of the sold insurance contracts will never be used as most houses won’t burn down. High probability option sellers try to do the same. They sell (OTM) options and expect them to expire worthlessly.

What is the IV rank for selling options?

So when selling options, try to find liquid assets with an IV Rank of over 50. 3.

Can you trade options on all assets?

The Price. Depending on your account size, you won’t necessarily be able to trade options on all assets. If you find an asset with very expensive options and your account size is small, you probably should look for a different asset. But note that you can also adjust your risk with different strategies.

Does $100 stock move every day?

A $100 stock mostly doesn’t move more than a few $1 up and down every day. Rarely does a $100 stock move $50 up in one day. Thus, stock price movement can be put into a standard deviation diagram. I will try to simplify this with a brief example: Let’s say stock XYZ is trading at $200.

What is stock option?

Stock Options Definition. Stock optionsare a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price.

What are the two types of stock options?

For starters, it’s important to note that there are two types of stock options: Non-qualified stock options(NQSOs) are the most common. They do not receive special tax treatment from the federal government. Incentive stock options(ISOs), which are given to executives, do receive special tax treatment.

How long does it take to exercise stock options?

A four-year vesting period means that it will take four years before you have the right to exercise all 20,000 options. The good news is that, because your options vest gradually over the course of this vesting period, you’ll be able to access some of your stock options before those four years are up.

How long do stock options last?

You can find this in your contract. It’s common for options to expire 10 years from the grant date, or 90 days after you leave the company. When You Should Exercise Stock Options. When and how you should exercise your stock options will depend on a number of factors.

How long after a stock exercise can you sell?

If you sell the shares as soon as you exercise them, the bargain element is treated as regular income. If you hold the stock for at least one year after exercise AND you don’t sell the shares until at least two years after the grant date, the tax rates you pay are the long-term capital gains rates. Bottom Line.

How long do you have to pay taxes on a sale date?

Sale Date Taxes. Must pay short-term capital gains on shares sold within one year of exercise date, and long-term capital gains on shares sold after at least one year. Taxed as long-term capital gains if shares are sold one year after the exercise date and two years after the grant date.

Do you pay less in capital gains tax?

That way, you’ll pay less in capital gains tax and on income tax (see below). Also, if your time period to exercise is about to expire, you may want to exercise your options to lock in your discounted price. But if you’re at all worried about losing money, you should consult an investment professional.

How much is an option to buy stock on Sept 30?

Say, for example, you have an option to buy a stock on Sept. 30 for $50 a share. If that date comes around and the stock is trading for $100 a share, that's $50 of built-in profit for each share when you exercise the option.

What does it mean when you have a put option to sell a stock for $55?

If you have a put option to sell a stock for $55 and it's trading for $50, then you're in the money. You can see in both instances that you're making money on the stock. "At the money" means the share price is the same as (or very close to) the strike price.

Why do options traders try to strike a balance between paying a reasonable premium and giving themselves a chance to profit

For example, buying an options far out of the money might be a lot cheaper, but it means the stock price has to move dramatically for the contract to be profitable.

Why do people miss out on trading options?

But many people miss out on these profits because they believe options are too complex, risky, or that you need to be a professional to access them. This couldn't be further from the truth.

Why do options trade for pennies?

Because you're buying the right to buy a stock, options trade for pennies on the dollar relative to the share price of the stock. This leverage – the ability to use a small amount of money to control a much more expensive stock – is what makes options trading so profitable.

Why are call options more expensive?

Call options with strike prices below the underlying stock's current price, or in the money, will be more expensive because they are worth more, while call options with strikes above the underlying stock's current price, or out of the money, will be cheaper because they are only valuable if the stock rises in price.

What does "in the money" mean in options?

"In the money" means the price of the stock is favorable to the option holder. So if you have a call option to buy a stock at a strike price of $50, and the current share price is $55, you are in the money.

What is profitable stock ownership?

Profitable stock ownership requires narrow alignment with an individual’s personal finances. Those entering the professional workforce for the first time may initially have limited asset allocation options for their 401 (k) plans. Such individuals are typically restricted to parking their investment dollars in a few reliable blue-chip companies and fixed income investments that offer steady long-term growth potential.

What is stock portfolio?

Stocks make up an important part of any investor's portfolio. These are shares in a publicly-traded company that are listed on a stock exchange. The percentage of stocks you hold, what kind of industries in which you invest, and how long you hold them depend on your age, risk tolerance, and your overall investment goals.

When was the New York Stock Exchange created?

The Bottom Line. The New York Stock Exchange (NYSE) was created on May 17, 1792, when 24 stockbrokers and merchants signed an agreement under a buttonwood tree at 68 Wall Street. 1 Countless fortunes have been made and lost since that time, while shareholders fueled an industrial age that’s now spawned a landscape of too-big-to-fail corporations.

Is it easier to make money in the stock market?

Making money in the stock market is easier than keeping it, with predatory algorithms and other inside forces generating volatility and reversals that capitalize on the crowd’s herd-like behavior. This polarity highlights the critical issue of annual returns because it makes no sense to buy stocks if they generate smaller profits than real estate or a money market account .

Can I invest in a self directed IRA?

Self-directed investment retirement accounts (IRAs) have advantages—like being able to invest in certain kinds of assets (precious metals, real estate, cryptocurrency) that are off-limits to regular IRAs. However, many traditional brokerages, banks, and financial services firms do not handle self-directed IRAs.

Can I make money from stocks?

Yes, you can earn money from stocks and be awarded a lifetime of prosperity, but potential investors walk a gauntlet of economic, structural, and psychological obstacles.

What happens when the stock market dips?

That may sound silly, but it’s exactly what happens when the market dips even a few percent, as it often does. Investors become scared and sell in a panic. Yet when prices rise, investors plunge in headlong.

Why do people say "I'll wait until the stock market is safe to invest"?

'I’ll wait until the stock market is safe to invest.'. This excuse is used by investors after stocks have declined, when they’re too afraid to buy into the market. Maybe stocks have been declining a few days in a row or perhaps they’ve been on a long-term decline.

Is investing a quick hit game?

Investing is not a quick-hit game, usually. All the gains come while you wait, not while you’re trading in and out of the market. What drives this behavior: an investor’s desire for excitement. That desire may be fueled by the misguided notion that successful investors are trading every day to earn big gains.

Do investors know which way stocks will move on any given day?

This excuse is used by would-be buyers as they wait for the stock to drop. But as the data from Putnam Investments show, investors never know which way stocks will move on any given day, especially in the short term. A stock or market could just as easily rise as fall next week. Smart investors buy stocks when they’re cheap and hold them over time.

Why do investors use options to speculate?

Speculating on the market with options enables an investor to make money not only when stock prices go up, but when they go down or sideways. It entails betting on the movement of a stock or security.

How much of an option contract is exercised?

About 10% of option contracts are exercised, while 60% are closed out. Option contracts also make money because they provide investors with creative means to play off the strengths and weaknesses of the market. Options have birthed many strategies, which allow investors to leverage options.

What is option contract?

Options are contracts that give an investor a right to buy or sell an underlying security at a predetermined price and date, respectively known as the strike price and expiration date. Whenever someone exercises that right, another party is saddled with the obligation to perform.

Why did the investor lose money on WNR?

While the investor correctly predicted the stock price increase of WNR, however, she still lost money because she failed to anticipate how much the price needed to change in order to earn a profit. This is why understanding volatility is an important ingredient of successful options trading.

What is leverage in options?

Leverage enables an investment to punch above their weight, figuratively speaking. When an option is controlling 100 shares with one contract, any slight price movement in those shares can generate significant profit.

How much does Sarah Jane have to invest in ABC?

For instance, Sarah Jane has $2,000 and wants to invest it in buying ABC stock. ABC is currently trading at $50, so that means her capital will net her 40 shares ($2,000/$50), not considering commission costs. However, Sarah Jane decides to broaden her options (no pun intended) and looks into option contrasts.

What happens if ABC stock falls below $100?

If ABC’s stock price falls below $100, John Q is covered because he has an insurance policy in the form of his put option contract that guarantees him the right to sell his shares at $100. While the drop in price has decimated the account of other less prescient ABC shareholders, John Q has avoided their fate.

What type of option to take on if the stock price moves up?

Depending on which direction you expect the underlying stock to move determines what type of options contract to take on: If you think the stock price will move up: buy a call option, sell a put option. If you think the stock price will stay stable: sell a call option or sell a put option.

How to trade options?

1. Open an options trading account. Before you can start trading options, you’ll have to prove you know what you’re doing. Compared with opening a brokerage account for stock trading, opening an options trading account requires larger amounts of capital.

What is a call option?

As a refresher, a call option is a contract that gives you the right, but not the obligation, to buy a stock at a predetermined price — called the strike price — within a certain time period (Learn all about call options.) A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. (Learn all about put options.)

How to choose an option broker?

Trading stock options can be complex — even more so than stock trading. When you buy a stock, you just decide how many shares you want, and your broker fills the order at the prevailing market price or a limit price you set. Options trading requires an understanding ...

How long do American options last?

Expiration dates can range from days to months to years. Daily and weekly options tend to be the riskiest and are reserved for seasoned option traders.

What happens if an option is left unprotected?

If the option position is left unprotected, it's naked. Based on your answers, the broker typically assigns you an initial trading level based on the level of risk (typically 1 to 5, with 1 being the lowest risk and 5 being the highest). This is your key to placing certain types of options trades.

What are the types of options you want to trade?

The types of options you want to trade. For instance, calls, puts or spreads. And whether they are covered or naked. The seller or writer of options has an obligation to deliver the underlying stock if the option is exercised. If the writer also owns the underlying stock, the option position is covered.

How to sell options on a stock?

Once you've chosen a stock that you believe would be worth owning at a particular strike price, there are steps you can take to attempt to carry out this common type of options trade: 1 Sell one out-of-the-money put option for every 100 shares of stock you'd like to own. A put option is out of the money when the current price of the underlying stock is higher than the strike price. 2 Wait for the stock price to decrease to the put options' strike price. 3 If the options are assigned by the options exchange, buy the underlying shares at the strike price. 4 If the options are not assigned, keep the premiums received for selling the put options.

What is stock option?

A stock option is a contract that gives giving the buyer the right to buy (call) or sell (put) at a specified price, on or before a certain date. Stock options are available on most individual stocks in the U.S., Europe, and Asia, and there are several advantages to using them.

What happens when you sell put options?

When you sell put options, you immediately receive the premiums. If the underlying stock price never decreases to the put options' strike price, you can't buy the shares you wanted but you at least get to keep the money from the premiums. 3 .

What happens if the stock drops below $413?

If the stock drops below $413, the stock investment becomes a losing trade. If QRS's stock price does not decrease to the put options' strike price of $420, the put options will not be exercised, so the investor will not be able to buy the underlying stock. Instead, the investor keeps the $7,000 received for the put options.