How long should you hold a stock?

How Long Should You Hold A Stock? The best rewards on a stock are typically with a hold time of between 50 to 300 days. It takes time for good profits to develop, and they certainly do not happen overnight, unless you are fortunate.

Should I hold on to my losing stocks?

Finally, many people will hold on to a losing stock to offset it against tax at the end of the year; this is called Tax Loss Harvesting. How Long Should I Invest In The Stock Market? You should invest in the stock market for a minimum of 10 years, as the US markets have always made a profit over a 10 year period since 1955.

Do you have to hold a stock to get the dividend?

You usually have to hold the stock to get the benefit of the dividend without locking in the losses from the price drop. Dividends are also taxable. They must be claimed as taxable income on the following year’s income tax return (unless you’re trading through a retirement account).

How do you get on the record when buying a stock?

To get on the record, you have to buy the stock two business days before the date of record (which is also one business day before the ex-dividend date). Date of payment: The date the company pays out the dividend.

How Long Should You Hold A Stock?

How to stop holding a losing stock?

How Long Does It Take To Make Money From Stocks?

How Long Should You Hold a Losing Stock Before Selling?

How Long Should I Invest In The Stock Market?

What is the Minimum Time to Hold a Stock?

What Does Hold Mean in Stocks?

See more

What do you hold when you hold a stock?

A hold recommendation can be thought of as hold what you have and hold off buying more of that particular stock. A hold is one of the three basic investment recommendation given by financial institutions and professional financial analysts. All stocks either have a buy, sell or hold recommendation.

How do you hold shares?

Here are five steps to help you buy your first stock:Select an online stockbroker. The easiest way to buy stocks is through an online stockbroker. ... Research the stocks you want to buy. ... Decide how many shares to buy. ... Choose your stock order type. ... Optimize your stock portfolio.

Is it good to hold stock?

One of the main benefits of a long-term investment approach is money. Keeping your stocks in your portfolio longer is more cost-effective than regular buying and selling because the longer you hold your investments, the fewer fees you have to pay.

How long can I hold a stock?

You could hold stock in your demat account or in physical form as long as you want. Some people keep it for 1 days while others keep it for 20 - 30 years. For example, many people hold SBI shares for 30+ years now in paper or demat format.

How do beginners invest in stocks?

One of the best ways for beginners to get started investing in the stock market is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

Can I buy 1 share of stock?

There is no minimum investment required as you can even buy 1 share of a company. So if you buy a stock with a market price of Rs. 100/- and you just buy 1 share then you just need to invest Rs. 100.

How do you profit from stocks?

To calculate the gain or loss on an investment, simply take the price at which the stock was purchased and subtract it from the current market price. To find the percent increase or decrease, take the price difference, divide it by the original purchase price and then multiply the resulting number by 100.

How do you gain money from stocks?

How To Make Money In StocksBuy and Hold. There's a common saying among long-term investors: “Time in the market beats timing the market.” ... Opt for Funds Over Individual Stocks. ... Reinvest Your Dividends. ... Choose the Right Investment Account. ... The Bottom Line.

Can you cash out stocks at any time?

There are no rules preventing you from taking your money out of the stock market at any time. However, there may be costs, fees or penalties involved, depending on the type of account you have and the fee structure of your financial adviser.

When should I sell my stock?

It really depends on a number of factors, such as the kind of stock, your risk tolerance, investment objectives, amount of investment capital, etc. If the stock is a speculative one and plunging because of a permanent change in its outlook, then it might be advisable to sell it.

How do you lose money in stocks?

Investors who experience a crash can lose money if they sell their positions, instead of waiting it out for a rise. Those who have purchased stock on margin may be forced to liquidate at a loss due to margin calls.

At what profit should I sell a stock?

Here's a specific rule to help boost your prospects for long-term stock investing success: Once your stock has broken out, take most of your profits when they reach 20% to 25%. If market conditions are choppy and decent gains are hard to come by, then you could exit the entire position.

How long do you have to hold on to a stock?

There’s no minimum amount of time when an investor needs to hold on to stock.

What is buy and hold in stock market?

Buy-and-hold is a strategy that is popular with index fund investors. Index funds hold a representative sample of the entire stock market, in an attempt to achieve the market’s average returns. Instead of betting on just one company stock’s performance, index funds invest in the entire engine of the economy. It’s a bet that in decades, companies will have created additional wealth in the world.

Why do investors choose 70% stocks and 30% bonds?

For example, an investor may choose a mix of 70% stocks and 30% bonds to balance out investment goals and risk tolerance. But, when diversifying assets, one type of investment may outperform the other. Because of the potential for this uneven growth, an investor’s asset allocation could get thrown out of balance.

Why is it important to hold stocks for a long time?

There are several allures of holding stocks for a long time. First, spending ample time in the market reduces the risk of short-term volatility. Ups and downs in value are an inevitable part of investing in the stock market, whether through a single stock or a fund.

What is limit order in stock?

They want to sell this stock if (and only if) the price reaches $65. A limit order can be set to sell when the stock hits this target price. If it never reaches $65, then order is not filled (and the stock remains held).

How much profit do you need to sell a stock?

A trader may want to sell once a stock reaches 10% or 20% in profit. Similarly, a stock could be sold once it hits a preselected price target—usually based on a stock’s per-share price. Price-target selling can be set up automatically, through what’s called a limit order.

What causes a person to want to keep more of their investment portfolio in easy-to-access cash?

For instance, a divorce, family death, the birth of a child, or a big move may cause a person to want to keep more of their overall investment portfolio in easy-to-access cash (or other less volatile investments).

What is holding your securities?

As an individual investor, you have up to three choices when it comes to holding your securities: Physical Certificate — The security is registered in your name on the issuer's books, and you receive an actual, hard copy stock or bond certificate representing your ownership of the security. ...

How to get a stock certificate?

When you buy a security, whether through your broker or from the company itself, you can ask to have the actual stock or bond certificates sent to you. You may have to pay a nominal fee for the added expense of issuing a paper certificate. It's important that you safeguard your certificates until you sell or transfer your securities. It can be difficult to prove that you once owned a certificate that has been lost, stolen, or destroyed. Your broker — or the company or its transfer agent — will generally charge a fee to replace a lost or stolen stock certificate. For more information on safeguarding your securities, please read our "Fast Answer" on Lost or Stolen Stock Certificates.

How to sell securities through broker?

If you want to sell your securities through your broker, you can instruct your broker to electronically move your securities via DRS from the books of the company and then to sell your securities. Your broker should be able to do this quickly without the need for you filling out complicated and time-consuming forms.

What happens if you lose your stock certificate?

This may make it harder for you to sell quickly. If you lose your certificate, you may be charged a fee for a replacement certificate.

When selling a security through the issuer, will the issuer sell your security?

When selling a security through the issuer, the issuer will sell your security under the terms and conditions in place for that issue. For example, some sell orders will be executed on the day the issuer receives them, and some orders are aggregated for frequent, but not daily, execution.

When you purchase a security to hold in direct registration, can you tell either your broker-dealer or the issue?

When you purchase a security to hold in direct registration, you can tell either your broker-dealer or the issuer to include pertinent broker-dealer information in the issuer's records.

Is it easier to set up margin accounts?

It is easier to set up a margin account .

How to determine trend of stock?

Determine the trend this stock is trading in: Is the stock trading above or below its 50-day and 200-day moving averages? Is it a thinly traded stock, or does it trade millions of shares per day? Has the volume recently increased or decreased? A decreasing volume could be a sign of less interest in the shares, which could cause a decline in the share price. Increases are generally favorable if the underlying fundamentals are solid, meaning the company has solid growth opportunities and is well-capitalized.

How to find out if a company is worth buying?

Barring more in-depth research options, an investor can find out a great deal about a company's value and whether its stock is worth buying by reading press releases and quarterly profit reports.

What happens if a company raises its earnings guidance?

Delving a bit deeper into the psychology behind earnings guidance, if a company raises its guidance for the current quarter but downplays expectations beyond that, the stock will probably sell-off. If a company reduces its estimates for the current quarter but raises its full-year estimate then the stock will probably take off.

Why do investors need to analyze companies on the fly?

By necessity, investors and their brokers often need to analyze companies on the fly and make snap decisions to buy, sell, or hold. Zeroing in on the key information helps them avoid a rash decision.

Why do companies reduce share count?

That said, management may have other motives. It may want to reduce the total share count in the public domain in order to improve financial ratios or boost earnings , thus making the company more attractive to the analyst community. It may be a public relations ploy to get investors to think the stock is worth more.

Is Wall Street going to overlook a short term stumble?

Most of the time, Wall Street will overlook a short-term stumble if it is convinced that there is an upwards catalyst on the horizon.

Who said "our favorite stock holding period is forever"?

Many legendary investors, including Warren Buffett, suggest that investors hold a stock for the long term. Buffett said that “our favorite stock holding period is forever.”. Peter Lynch has talked about tenbaggers that rose multifold in value as he hung onto a few quality stocks for a long time period.

Is holding a stock for the short term considered speculation?

Tax implications of holding a stock. Holding a stock for the short term is usually considered speculation rather than investing. Another consideration for investors when deciding for how long to hold their stocks has to do with tax implications. If a stock is sold at a profit, it attracts a capital gains tax rate.

How long do you hold on to a stock to get dividends?

What does determine that is the ex-dividend date. As long as you’ve owned the stock (and didn’t sell) before the ex-dividend date, you will receive the dividend. Usually the dividend payout is set about a month after the ex-dividend date .

When to buy stock to get dividends?

All you have to do is hold onto the stock until at least the ex-dividend date.

How long after dividend date do you get your dividends?

You get your dividend about a month after the ex-dividend date. There are exceptions for stocks paying out 25% or more of their value in dividends and stocks whose dividends come in the form of more stocks. These stocks have their ex-dividend dates set one day after the payout date. You can lookup your stock’s date of payment to verify.

What happens if you short a stock?

If you short a stock during this time, you will need to pay the company the dividend instead of the company paying you the dividend, offsetting anything you might earn. This is why dividends are usually more of a long term play: the stock price does correct itself to its actual value, but this takes some time.

Why does the stock price not match the dividend payout?

If the market was perfectly efficient, the stock price would exactly match the dividend payouts. However, due to market inefficiencies/volatility, the price sometimes doesn’t quite match up with the dividend payouts. These discrepancies are what make the dividend recapture strategy profitable.

How long does it take to get a dividend payment?

Usually, the date of payment is set about a month out from the date of record. In most cases, you’ll have to wait about a month to get your dividend payment from the ex-dividend date/date of record.

What is dividend distribution?

A dividend is basically a company’s distribution of some of its earnings to its shareholders as determined by the company’s board of directors. It’s kind of like a little bribe to their investors as an incentive to own shares of their company.

What is holding period on stock?

The holding period is the amount of time you've owned a stock , and this time frame can be the difference between paying no taxes or giving up thousands of dollars to the IRS. To clear up any confusion around holding periods and how it may impact your tax bill, here are some points to remember as you prepare to file your tax return .

What happens when you sell stock?

When you sell stock investments and earn a profit, you step into the world of capital gains. All this means is that you've made some money in the market and as a result, you owe the IRS a piece of your earnings. Your tax bill is partially determined by how long you've held the stock.

What happens if you sell your stock on Jan. 1, 2020?

If you sold your shares on Jan. 1, 2020, you are hit with a short-term capital gains tax because your holding period is considered a year or less. On the other hand, if you sell your shares on Jan. 2, 2020, you've hit the long-term capital gains threshold. As you can see, one day can make a difference in the tax rates you qualify for ...

When do you start counting your holding period?

So if you bought 100 shares of stock on Jan. 1, 2019, start counting your holding period from Jan. 2, 2019. Therefore, this date becomes the basis for every new month no matter how many days are in the month. If you sold your shares on Jan. 1, 2020, you are hit with a short-term capital gains tax because your holding period is considered a year ...

Why do investors buy and hold stocks?

One of the reasons investors buy and hold stocks is to receive the dividend payments companies issue on a periodic basis. To qualify for the dividend, an investor must own the stock -- making them the holder of record -- when the company records its shareholders.

How long does it take for a stock to trade ex dividend?

The holders of record then receive the dividend on the date of payment. The stock will trade ex-dividend two business days before that date, meaning anyone buying the stock will not get the pending dividend. Instead, the seller receives the dividend because they owned the stock on the date of record.

What does it mean when a stock trades without a dividend?

When the stock market opens on the ex-dividend date, stocks trading without a dividend are notated by an "x," signify that the buyer will not receive the pending payment. Since the the value of the company has decreased by the amount of the slated dividend payment, the value of the stock is also lowered. This price reduction affects all pending buy ...

What is the date of a company's dividend?

The date the firm's board of directors announces it will be paying a dividend is known as the declaration date. On that date the board also discloses the schedule for recording the shareholders and making the dividend payment.

Do dividends come on a quarterly basis?

Although most companies that issue dividend stocks do so quarterly, there are exceptions. Some will pay dividends monthly, semi-annually, annually or on an irregular schedule.

What is the best way to buy stocks?

An online brokerage account is the most convenient place to buy stocks, but it’s far from your only option. If you see yourself as a hands-on investor who likes researching companies and learning about markets, an online brokerage account is a great place to get started buying stocks.

When is the best time to sell stocks?

The ideal time to sell your stocks is when you need the money. Long-term investors should have a strategy centered on a financial goal and a timeline for achieving it. That means it should include a plan to start tapping your investments and using the cash you’ve accumulated when the time is right.

What is dividend stock?

Dividend stocks pay out some of their earnings to shareholders in the form of dividends. When you buy dividend stocks, the goal is to achieve a steady stream of income from your investments, whether the prices of your stocks goes up or down. Certain sectors, including utilities and telecommunications, are also more likely to pay dividends.

What is growth stock?

Growth stocks are shares of companies that are seeing rapid, robust gains in profits or revenue. They tend to be relatively young companies with plenty of room to grow, or companies that are serving markets with lots of room for growth. Whether the shares of a growth stock seem expensive or not, investing in growth stocks assumes that continued rapid growth will deliver strong price gains over time.

How much does a 100% stock portfolio return?

Between 1926 and 2018, a 100% stock portfolio returned an average 10.1% a year , according to Vanguard. Over the same timeframe, a 100% bond portfolio earned 5.3% a year. Just remember, buying stocks means more risk for your investment portfolio. Here’s our step-by-step guide on how to buy stocks.

What is value stock?

Value stocks are shares of stock that are priced at a discount and stand to see price gains as the market comes to recognize their true value. With value investing, you’re looking for “shares on sale,” with low price-to-earnings and price-to-book ratios.

Can you buy stocks with robo investors?

The thing about robo-investors, though, is that you’re not buying stocks directly— you’re buying a portfolio of ETFs. Some of those funds will almost certainly be stock ETFs, like the SPDR S&P 500 ETF Trust ( SPY ), which strives to match the performance of the S&P 500 stock index. But others could be broad bond funds, like Vanguard Total Bond Market ETF ( BND ), which invests in fixed income securities.

Why is investing in stocks important?

Investing in stocks can be a great way to build wealth and financial security, but it’s important to understand how taxes on stocks could affect your tax bill.

What is the tax rate on dividends?

The tax rate on nonqualified dividends is the same as your regular income tax bracket. The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. This is usually lower than the rate for nonqualified dividends.

Do people in higher tax brackets pay more taxes on dividends?

In both cases, people in higher tax brackets pay more taxes on dividends.

How Long Should You Hold A Stock?

The best rewards on a stock are typically with a hold time of between 50 to 300 days. It takes time for good profits to develop, and they certainly do not happen overnight, unless you are fortunate. The typical high-profit trade in my back-tested systems is 30%, and the hold time is an average of 45 days.

How to stop holding a losing stock?

Secondly, stop holding a losing stock if it hits your pre-established stop-loss and risk/reward ratio. Finally, many people will hold on to a losing stock to offset it against tax at the end of the year; this is called Tax Loss Harvesting.

How Long Does It Take To Make Money From Stocks?

Typically it takes 300 to 600 days for stock to appreciate significantly in value. My research shows that over the last 5 years, Apple Inc. has increased 447%. However, Apple’s stock has averaged +0.78% on a positive trading day and averaged -0.74% on a negative day. Apple’s stock price only increased 54% of the time while decreasing 46% of the time. Also, Apple stock’s longest winning streak was only 9 days.

How Long Should You Hold a Losing Stock Before Selling?

There is no exact answer to this question; there are three scenarios. Firstly, sell a losing stock if you can no longer afford to shoulder the losses. Secondly, stop holding a losing stock if it hits your pre-established stop-loss and risk/reward ratio. Finally, many people will hold on to a losing stock to offset it against tax at the end of the year; this is called Tax Loss Harvesting.

How Long Should I Invest In The Stock Market?

You should invest in the stock market for a minimum of 10 years, as the US markets have always made a profit over a 10 year period since 1955. My research shows that over the last 10 years, the S&P 500 increased 55% of the time, by on average 0.2% per day, and the longest uninterrupted uptrend was 8 days. This means you should invest for the long term.

What is the Minimum Time to Hold a Stock?

For investors, the minimum time to hold a stock is until it begins bearing fruit and returning a profit. However, you may choose to sell sooner if the stock exceeds your risk tolerance and begins to generate significant losses.

What Does Hold Mean in Stocks?

When a stock rating agency rates a stock as Hold, it means they believe the stock is fairly valued and it will maintain its value proposition. The alternative meaning is that you “Hold a stock”, which means you are the beneficial owner of shares in a company, having purchased them directly or through a brokerage account.

Physical Certificate

Street Name Registration

- You may have your security registered in street name and held in your account at your broker-dealer. Many brokerage firms will automatically put your securities into street name unless you give them specific instructions to the contrary. Under street name registration, your firm will keep records showing you as the real or "beneficial" owner, but y...

Direct Registration

- If a company offers direct registration for its securities, you can choose to be registered directly on the books of the company regardless of whether you bought your securities through your broker or directly from the company or its transfer agent through a direct investment plan. Direct registration allows you to have your security registered in your name on the books of the issuer …

Frequently Asked Questions

- Q: What is the Direct Registration System? A:The Direct Registration System, or DRS, is a system that enables an investor to electronically move his or her security position held in direct registration book-entry form back and forth between the issuer and the investor's broker-dealer. Q: After I make my decision on how I want to hold my security, what do I do? A:You should check w…

Increasing Sales

Improving Margins

- A company's margins generally improve or deteriorate depending on how well it is managed. If the sales line is going up but costs are going up faster, something is going on. It's not necessarily bad news. It could be that the company is entering a new business, launching a new product, or expanding its footprint. Amazon, for example, infuriated investors for years by investing heavily i…

The Guidance

- Many companies offer Wall Street some sort of guidance on future earnings, and it's nearly always important. How "the Street" reacts to the news is equally important. That is, the company's guidance for the next quarter may be better or worse than Wall Streetanalysts are expecting. And those expectations will move the stock price up or down, at least short-term. Delving a bit deepe…

Stock Buyback Programs

- When a company uses its cash to buy back its own stock, it's usually a good sign that management believes the stock is undervalued. Repurchase programs will probably be mentioned in the company press release. That said, management may have other motives. It may want to reduce the total share count in the public domain in order to improve financial ...

New Products

- It's virtually impossible to predict whether a new product will be a winner or not. But it's a big mistake to overlook the stocks of the companies that make them. New products often garner the most attention from consumers and investors. This often helps move the share price higher in the near term. And the company has probably spent a huge amount of money on R&Dand promotion…

The Subtleties of Language

- As you read the press release, consider your impression of what occurred in the quarter. Management might have talked up the company's many "opportunities" and relished its past growth. Or it might have outlined the many "challenges" facing the company. Management might identify potential catalysts for the business, such as new products or acquisition candidates. In …

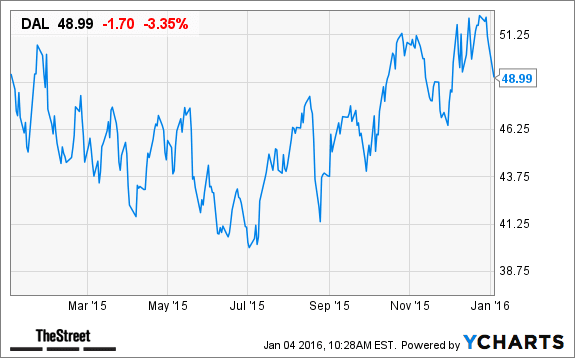

Technical Indicators

- Finally, look at the stock chart for the last year and last five years. Are there seasonal variations in the stock price? You may find it routinely trades higher or lower in certain seasons. Determine the trend this stock is trading in: Is the stock trading above or below its 50-day and 200-day moving averages? Is it a thinly traded stock, or does it trade millions of shares per day? Has the volume r…

The 10,000-Foot View

- Beyond the press release, consider the macrotrends that might impact the stock. Rising interest rates, higher taxes, or consumer behavior may have an impact on the stock. Other external factors, such as an industry-wide downturn, might affect the company. These considerations can be as important as the fundamentals and technical indicators. For example, consider Continenta…

The Bottom Line

- By necessity, investors and their brokers often need to analyze companies on the fly and make snap decisions to buy, sell, or hold. Zeroing in on the key information helps them avoid a rash decision. Of course, to trade or invest you would need a broker. If you don't already have one and are considering which broker to choose, do some research so that you can find a brokerto fit yo…