How Do Puts & Calls Work in the Stock Market?

- Call Options. A call option is a contract to buy a stock at a set price, and within a limited time. The contract sets a...

- Option Prices. Calls have intrinsic value if the stock is trading above the strike price. A Microsoft 25 call, for...

- Put Options. A put is a contract to sell a stock or "put" it to a buyer. It also...

Full Answer

What are puts calls?

Sep 27, 2021 · A call option gives the buyer the option to buy 100 shares of the underlying stock, but they are not obligated to do so. The call option buyer can purchase the underlying security at the specified price, known as the strike price, on or before the expiration date. A call option seller, or writer, can generate income by selling options and ...

How to make money with call and put options?

How Do Puts & Calls Work in the Stock Market? Call Options. A call option is a contract to buy a stock at a set price, and within a limited time. The contract sets a... Option Prices. Calls have intrinsic value if the stock is trading above the strike price. A …

What is call and put in stocks?

Jan 25, 2022 · A put option is a contract that gives its holder the right to sell a number of equity shares at the strike price, before the option's expiry. If …

How do calls work stocks?

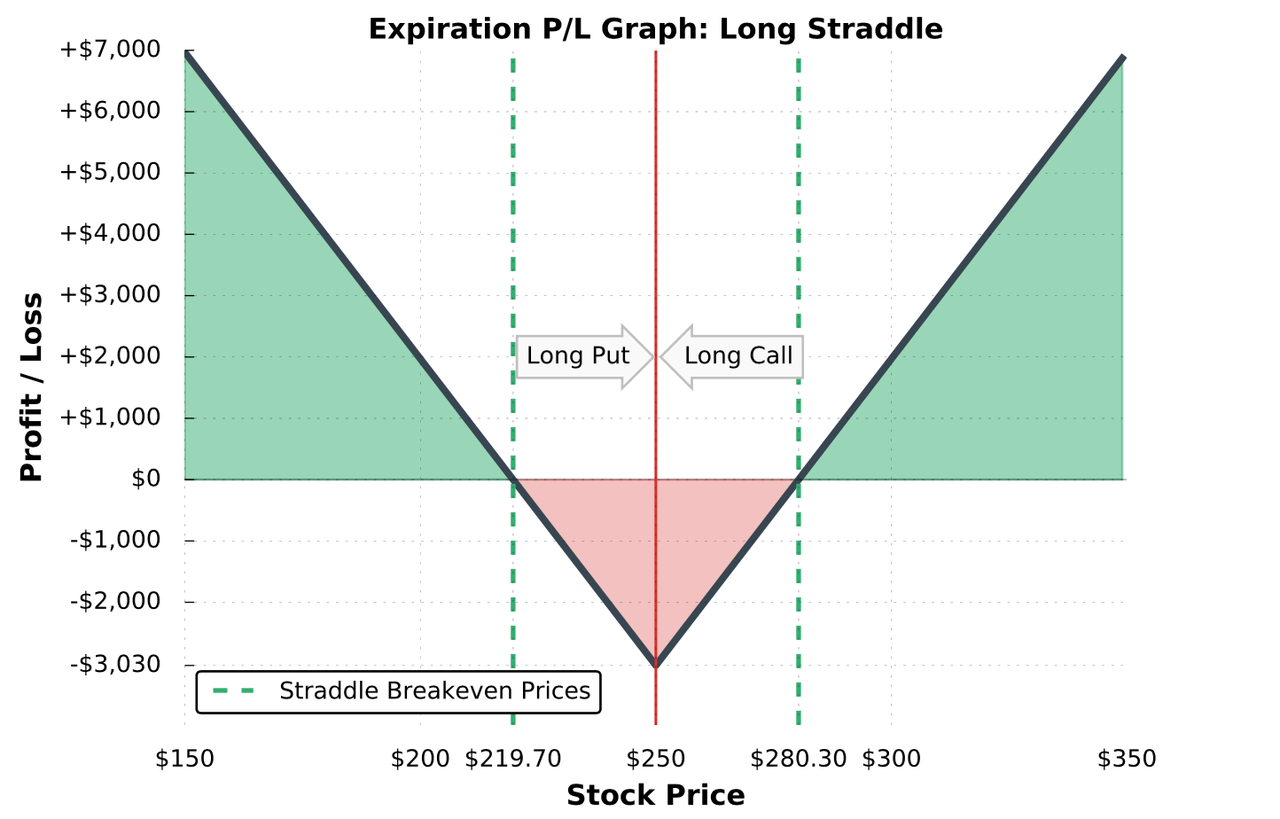

Sep 14, 2021 · To execute a straddle, an investor buys two options, one call and one put. Both options should have the same strike price and expiration date. If the stock gains a lot of value, the trader can exercise the call option to buy shares below market price and sell them for a profit.

How do calls and puts work in stocks?

Call and Put Options A call option gives the holder the right to buy a stock and a put option gives the holder the right to sell a stock. Think of a call option as a down payment on a future purchase.

How do you make money on calls and puts?

A call option buyer stands to make a profit if the underlying asset, let's say a stock, rises above the strike price before expiry. A put option buyer makes a profit if the price falls below the strike price before the expiration.

How do calls and puts work for dummies?

With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called exercise price or strike price. With a put option, the buyer acquires the right to sell the underlying asset in the future at the predetermined price.

How do calls and puts work example?

For example, a call option goes up in price when the price of the underlying stock rises. And you don't have to own the stock to profit from the price rise of the stock. A put option goes up in price when the price of the underlying stock goes down. As with a call option, you don't have to own the stock.

Is it better to buy calls or sell puts?

Which to choose? - Buying a call gives an immediate loss with a potential for future gain, with risk being is limited to the option's premium. On the other hand, selling a put gives an immediate profit / inflow with potential for future loss with no cap on the risk.

What is the most successful option strategy?

The most successful options strategy is to sell out-of-the-money put and call options. This options strategy has a high probability of profit - you can also use credit spreads to reduce risk. If done correctly, this strategy can yield ~40% annual returns.Oct 27, 2020

Do you have to buy 100 shares of stock with options?

You could buy shares of the stock, or you could buy a call option. Say a call option that gives you the right, but not the obligation, to buy 100 shares of XYZ anytime in the next 90 days for $26 per share could be purchased for $100.

Is options trading Better Than Stocks?

Options can be a better choice when you want to limit risk to a certain amount. Options can allow you to earn a stock-like return while investing less money, so they can be a way to limit your risk within certain bounds. Options can be a useful strategy when you're an advanced investor.Apr 13, 2022

Are options gambling?

Here's How to Bet Wisely. Let us end 2021 reflecting on a powerful lesson we learned this year: America is a nation of gamblers, and the options market has become the biggest casino in the country.Dec 22, 2021

How do you exercise a call option?

To exercise an option, you simply advise your broker that you wish to exercise the option in your contract. If the holder of a put option exercises the contract, they will sell the underlying security at a stated price within a specific timeframe.

When should you sell a call option?

Call options are “in the money” when the stock price is above the strike price at expiration. The call owner can exercise the option, putting up cash to buy the stock at the strike price. Or the owner can simply sell the option at its fair market value to another buyer before it expires.Nov 1, 2021

How do you trade options for beginners?

How to trade options in four stepsOpen an options trading account. Before you can start trading options, you'll have to prove you know what you're doing. ... Pick which options to buy or sell. ... Predict the option strike price. ... Determine the option time frame.

What is the purpose of a put option?

2. Put options. Puts give the buyer the right, but not the obligation, to sell the underlying asset at the strike price specified in the contract. The writer (seller) of the put option is obligated to buy the asset if the put buyer exercises their option. Investors buy puts when they believe the price of the underlying asset will decrease ...

What is a call option?

1. Call options. Calls give the buyer the right, but not the obligation, to buy the underlying asset. Marketable Securities Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

What is strike price in option?

An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a certain date (expiration date) at a specified price ( strike price. Strike Price The strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, ...

How do investors benefit from downward price movements?

Investors can benefit from downward price movements by either selling calls or buying puts. The upside to the writer of a call is limited to the option premium. The buyer of a put faces a potentially unlimited upside but has a limited downside, equal to the option’s price. If the market price of the underlying security falls, the put buyer profits to the extent the market price declines below the option strike price. If the investor’s hunch was wrong and prices don’t fall, the investor only loses the option premium.

Who owns mutual funds?

Mutual funds are owned by a group of investors and managed by professionals. Learn about the various types of fund, how they work, and benefits and tradeoffs of investing in them. managers often use puts to limit the fund’s downside risk exposure.

Can you buy calls or sell puts?

If an investor believes the price of a security is likely to rise, they can buy calls or sell puts to benefit from such a price rise. In buying call options, the investor’s total risk is limited to the premium paid for the option. Their potential profit is, theoretically, unlimited. It is determined by how far the market price exceeds the option strike price and how many options the investor holds.

What happens when you buy an option?

The buyer of a call option pays the option premium in full at the time of entering the contract. Afterward, the buyer enjoys a potential profit should the market move in his favor. There is no possibility of the option generating any further loss beyond the purchase price. This is one of the most attractive features of buying options. For a limited investment, the buyer secures unlimited profit potential with a known and strictly limited potential loss.

What are calls and puts?

In addition to individual stocks, you can trade puts and calls on market indexes such as the Dow Jones industrials or the Standard & Poor's 500. You can also trade options on futures contracts for commodities such as oil, gold or copper. When you deal in options, you can trade them to close your position, you can exercise them to buy or sell the underlying stock, or you can hold them until expiration. At that point your position in a worthless option disappears, or your broker settles the contract for you if it still has value.

How does a call option work?

A call option is a contract to buy a stock at a set price, and within a limited time. The contract sets a strike price at which you can buy the stock. The contract ends when its expiration date passes. A stock option represents 100 shares of the underlying stock, and the expiration date is the third Friday of the expiration month. For example, a Microsoft March 2013 25 call option gives you the right to buy 100 shares of Microsoft at $25 per share until the close of business on the third Friday of March 2013. If the option is quoted at $2, then you must put down $200 to buy the contract, in addition to transaction fees.

What is options market?

The options market allows traders to speculate on the direction of stock prices or to hedge investments they already own. Before having a go at the volatile options market, educate yourself on how it works and about the two basic flavors of option contracts: puts and calls.

Who is Tom Streissguth?

Founder/president of the innovative reference publisher The Archive LLC, Tom Streissguth has been a self-employed business owner, independent bookseller and freelance author in the school/library market. Holding a bachelor's degree from Yale, Streissguth has published more than 100 works of history, biography, current affairs and geography for young readers.

What is the intrinsic value of a call?

Calls have intrinsic value if the stock is trading above the strike price. A Microsoft 25 call, for example, has $5 of intrinsic value if the stock itself is at $30. If the stock goes to $35, the option doubles its intrinsic value to $10. Options also have time value.

Can you trade options on futures?

You can also trade options on futures contracts for commodities such as oil, gold or copper. When you deal in options, you can trade them to close your position, you can exercise them to buy or sell the underlying stock, or you can hold them until expiration.

What is put option?

Put Options. A put is a contract to sell a stock or "put" it to a buyer. It also represents 100 shares, and it has the same intrinsic value as a call -- in reverse. The lower a stock moves, the higher its put options rise. You can buy one or 100 calls or puts at a time.

How do put options work?

There are a number of ways to close out, or complete, the option trade depending on the circumstances. If the option expires profitable or in the money, the option will be exercised. If the option expires unprofitable or out of the money, nothing happens, and the money paid for the option is lost.

What is put option?

A put option is a contract that gives its holder the right to sell a number of equity shares at the strike price, before the option's expiry. If an investor owns shares of a stock and owns a put option, the option is exercised when the stock price falls below the strike price. Instead of exercising an option that's profitable, ...

What does it mean when an option is exercised?

"Exercising the option" means the buyer is opting to take advantage of the right to sell the shares at the strike price. The opposite of a put option is a call option, which gives the contract holder ...

Who is Cory Mitchell?

Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies.

What is a short position in stock?

A short position is when an investor sells the stock first with the goal of buying the stock or covering it later at a lower price. Since Max doesn't own any shares to sell, the put option will initiate a short position at $11.

What is margin account?

A margin account is a brokerage account in which the customer borrows money or shares from the broker to finance a long (buy) or short (sell) position.

Can you sell an option before expiration?

There are many benefits to selling an option, such as a put, before the expiry instead of exercising it. Option premiums are in constant flux, and purchasing put options that are deep in the money or far out of the money drastically affects the option premium and the possibility of exercising it.

What happens if you sell a call option?

If the buyer exercises the option, the option seller must sell their shares at the strike price, regardless of their current market price.

How do put options work?

For put options, a contract gains value as the market value falls nearer to or below the strike price. The lower the market value of the security in comparison to the option strike price, the more valuable the option is. The other component of option value is time value. Options have expiration dates.

Why do people buy calls?

Investors who buy calls believe the price of a company’s shares will increase. Buying calls is popular because it lets investors leverage their portfolio. For example, on September 16, 2020, one share of the exchange-traded fund (ETF) SPY cost about $340.

What is an option?

Options are a type of derivative that investors can use to execute complex trading strategies or to leverage their portfolios. Unlike stocks or bonds, which have an inherent value because they represent ownership of a company or debt, options derive their value from other securities.

What is an option contract?

An option is an agreement between two people to conduct a specific transaction. One party writes the option and sells it to the other party, who buys it and becomes the option holder. The holder of the option contract has the power to exercise the contract, which means the transaction described in the contract happens.

How does a straddle work?

A straddle is a more complex option strategy that lets an investor earn a profit if a company’s shares experience a large change in value, regardless of whether the change is an increase or a decrease in value. To execute a straddle, an investor buys two options, one call and one put.

What are the risks of a call option?

Risks of Call Options. For the buyer of a call option, the primary risk is that the market price of a stock won’t rise above the option’s strike price. If the price of a share stays below the strike price, it’s cheaper to buy the shares on the stock market than to exercise the option.

Why do we use trading calls?

Trading calls can be an effective way of increasing exposure to stocks or other securities, without tying up a lot of funds. Such calls are used extensively by funds and large investors, allowing both to control large amounts of shares with relatively little capital.

Why do you buy calls?

Investors often buy calls when they are bullish on a stock or other security because it affords them leverage.

How do investors close out call positions?

Investors may close out their call positions by selling them back to the market or by having them exercised, in which case they must deliver cash to the counterparties who sold them.

Who is Alan Farley?

Alan Farley is a writer and contributor for The Street and the editor of Hard Right Edge, one of the first stock trading websites. He is an expert in trading and technical analysis with more than 25 years of experience in the markets.

What is call option?

Call options give investors the opportunity, but not the obligation, to purchase a stock, bond, commodity or other security at a certain price, within a specific time frame. The sellers must let the buyers exercise this option.

How do I buy call options?

You can purchase a call option through an online brokerage account or on a variety of exchanges. However, you must first be approved, which is based on the level of experience and amount of knowledge with options trading.

Who is Ashley Chorpenning?

Ashley Chorpenning Ashley Chorpenning is an experienced financial writer currently serving as an investment and insurance expert at SmartAsset. In addition to being a contributing writer at SmartAsset, she writes for solo entrepreneurs as well as for Fortune 500 companies. Ashley is a finance graduate of the University of Cincinnati.

What is a trade amount?

Trade amount. The trade amount is the maximum amount you want to spend on a call option transaction. Number of contracts. When you buy a call option, you will need to decide the number of shares you would like to purchase. Strike price. Regardless of what the current stock price is, an owner of a call option can decide at what strike price they ...

What happens if you don't buy a stock?

If the investor didn’t purchase the stock when it was at a lower price, they may have missed their opportunity to profit. Therefore, the stock option allowed them to capitalize on the rising price of the stock. You can purchase a call option through an online brokerage account or on a variety of exchanges.

What is a limit order?

For example, an investor can select a limit order, which allows the investor to buy or sell a stock at a certain price. Put option. The opposite of a call option, where investors place an order to sell their shares at a certain price within a certain time frame.

Options for dummies. Can you explain how puts & calls work, simply?

I never understood Puts or Calls. Could anybody explain it like I were a child?

In summary

Our kid bought the Put option and later sold it for a profit, and all of this happened before the option reached its expiry date.